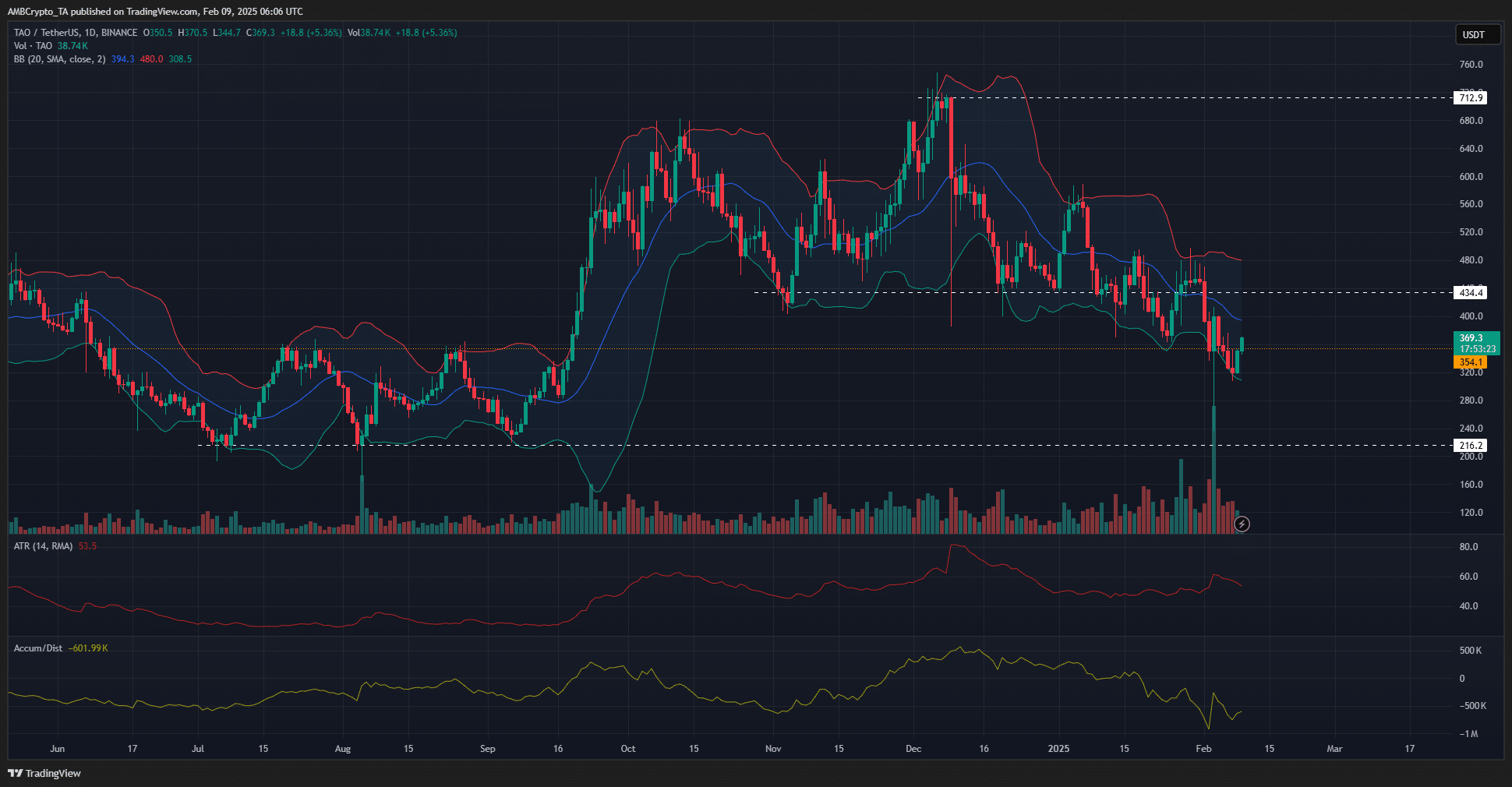

- TAO broke below support levels of $ 434 and $ 354 and could be led lower in the coming weeks.

- The liquidation thermal card showed that a $ 390 rebound was likely.

Bittensor bulls (TAO) were forced to concede the support area from $ 440 to $ 480 in the last month of negotiation. Ten days ago, it was reteteted as resistance, and since these local summits, Tao has lost 26.7%.

Tao’s volatility has resumed in the past two weeks while Bitcoin (BTC) has continued to negotiate itself in a range around the $ 100,000 bar.

The absence of optimistic conviction through the Altcoin space affected Tao, and his momentum has been a lowering since December.

Tao fell below $ 354 but rebounded higher quickly

Source: TAO / USDT on tradingView

Bollinger bands have been relatively wide since the second half of November.

This meant an increase in volatility on the daily graph, and the TAO prices movements since then have been rapid and clear compared to August, for example.

The upward trend established in November has not been maintained and Tao overturned its market structure.

In January, the Bulls also sold the level of support of $ 434, an important level of the weekly period.

The levels of $ 354 and $ 216 were the following key levels. At the time of the press, Tao had already closed a daily session below $ 354, but had rebounded 14% compared to local stockings.

This did not reveal recovery, but rather a shallow rebound before the next step in the downward trend.

The ATR agreed with the BB indicator and showed increased volatility, especially during last week. The sale pressure and the lower structure highlighted other stockings.

Source: Coringlass

Read the Bittensor Price Provision (TAO) 2025-26

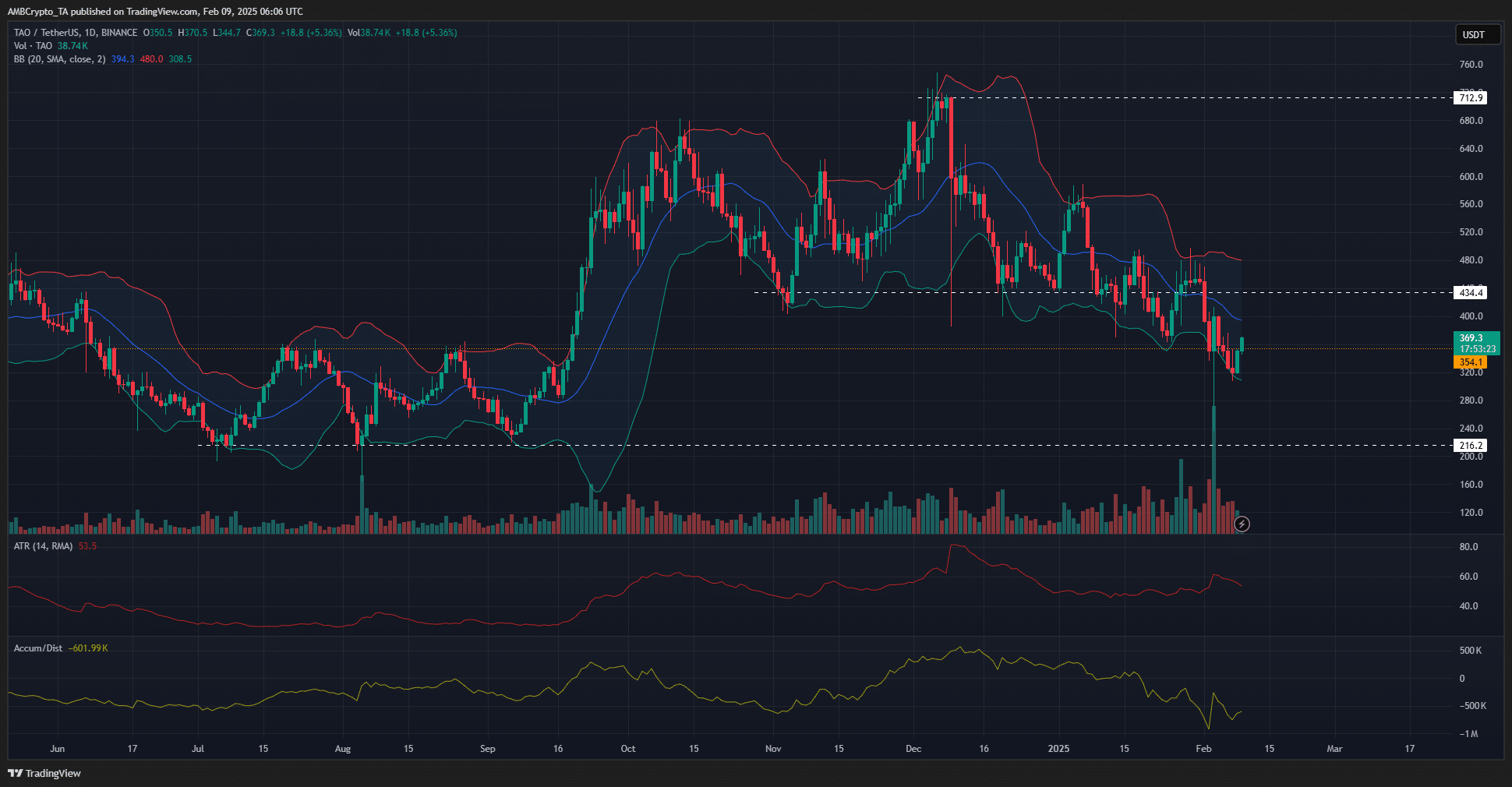

The one month’s liquidation thermal card showed a short liquidation group accumulating around the region from $ 380 to $ 400. This coincided with the local highs that Tao reached during the chat rebound on Monday, February 3.

The lack of demand and the overall downward structure meant that a rejection of the $ 400 resistance zone was likely. Swing traders can wait for the Bittensor test of this region before trying not to short.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer