On-chain data shows that Ethereum’s adoption rate has hit a four-month high, which could be bullish for the cryptocurrency’s price.

Ethereum network growth has exploded recently

According to data from on-chain analytics firm Santiment, the ETH blockchain has recently created a lot of wallets. The relevant metric here is “network growth,” which tracks the total number of new addresses appearing on the network daily.

Naturally, an address is considered used when it has made its first transaction on the chain. Network Growth counts the daily number of such addresses that become active for the first time.

When the value of this metric is high, it means that users have just opened a large number of new addresses on the network. This may be due to the arrival of new investors in the market or the return of old investors who had left it earlier.

This trend can also occur when existing users open new addresses to increase privacy. Typically, all of these phenomena occur at the same time when the metric spikes, so it can be assumed that some adoption is taking place on the net.

On the other hand, the low indicator implies that few new addresses are being created on the network, a potential sign that interest in the cryptocurrency is low.

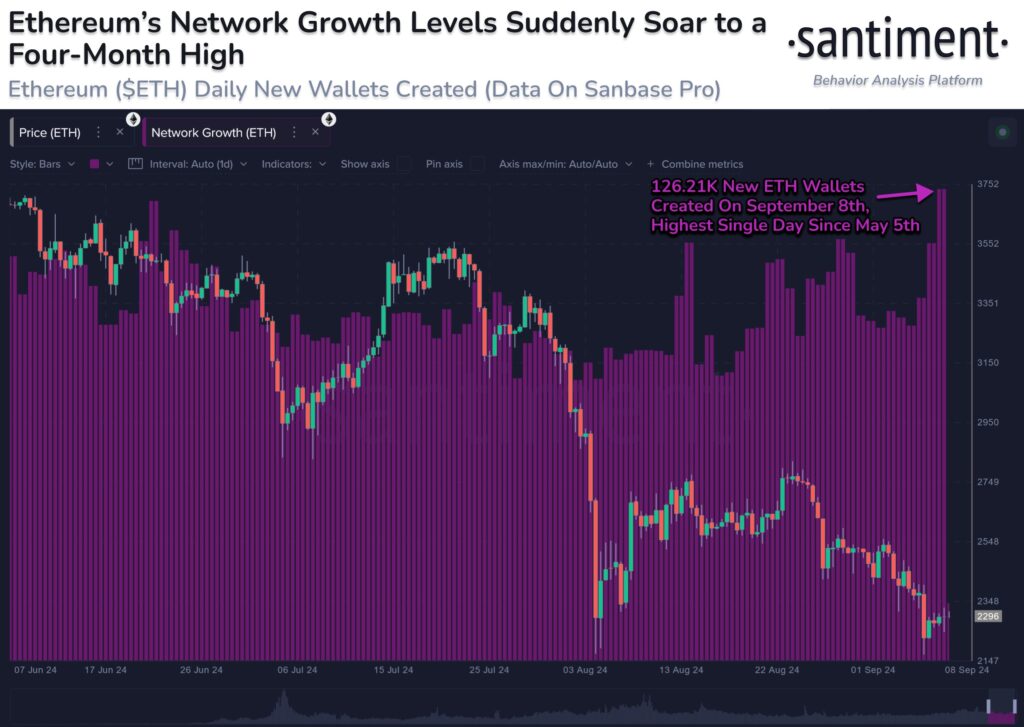

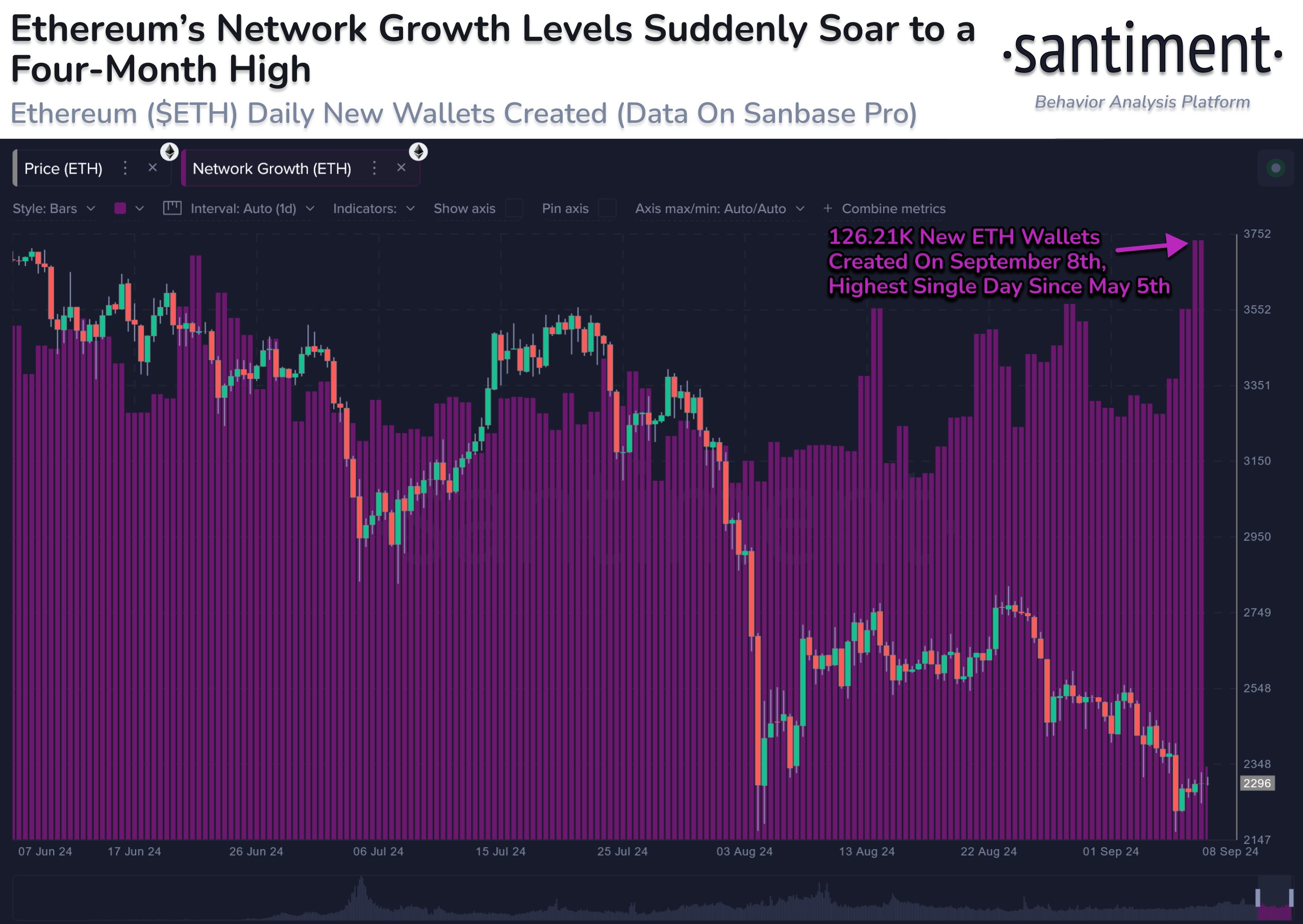

Now here is a graph that shows the growth trend of the Ethereum network over the past few months:

As seen in the chart above, Ethereum network growth saw a sharp increase yesterday, as 126,210 new addresses appeared on the blockchain in 24 hours.

The latter value is the highest indicator observed in more than four months, suggesting that the asset is attracting an extraordinary number of users.

Generally, adoption is bullish for any asset in the long term, as a larger user base can provide a stronger foundation for future price growth. In the short term, however, spikes in network growth can move the coin’s price in one direction or the other.

The chart shows that the indicator’s spikes coincided with some local highs in August. These spikes were a sign of FOMO around price increases, and excessive hype has never been positive for any asset, which may explain why the highs occurred.

This time around, however, the surge in network growth has occurred while Ethereum has been falling. This surge in interest while the asset isn’t doing so well could potentially help fuel a rebound.

ETH Price

Ethereum has been struggling recently as its price is currently below $2,280.