- Popcat, Artificial Superintelligence Alliance and SATS were the biggest gainers last week.

- Helium, Toncoin and Notcoin were the biggest losers last week.

Recent developments surrounding Telegram have had a significant impact on the performance of Toncoin (TON) and Notcoin (NOT), placing them among the biggest losers in the cryptocurrency market.

On the other hand, Popcat has performed well over the past week, becoming a leader among memecoins.

The biggest winners

Popcat (POPCAT)

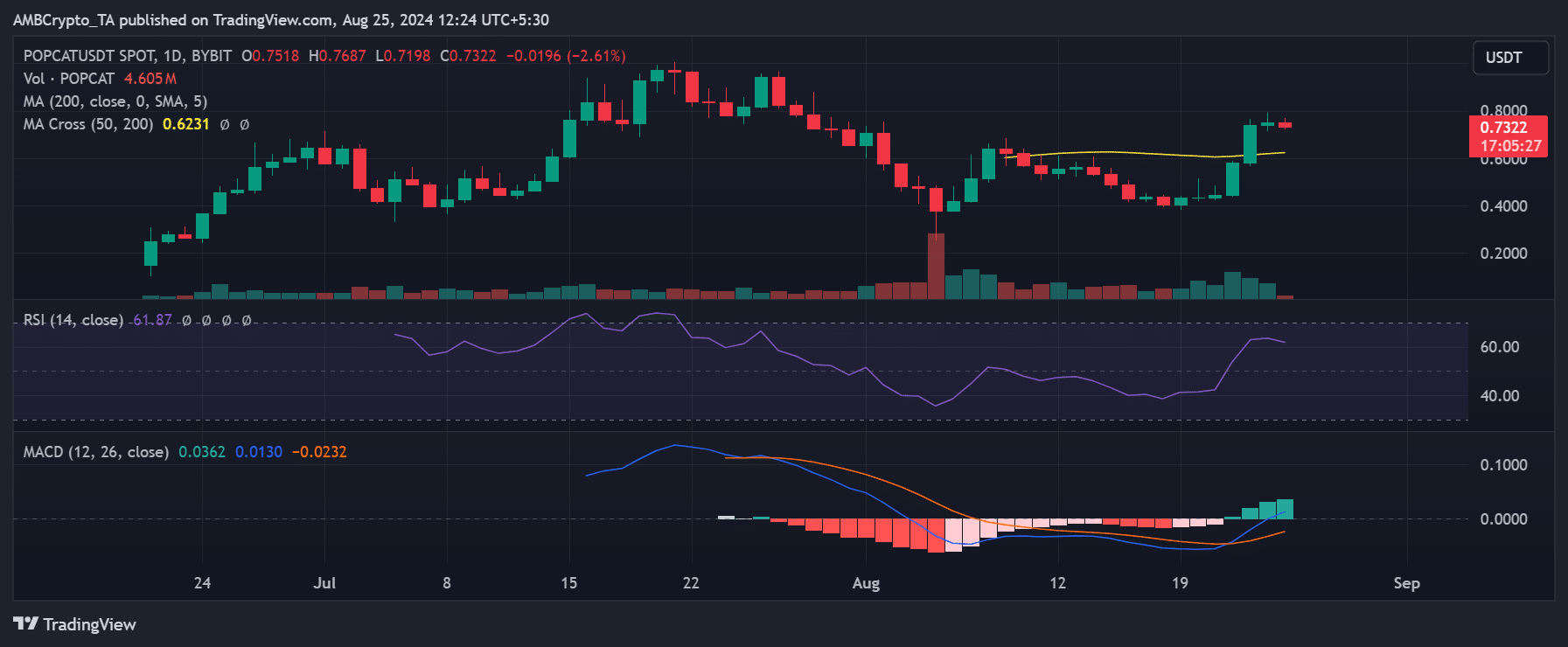

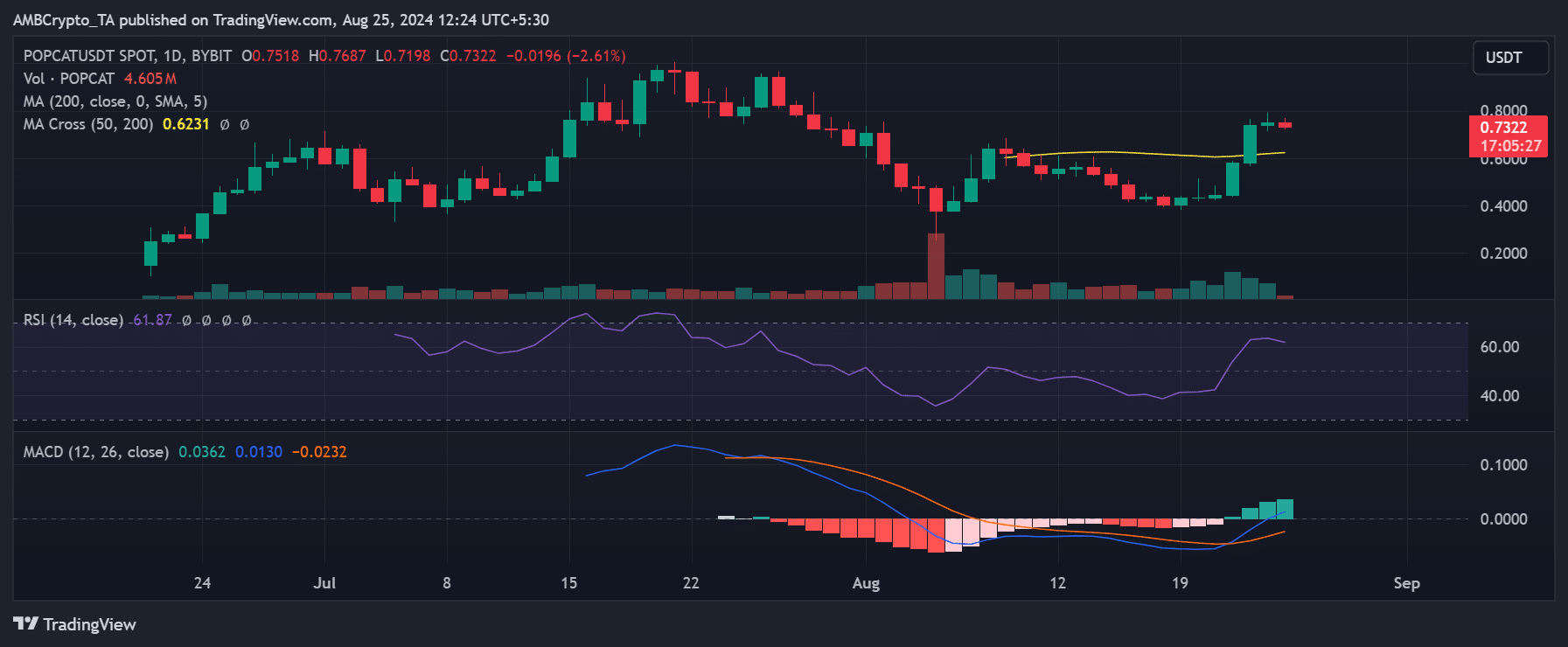

Popcat (POPCAT) daily price chart analysis indicates significant spikes over the past week, making it the biggest gainer. According to data from CoinMarketCap, POPCAT gained an impressive 77.43% over the week.

Source: TradingView

Price trend analysis reveals that POPCAT started the week trading around $0.40, initially experiencing a decline of over 7%. However, this trend quickly reversed, starting with an increase of over 7% the following day.

The most notable upward trends occurred on Thursday, August 22 and Friday, August 23, where the price increased by 30.79% and 27.16% respectively.

By the end of the week, the price of POPCAT had risen to around $0.75 after an additional increase of more than 1%.

These significant spikes have shifted the overall trend to an uptrend, as evidenced by the Relative Strength Index (RSI), which has crossed above 60, signaling strong bullish momentum.

Popcat’s market cap is around $718 million at the time of writing. However, its trading volume has decreased by over 40%, and now stands at around $91.3 million.

Alliance for Artificial Superintelligence (FET)

The Artificial Superintelligence Alliance (FET) emerged as one of the top performers of the week, recording the second-largest gains.

Despite a slow start, with a price around $0.8 at the beginning of the week, FET saw significant uptrends in the following days. By the end of the week, its price had climbed to around $1.2, marking a substantial gain.

According to data from CoinMarketCap, FET has seen a 46.81% increase over the week, driven by these positive trends. This growth has also had a notable impact on its market capitalization.

At the start of the week, FET’s market cap was around $2.1 billion. However, by the end of the week, it had grown to around $3.1 billion, which remains the case at the time of writing.

Despite the impressive growth in price and market capitalization, FET’s trading volume has been declining. Currently, its volume is about $213 million, a decrease of more than 20%.

SAT (1000SAT)

SATS (1000SATS) was the third-biggest gainer of the week, posting a 46.81% gain, according to data from CoinMarketCap. Price trend analysis shows that SATS had a strong start to the week, trading at around $0.00028.

Throughout the week, its price saw steady gains, culminating in a significant spike on August 23. By the end of the week, SATS was trading at around $0.0004.

This price increase has also had a notable impact on SATS’s market capitalization, which has reached around $826 million at the time of writing. Despite this strong performance, trading volume has seen a decline.

Currently, the SATS volume is around $176 million, which is a decrease of more than 20%.

The biggest losers

Helium (HNT)

After two strong weeks, Helium (HNT) saw a significant decline, becoming the biggest loser last week with a drop of 17.66%.

Analysis shows that HNT started the week negatively, starting around $7.8 and dropping to around $7.4 by the end of the first day. The downtrend continued throughout the week, eventually dropping to around $6.5.

This drop has also had a notable impact on Helium’s market cap. At the start of the week, its market cap was around $1 billion, but it has since declined by more than 6% at the time of writing.

Additionally, HNT’s trading volume has also seen a significant decline, currently sitting at around $12.7 million, a drop of over 30%.

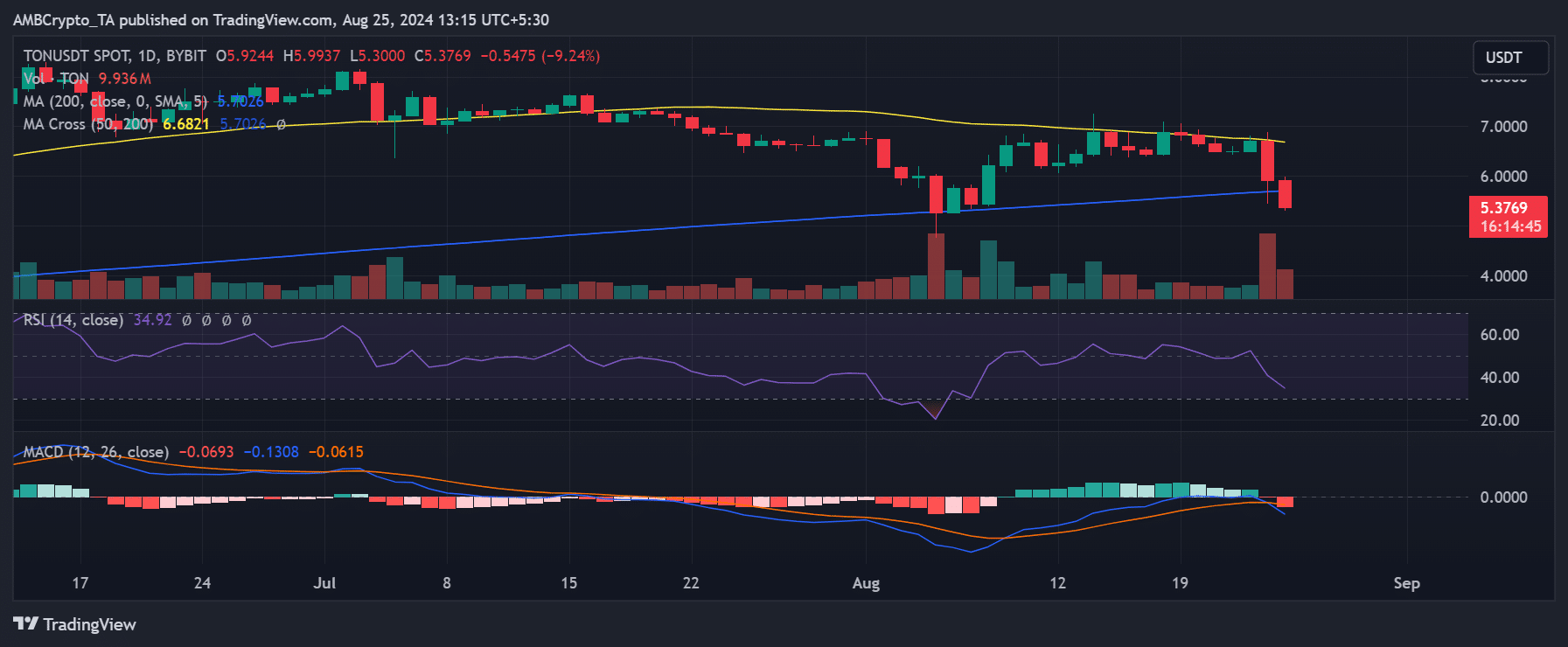

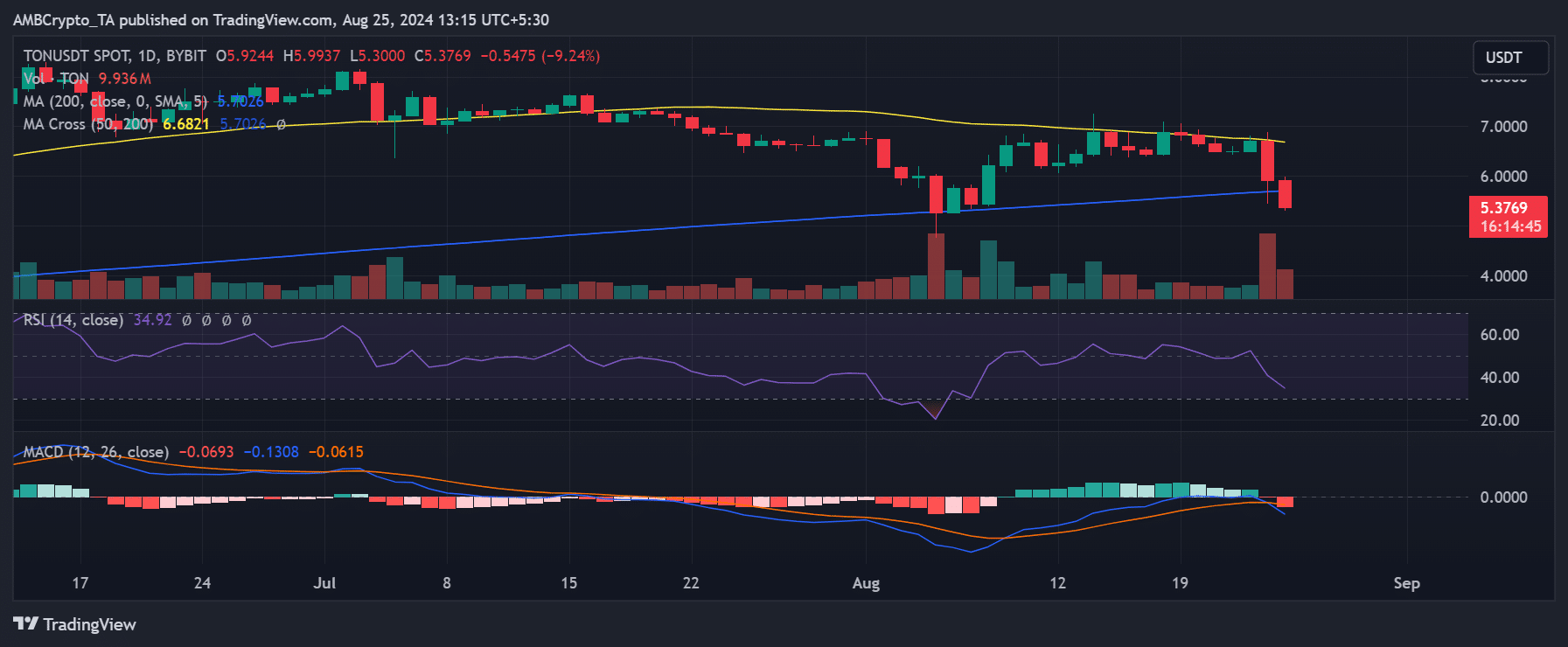

Toncoin (TON)

Toncoin (TON) analysis on a daily chart reveals a tumultuous week marked by significant price volatility. The week started positively for TON, with a rise of almost 7%, bringing its price back to around $6.8.

However, this initial upward momentum was sharply reversed by the end of the week.

Source: TradingView

The chart shows a decline of over 11% at the close of the week, with TON trading around $5.9, making it the second-biggest loser of the week with a total decline of over 14%, according to additional data from CoinMarketCap.

This sharp drop coincided with the news of the arrest of the Telegram founder, which likely contributed to the negative sentiment and selling. At the time of writing, the price of Toncoin has continued to decline, dropping by over 9% to around $5.3.

Toncoin’s market cap was also significantly impacted, dropping by about 17% to around $13 billion. Despite the price drop, trading volume increased significantly, increasing by over 600% to around $1.9 billion.

This increase in volume suggests increased trading activity, likely driven by the news and subsequent market reactions. Additionally, an analysis of Toncoin’s Relative Strength Index (RSI) indicates that it is following a downtrend and has entered the oversold zone.

Notcoin (PAS)

Notcoin (NOT), another Telegram-related cryptocurrency, has been significantly impacted by the recent developments surrounding Telegram. According to data from CoinMarketCap, Notcoin was the third-biggest loser of the week, down about 12.19%.

Notcoin price trend analysis shows that it started the week with an uptrend, trading at around $0.011. However, similar to Toncoin, Notcoin’s performance saw a sharp decline later in the week.

On August 24, Notcoin experienced a drop of over 8%, bringing its price down to around $0.010. At the time of writing, NOT has fallen further, dropping by over 12%, and is currently trading at around $0.009.

This price drop has also had a significant impact on Notcoin’s market cap, which has decreased by more than 20% in the last 24 hours, now sitting at around $937 million.

Despite the price drop, Notcoin’s trading volume has surged, as has Toncoin’s, increasing by nearly 150%. At the time of writing, the volume is over $600 million, indicating increased trading activity, likely in response to recent news and market conditions.