A widely followed cryptographic strategist thinks that a safe asset correction will likely trigger risky behavior that could benefit Altcoins.

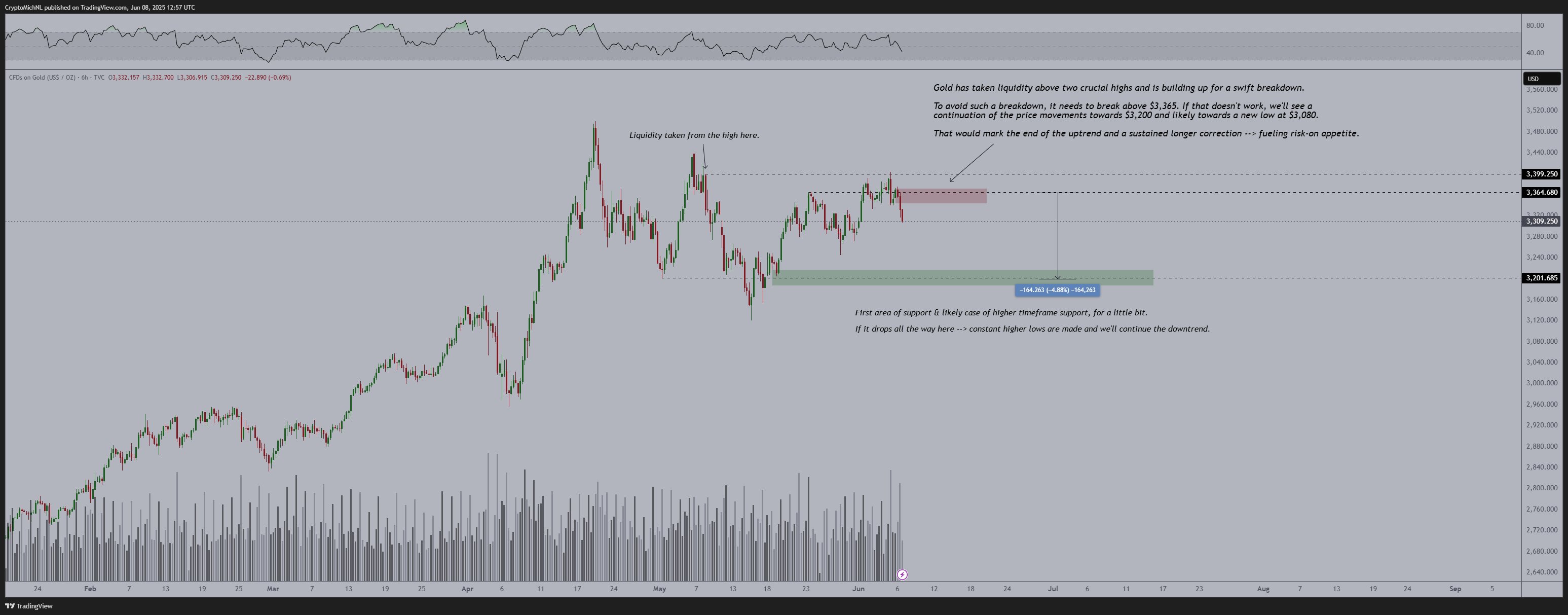

Analyst Michaël Van de Poppe told his 791,800 subscribers on the X social media platform that he closely monitored the action of Gold prices, noting that the graph of the precious metal is the “most important graphic to look at” this week.

According to the merchant, Gold seems to have printed a high low configuration drops to the six -hour table, suggesting that the precious metal could fall to $ 3,200 in the short term.

“As long as gold is less than $ 3,365, we will probably see a strong fall in the coming to two weeks from 4 to 10%, which has resulted in a sudden macroeconomic change.”

Van de Poppe estimates that the drop in gold prices will be beneficial for altcoins, as it suggests an increased appetite for risk among investors.

“At the end of the (last) week, a sudden correction (gold) took place, which could result in confirmation of a short -term trend.

This is vital because it would attract more investors to altcoins.

For what?

This would allow more investors to switch to risky assets, when gold implies that it continues to fall.

This means -> money / liquidity circulates from risk assets to risky assets, and the best class of assets remains to be cryptographic. »»

But the trader warns that altcoins will probably see lower levels if the gold breaks $ 3,365.

“If this moved above this crucial level, the theory is invalidated, and we are probably open for the printing of new peaks, which means that we print new low on altcoins.

For me, this is crucial, because a gold and rally correction in the CNH (Chinese offshore renminbi) implies that we will see more interest flowing in the crypto after that. “”

At the time of writing, Gold is negotiated at $ 3,324, up more than 60% in the last 18 months.

Follow us on X, Facebook and Telegram

Do not miss a beat-Subscribe to obtain alerts by e-mail delivered directly in your reception box

Check price action

Surf the daily Hodl mixture

& nbsp

Warning: Opinions expressed at Daily Hodl are not investment advice. Investors should make their reasonable diligence before making high-risk investments in bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and that all the losses you may undergo are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, and the Daily Hodl is an investment advisor. Please note that the Daily Hodl is participating in affiliation marketing.

Image generated: Midjourney