- Binance Coin’s weekly chart highlighted two important levels that have yet to be broken.

- The short-term bias was bearish, but traders should be wary of a potential short squeeze.

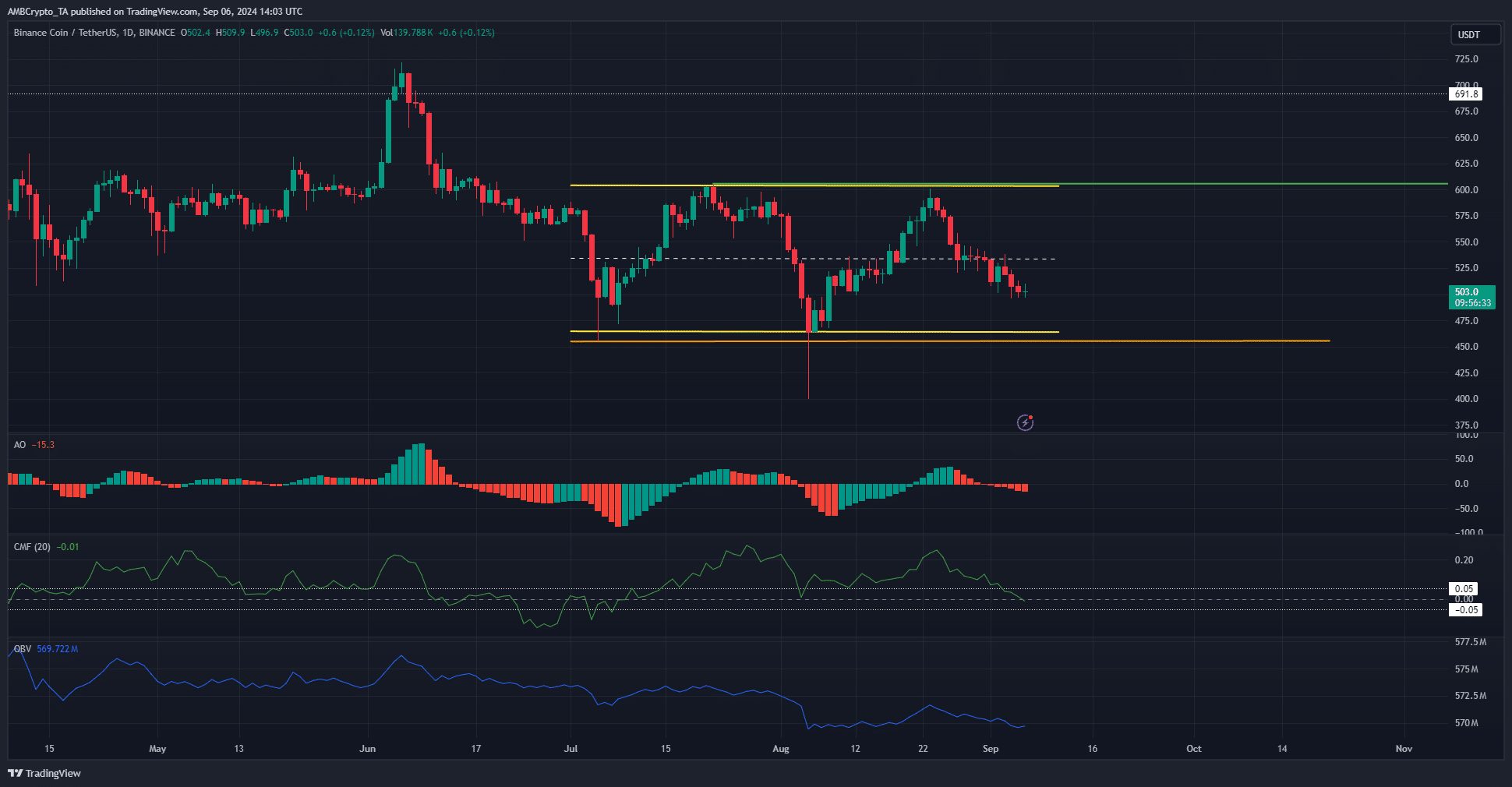

Binance Coin (BNB) posted a bearish divergence a few days ago and the exchange token’s price has declined by 2% since then. The rejection from the psychological level of $600 during the last week of August was still in effect.

Higher time frame charts highlighted levels where bulls and bears would likely battle in the coming weeks, but in the meantime, the range should reign.

Binance Coin Two-Month Range Forms

Source: BNB/USDT on TradingView

The orange and green levels at $454.8 and $605.6 marked the recent low and high respectively on the weekly chart. It was within these important and structuring weekly levels that the formation of the range of the last eight weeks took place.

The weekly market structure was bullish, but the drop below $450 in August showed that sellers’ dominance was visible. The CMF broke below +0.05 on the daily chart to highlight the weakening of the bulls.

The OBV has edged up over the past month, giving holders some hope for upside. As things stand, the $600 and $450 resistance and support levels are formidable, but the latter is likely the weaker of the two.

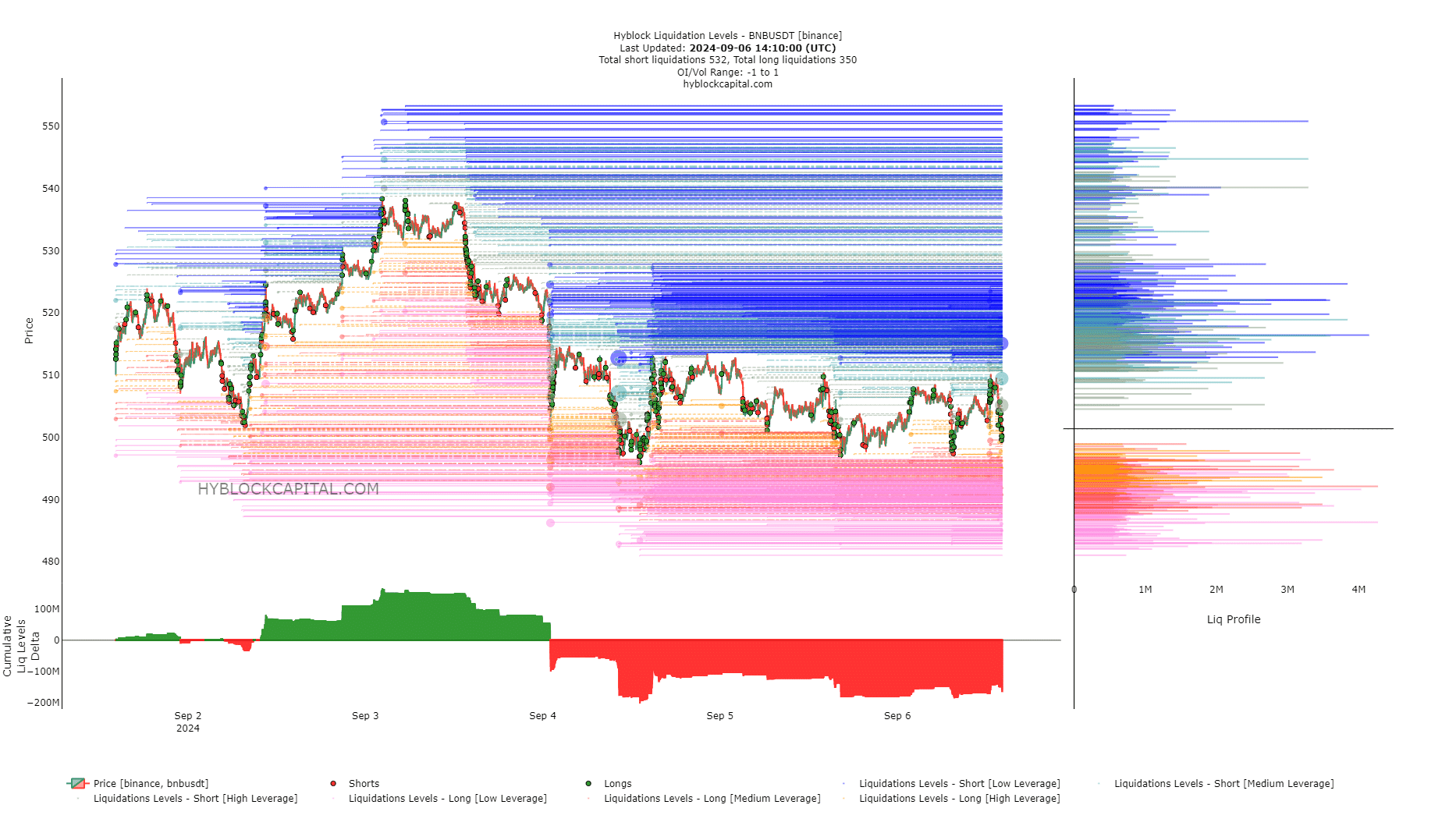

Liquidation Levels Show Downward Pressure on BNB

Source: Hyblock Capital

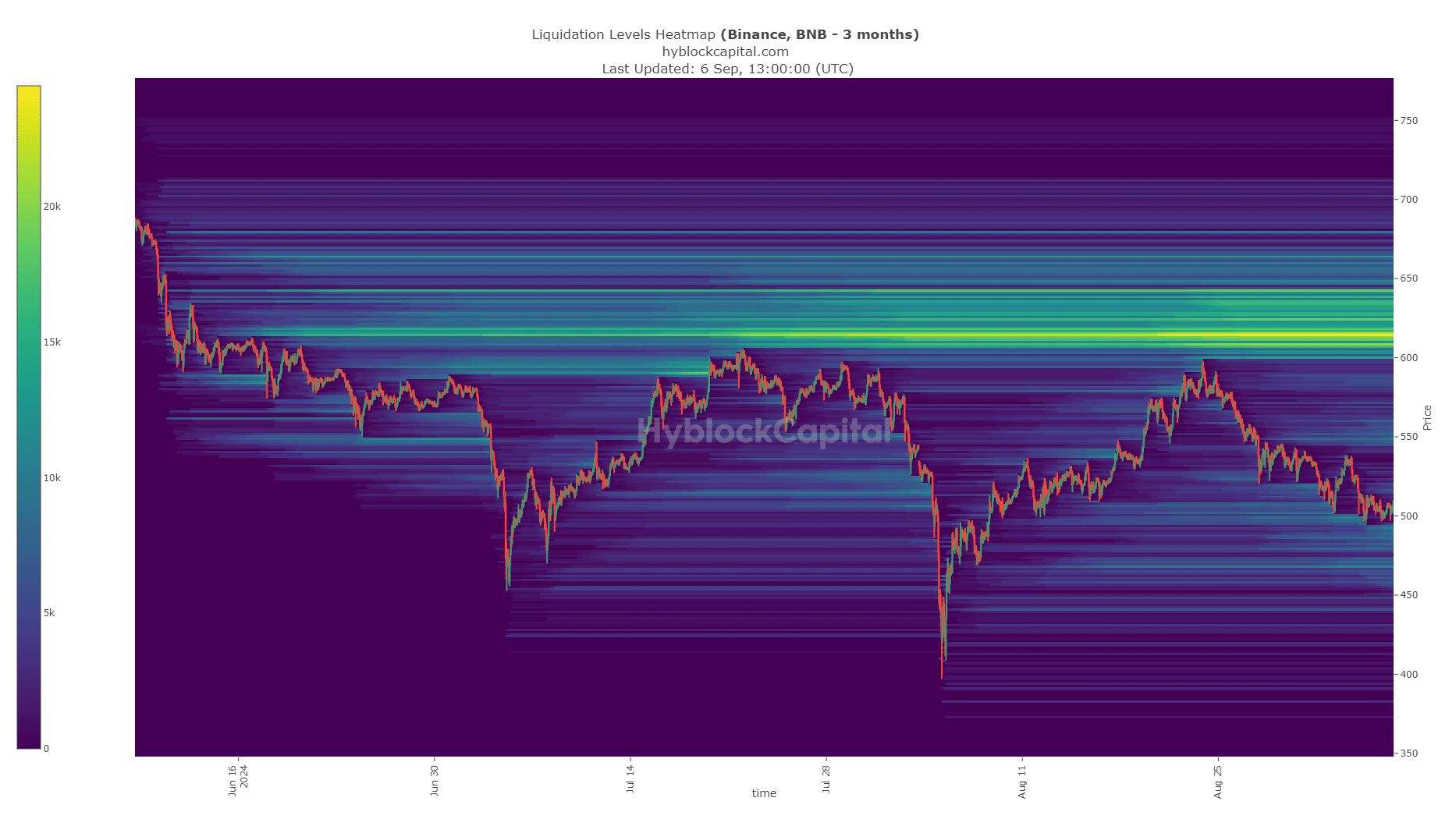

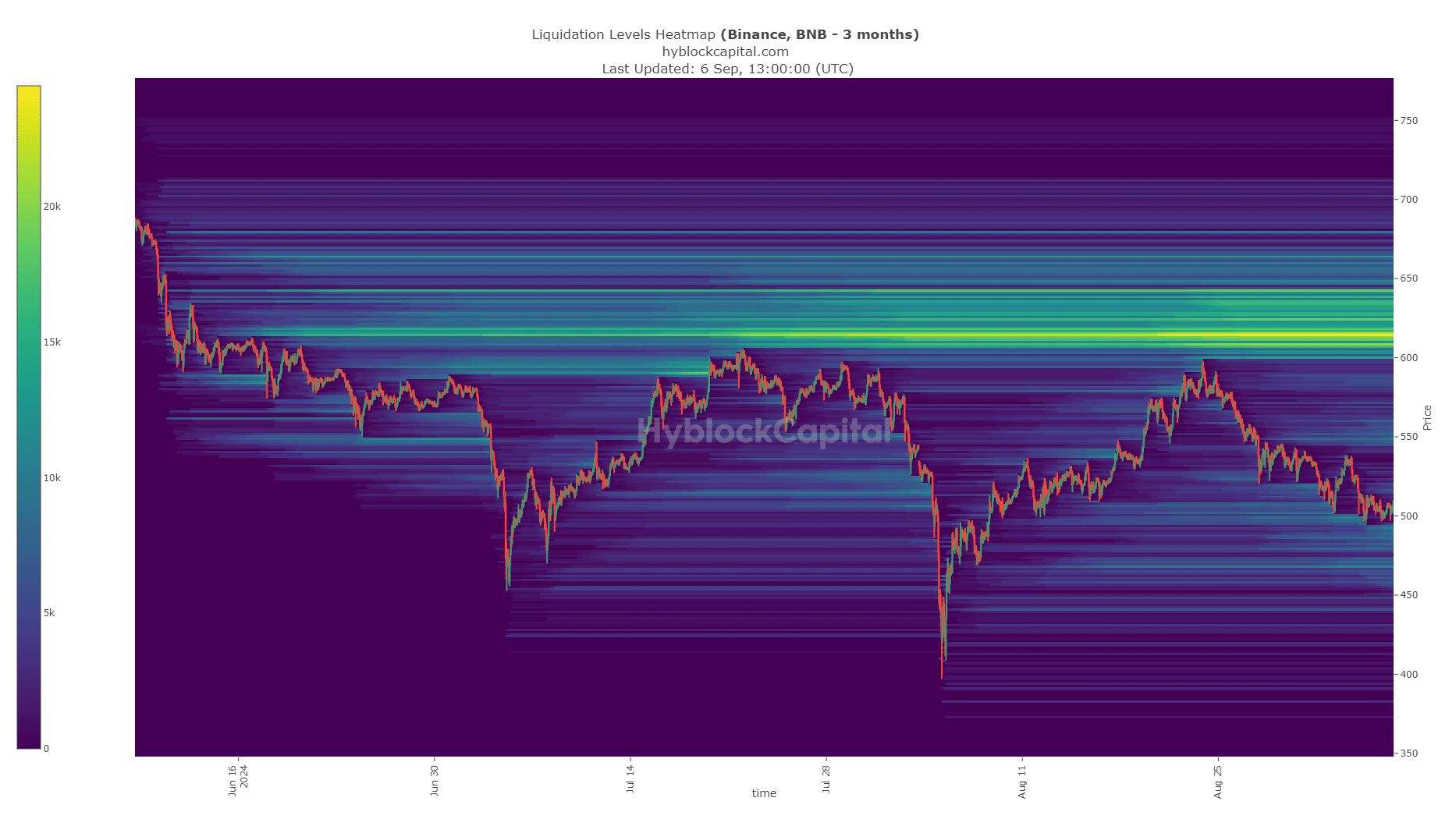

The weekly resistance zone has also formed a high-density liquidity pool for Binance Coin at $615. Therefore, the exchange token prices will be drawn north but will likely be rejected soon after a move beyond $600.

Source: Hyblock Capital

Read Binance Coin (BNB) Price Prediction for 2024-25

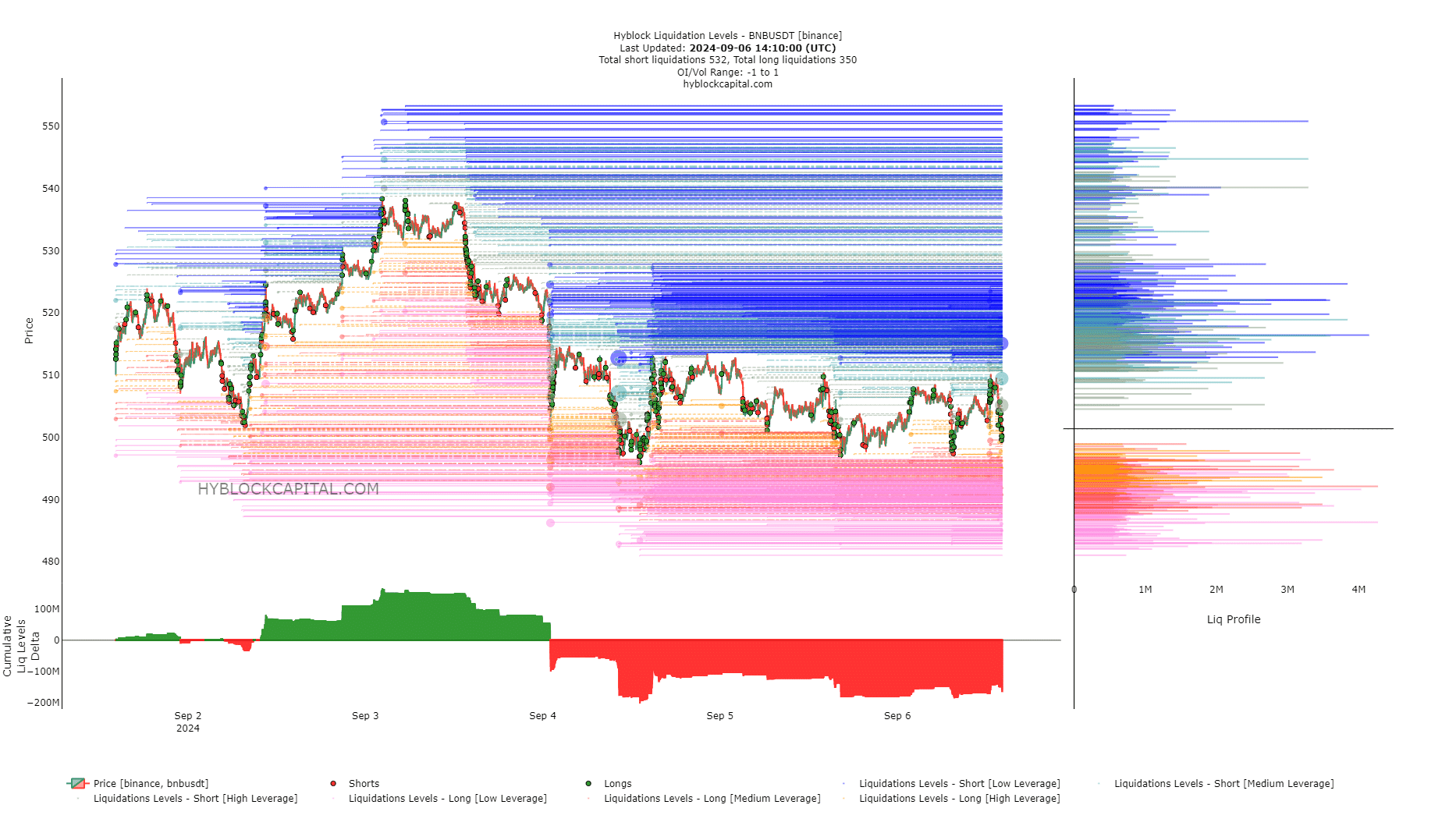

Short-term liquidation levels showed that an imbalance was growing. Short liquidations were starting to outnumber long liquidations. This meant that a short squeeze was possible.

A price bounce to $507 and $512 is likely. AMBCrypto looked at the 1-hour price chart and found a small range formation between $498 and $513, with $506 serving as resistance recently.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.