This article is also available in Spanish.

Crypto trading firm QCP Capital says the “shallow sell-off” in crypto markets following the recent Iranian attack on Israel indicates healthy market demand for risky assets.

Crypto market remains well offered for risky assets

Although Iran launched more than 180 missiles towards Israel yesterday, the sale of traditional financial assets (TradFi) was relatively subdued. The S&P 500 closed 1% lower, while prices for U.S. benchmark West Texas Intermediate (WTI) oil rose 2%.

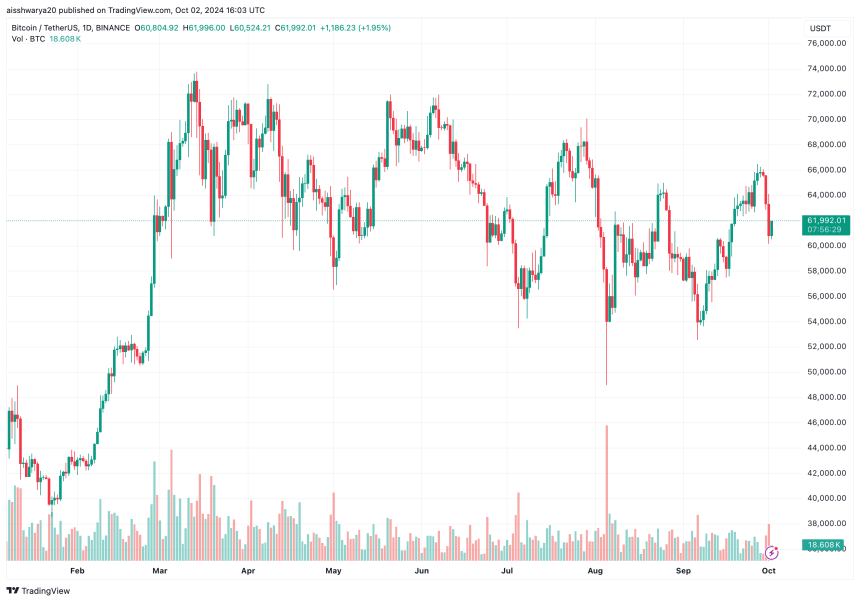

In contrast, the digital asset market was relatively harder hit, with Bitcoin (BTC) falling more than 5% following the Iranian attack. The total crypto market cap eroded by more than 6% while liquidations exceeded $550 million in the last 24 hours, according to CoinGlass data. noted.

Related reading

In the reportQCP Capital says the leading cryptocurrency appears to have found strong support at the $60,000 level. However, the company warns that further escalation in the Middle East could force BTC to fall to $55,000.

Regarding the market sell-off observed yesterday, the trading company said:

Middle East geopolitics will be in the spotlight for now, but the sell-off suggests the market remains long in risky assets. This slight setback should not distract from the bigger picture.

The report also highlights that China’s recent economic policy actions are similar to those of Japan in the 1990s. The Bank of Japan (BoJ) has notably combated deflation by reducing interest rates, introducing interest rates negative interest rates and launching a quantitative easing program. The report added:

The PBoC liquidity influx and potential fiscal support will likely support asset prices in China, with bullish sentiment potentially spreading globally to support risk assets, including cryptocurrencies.

Additionally, the report highlights recent dovish remarks by US Federal Reserve (Fed) Chairman Jerome Powell to the National Association for Business Economics, signaling further interest rate cuts in 2024.

For context, the Fed cut interest rates for the first time in 4 years on September 18. Subsequently, financial markets around the world saw a surge in the prices of risky assets, such as stocks and cryptocurrencies.

The report concludes that “asset prices are expected to remain supported through 2025,” supported by aggressive interest rate cuts from the largest (Fed) and third-largest (People’s Bank of China) central banks. of the world.

What to expect from Bitcoin in Q4 2024?

Although the Iran-Israel conflict has had a direct impact on the price of BTC, crypto analysts remain optimistic about a potentially strong fourth quarter of 2024. suggested that the recent drop could represent BTC’s “quarterly low.”

Related reading

Eric Crown, another crypto analyst of opinion that BTC could reach a new all-time high (ATH) in Q4 2024, basing its analysis on the cryptocurrency’s historical performance in the months following September. Bitcoin is trading at $61,992 at press time, down 1.2% in the last 24 hours.

Featured image from Unsplash, chart from Tradingview.com