Decentralized financial companies are signing a sigh of relief after the Treasury Department and the Internal Revenue Service gave them a

At the end of December, the Treasury and the IRS

“They have somehow resumed the requirements on DEFI probably as far as they could,” said Jonathan Jackel, Director General of the Information Connection and Retention of Information of EY. “Practically the only part of DEFI which has obligations under these regulations are frontal service providers. So everyone in the other layers of the DEFI battery does not need to worry about anything .

He pointed out that frontal service providers are not set up in a way that would allow them to submit reports easily. “Their argument is that we are not doing enough to contribute to the sale of the crypto to make us the tax report,” said Jackel. “The argument is that you cannot call us a broker because we are not really making sale. We are only aid or help or provide coded information or instruction. But that is not It is up to us to pass this instruction along or execute it.

Three groups of the crypto industry – La Blockchain Association, the Texas Blockchain Council and the DEFI education fund – have filed a

“There is at least one trial that I know to prohibit the rules to enter into force,” said Jackel. “I guess we will see what the court thinks about this.”

The two additional years can give the court time to settle the issue, and the DEFI companies will also have more time to adapt. Crypto companies did not have so much latitude.

“They provided a similar reduction on the

It is not known whether the Trump administration could soften the regulations, which have been chopped between cryptographic industry and the Treasury and IRS over the years which have followed the adoption of the Investment and Jobs The infrastructure in 2021, which mandated the reports.

“When the new regime takes over, will it turn around and overturn?” said Thomas Shea, Ey Americas Financial Services Crypto Tax Tax. “It is difficult to think that it would happen, given all the time and the energy devoted to reaching this point. But you really never know.”

There may be advantages for reports for cryptographic industry, which has requested clearer rules. “It’s not so obvious,” said Jackel. “There is clearly an expense and a certain effort that the industry must go through. But there is the argument that this type of tax report is consistent with a good customer experience. And if you want to legitimize the crypto, then then You will have to do things like people to understand what they should put on their income declaration. Easy to comply.

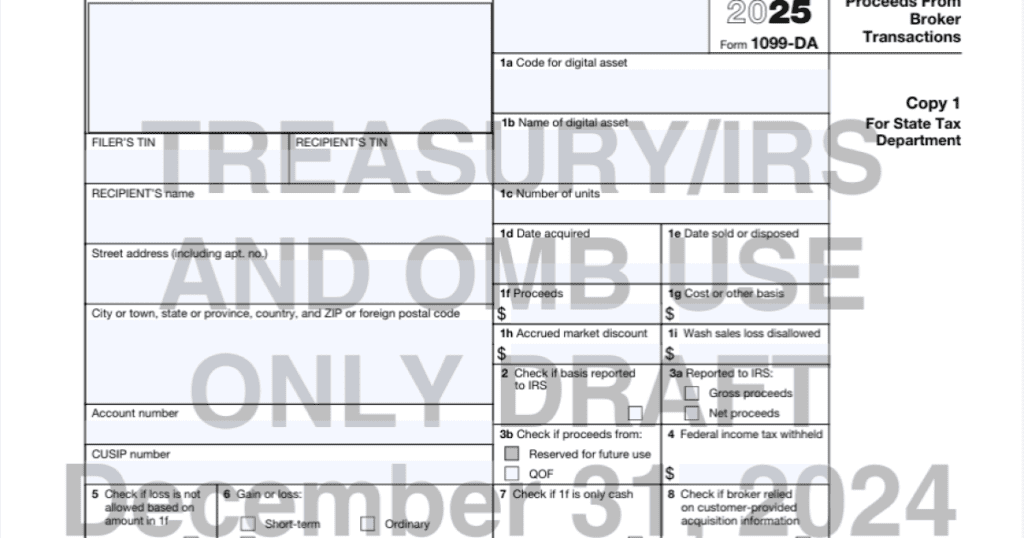

Even if DEFI companies have two more years, crypto exchanges will have to start sending the 1099-DA form this year.

“I would certainly expect the centralized exchanges to be ready to leave, because the transactions occurring in 2025 will be reported,” said Jackel. “Not to comply is not really an option available. With DEFI, it is obviously a little less clear. There will not be really the question of complying before 2027, then there is the trial. It is conceivable That the court would say the latter the rules do not work and they are not enforceable.