- Ethereum’s recent price action has revealed critical support and resistance levels that traders should monitor.

- As ETH fell below the $3,593.46 support, open interest on Ethereum futures initially increased.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, recently fell below a key support level, sparking concerns among traders.

As Bitcoin (BTC) undergoes its own correction, Ethereum has shown signs of retracing again.

Analysts are eyeing $2,809 as a potential accumulation zone before a possible rebound. This pattern suggests that a deeper correction could occur before bullish momentum resumes.

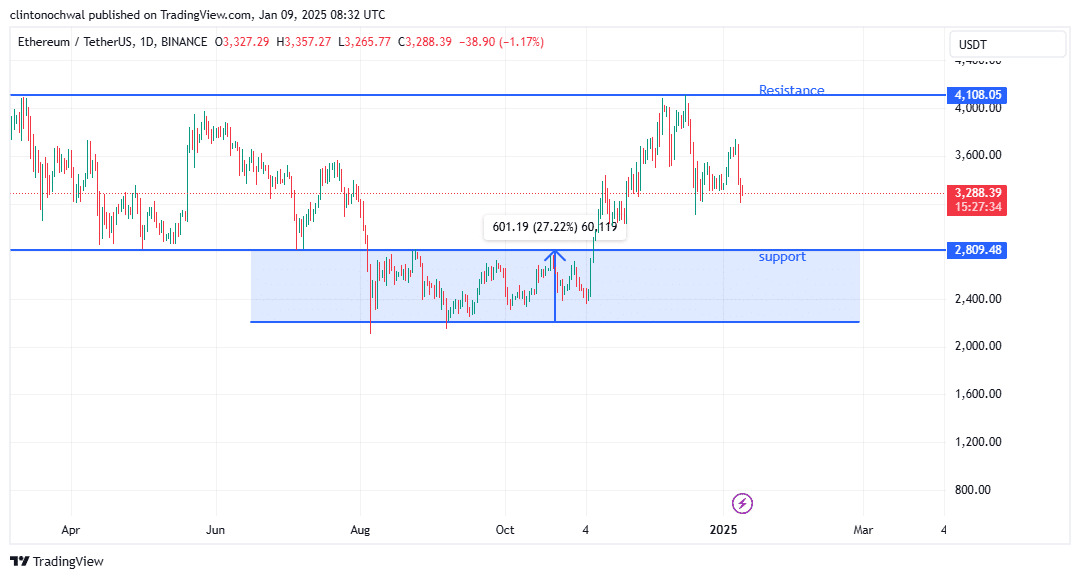

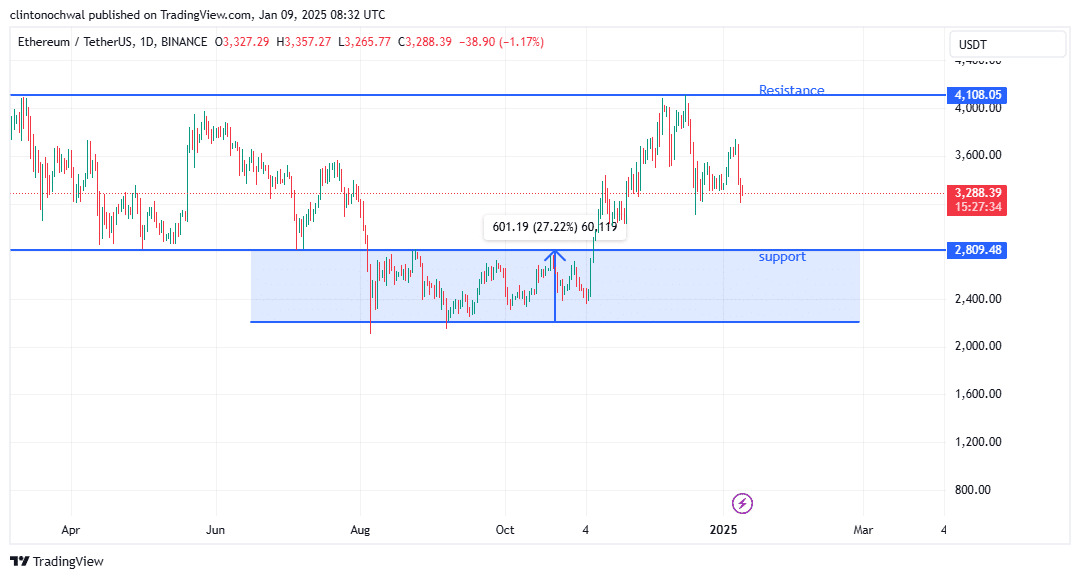

Support and resistance levels

Ethereum’s recent price action has revealed critical support and resistance levels that traders should monitor. Over a 4-day period, Ethereum’s price movement remained defined by key support and resistance levels.

There was a critical support area at $2,809.48while the nearest resistance was at $4,108.05. These levels serve as important benchmarks for traders monitoring potential reversals or the continuation of ETH’s trajectory.

Source: TradingView

The break below $3,593.46 confirmed the bearish momentum, with the price hovering near $3,297.19 at time of publication.

This level sits closer to the midpoint between support and resistance, potentially signaling a consolidation phase before the next significant move.

If ETH tests the $2,809.48 support and holds, this may mark a strong accumulation zone for long-term traders. Conversely, failure to maintain this level could lead to further declines, or even trigger a broader downtrend in the market.

The bears give up?

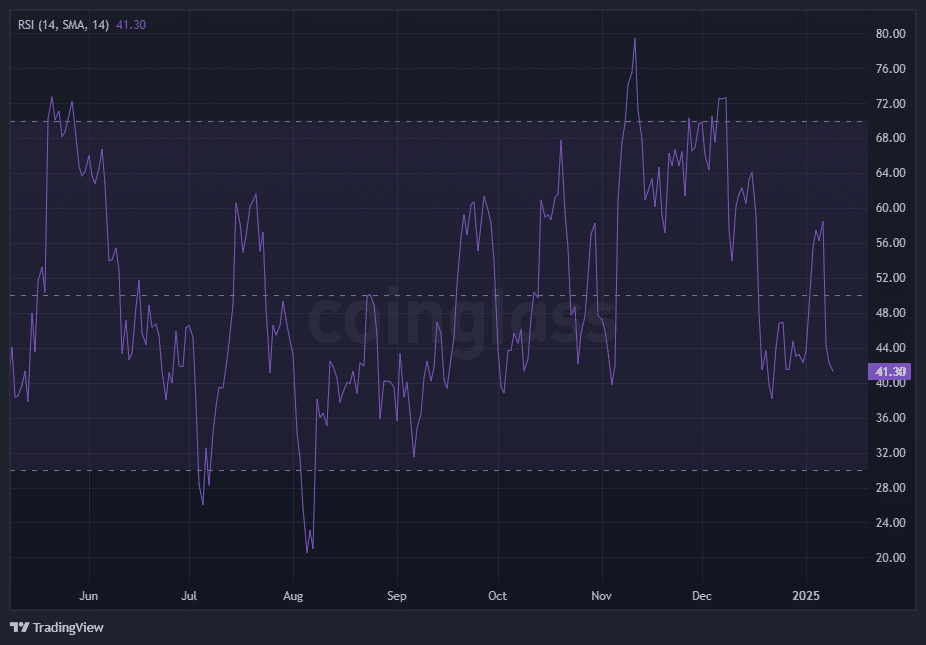

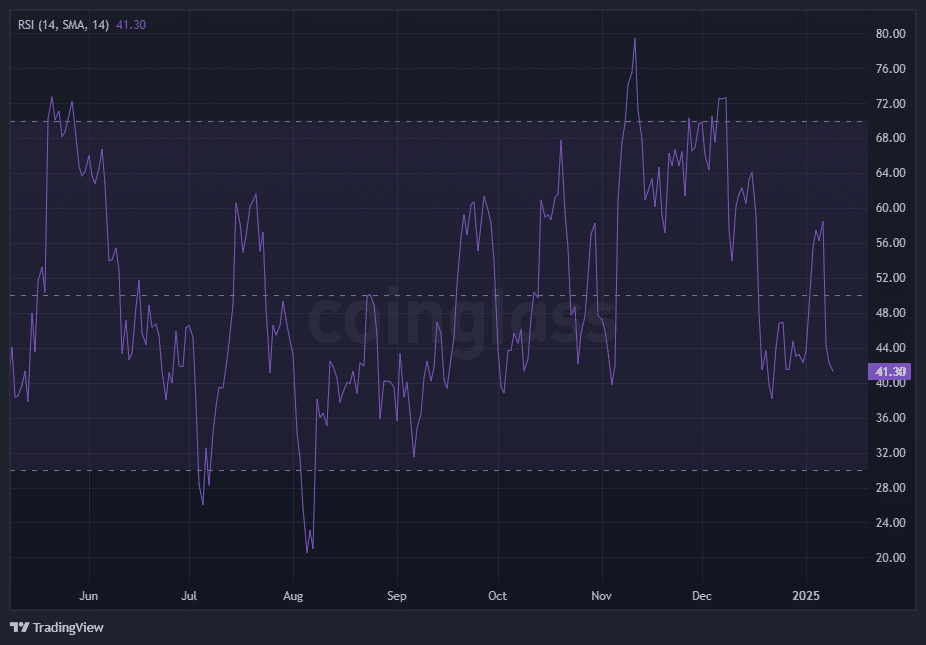

The Relative Strength Index (RSI) provides essential information about Ethereum’s current momentum and potential price trajectory.

As the chart shows, the RSI has been trending downward, reflecting increasing selling pressure and declining bullish strength.

As the RSI approaches the oversold threshold of 30, the market is signaling a potential exhaustion of recent bearish momentum.

Source: Coinglass

RSI analysis remains crucial to understanding Ethereum dynamics. RSI levels at press time, reflecting the updated price movement, suggest increasing selling pressure.

As ETH approaches $2,809.48the RSI could fall further towards the oversold threshold of 30.

This would signal a potential rebound or consolidation, depending on market sentiment.

Traders should watch for a decisive rebound in the RSI above 40, which could indicate a recovery aligned with a move towards $4,108.05. Failure to do so could cause ETH to maintain its downward trajectory.

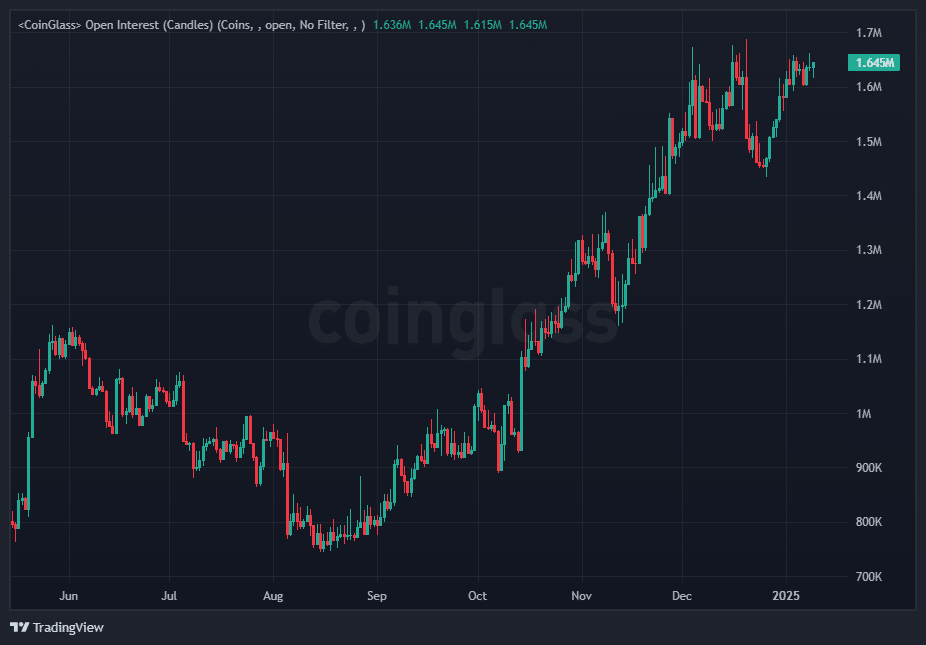

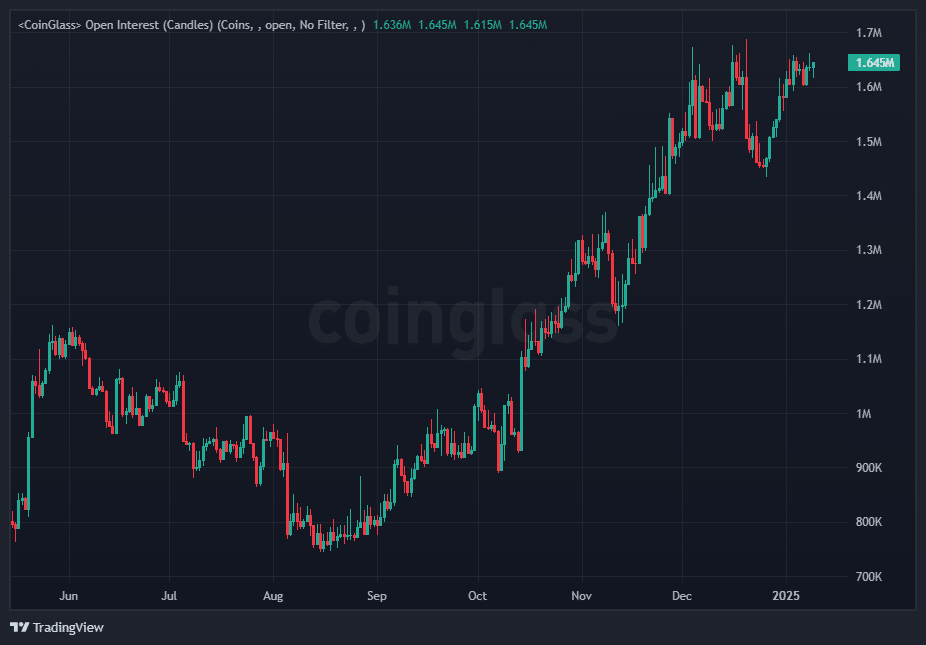

Ethereum: Gauging Market Sentiment

Open interest, which reflects the total number of futures and options contracts outstanding, serves as a key metric for gauging market participation and sentiment.

In the case of Ethereum, the recent price decline has been accompanied by fluctuating levels, revealing important trends.

Source: Coinglass

As ETH fell below the $3,593.46 support, open interest on Ethereum futures initially increased. This suggests increased speculative activity as traders position themselves for further decline.

Increasing open interest during a price decline often signals that bearish sentiment is intensifying, as more market participants anticipate continued declines.

However, after the sharp correction to $3,318.41, Open Interest began to stabilize, hinting at a reduction in speculative pressure and potential market indecision.

A significant drop in open interest at this stage could indicate a cooling of the market, with traders closing their positions and waiting for clearer signals.

Conversely, further increases in open interest, especially near the $2,807.13 support zone, could indicate accumulation by long-term investors or increased speculative interest in anticipation of a rebound.

Read Ethereum (ETH) Price Forecast 2025-2026

As external factors such as Bitcoin’s correction continue to influence Ethereum’s performance, traders should remain cautious and closely monitor these key levels and metrics.

A bounce from the $2,807.13 support could reignite the bullish momentum, while failure to hold this level could lead to deeper corrections.