- Ethereum sets a new year-to-date inflow record at $2.2 billion, breaking its 2021 highs.

- ETH could reach $10,000 in the medium term if more on-chain activity continues to flourish.

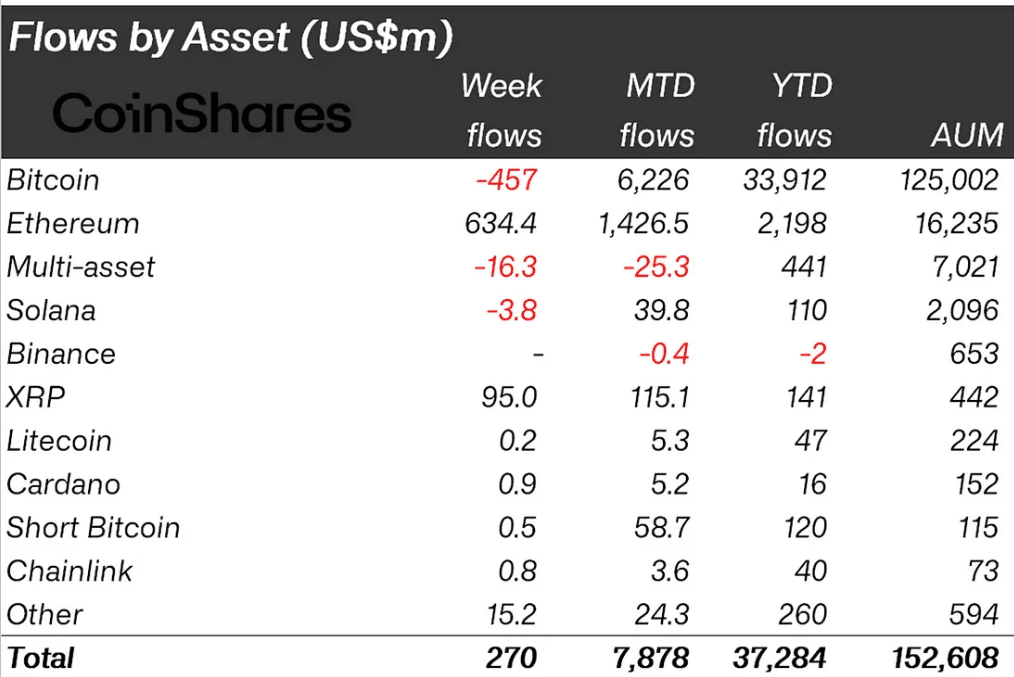

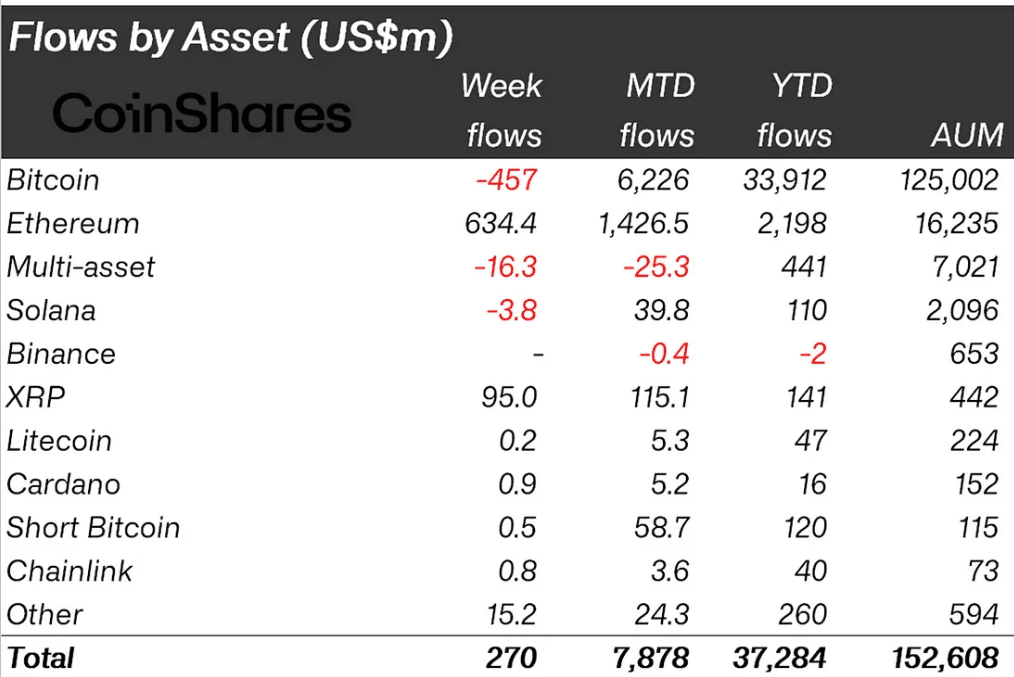

Ethereum (ETH) has set a new inflow record, reaching $2.2 billion year-to-date, surpassing its previous record from 2021.

Recent inflows accounted for $634 million, indicating a significant increase in investor confidence and market sentiment.

This rise was attributed to the strong performance of Ethereum ETFs. These ETFs have become a preferred vehicle for investors because they provide exposure to ETH without direct investment in the digital currency.

Growing institutional interest was evident as significant sums continue to be directed towards Ethereum-based investment products.

Source: Bloomberg, Coinshares

Despite some fluctuations and market volatility, Ethereum’s overall trend appears bullish, with increased institutional support providing a solid foundation for future growth.

These developments have coincided with an overall increase in flows into crypto ETPs, with Ethereum leading the way alongside Bitcoin.

ETH TVL and Spot ETF Entries

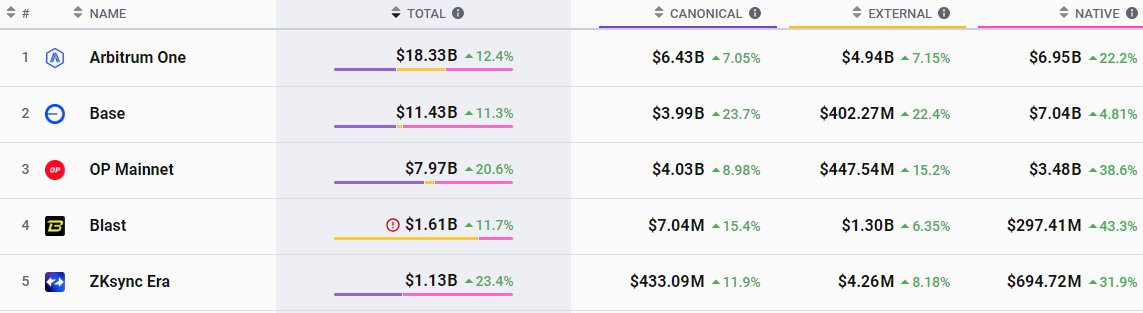

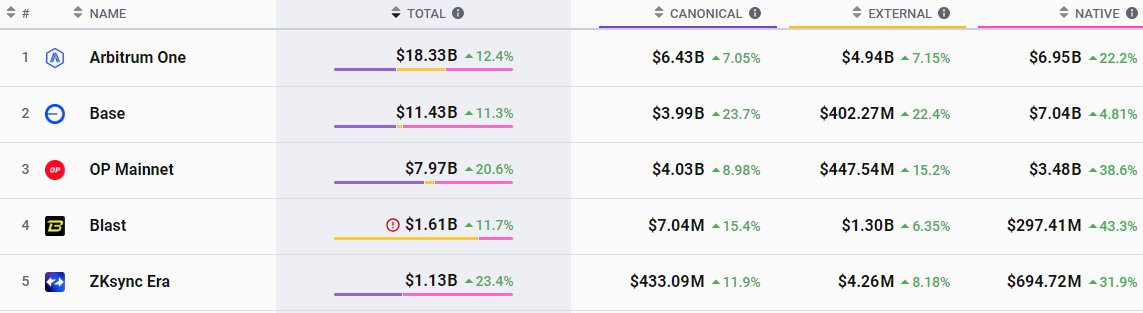

Over the past week, Ethereum saw a large inflow of $4.81 billion, leading to a notable increase in its total value locked (TVL), as reported by Lookonchain.

These flows propelled Ethereum’s Layer 2 networks to a new high, with the combined TVL reaching a record $51.5 billion, an increase of 205% year-over-year.

Additionally, Base TVL increased by $302.02 million, reflecting increased activity and scalability improvements.

Ethereum L2 Market Caps | Source:

This record growth in DeFi TVL has not only revisited November 2021 highs, but has also diversified with increased liquid staking options, Bitcoin DeFi integrations, and enhanced contributions from Solana and other Layer 2 networks.

Additionally, Ethereum spot ETFs reported a substantial net inflow of $24.23 million, marking six consecutive days of positive inflows.

Source: SoSo Value

Leading this wave, BlackRock’s ETHA ETF saw a remarkable inflow of $55.92 million in a single day. Similarly, Fidelity’s FETH ETF performed strongly, with a net inflow of $19.90 million.

Combined, the total net asset value of spot ETH ETFs reached $11.13 billion, highlighting sustained and growing interest in Ethereum as an important asset in the digital currency space.

Price action to reach $10,000

These developments could push ETH to new highs as the 3-day time frame chart shows a breakout of a consolidation triangle and a strong surge.

Since the start of 2021, the price of ETH has maintained an overall bullish trend, with some periods of corrections and consolidation.

ETH is poised to break free from a triangle pattern, aiming for higher levels with an expected rise towards $10,000.

Source: TradingView

Read Ethereum (ETH) Price Forecast 2024-2025

The uptrend, reaching just over $3,600, suggests that Ethereum could potentially reach $10,000 in the medium term if on-chain activity continues to flourish.

Such a move indicates strong buyer interest and strong market sentiment, perhaps ushering in a new stage for Ethereum’s growth.