- ENA’s price presented notable fluctuations, up 1.89% from $ 0.4020 to $ 0.4096 before falling to $ 0.3790 under-sale pressure.

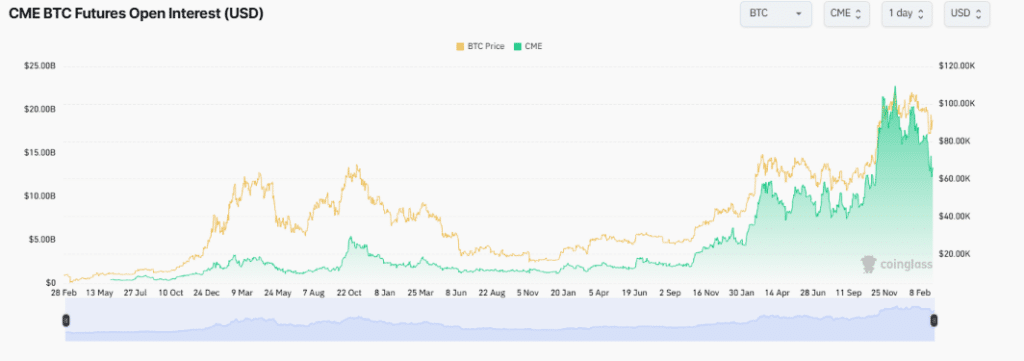

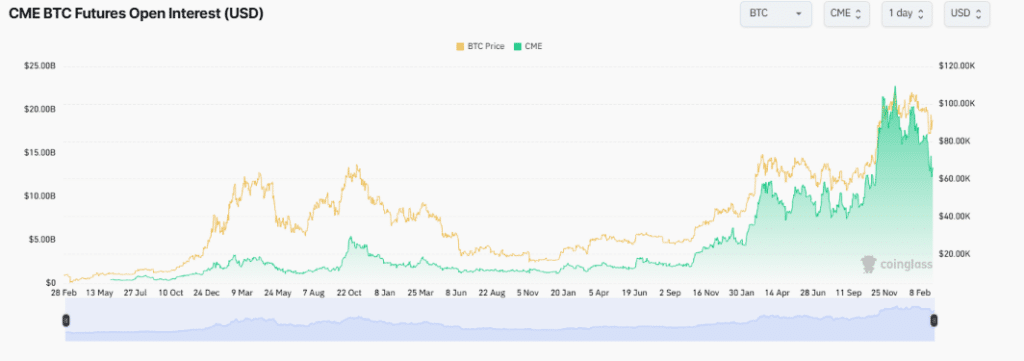

- The open interest of CME Futures d’Ena increased to $ 120,000 on March 6, 2025, coinciding with the Bitcoin rise at $ 65,000.

Ethena (ENA) recently released 2.07 billion ENA, worth $ 740.71 million, marking a major increase in the supply in circulation.

This decision, as well as major investor deposits in major exchanges, have raised questions about the potential price movements and market stability.

The ethhena unlocks

On March 5, 2025, Ethena released 2.07 billion ENA in circulation, representing 39.17% of its total offer. After this event, large investors moved 125 million ENA, worth $ 45 million, in Binance, Bybit and Falconx.

Historically, similar unlocks have triggered a drop in prices due to the increase in supply and use of investors. Significant deposit volumes indicate that investors can cover themselves or obtain profits in anticipation of a slowdown in the market.

Despite the risk of dilution, long -term stability could occur if demand effectively absorbs the new offer. However, if the sales pressure continues, the ENA could test lower levels, which could be dropped to $ 0.30.

This model aligns with previous Altcoin unlocking, where deposit overvoltages have often preceded price corrections.

Navigation of the ENA market swings

Recently, the price of the ENA showed notable fluctuations, increasing by 1.89% from $ 0.4020 to $ 0.4096 before falling to $ 0.3,790 per sales pressure. The volatility index amounted to 0.3769, indicating moderate market oscillations.

Meanwhile, the MCV of aggregated points have gone from -108,707m to -107.359m and later at -107.07m, signaling a lower volume imbalance where the sellers dominated the buyers.

Source: tradingView

The downward MCV trend has discouraged merchants from aggressive purchases, as a sustained sales momentum suggested a risk of decline.

If the MCV is reversed in positive territory, a recovery at $ 0,4200 may be possible. Conversely, if volatility exceeds 0.4000 and MCVs remain low, ENA can drop to $ 0.3,500.

This model looked like ADA’s recent discharge, where similar MCV trends have preceded other drops.

Feeling of the ENA market and price implications

The open interest of CME Futures Open (OI) of ENA increased to $ 120,000 on March 6, 2025, coinciding with the increase in Bitcoin at $ 65,000. In previous weeks, OI increased from $ 20,000 to $ 100,000, culminating at $ 110,000 at the end of February.

This upward trend has indicated increased leverage exposure, the open interests closely following the movements of bitcoin prices around $ 60,000.

Source: Coringlass

If they remain high, the bullish feeling could lead $ ENA to $ 0.4,500. However, a drop in OI less than $ 50,000 could trigger liquidations, potentially making prices at $ 0.3,800.

The $ ENA unlocking event has introduced significant pressure on supply, with 125 million tokens transferred to the scholarships, probably for taking advantage.

Although $ ENA initially saw a price increase of 1.89%, a drop in MCV indicates the current sales pressure.