- Market sentiment around Chainlink remained bearish despite a price rally over the past 24 hours.

- If market indicators are to be believed, LINK could first aim for $29.

After a red weekly chart, Chain link (LINK) became bullish again as its daily chart turned green. Therefore, AMBCrypto dug deeper and evaluated the token’s on-chain data to determine where it could reach in 2025.

Chainlink bulls are back in action!

According to CoinMarketCap dataLINK price has fallen 1.2% over the past seven days. But LINK bulls came in over the past 24 hours as the token’s value increased by over 2.5%.

At the time of writing, Chainlink was trading at $21.73 with a market cap of over $13.8 billion.

Thanks to the latest price increase, more than 478,000 LINK addresses were “in the money”, which represented almost 68% of the total number of Chainlink addresses, according to In the block.

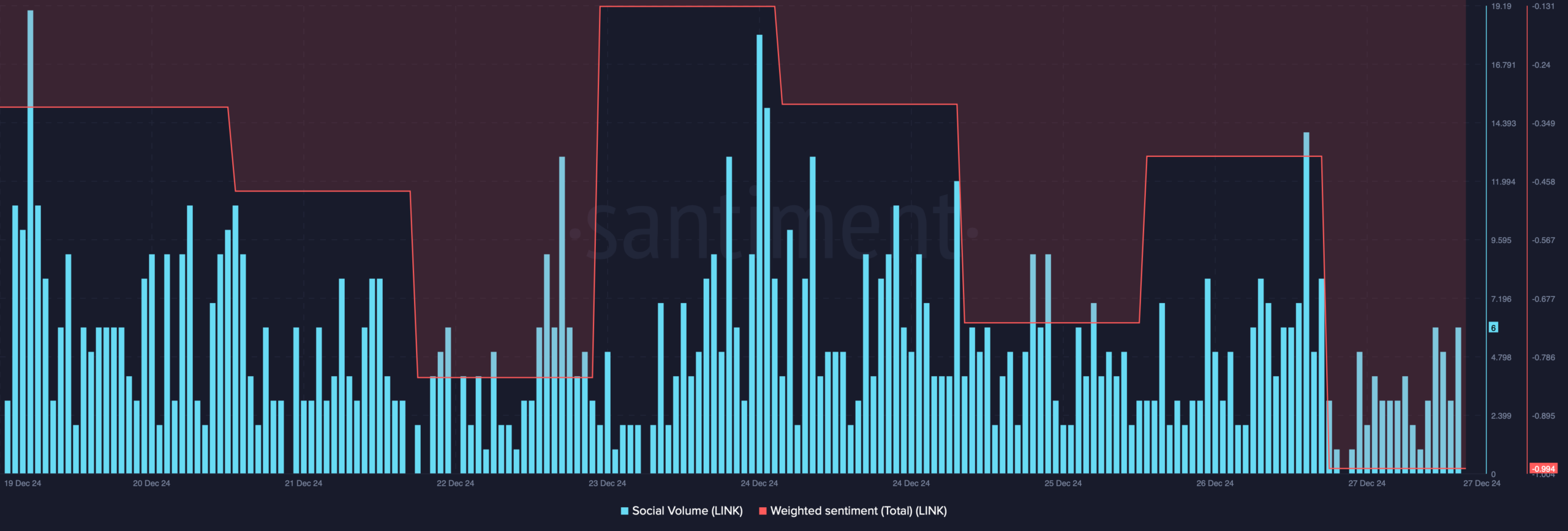

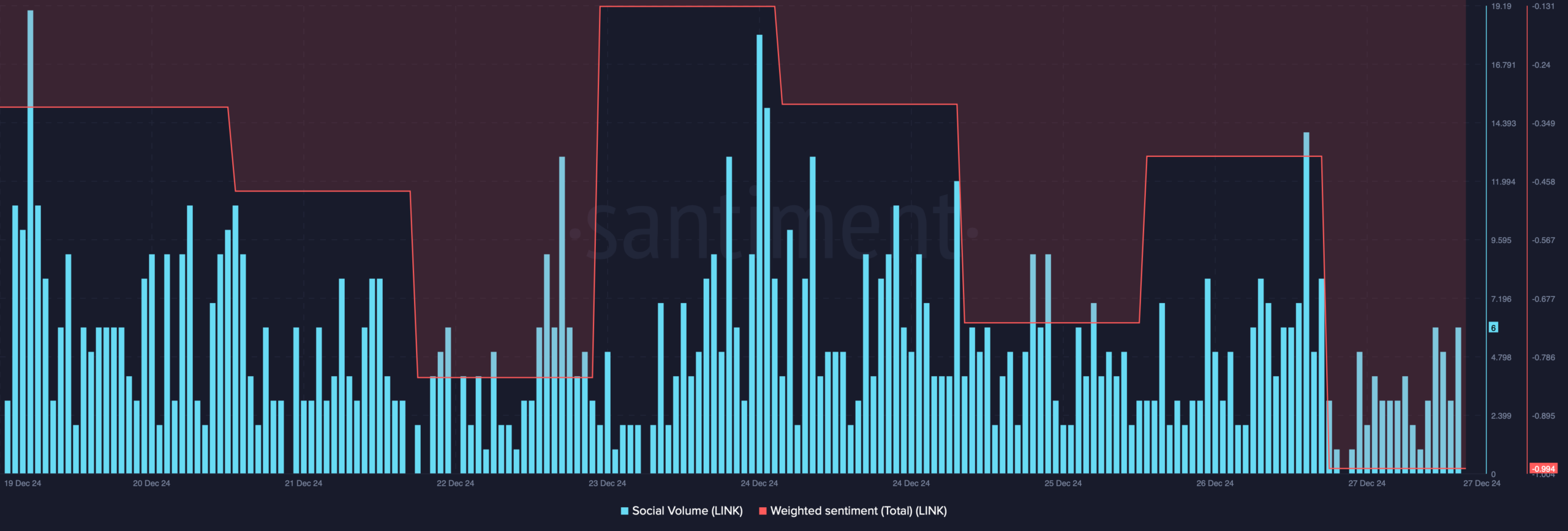

However, the price rise over the past 24 hours has not had a positive impact on the token’s social metrics. Notably, LINK’s weighted sentiment declined sharply, which was a clear indication of growing bearish sentiment.

Additionally, Chainlink’s social volume also declined last week, reflecting a decline in the token’s popularity.

Source: Santiment

Will LINK hit $50?

While all this was happening, World Of Charts, a popular crypto analyst, published a tweet revealing that LINK was still trading within an optimistic range. Thus, the token could evolve towards $50 in the coming days.

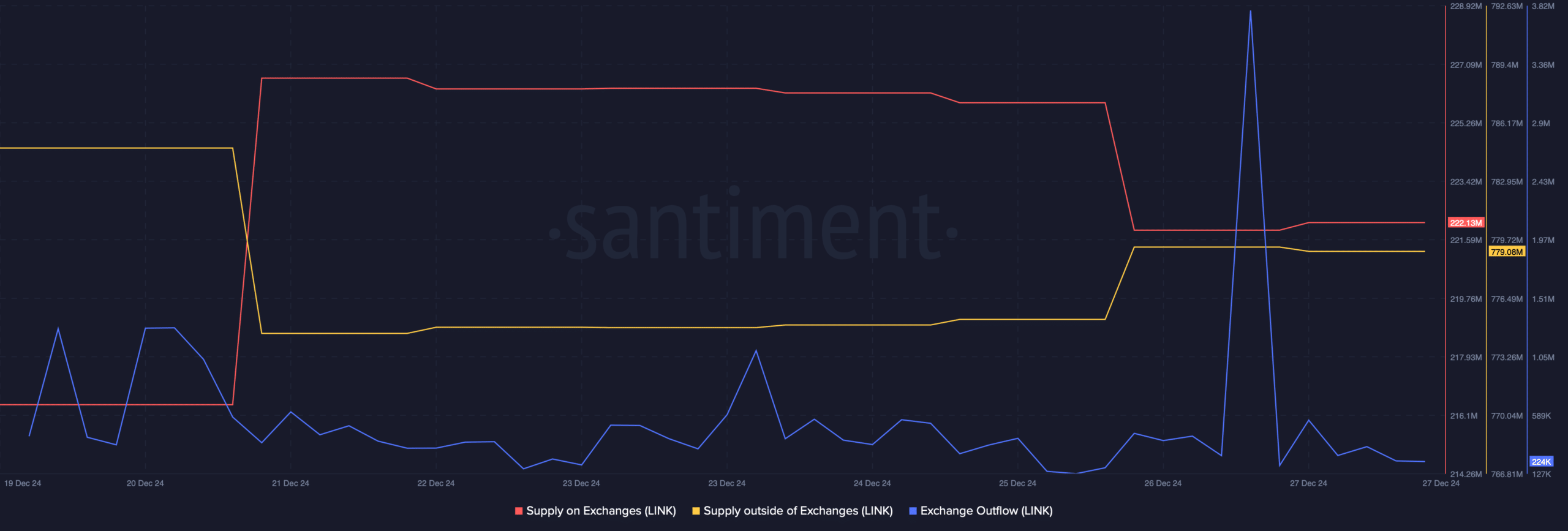

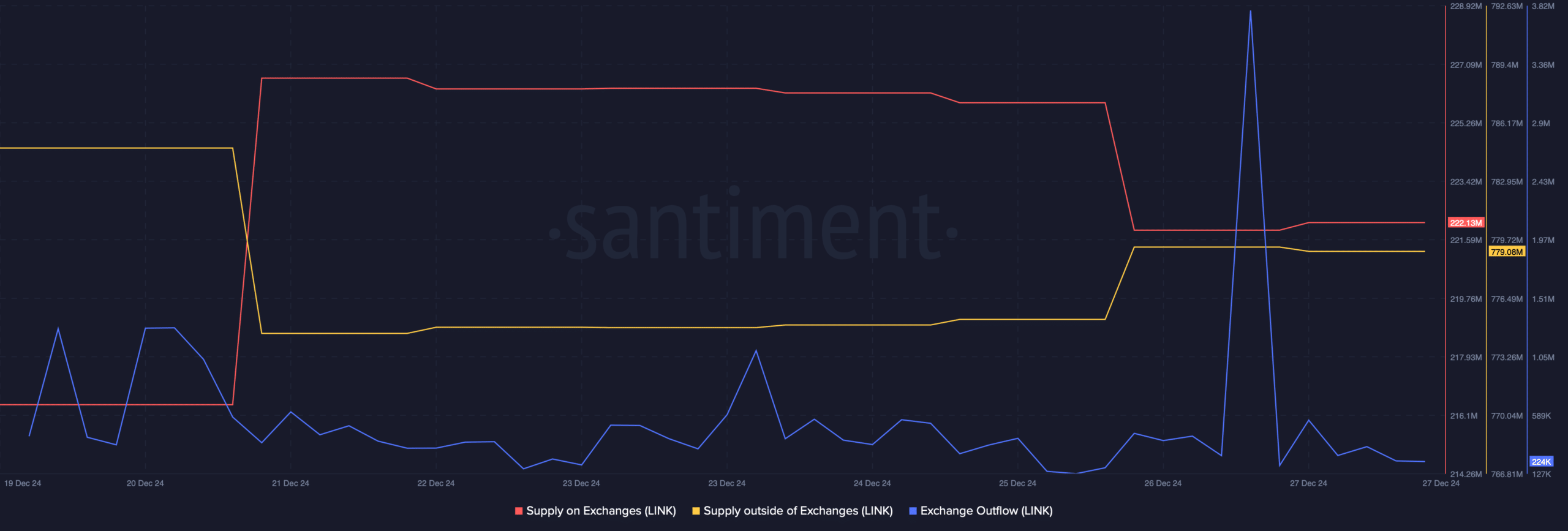

Therefore, AMBCrypto checked other datasets to know the chances of LINK reaching this level in the medium term. The good news was that buying pressure on the token was starting to increase.

This is evident from its increasing supply outside of exchanges and decreasing its supply on exchanges.

Additionally, Chainlink exchange outflows also increased on December 26, suggesting an increase in buying pressure.

Source: Santiment

What’s next for LINK?

However, at the time of writing, Chainlink fear and greed index had a result of 61%, meaning the market was in a “greed” phase. Whenever this happens, it indicates that there are chances of a price correction.

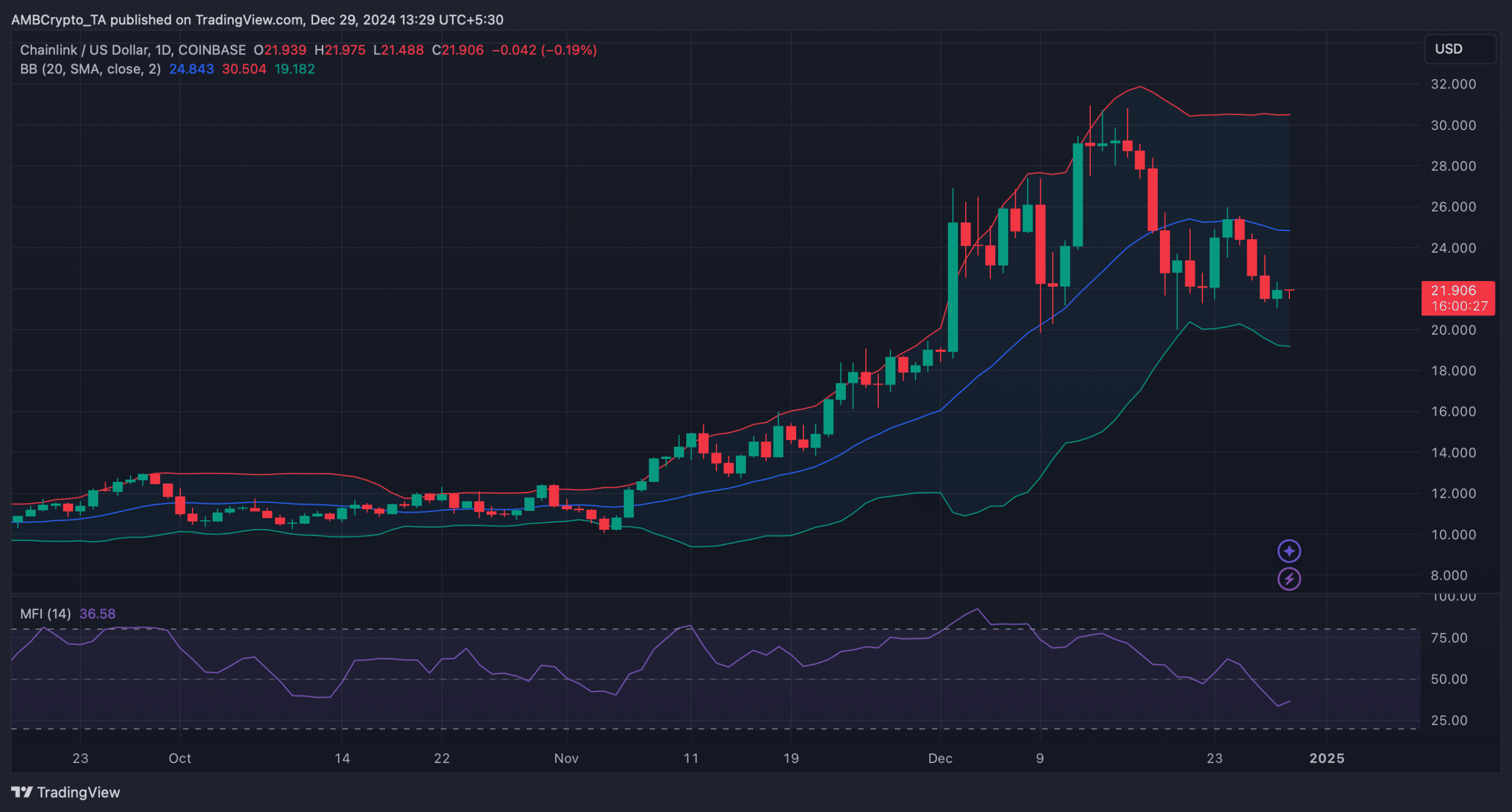

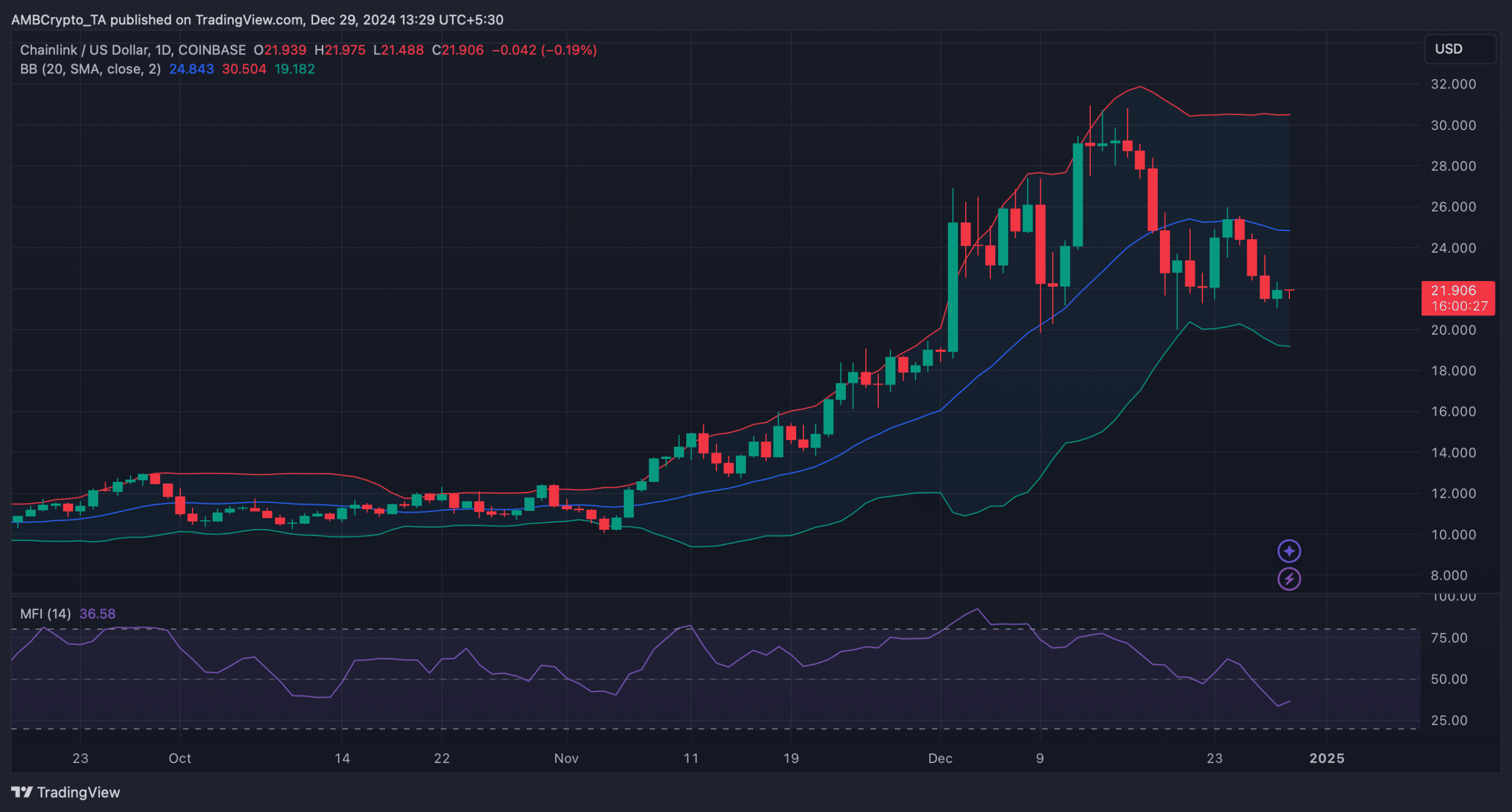

But technical indicators suggested that LINK price was about to reach the lower limit of the Bollinger bands. If this happens, it may trigger a bull rally.

Is your wallet green? Discover the LINK Profit calculator

Further price rise could see the token recover $29 before considering $50.

In fact, after a decline, the Money Flow Index (MFI) also recorded a slight rise, which can support the token’s journey towards $29.

Source: TradingView