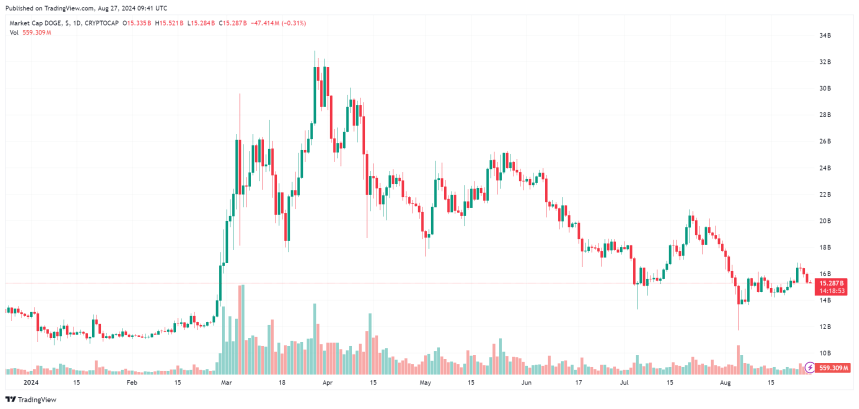

DOGE, the widely recognized king of meme coins, is starting to show signs of a potential resurgence in its bullish momentum after suffering several weeks of bearish pressure. The cryptocurrency has demonstrated an impressive recovery over the past seven days, with its price up 16.3%, reaching a peak of $0.115.

Related Readings

This upward movement marks a notable change of pace for DOGE, which spent most of the month either declining or consolidating.

This recent price rally has renewed bullish momentum and aligns with a resurgence in crucial on-chain metrics. These metrics, which include increased trading volumes, increased exchange outflows, an increase in whale transactions, and an increase in buy orders, collectively indicate that sentiment surrounding DOGE is turning bullish again.

Dogecoin Indicators Turn Green

Miscellaneous Dogecoin chain metrics indicate that DOGE is experiencing a bullish rally as we enter a new week. Notably, IntoTheBlock metrics bullish signal, with two on-chain signals and two exchange signals turning green.

As for on-chain signals, the “In The Money” metric increased by 2.52%, while the “Large Transaction” metric increased by 1.65%, both of which are bullish for DOGE. The former on-chain metric indicates the return of positive sentiment among holders, suggesting that many more holders are now in profit. More often than not, this gives most of them a reason to hold on to the stock while the price rally plays out.

As for exchange signals, the bullish sentiment is echoed by the “supply-ask volume imbalance.” This metric recently turned green and reached 28.87%. This imbalance indicates that buy orders are significantly outweighing sell orders across various cryptocurrency exchanges, suggesting strong demand for DOGE.

When buy orders dominate the market in this way, it often leads to upward pressure on prices as sellers can demand higher prices due to increased buying interest.

The bullish momentum can be relayed by the entry/exit data of cryptocurrency exchanges. Periods of negative sentiment are characterized by a high entry rate into exchanges, which increases the selling pressure. In contrast, positive sentiment is characterized by notable exits from exchanges.

According to this ideology, inflows to exchanges have seen a drastic drop of -73.81% in the last 24 hours. Similarly, the net flow (inflow minus outflow) has decreased by 120.56 million DOGE tokens during the same period, suggesting more withdrawals than deposits to exchanges.

Dogecoin aims for a rise

With bullish indicators and the broader market receiving inflows, the only place DOGE can go is up. As the king of meme coins, promising DOGE price action is good for all meme cryptocurrencies.

Related Readings

At the time of writing, DOGE is trading at $0.1088. Although it has reversed slightly since hitting $0.1147, it appears to have established support around $0.108. Another move higher from this support would undoubtedly spark confidence among many investors.

Cover image of Dall-E, chart by Tradingview