- Ethereum’s dominance is declining despite a rising overall market capitalization.

- ETH remaining above all weekly moving averages signals strength.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is facing challenges in maintaining its dominance in the broader crypto market.

While the total market capitalization of cryptocurrencies, excluding stablecoins, shows a long-term upward trend, ETH’s share of this market is declining.

Currently, Ethereum’s market dominance sits at just above 15%, indicating that ETH may be at a crucial point. With ETH’s market cap currently fluctuating between $546 billion and $316 billion, its struggle to regain dominance raises questions.

Source: In the cryptoverse

An increase in total market capitalization while ETH’s share decreases could indicate divergence, often signaling a reversal or continuation of a trend. Uncertainty over whether ETH will rise or fall remains a critical issue, but what do the other metrics say!

ETH remains above weekly SMAs

Ethereum is holding strong on its weekly simple moving averages (SMA), offering a bullish outlook. ETH remains above key SMAs including the 8SMA and 20SMA, suggesting strong momentum.

This is an encouraging sign that Ethereum may continue its recovery as it rebounded from a deep decline when its price hit $2,100.

ETH’s ability to stay above these SMAs indicates that the short- and long-term uptrends over the week remain intact. However, traders should remain cautious as the next quarter is expected to be a source of volatility.

Source: In the cryptoverse

Despite a decline in ETH market dominance, these indicators support the idea that Ethereum is still on an upward trajectory.

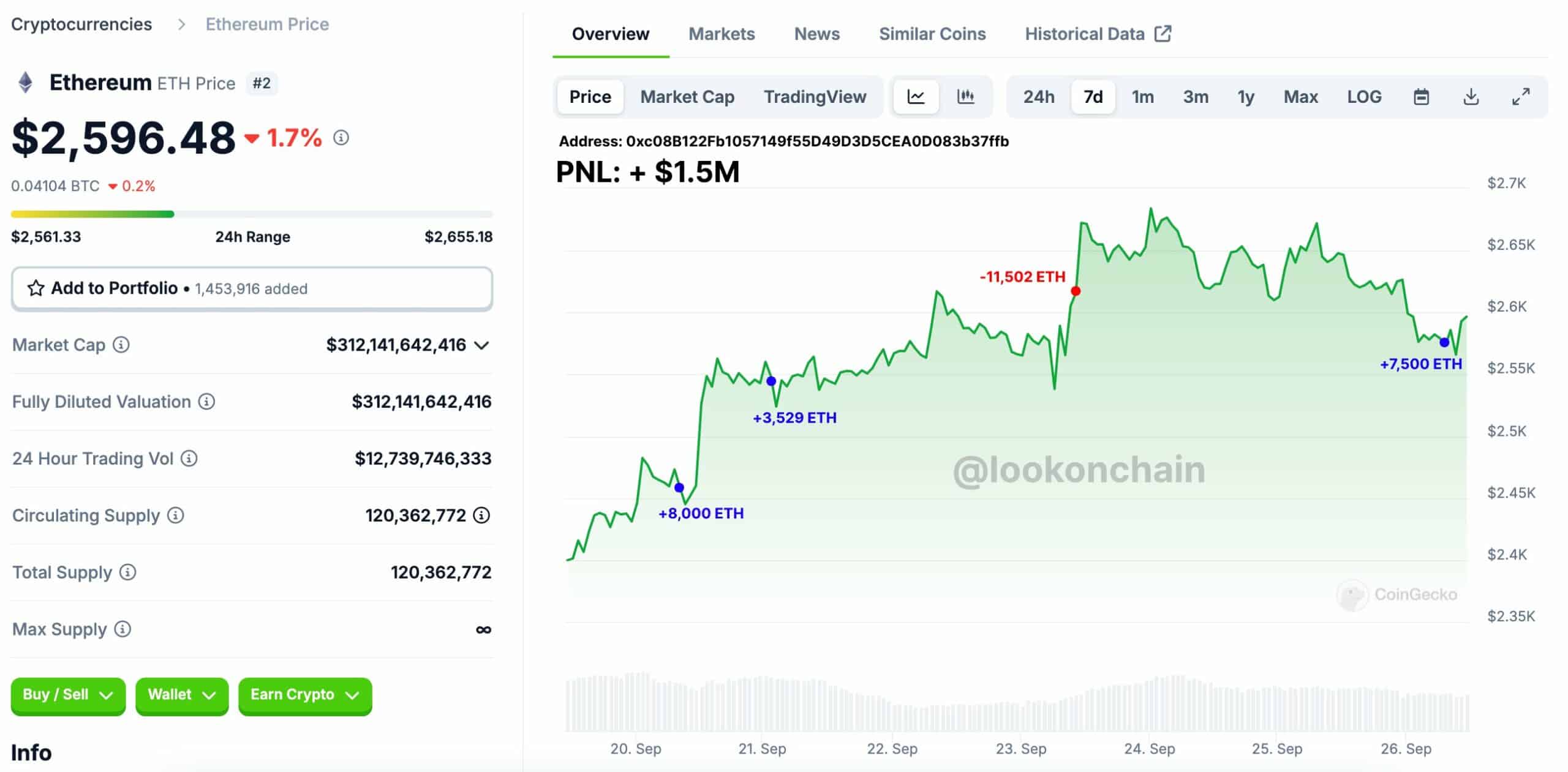

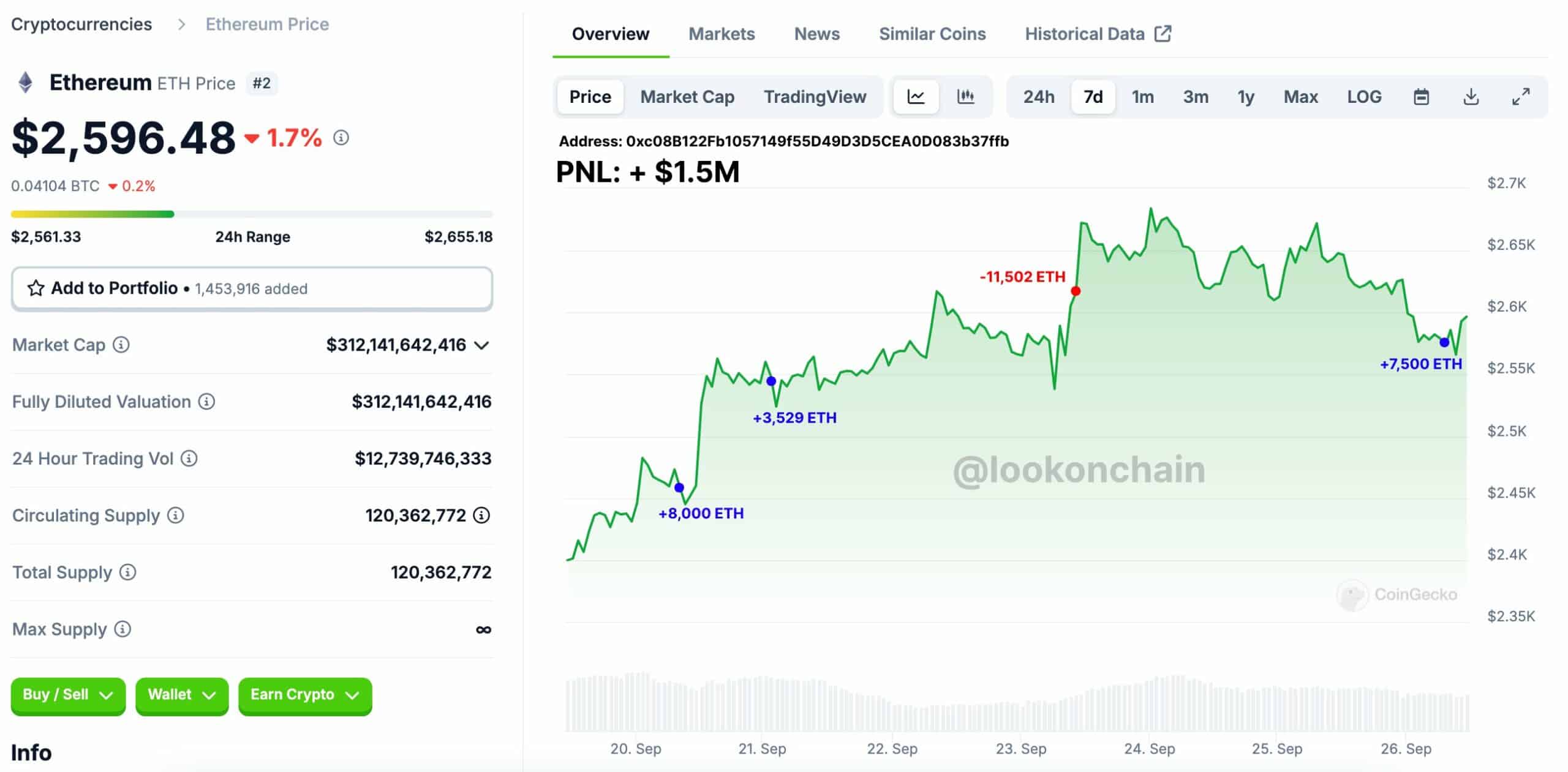

Smart whales benefit

Smart whales capitalize on these fluctuations, providing additional support for the bullish outlook. Some savvy traders have made significant profits by purchasing Ethereum during downturns.

One whale, 0xe0b5, has been trading ETH regularly, with a 100% success rate across eight trades since August 12. This whale purchased over 10,000 ETH worth over $26 million and sold it at higher prices, earning over $1.56 million in profit.

Source: Lookonchain

Another whale, 0xc08B, bought 11,529 ETH worth over $28 million at $2,485 and sold at $2,618 three days later, making a profit of $1.5 million .

These activities demonstrate that large traders believe in Ethereum’s higher earnings potential despite its recent struggles for dominance.

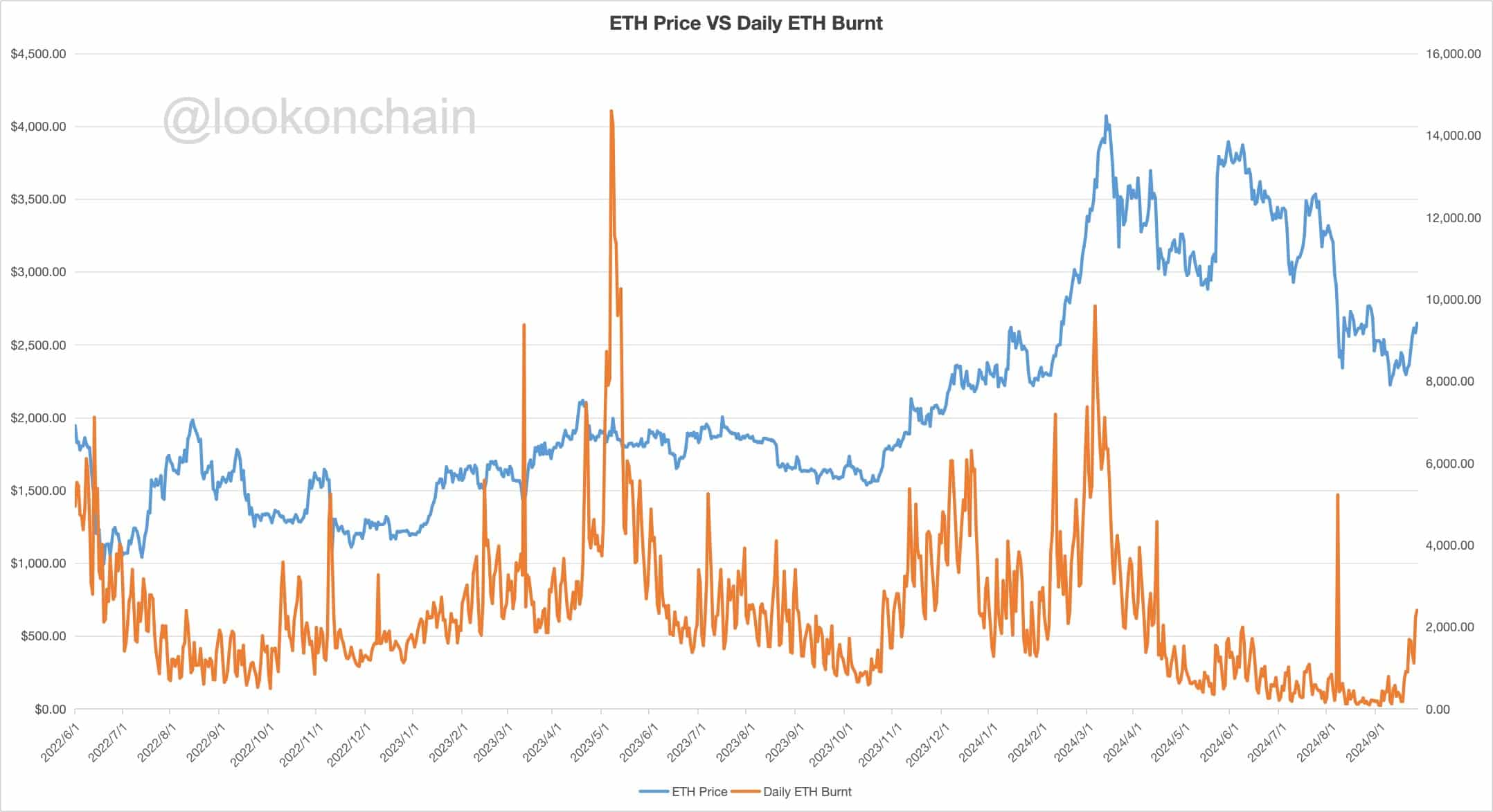

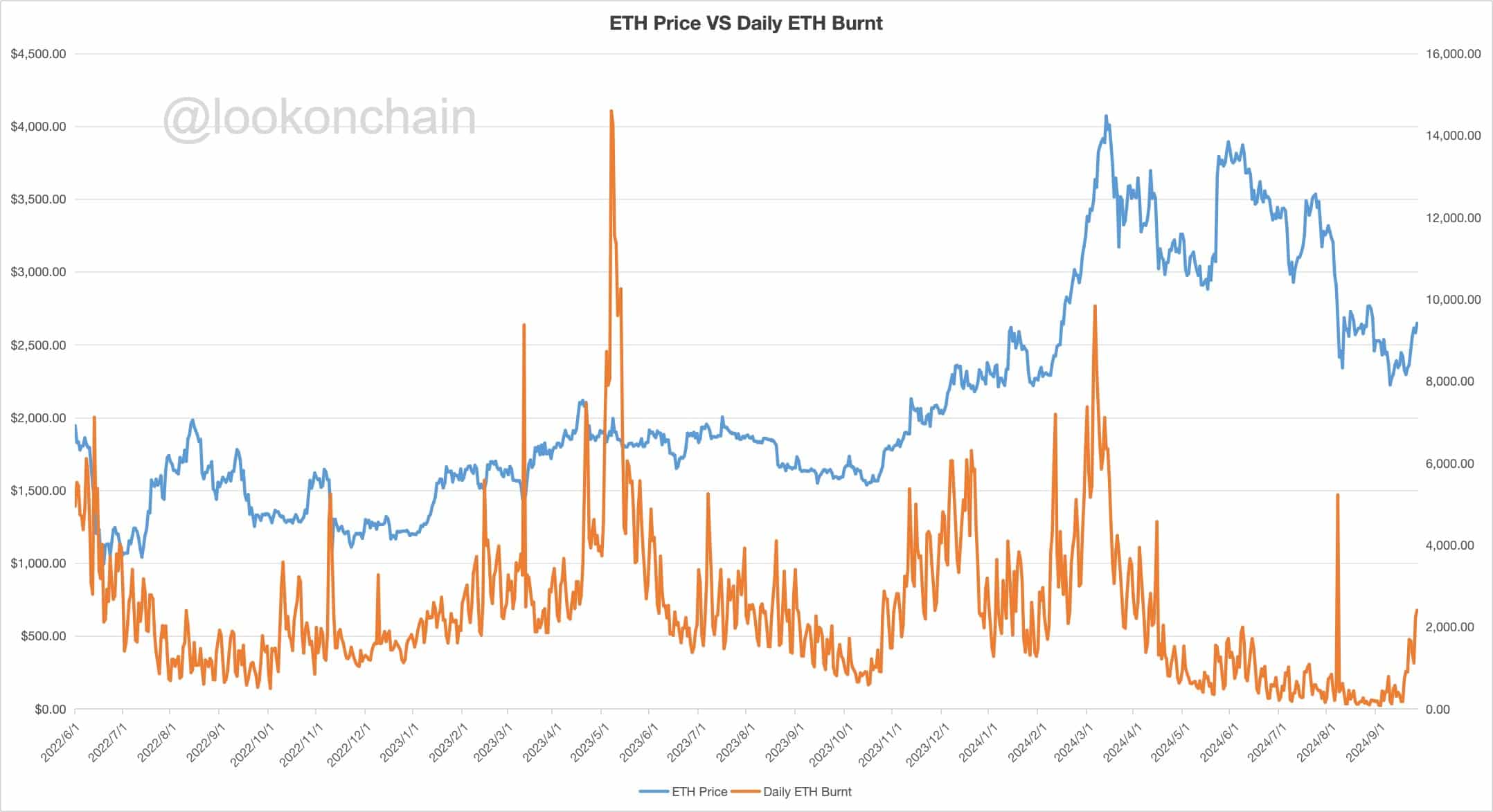

ETH burned daily increases

Additionally, the daily amount of ETH burned increased by 163% over the past week, providing another positive signal for the future price of Ethereum.

The ETH price and daily ETH burned chart show a clear trend, with the amount of ETH burned increasing ahead of the price surge in January and October 2023.

This burning of ETH reduces the overall supply, which can drive the price higher if demand remains stable. As the burn rate increases, so does the likelihood of the price of ETH.

Read Ethereum (ETH) Price Forecast 2024-2025

Source: Lookonchain

Despite current challenges to market dominance, ETH’s strong performance at key technical levels, whale activity, and increasing burn rate suggest that Ethereum price will continue to rise.

These factors point to a bullish future for ETH, even though its market dominance may be in decline.