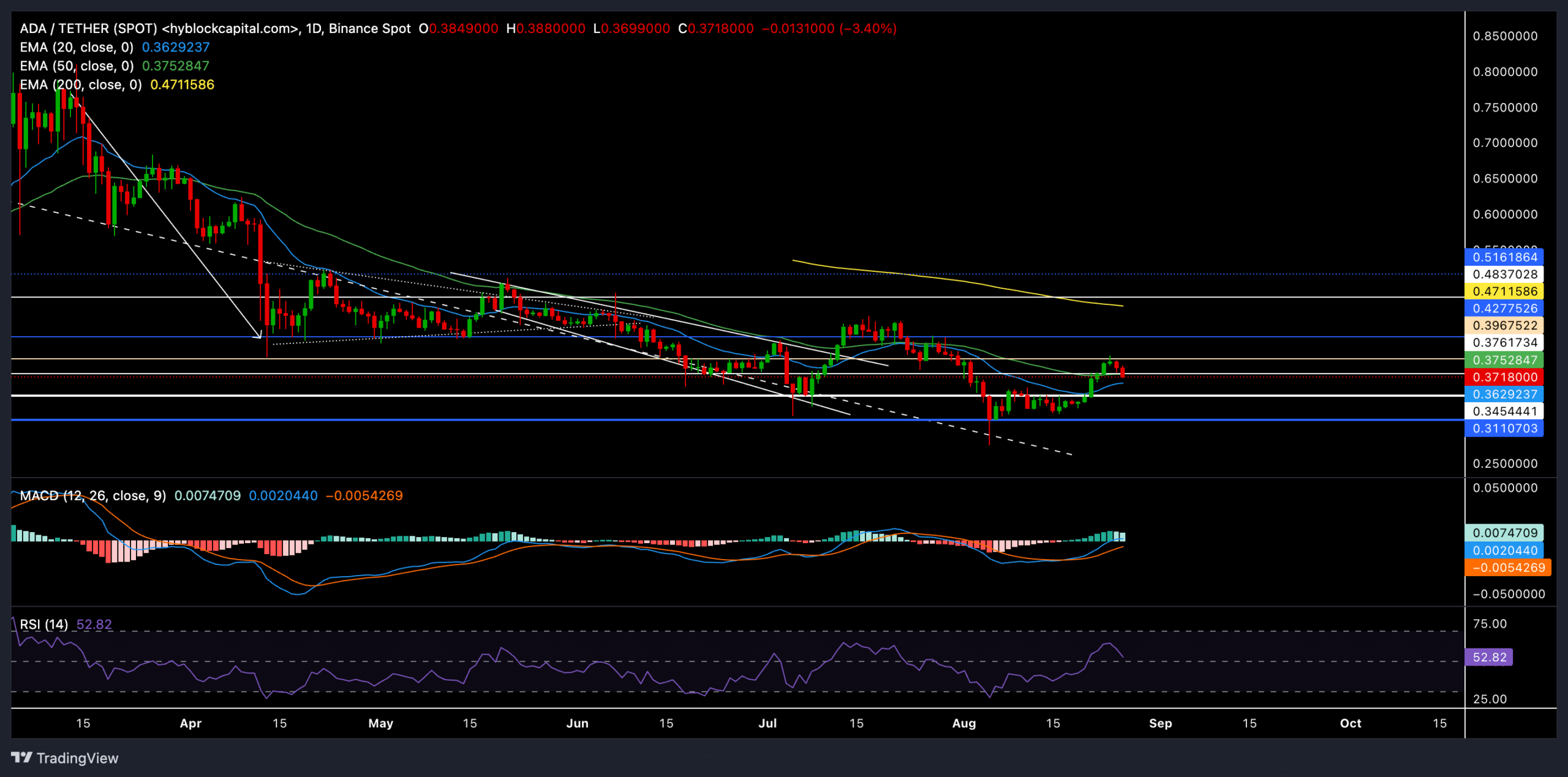

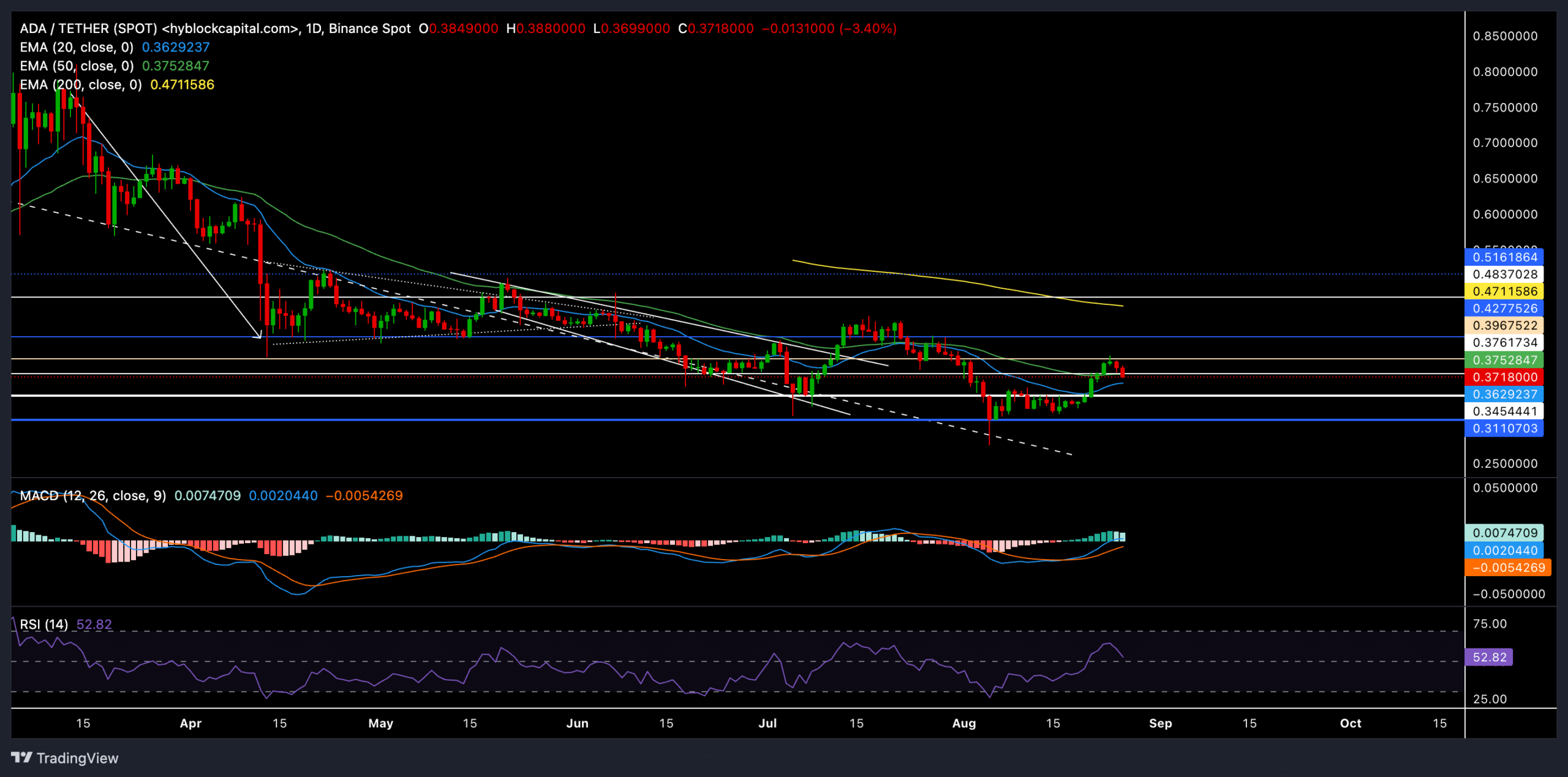

- Recent price action suggests that the bears are still in control from a long-term perspective.

- Traders should closely monitor the $0.3629 support as a break below this level could lead to further downside risks.

Cardano (ADA) has been navigating somewhat uncertain market sentiment, with its price recently succumbing to increased selling pressure from the $0.39 resistance.

As the overall sentiment in the cryptocurrency market has improved slightly over the past day, Cardano could find support near the 20-EMA. ADA was trading at $0.37 at press time after seeing a decline of nearly 5% in 24 hours.

Cardano bulls spark rally above short-term EMAs

Source: ADA/USDT

ADA recently bounced from the $0.31 support level but struggled to close above the resistance level near the $0.39 mark.

While price action closed above the 20-day EMA ($0.3629) and 50-day EMA ($0.3752) after the bounce, the recent reversal pulled ADA below its 50-day EMA level.

It is worth noting that the 200-day EMA at $0.4711 acts as a more distant resistance level, highlighting longer-term bearish dominance.

The MACD showed a slight bullish trend, with the MACD line slightly above the signal line. However, the MACD finally entered positive territory after a few weeks. This indicates that the immediate selling momentum may be slowing down.

For bulls to regain control, ADA must find a rebound from the 20-day EMA and retest the $0.39 resistance.

The RSI has been hovering near equilibrium, but buyers should expect a potential bounce from the 50 mark. However, any decline below this level may expose ADA to a delayed recovery.

Key levels to watch

The immediate support to watch is the $0.375 level. If ADA manages to hold above this level, it could attempt to break the $0.39 resistance. A successful close above this resistance could pave the way for a recovery towards the 200 EMA near the $0.47 level.

However, if the bears continue to exert pressure and ADA breaks below $0.3629, it could retest the $0.3454 support level.

Read Cardano (ADA) Price Prediction for 2024-25

Volume decreased by 3.52% to $292.17 million over the past 24 hours, and open interest increased by 0.96% to $192.97 million. This indicates that traders are still engaged in the market and waiting for clearer signals.

Source: Coinglass

The long/short ratio for the past 24 hours was 0.8372, indicating bearish sentiment. However, on Binance, the ADA/USDT long/short ratio was rather bullish at 2.4626 at press time.