Amidst the general financial crash in early August, Ethereum (ETH) lost around 30% of its value, falling to $2,226 per unit. Particularly in the last few weeks, the leading altcoin has shown great resilience by climbing back up to the $2,600 price region. However, this recent price retracement comes with great uncertainty as to how long Ethereum can maintain such upward momentum. Commenting on this dialogue, CryptoQuant analyst ShayanBTC posited that Ethereum could likely resume its bearish trajectory.

Ethereum Price Will Suffer From Seller Domination

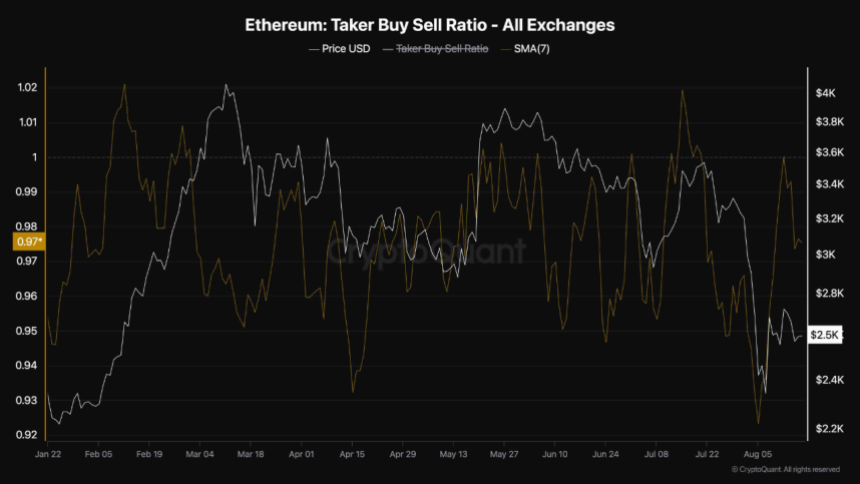

In a QuickTake post published on Saturday, ShayanBTC noted that the taker buy/sell ratio indicates that Ethereum could see another price drop in the coming days. To explain, the taker buy/sell ratio is an analytical tool that assesses the balance between aggressive buying and selling activity. It is calculated based on the volume of taker buy orders and sell orders.

As is often the case with other indicators, a bid/taker ratio above 1 suggests that there is upward market momentum with buyers more aggressive than sellers and a ratio below 1 represents downward market pressure with the opposite scenario.

According to ShayanBTC, after recently failing to break above the $3,000 price resistance, Ethereum’s Taker buy/sell ratio has declined significantly, as evidenced by the asset’s price movement. As expected, the metric has also seen a rebound following ETH’s recent price gains. However, the Taker buy/sell ratio has failed to rise above 1 as it remains in the zero region, indicating that a lack of sufficient buying pressure is allowing sellers to maintain control of the market.

However, ShayanBTC reports that the TakerBuy/Sell ratio has decreased again, indicating that sellers are preparing to sell their assets, which could lead to a drop in the price of Ethereum. The analyst urges caution, saying that the ETH market will need a massive increase in demand to avoid resuming the downward price movement.

ETH Price Overview

According to data from CoinMarketCap, Ethereum is currently trading at $2,610, reflecting a slight increase of 0.61% over the past day. However, the asset’s performance over longer time frames remains unimpressive with a decrease of 23.93% over the past month.

With sustained gains, the top altcoin is likely to encounter early resistance in the $2,700 price region. If buying pressure proves sufficient, ETH could break through this barrier and surge to $3,000. On the other hand, massive selling pressure as indicated by the Taker Buy/Sell ratio can push the asset’s price down to $2,300.