The data show that Dogecoin currently leads the best cryptocurrencies in terms of funding rate, suggesting a long positioning peak among traders.

The Dogecon financing rate is 0.0092% at the moment

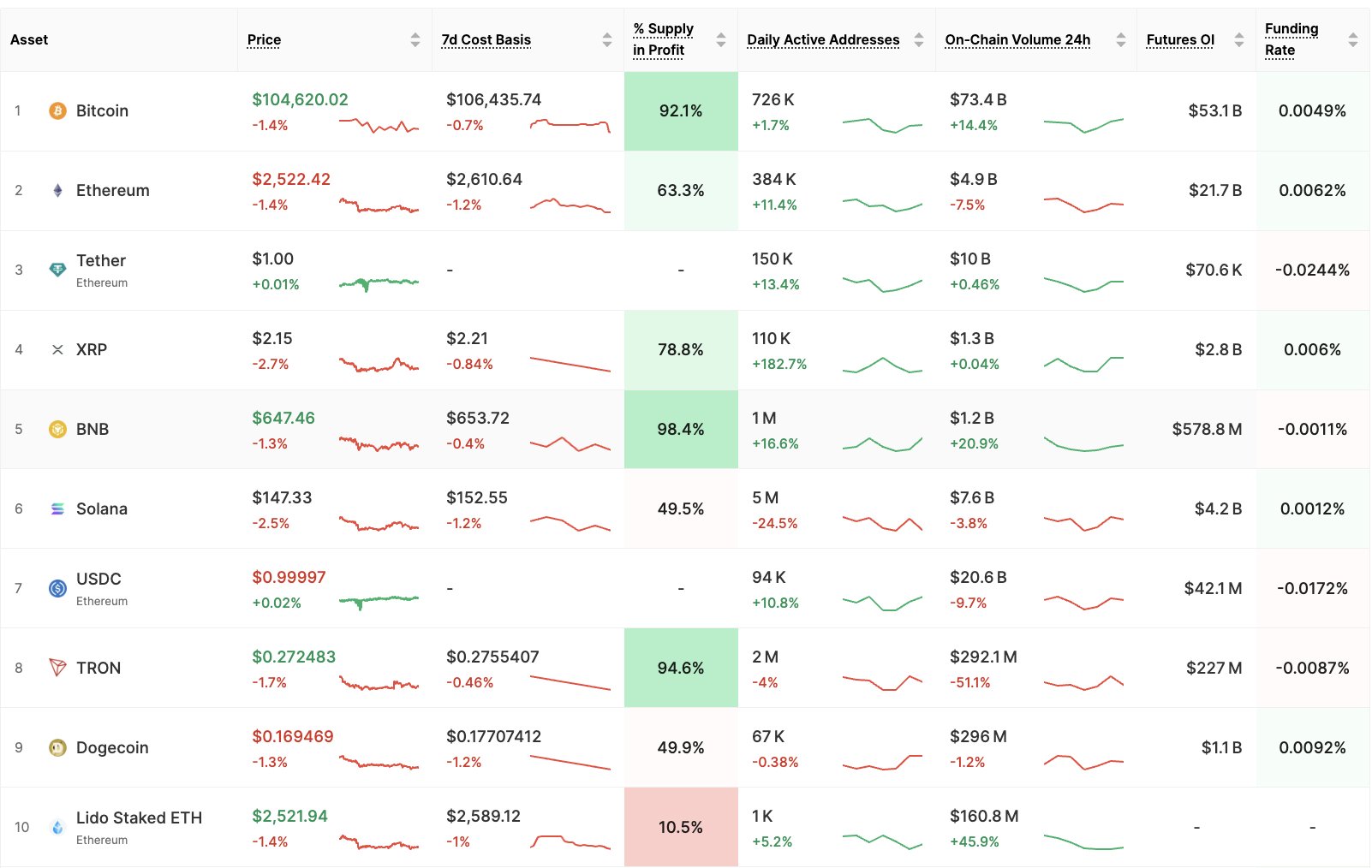

In a new article on X, the Glassnode analysis company explained how the best cryptocurrencies in the sector compare each other in terms of funding rate.

The financing rate refers to an indicator which maintains a trace of the average periodic quantity of fees which perpetual perpetual term traders of a given asset exchange between them on the centralized derivative platforms.

When the value of this metric is positive, this means that long investors pay a premium to short in order to keep their positions. Such a trend is a sign that the majority of investors share an upward mentality.

On the other hand, the indicator being under the zero brand suggests that short investors prevail over long. This type of trend implies that a lowering feeling is dominant in the sector.

Now here is the table shared by Glassnode which shows how the best cryptocurrencies by market capitalization are looks in terms of funding rate at the moment:

The value of the metric seems to be the highest for Dogecoin at the moment | Source: Glassnode on X

As visible above, the financing rate is currently positive for Bitcoin (BTC) and Ethereum (ETH). According to the analytical society, this is a rebound compared to yesterday, when the feeling was down among the traders.

The indicator is 0.0049% for BTC and 0.0062% for ETH. XRP (XRP), the fourth largest room by market capitalization, also has a similar bull’s degree with metric at 0.006%.

A coin that stands out for its feeling, however, is the same Dogecoin, because its funding rate is 0.0092%, especially higher than any other cryptocurrency

Then there is a tron (TRX) on the exact opposite side of the spectrum, the bears paying the costs at a rate of -0.0087%. Solana (soil) is exactly between the two with a neutral financing rate of 0.0012%.

Generally, the dominant side on the financing rate is more likely to be enveloped in a mass liquidation event. As such, for an asset like Dogecoin, where a bullish feeling seems to be strong compared to the rest of the sector, long can be more likely to be tightened.

In the same table, data for some other indicators is also displayed. Among these, this is perhaps the supply of profit, measuring the percentage of the offer of an asset which is currently taking place at an unparalleled gain.

While parts like Bitcoin, Tron and BNB have more than 90% of their supply in green, others like Dogecoin and Solana have metrics less than 50%.

Mediating prices

At the time of writing the editorial staff, Dogecoin is negotiated about $ 0.1666, down more than 15% compared to last week.

Looks like the price of the coin has been sliding down | Source: DOGEUSDT on TradingView

Dall-E star image, Glassnode.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.