- TVL and stablecoin market cap inflows indicate rising sentiment.

- Ethereum could be about to experience a DeFi revival after weeks of declining demand.

The Ethereum (ETH) network has seen a notable drop in activity over the past few months, a result that reflects the state of DeFi in an environment characterized by low demand.

Ethereum has historically demonstrated strong network activity and engagement in its DeFi ecosystem, particularly during bullish market conditions.

The market has had a bullish week so far, with rate cut announcements acting as a catalyst. Will this be enough to reignite interest in Ethereum’s DeFi landscape?

So far, the Ethereum network has seen healthy activity that could indicate a recovery. The market cap of the network’s stablecoins could offer some perspective on the situation.

The market cap of the Ethereum stablecoin (in green) peaked at $82.154 billion in April and has been declining since then. It recently bottomed out at $78.20 billion in early August. It has since rebounded slightly to its current level of $83.84 billion.

Source: DeFiLlama

Ethereum’s TVL (blue) has also declined significantly since its local peak of $66.91 billion in June, reaching a low of $43 billion. However, it has since recovered to $47.79 billion. This recent recovery could indicate the return of confidence in the Ethereum network.

Is Ethereum Out of the Woods?

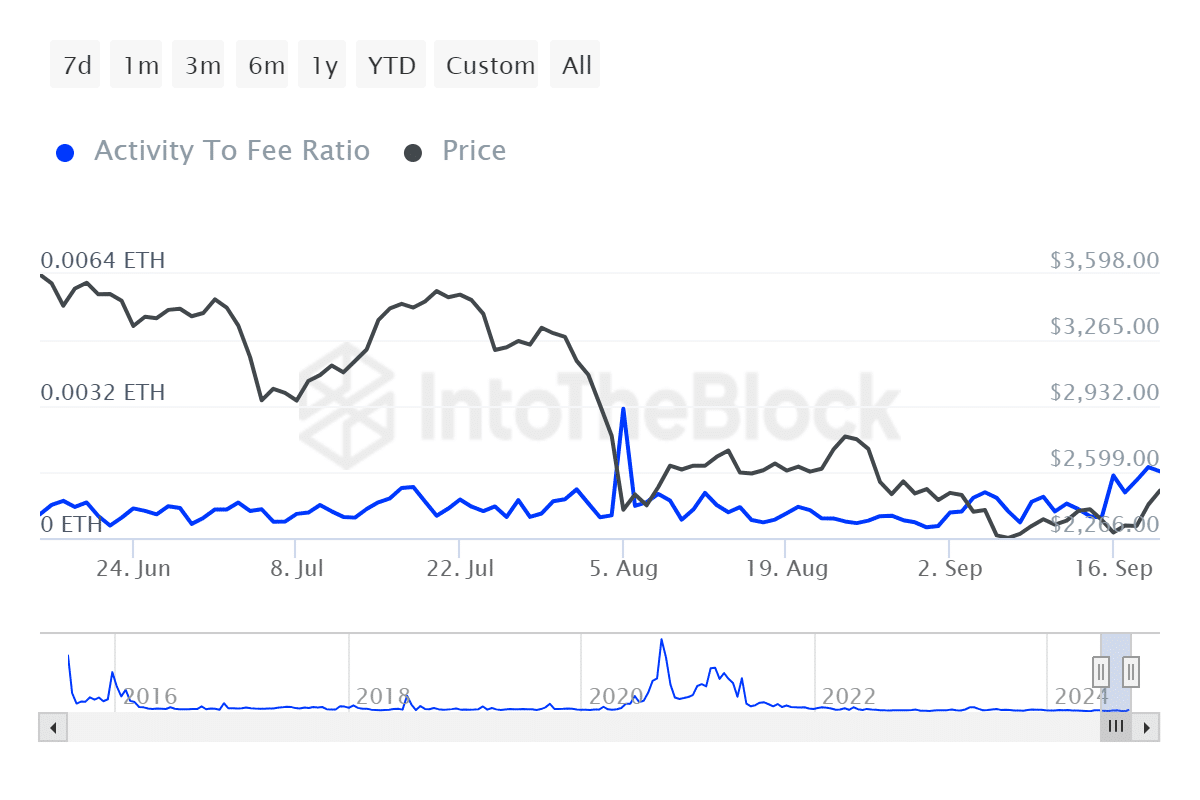

Ethereum has seen a notable increase in its network-to-fee ratio since mid-September. This is the second-highest increase in this metric we’ve seen in the last three months. This confirms the increase in fees resulting from fees generated by increased network activity.

Source: IntoTheBlock

This surge demonstrated correlation with ETH’s recent price rally and was in line with improving sentiment in the cryptocurrency market, so it may not be an ideal representation of Ethereum’s DeFi ecosystem’s performance.

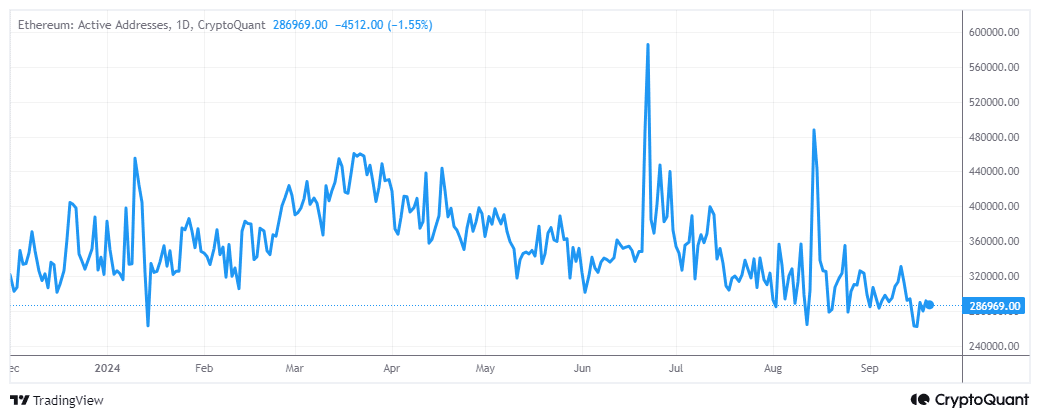

While the above results highlight some improvement in the Ethereum ecosystem, signs of underperformance persist. For example, the number of active Ethereum addresses was still near its lowest levels since the beginning of the year.

Source: CryptoQuant

In other words, the network hype was still low despite the recent increase in activity. This can have a negative impact on ETH price action. For example, whale and institutional sentiment was bearish according to recent observations.

Read Ethereum (ETH) Price Prediction 2024-2025

The analysis suggests that ETH’s recent surge has been driven primarily by retail demand. This may also indicate the possibility that the recent price rally may be short-lived, especially if savvy investors remain bearish for longer.

Furthermore, it may take weeks or even months for ample liquidity to return to the cryptocurrency market.