- A sustained bullish rally could see Aptos retest its March highs

- The metrics showed that APT whales benefited from greater market exposure

Aptos (APT) has performed very well over the past seven days, with the altcoin recording double-digit growth. Thanks to this, the token even managed to break out of a multi-month bullish pattern, a breakout that could soon lead to APT’s price doubling.

Aptos bucks trend

According to CoinMarketCap, Aptos bulls have pushed the token’s price up by over 20% in the past seven days. The bullish trend has also continued in the past 24 hours, with APT’s value increasing by over 7%. At the time of writing, APT was trading at $7.11 with a market cap of over $3.44 billion.

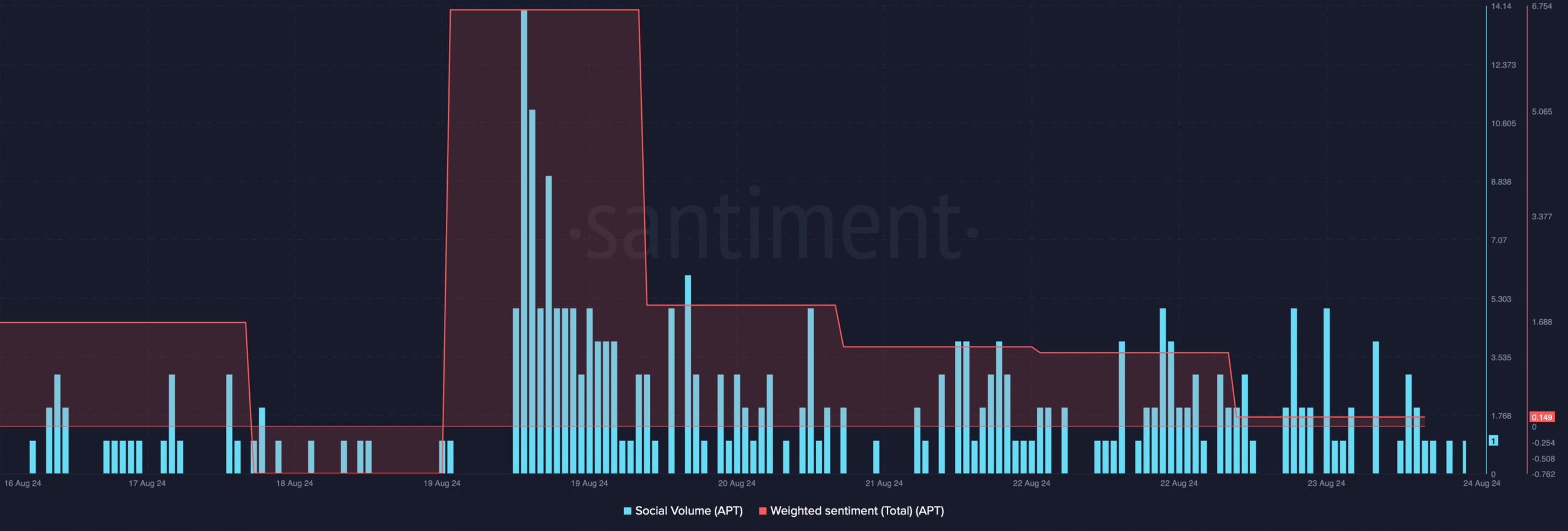

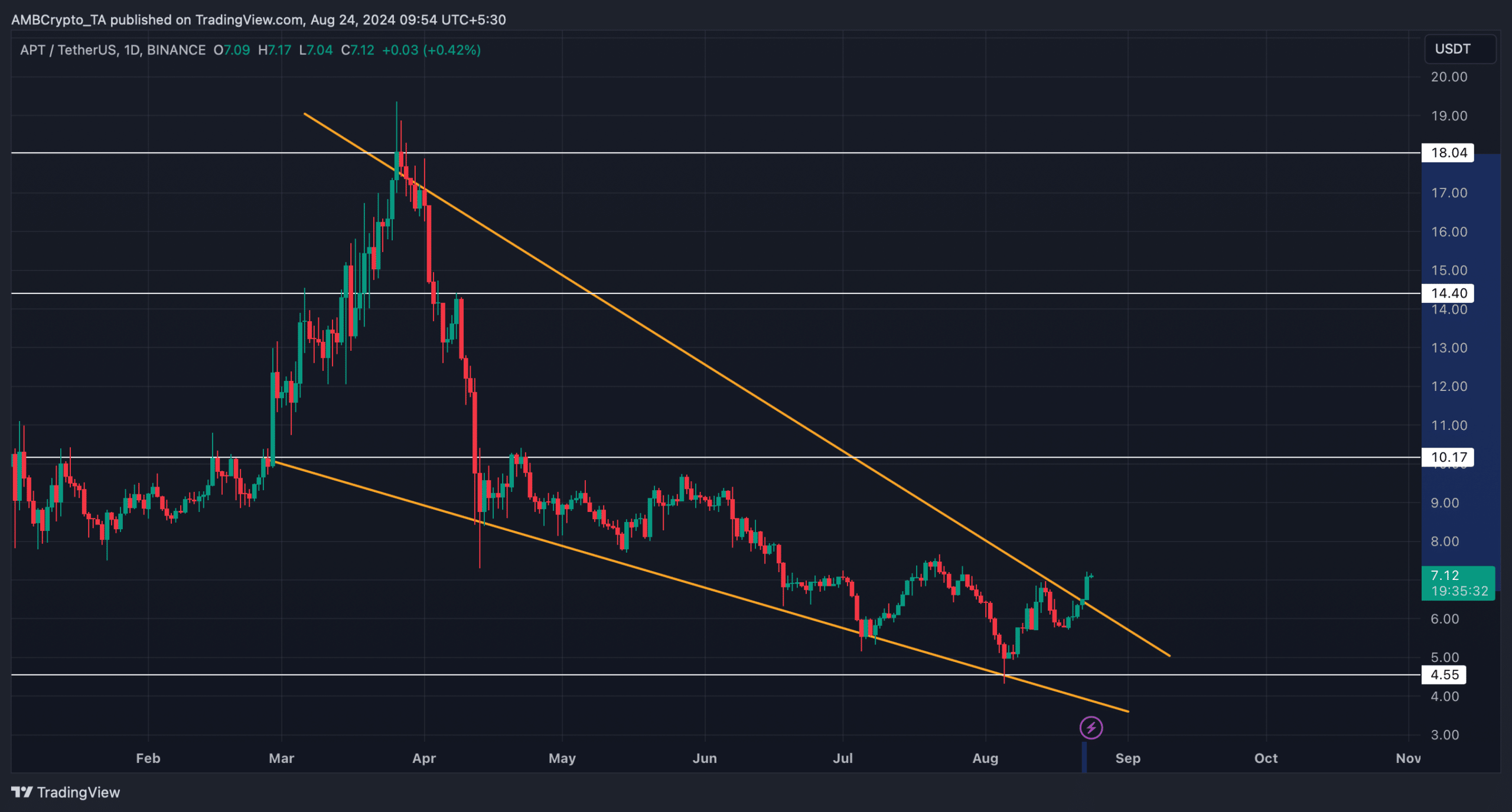

Surprisingly, despite the latest price rally, Aptos’ weighted sentiment has decreased. This suggests that bearish sentiment around the token has increased. Its social volume has also decreased, highlighting a decline in the altcoin’s popularity.

Source: Santiment

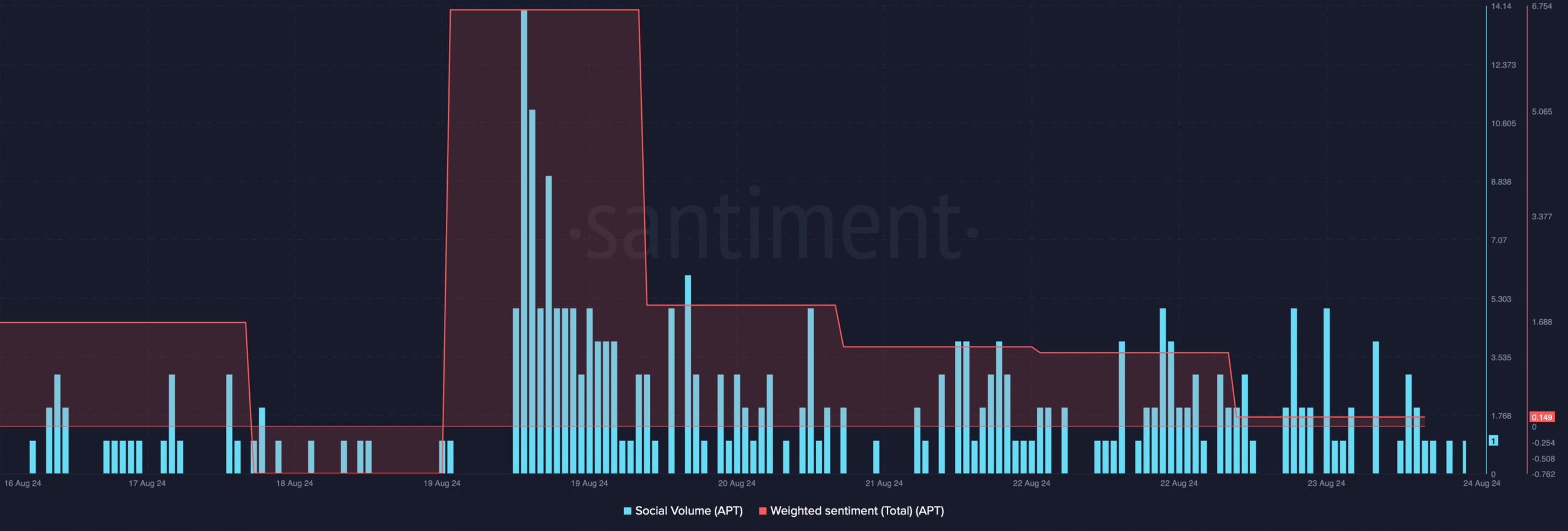

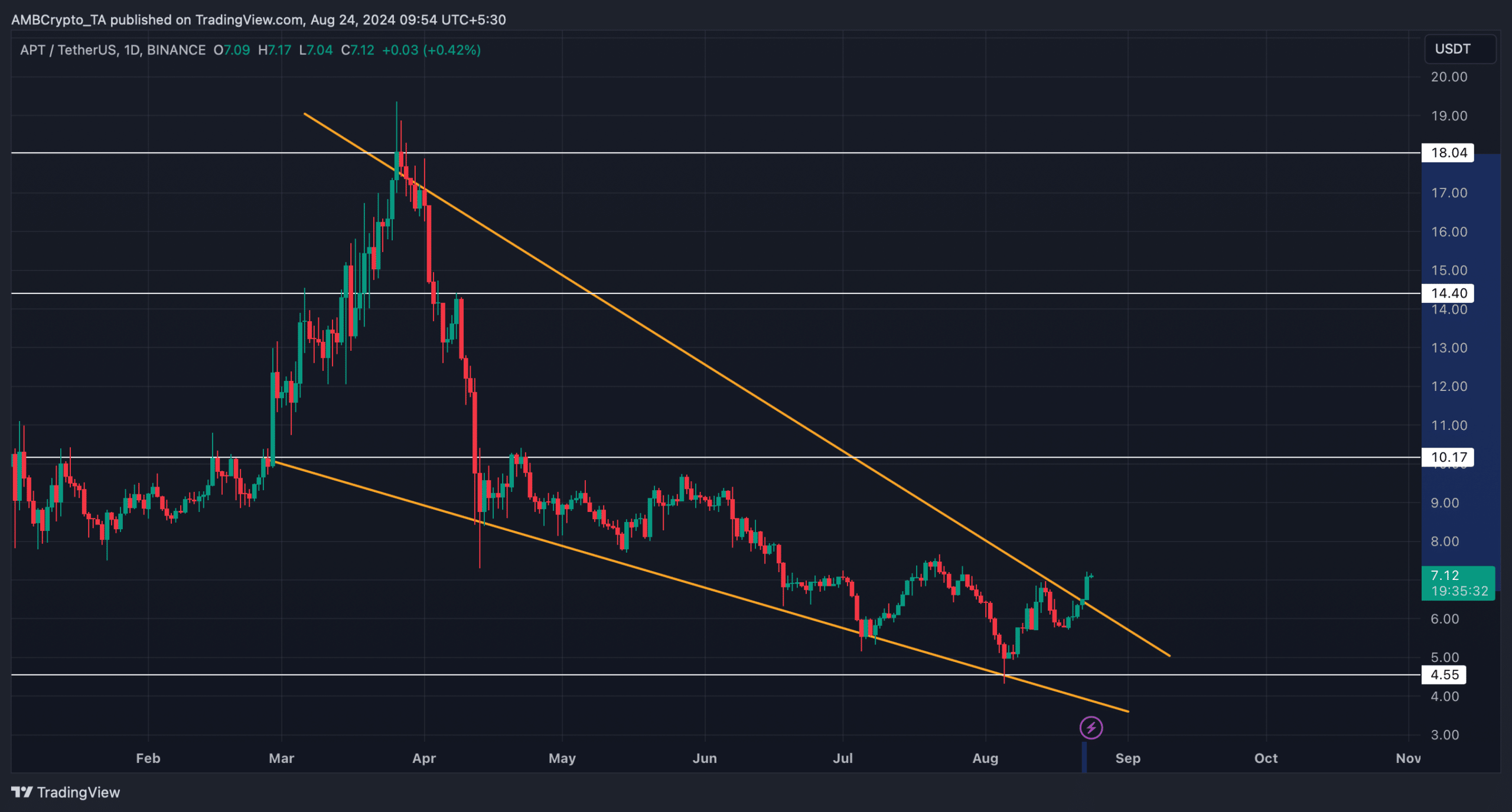

Meanwhile, the token has broken out of a bullish falling wedge pattern. This pattern appeared in March and APT price consolidated within it, only to break out of it a few days ago.

This breakout indicates that APT could see a 2x growth and retest its March highs soon. However, before aiming for its March highs, the token must first break above its resistance levels at $10.17 and $14.4 in the coming weeks.

Source: TradingView

Will the APT price increase continue?

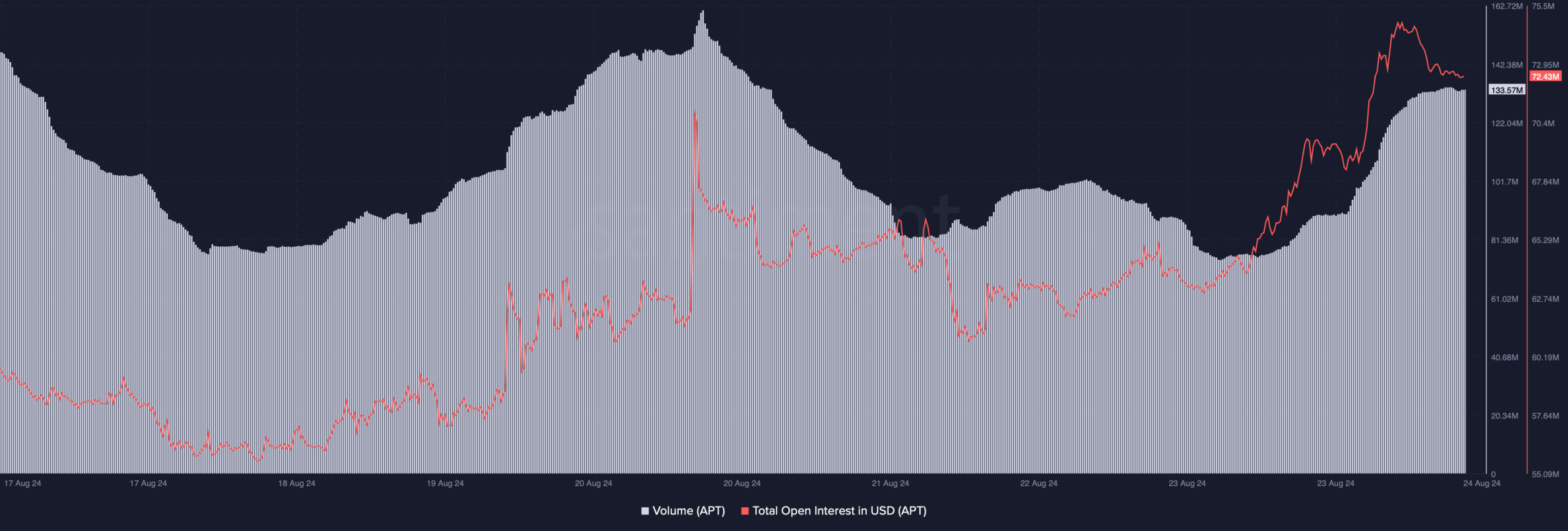

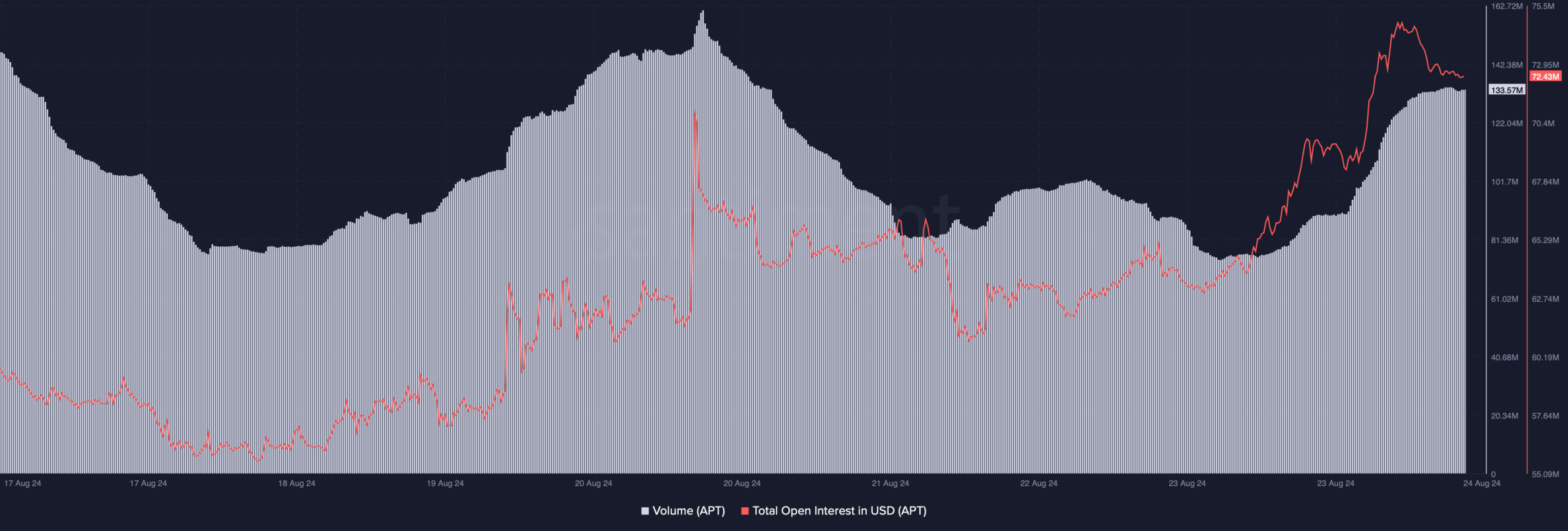

AMBCrypto then looked at Aptos’ on-chain data to see what it suggested about a sustained price rally. We found that APT’s trading volume increased by 71%, which is typically the basis for a rally.

The token’s open interest has been increasing alongside its price. An increase in this metric indicates that the chances of the current price trend continuing are high.

Source: Santiment

In addition, Coinglass’ data revealed that APT’s long/short ratio has also increased.

This means that there were more long positions in the market than short positions, which seemed bullish. Additionally, according to data from Hyblock Capital, Aptos’ whale/retail delta was at 54 at press time. A number closer to 0 to 100 indicates that whales were more exposed.

Source: Hyblock Capital

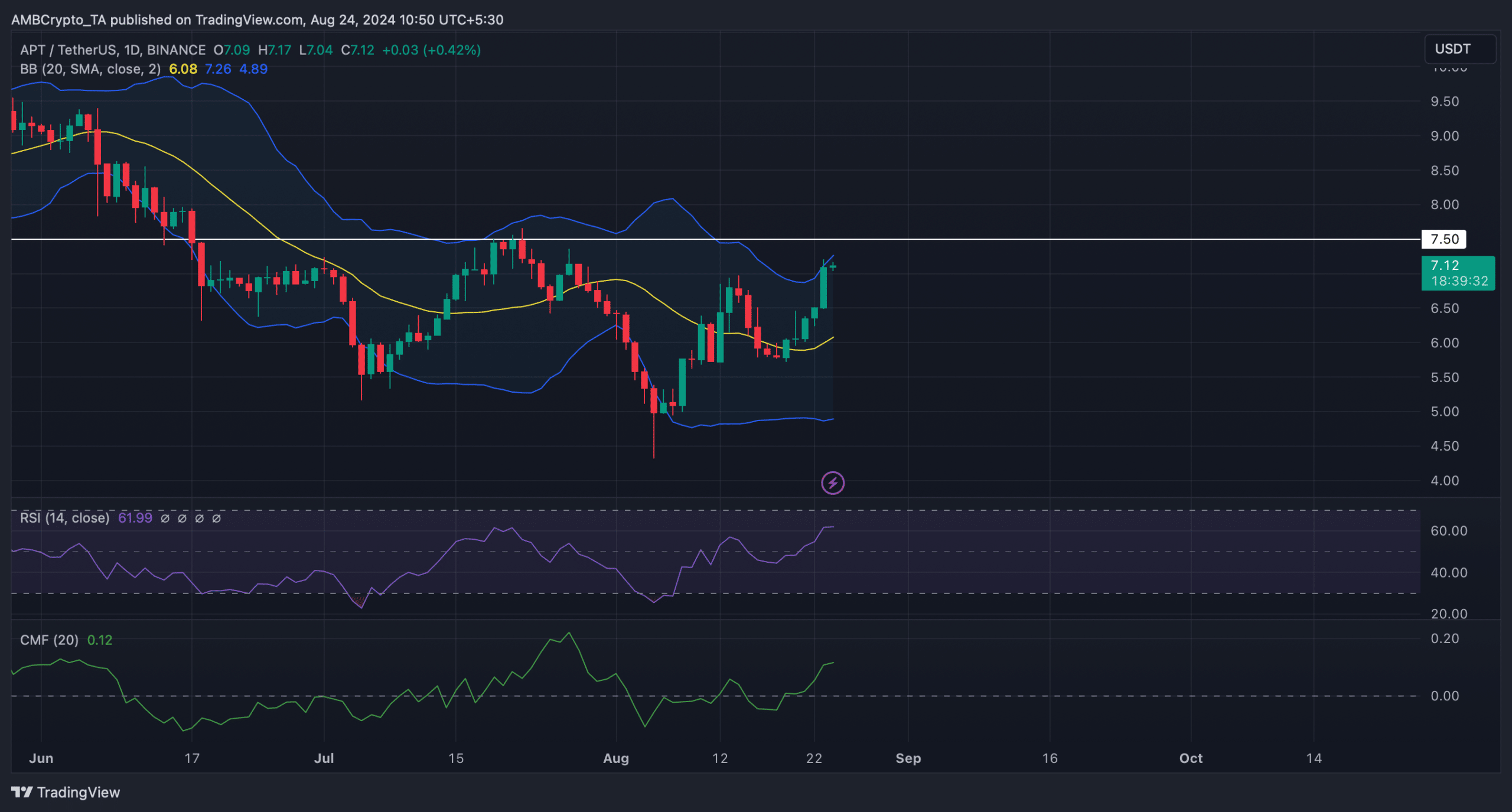

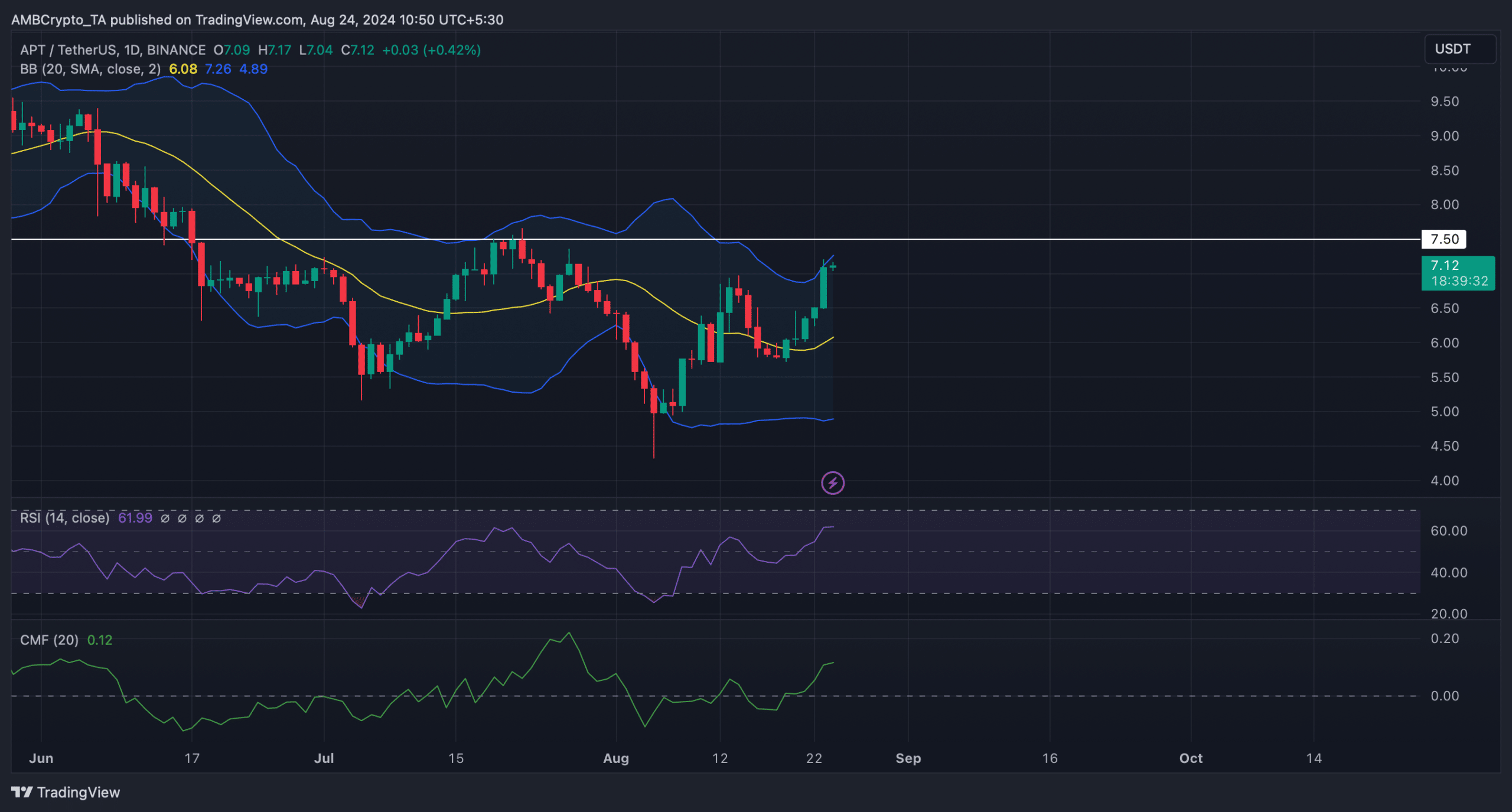

AMBCrypto finally analyzed APT’s daily chart to better understand what to expect from the token. According to our analysis, APT’s Chaikin Money Flow (CMF) registered a strong increase. The Relative Strength Index (RSI) was also above the neutral mark – a bullish sign.

Read Aptos (APT) Price Prediction 2024-25

However, the token’s price has touched the upper boundary of the Bollinger Bands, which often leads to price corrections. Nevertheless, if the bullish rally continues, it will be crucial for APT to break above its resistance near $7.5.

Source: TradingView