- The intelligent contract of the BNB channel and the activity of the developers have plunged, revealing over-dependence on the DEFI sector

- Despite a stable price and an open interest, the techniques show a low impulse and a community of disengaged manufacturers

Binance (BNB) shows cracks below the surface.

The intelligent contract activity on BNB fell to its lowest point in one year. Recent data reveal an unhealthy dependence on the DEFI and DEX sectors, which are now withdrawn.

On the other hand, other ecosystems develop in games, NFTs and broader innovation of developers. BNB’s limited diversification can expose it to higher long -term risks.

Excessive dependence leaves the BNB chain on display

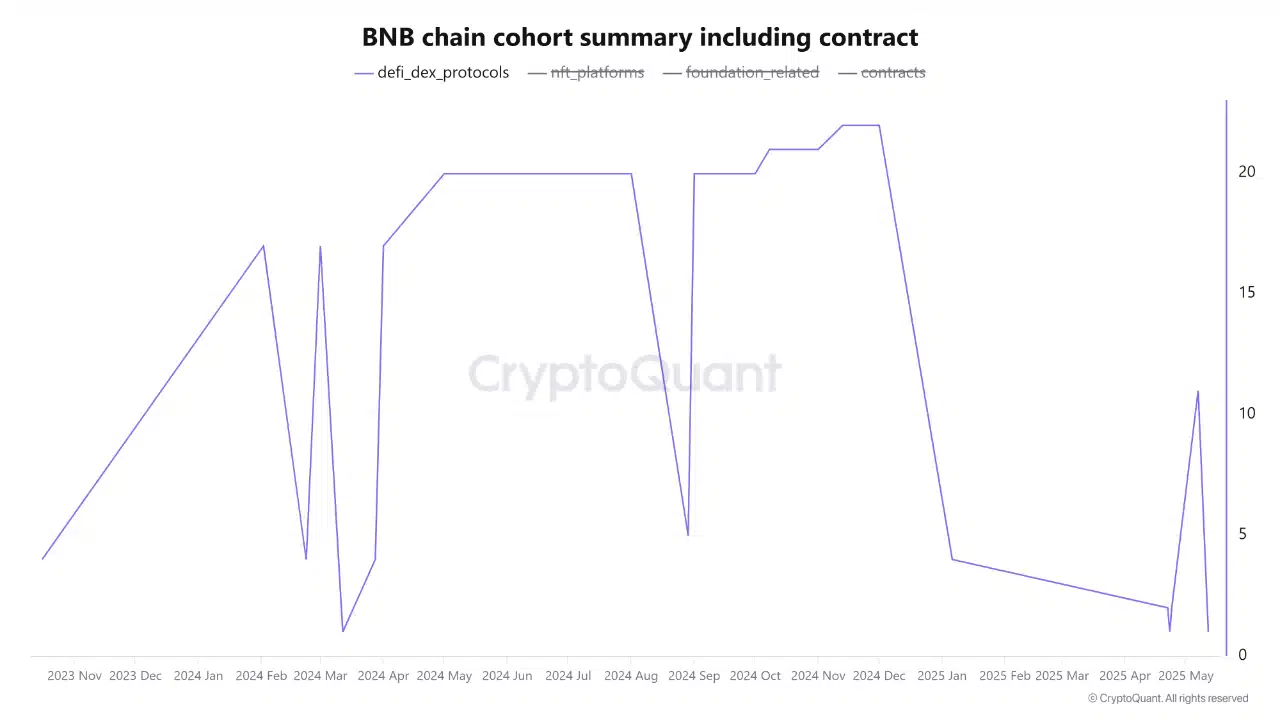

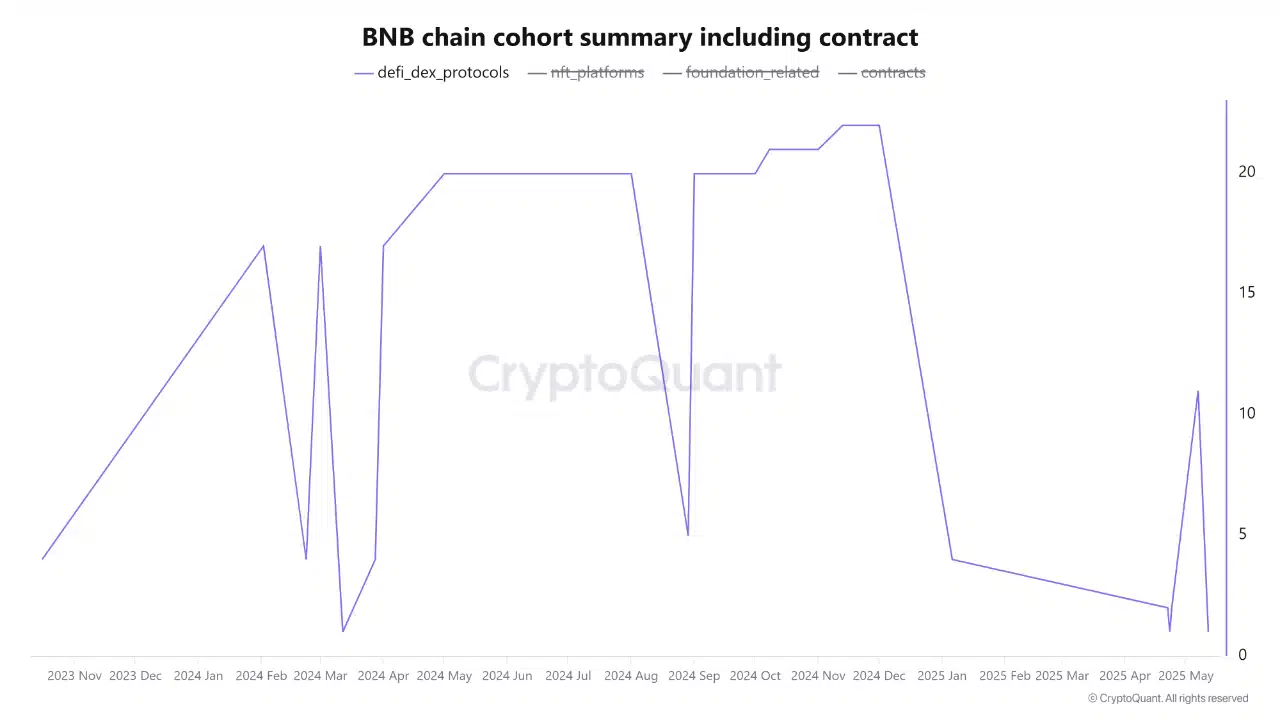

The latest cohort data of the BNB chain reveal a collapse concerning active intelligent contracts, falling at the bottom of one year.

A more in -depth examination of the rupture shows that almost all activities on chain are concentrated in the DEFI / DEX sector, with other verticals, such as NFT, projects supported by the Foundation and Games, recording practically no traction.

Source: cryptocurrency

The recent drop in the network directly reflects the drop in DEFI activity. This lack of diversification now has a serious systemic risk.

Without significant growth in other sectors to compensate for this crisis, the BNB chain is left dangerously exposed to volatility in a single sector, which makes it very sensitive to slowdowns, migrations or trusted shocks.

Open interest is, but development disappears

Source: Coringlass

Despite the stable open interest, the activity of chain developers on BNB plunged more than 85% in the last month.

This highlights a brutal gap between the speculative interest and the real commitment of the manufacturer. While traders seem to stay there, developers are moving away.

Source: Santiment

With the development activity which now approaches YTD stockings, there is an obvious disconnection between the feeling of the market and the health of the underlying network.

Without the renewed commitment of developers, long -term sustainability of the BNB ecosystem could be in danger, whatever the short -term data.

Elanful stalls with indicators flashing the neutral – but is that part of the problem?

The technical signals on the daily graph of BNB show indecision.

At the time of the press, the RSI hovered nearly 51, showing neither strength nor weakness. The MacD lines were flat and barely crossed a positive territory, showing a significant lack of momentum.

Meanwhile, the OBR remained stable at around 574 million, showing no accumulation or clear distribution.

Source: tradingView

This neutrality is a sign of a market in limbo, where the price is stable, but the conviction is absent.

With the fundamental principles that deteriorate and the collapse of developers’ activities, the mocked molic signals show that the deeper question of the ecosystem is not panic, but indifference.