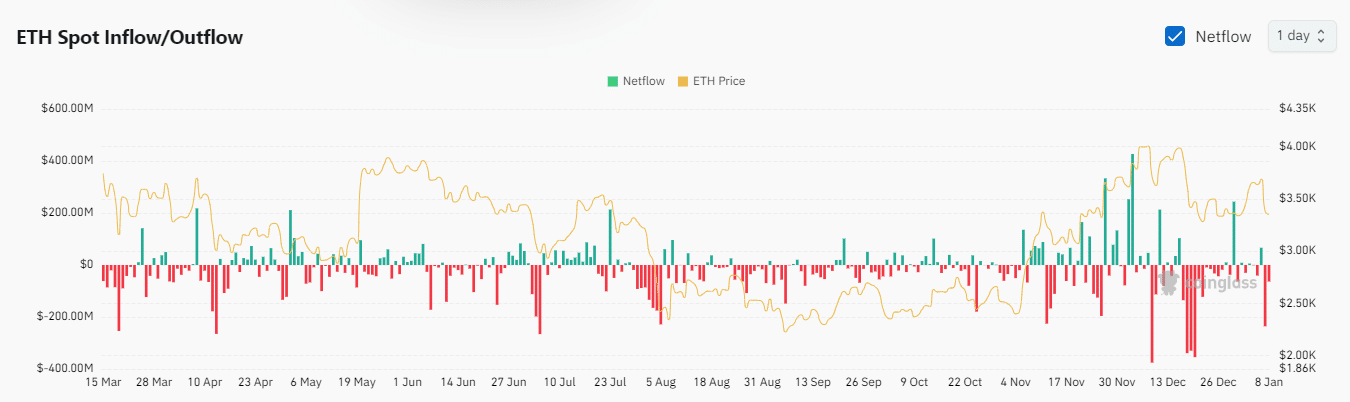

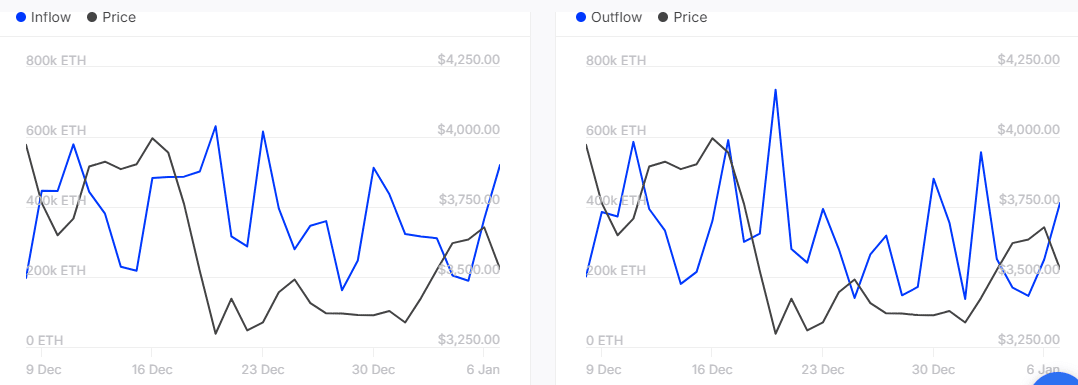

- Spot flows, including those from ETFs, turned negative, erasing recent gains.

- Why a shake-up in short-term leverage has taken place recently and what’s next as the whales make their comeback.

An unexpected wave of selling pressure wiped out recent gains made by Ethereum (ETH) during the first days of January.

There are several reasons for this selling pressure, including reduced leverage and cash outflows, among others.

The ETH spot ETF outflows were arguably the most notable sign of selling pressure. It initially kicked off this week with inflows worth $128.7 million on January 6, building on January 3 inflows.

This may have created a false sense of relief and led to a sell-off in FUD after the ETF pivot on January 7.

On the other hand, Bitcoin ETFs were still positive over the last 24 hours despite the opposite result on the ETH side. This reflected the situation of domination.

ETH ETF outflows totaled $86.8 million on January 7. This is consistent with the total negative spot flows observed on the stock exchanges during the same period. Releases peaked at $235.66 million on that date.

Source: Coinglass

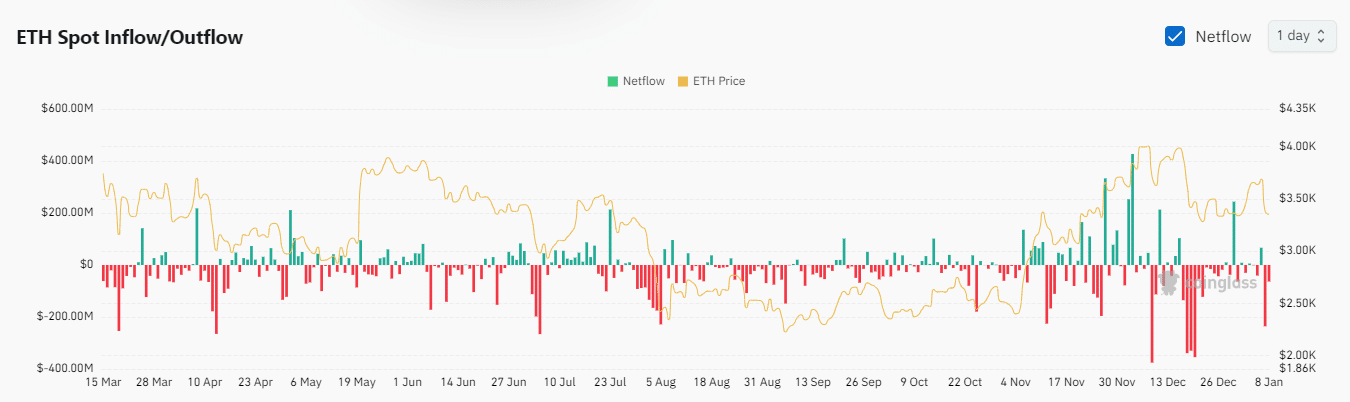

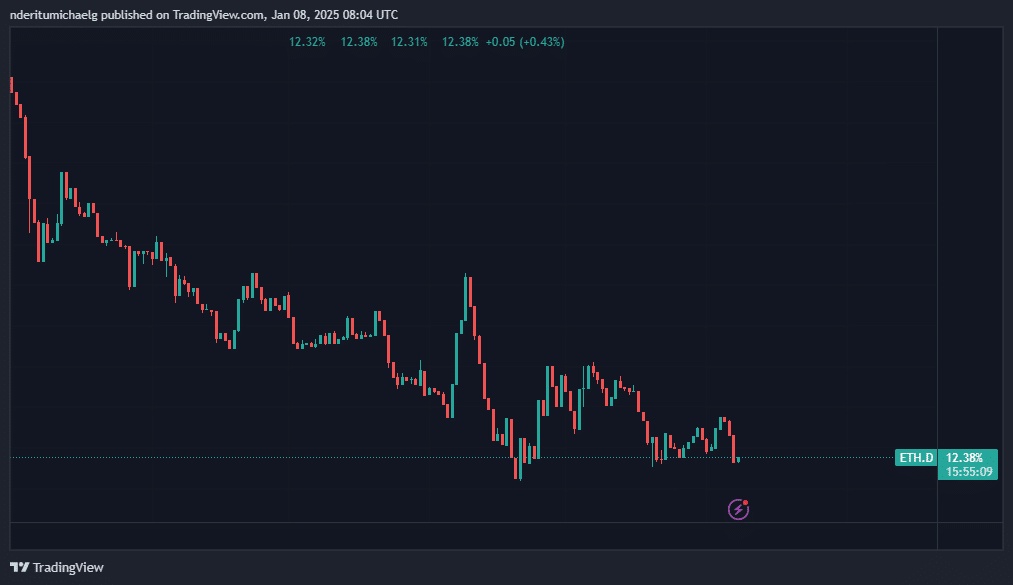

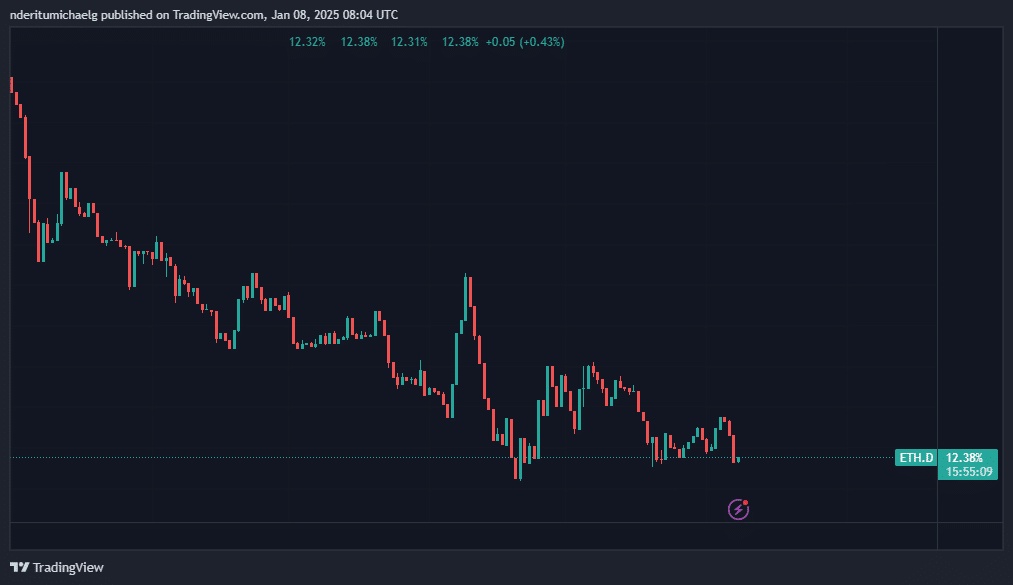

ETH dominance wanes, but could be ready to pivot

The recent selling pressure has taken a toll on ETH’s dominance, which previously rose as high as 12.87% over the weekend. However, the latest turn of events saw it drop to 12.32%.

ETH could make another attempt with higher dominance from its current level. This is because the same area has already shown its support.

Source: TradingView

The same ETH dominance support also aligns with the new support test in ETH price action. But is the latest decline over or will prices fall further?

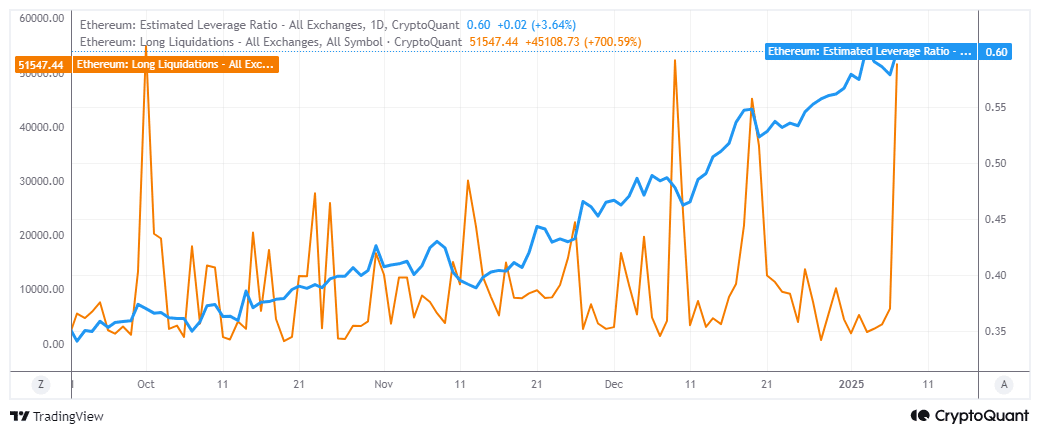

Leveraged long liquidations likely contributed to the latest wave of selling pressure seen over the past two days.

The appetite for leverage has increased in recent months. Long liquidations have increased by over 700% since January 3.

Source: CryptoQuant

More than $173 million in liquidations were seen in the last 24 hours. This suggests that the final rally in the first week of January may have been a preparation for a leverage restructuring.

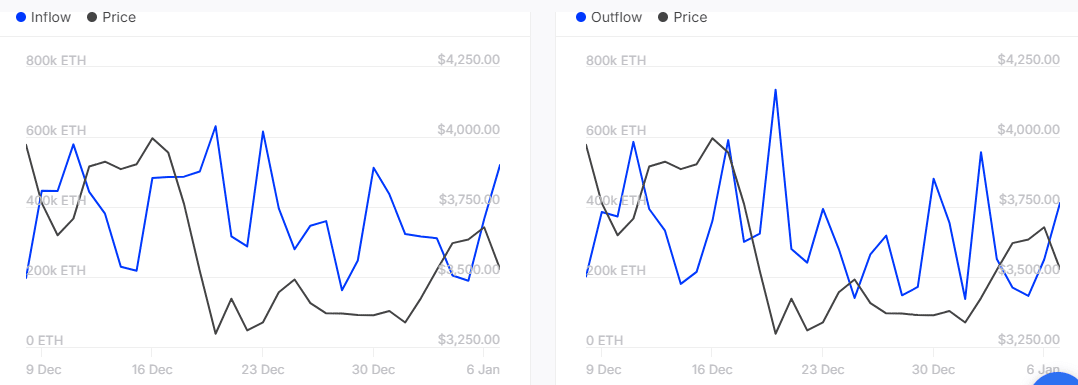

Will ETH rebound in the second half of the week? This is plausible because of a major observation that could provide insight into what’s next. Whales have been selling since the beginning of January.

Read Ethereum (ETH) Price Forecast 2025-2026

However, recent data reveals that they accumulated during the last decline.

Source: In the block

ETH whales accumulated 519,620 ETH on January 7, while outflows were lower at 411,300 ETH on the same day. This confirmed that whales bought the dip and could potentially contribute to a mid-week rally.