- Cardano surpassed its high from 4 months ago

- A move towards $0.422, driven by liquidity, seems likely to occur soon.

Cardano (ADA) completed its breakout over the past week, gaining a remarkable 43.3% from Monday’s lows to reach $0.4587. In fact, a recent report highlighted that whale transactions have also increased by 32%.

Such an increase in whale activity reflects renewed interest in Cardano and higher demand. Here, it is also worth pointing out that the trading volume has been significantly above average during this rally.

Cardano dips are worth buying

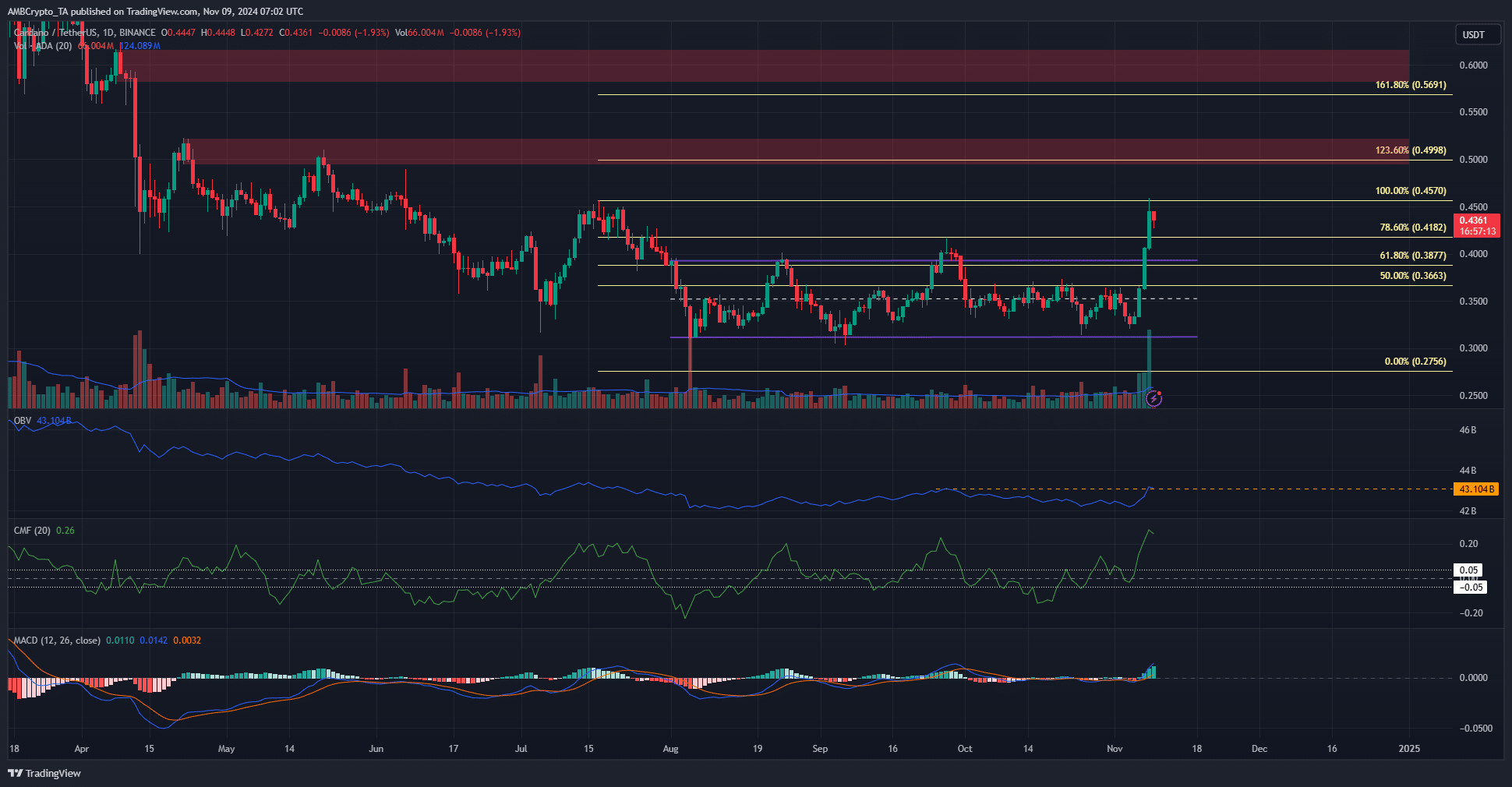

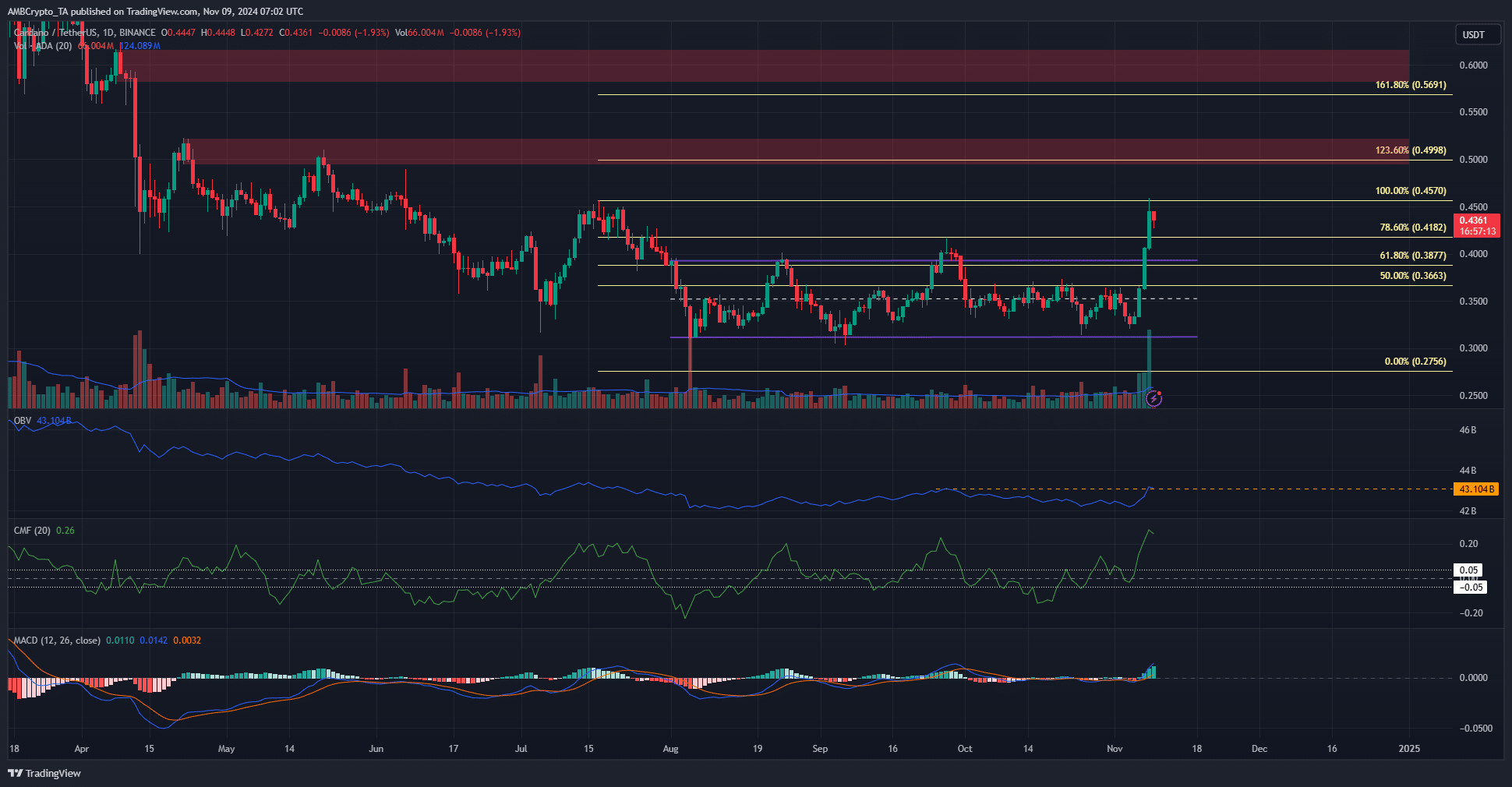

Source: ADA/USDT on TradingView

Since August, Cardano has been trading in a range of $0.313 to $0.394. In late September, it attempted to break above the range top and reached $0.418, but was rejected. Around this time, Bitcoin (BTC) was also rejected by its resistance at $66.2k.

The fall in ADA took it to the lows of the range in the second half of October. On November 4, the CMF and MACD reported no significant capital inflows and bearish momentum.

Indicators have turned around following the rapid gains made by the token over the past week. The CMF was at +0.26, above its level since February. The MACD showed strong bullish momentum. Finally, OBV was poised to surpass its local highs, which also remain undefeated since August.

Hunting for Liquidity Likely Before Next Impulse Move

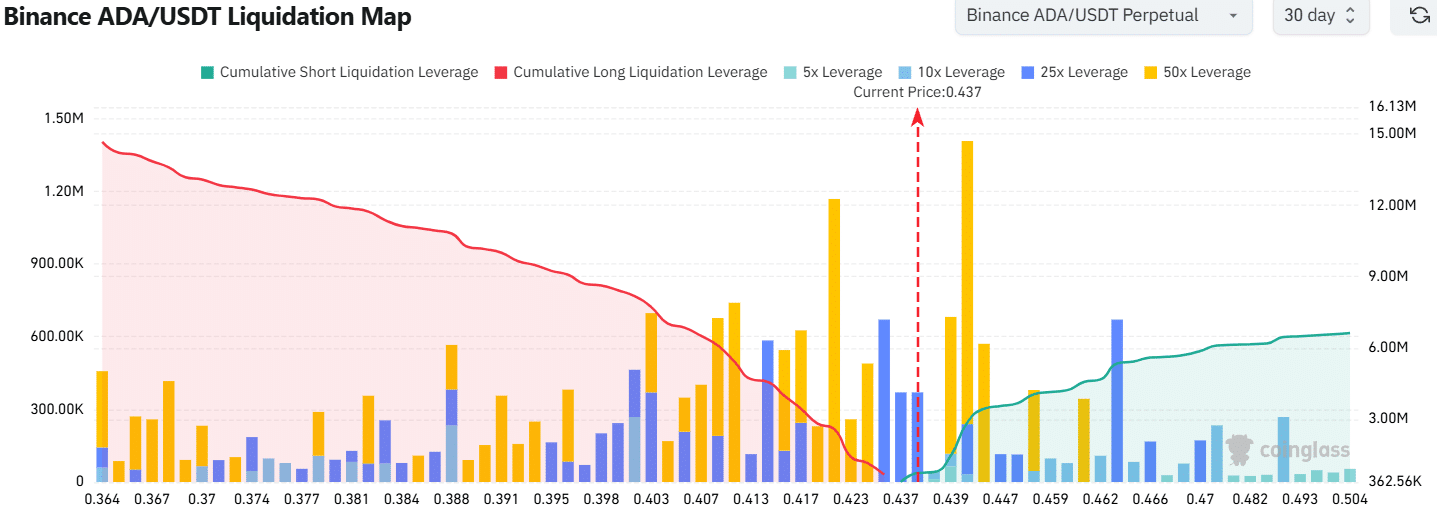

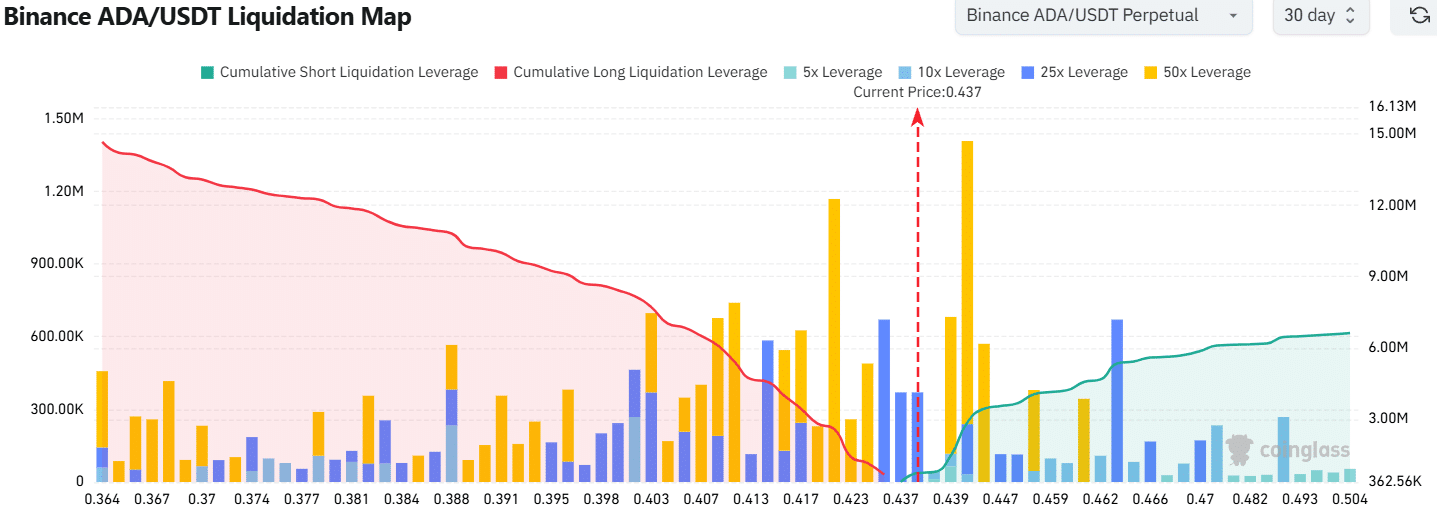

Source: Coinglass

The liquidation map featured the $0.422 and $0.44 levels as locations with considerable concentration of liquidation levels. Cumulative short liquidations at $0.44 were higher. Additionally, a rebound to $0.44 would prompt more traders to take long positions, thereby accumulating liquidity heading south.

Is your wallet green? Check the Cardano Profit Calculator

Subsequently, a retracement to $0.422 or higher can collect this liquidity before Cardano is ready for its next move. Technical analysis revealed that a rise beyond $0.457 is only a matter of time, and $0.5 and $0.57 would be the next long-term targets.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.