Eigen is trendy and the bulls are confident despite the sale. While the Eigenlayer TVL develops, adding 41% in a month, will Eigenusdt break $ 5 in the coming months?

The total market capitalization of cryptography is down almost 5% to 3.44 dollars. Although Bitcoin remains the most dominant, controlling more than 60% of the market share, it was less than a drop, negotiating less than $ 106,000 at cash rates.

This drop means that the most precious part is down 5% in last week, but still surpasses XRP and Dogecoin (Doge), down 10% and 16%, respectively.

Despite this firmness and potential weakness that could flow on the market, Eigenlayer, the liquidity rehabilitation platform, is part of the Best cryptos to consider buyingAfter dominating trends in the last 24 hours.

Discover: the 12+ warnings of the hottest cryptography to buy now

Eigen jumps 15% before dropping

Coingecko data reveal that Eigen, the native token, jumped 15%, exceeding a level of key liquidation before dropping.

By breaking higher, Eigen not only extended the gains against Ethereum and Bitcoin, but also cemented its role in Defi.

However, this point was short -lived while prices sang after Bears intensified earlier during the day. Most of the DEFI tokens have also sold.

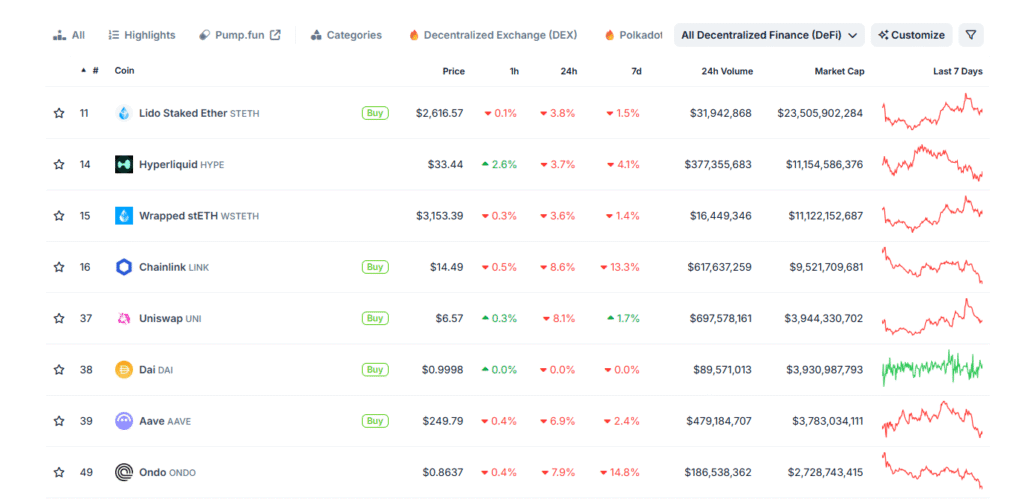

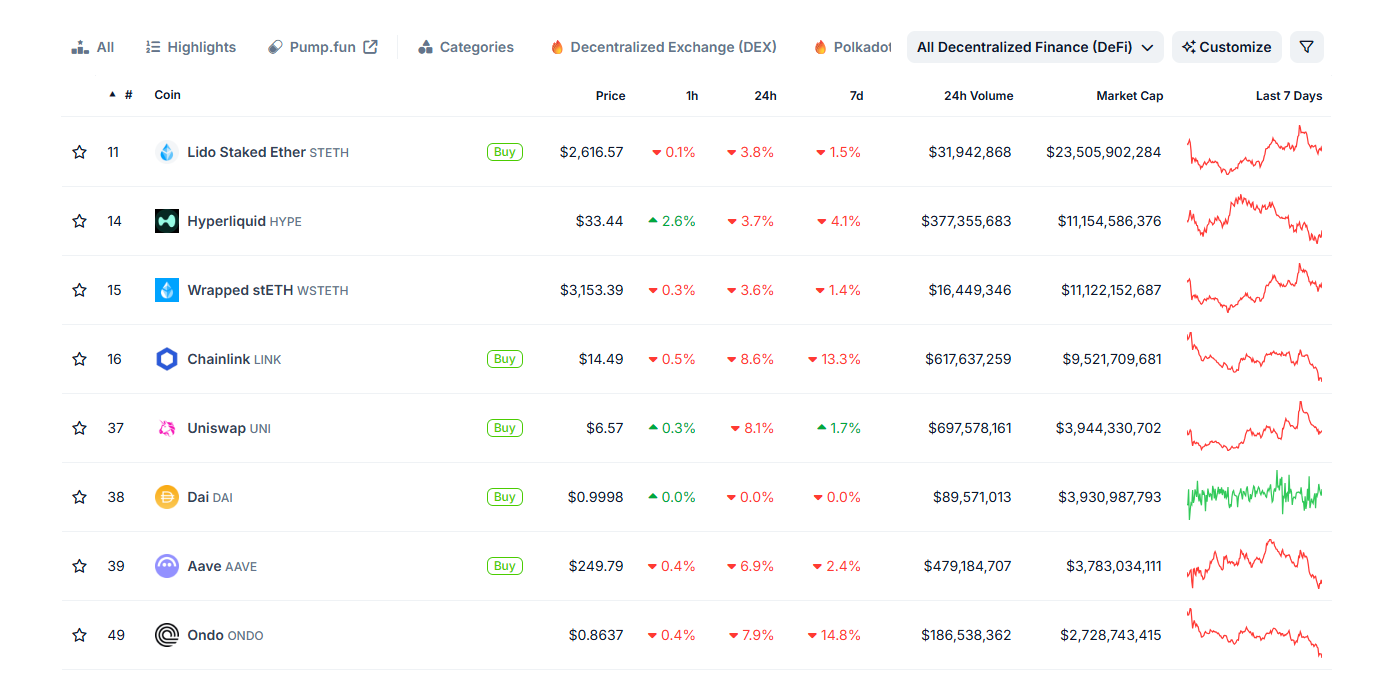

(Source))

As of May 30, Eigenlayer managed more than $ 11.15 billion in assets, mainly on Ethereum, and was the third larger DEFI protocol, behind Aave and Lido.

In only the last month, its TVL increased by more than 41%, according to Defilma Data.

(Source))

Trendy eigenlayer: what’s going on?

Although it is impressive, Eigenlayer tends and helps improve feeling and interest in part of the The best new cryptocurrencies to invest in 2025.

Yesterday, the founder of Eigenlayer, Sreeram Kannan, confirmed Changes in the way in which the reduction penalties will be processed.

This announcement will probably unlock a new class of financial applications, which could still propel Eigen to the heights of the fourth quarter 2024.

Slashing was officially posted on Eigenlayer on April 17, and immediately afterwards, Infura and Layerzero joined the services for their actively validated services (AVSS).

The publication of the Slashing function officially rendered the EIGEN area “complete”, allowing the protocol to automatically apply the responsibility of operators and stakers.

The validators and key operators of the clean race which do not work, for example, not retaining high node reliability, are penalized for poor performance.

In addition, validators and operators engaged in malicious behavior are subject to a reduction.

Although attractive, Slashing includes an opt-in function, which means that stakers and other key players must choose to participate in slasic conditions.

A “single stake allowance” feature has also been introduced to isolate the risks of reducing specific AVS, reducing global systemic risks.

DISCOVER: 20+ Next Crypto to explode in 2025

A new era of supercharged growth? Will Eigenusdt retest $ 5?

After the announcement of May 28, Eigenlayer plans to distribute reduced funds to AVSS complaints in addition to the protocol rather than burning them.

Combustion, as seen in the Ethereum and BNB chain, could reduce inflation. In the case of Eigenlayer, distribution could fuel growth, increasing Eige demand.

It remains to be seen how fast the developers and AVSS will create new financial DAPPs on the platform. However, when they do, they will be secured by Eth locked on the Mainnet.

For the moment, Eigen is negotiated above $ 1.5. Any increase confirming the escape on May 29 could trigger an elevator at $ 2 and later $ 5 in a training continuation of purchase trend.

(Eigenusdt))

Partnerships with Lombard Capital, bring a return to Bitcoin to clean cheerfulness, and new products taking advantage of the liquidity layer of replenishment will probably feed growth.

DISCOVER: 7 high -risk high -reward cryptos for 2025

Eigenlayer Eigen Trend after a keys reduction announcement

- Eigen tends, holds $ 1.5 firmly

- Eigenlayer cements its place in top defi protocol with more than $ 11.15 billion on TVL

- DEFI protocol to start distributing reduction funds

- Will Eigenusdt go up to $ 5 and will retest heights in 2024?

The Eigenlayer post dominates trends despite the sale of Defi: what is going on? appeared first on 99Bitcoins.