The total value locked in decentralized finance protocols has hit a one-month high as the broader cryptocurrency market recovers.

According to data provided by DefiLlama, global DeFi TVL currently stands at $87.3 billion, a level last seen on August 27. However, weekly trading volume has declined by 2.2% over the past seven days and is hovering around $23 billion.

It is worth noting that DeFi TVL plunged to $75 billion on September 7 for the first time since late February.

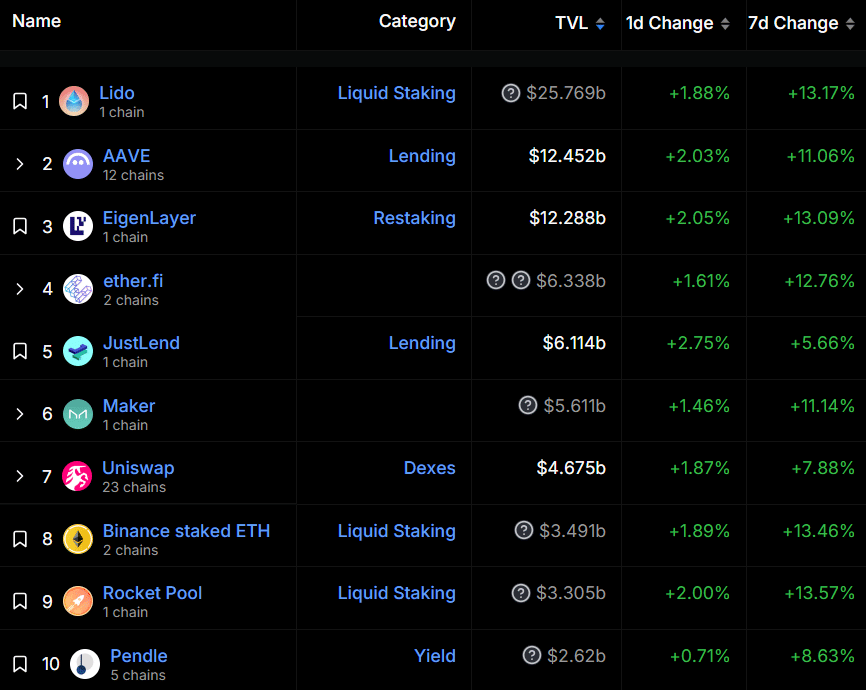

Data shows that all top 10 DeFi protocols have seen bullish momentum over the past week.

Lido’s revenue surpassed the $25 billion mark after a 13% increase in seven days. AAVE saw a similar move, with its revenue jumping to $12.4 billion. EigenLayer took third place with $12.2 billion in revenue.

Additionally, Lido DAO (LDO) and Aave (AAVE) — the native tokens of the two leading protocols — have increased by 1.5% and 7.8%, respectively, over the past 24 hours. LDO is currently trading at $1.15 and AAVE has surpassed $170.

Ethena lost 10th place to Pendle after its TVL fell by 3% over the past week.

The total value locked in DeFi is still down more than 50% from its November 2021 peak of nearly $188 billion.

According to data from CoinGecko, the global cryptocurrency market cap increased from $2.14 trillion to $2.31 trillion over the past week. Most of the gains came on September 18, when the U.S. Federal Reserve cut interest rates by 50 basis points.