Key takeaways

- Aave successfully executed $300 million in liquidations during the market crash, contributing $6 million in profits to its DAO.

- Liquid repositioning tokens and yield-generating stablecoins experienced brief rate drops but quickly recovered, demonstrating market stability.

Share this article

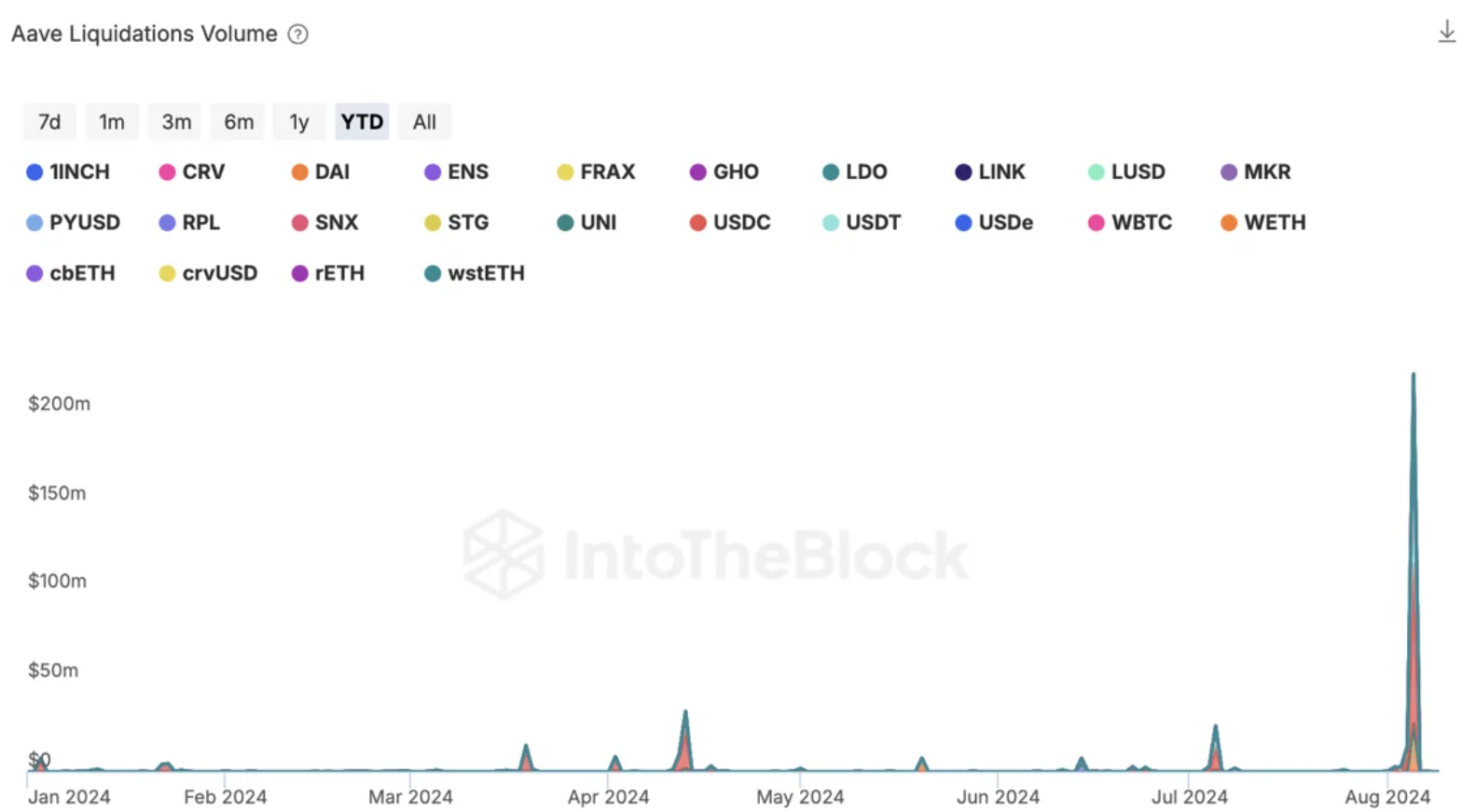

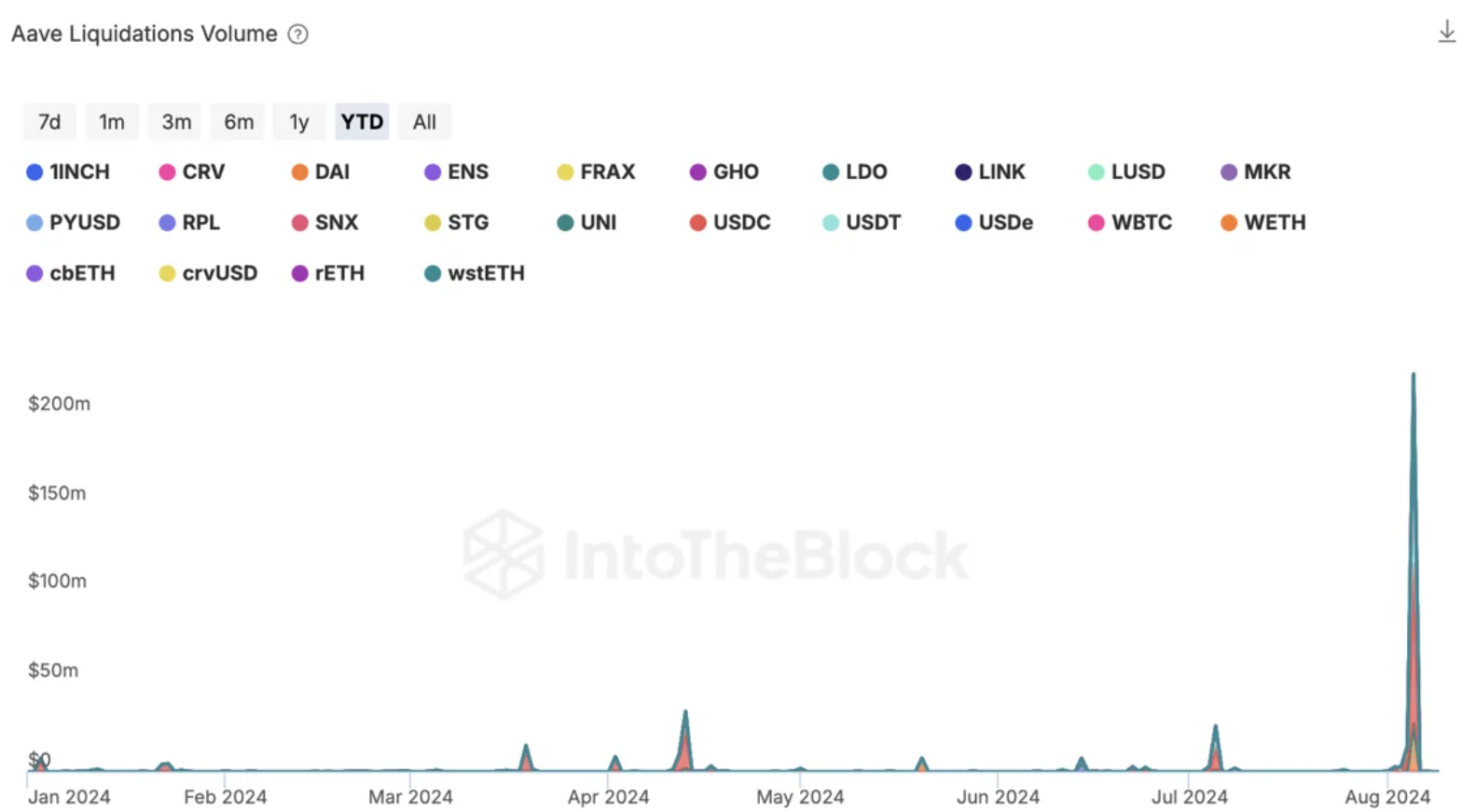

DeFi protocols have shown resilience during this week’s market crash, with Aave facing its largest liquidations ever, amounting to $300 million on the Ethereum mainnet. According to IntoTheBlock, most of the liquidations occurred from stablecoin loans against wstETH collateral, Lido’s wrapped liquid staking token.

Despite ETH dropping by up to 25% in a week, the liquidations were successfully executed, rebalancing the protocol and contributing $6 million in profits to the Aave DAO.

It is notable that the settlement of hundreds of millions in liquidations occurred without relying on a central point of failure, all executed automatically by smart contracts.

Liquid re-staking tokens (LRTs) and yield-bearing stablecoins saw brief deviations from their baselines. EtherFi’s eETH, the largest LRT by market cap, lost as much as 2% of its value during Monday’s crash but recovered within six hours. Non-cashable LRTs faced larger de-stabilizations but also recovered most of their discounts.

Ethena’s USDe maintained its peg to the dollar as its supply decreased by $100 million due to buybacks. The stablecoin lost no more than 0.5% of its parity despite market volatility.

Overall, new and established decentralized finance (DeFi) protocols have successfully weathered the macroeconomic storm, demonstrating the sector’s ability to withstand harsh conditions without outside interference.

Additionally, the total value locked (TVL) of DeFi applications decreased by up to 10% after the August 4 crash but managed to recover all the value lost during the correction, amounting to over $128 billion. In 2024, the TVL of DeFi applications increased by 41%, according to data from DefiLlama.

The cryptocurrency market slowdown is part of a broader global deleveraging movement, triggered by the liquidation of the yen carry trade following the Bank of Japan’s interest rate hike to 0.25%. This led to a rise in the yen and widespread asset sales, sending the correlation between cryptocurrencies and stocks to a six-month high.

Share this article