Electric Capital has released its annual developer report for the sixth consecutive year. The report, gathered through open source code activity, compiled notable industry developments in 2024 so far. The 2024 report includes data from StablePulse.org, NFTpulse.org and CodeSlaw.app.

Electric capital report confirmed perceptions regarding the significant growth the crypto industry has seen across multiple sectors and globally this year. The industry’s continued adoption and adaptation has had a great impact on the world and shown the industry’s ability to innovate.

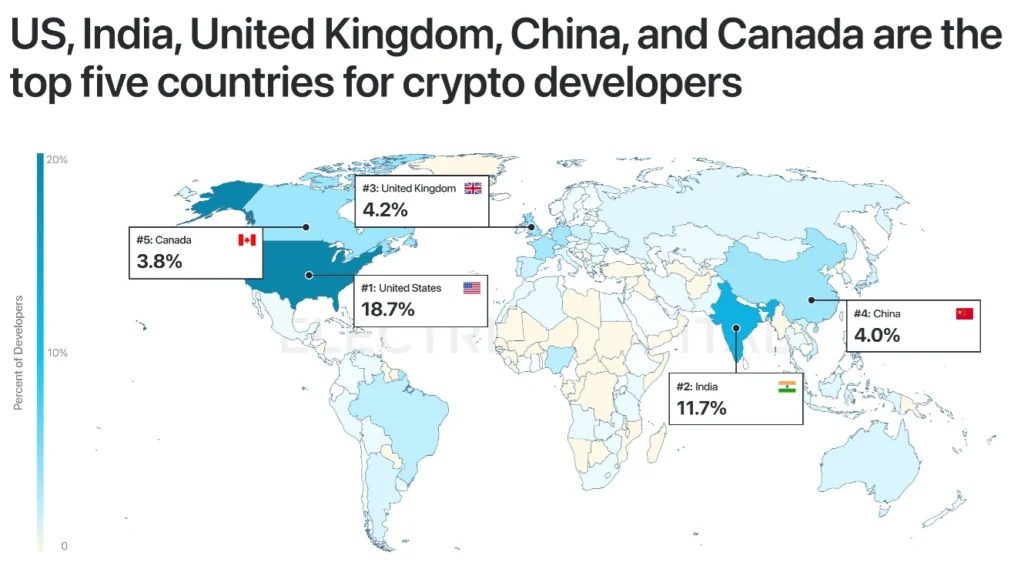

One of the notable trends in this year’s report is the dynamic of Asian developers. The population of programmers in this part of the world has been growing, overtaking North America. Asia now ranks first, while North America ranks third after Europe.

In 2015, 81% of crypto developers were in North America and Europe. Today, that statistic has fallen to 55%.

India and Ethereum were the biggest winners this year

Even though Asia takes the lead among other continents, the United States remains the country with the highest concentration of developers, with 19%. However, the country is down from 38% in 2015. India, on the other hand, has seen the strongest growth and is now the country with the second largest share of developers. The South Asian nation has come a long way from its 10th position in 2015. The country also onboarded the highest number of new crypto developers in 2024, contributing 17% of new talent.

Established developers with 2+ years of experience increased by 27% and now account for 70% of code commits. 39,148 new developers explored crypto this year, according to Electric Capital’s report. Developers in the crypto space are also extremely diverse, with 1 in 3 developers working across multiple ecosystems. In 2015, less than 10% of developers had a similar level of diversity.

Crypto developers have grown 39% annually since Ethereum launched in 2015, and they remain the leading ecosystem by developer share in the world, driven by growth in Layer 2 adoption.

EVM-enabled chains continue to dominate, accounting for 74% of multi-chain developers.

This year, Solana became the preferred ecosystem for new developers, with over 57% of wallets created. It increased by 83% year-on-year.

NFTs and DeFi have made strong recoveries, but ETFs and stablecoins have led the way

Data collected by Electric Capital indicates that different parts of the world gravitate towards different crypto use cases and ecosystems.

Stablecoin transactions are constantly active, increasing 2-3% during business hours in Asia, Europe and Africa. NFT trading peaks during work hours in the United States, while minting peaks during work hours in Asia.

According to Electric Capital’s report, Base and Solana lead the low-cost use cases for NFTs, making them ideal for high-volume minting and trading.

Base owns 97% of the NFT minting volume, while Solana owns 64% of the NFT minting transactions. NFT minting volume reached a record high of $1.5 billion this year. Minting wallets increased to 67 million in 2024, with most activity on Solana (57%), Polygon (24%), and Base (13%).

The record volume of unique minting wallets was 23 million. Minting transactions increased from 153 million in 2023 to 568 million in 2024, with the greatest activity on Solana (64%) and Base (26%).

This year, NFT currencies have gone beyond the arts. Top NFT collections included finance, rewards, identity, gaming and more. NFT deployments tripled year-over-year, with Base and Zora leading minting activity by 87%.

DeFi also had a big year. Total value locked (TVL) in DeFi has increased by 89% this year, with Ethereum taking the lead at 53%. Ethereum had 7 times more TVL than Solana, its strongest competitor, with $16 billion.

Reinvestment appeared in 2023 and reached $30.6 billion this year. It has now become the most important sector in DeFi. EigenLayer has spearheaded the growth of resttaking as it saw its number of developers double in 2024. 53% of EigenLayer’s developers are established and 39% of them are committed developers.

Electric Capital’s report also shows that stablecoins close the year at a record high of $196 billion in circulation and $81 billion in daily trading volume. Tether’s USDT is the undisputed leader in stablecoin dominance, accounting for 72% of fiat-anchored tokens in circulation this year. Circle USDC’s 20% is its closest competitor. Ethereum and TRON hosted the most issued stablecoins, with 59% and 35%, respectively.

Arguably the catalysts for one of the best crypto years on record, Bitcoin and Ethereum ETFs saw record launches. Bitcoin ETFs have attracted over $50 billion in net inflows, while Ethereum ETFs have reached $13 billion in assets under management (AUM) since July.

Land a Well-Paying Web3 Job in 90 Days: The Ultimate Roadmap

Disclaimer: For informational purposes only. Past performance is no guarantee of future results.