- Ethereum’s price mirrors that of Bitcoin, showing some volatility as recent staking influxes have led to price drops.

- Analysts have predicted a potential rally for Ethereum, targeting a price of $3,000 amid market corrections.

Ethereum (ETH), the second-largest cryptocurrency by market cap, has continued to closely follow Bitcoin (BTC) in its efforts to reach new highs. Ethereum is down 2.1% over the past week so far.

This decline seems to have extended to the last day in which ETH dropped by just 0.2%. This price performance has now led the asset to currently trade at a price of $2,619, at the time of writing.

Ethereum Staking Inflows Skyrocket

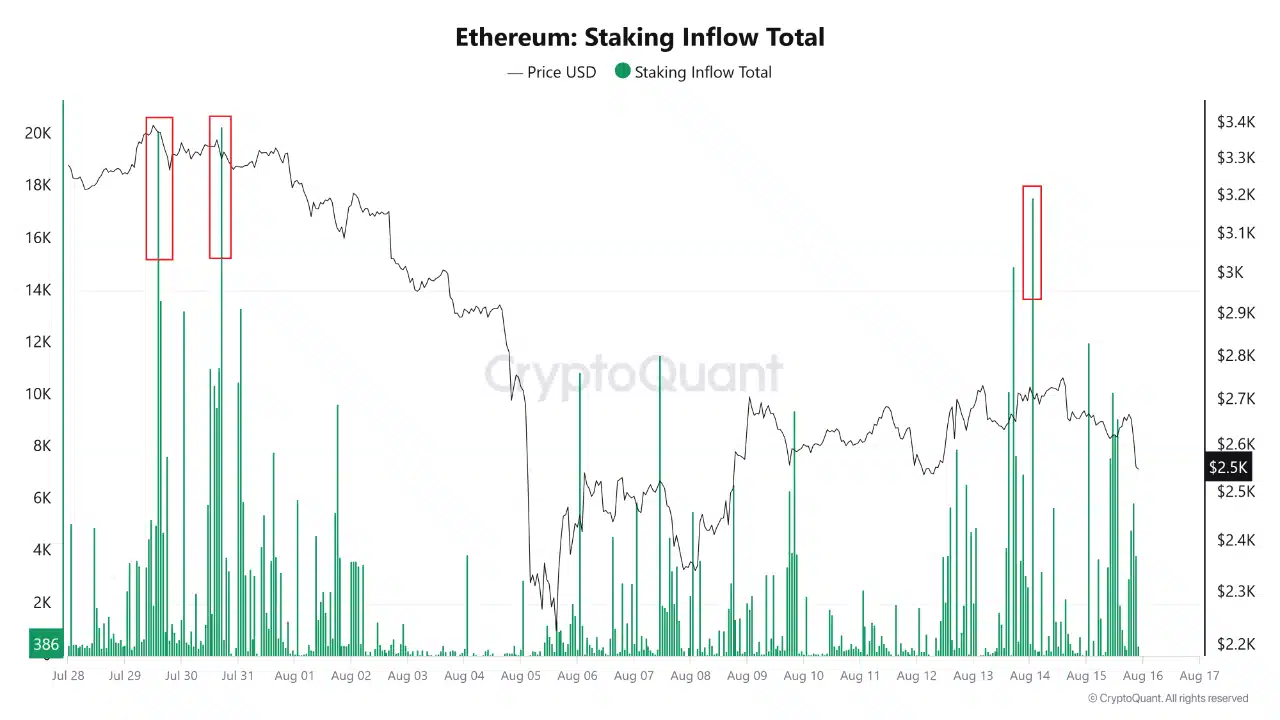

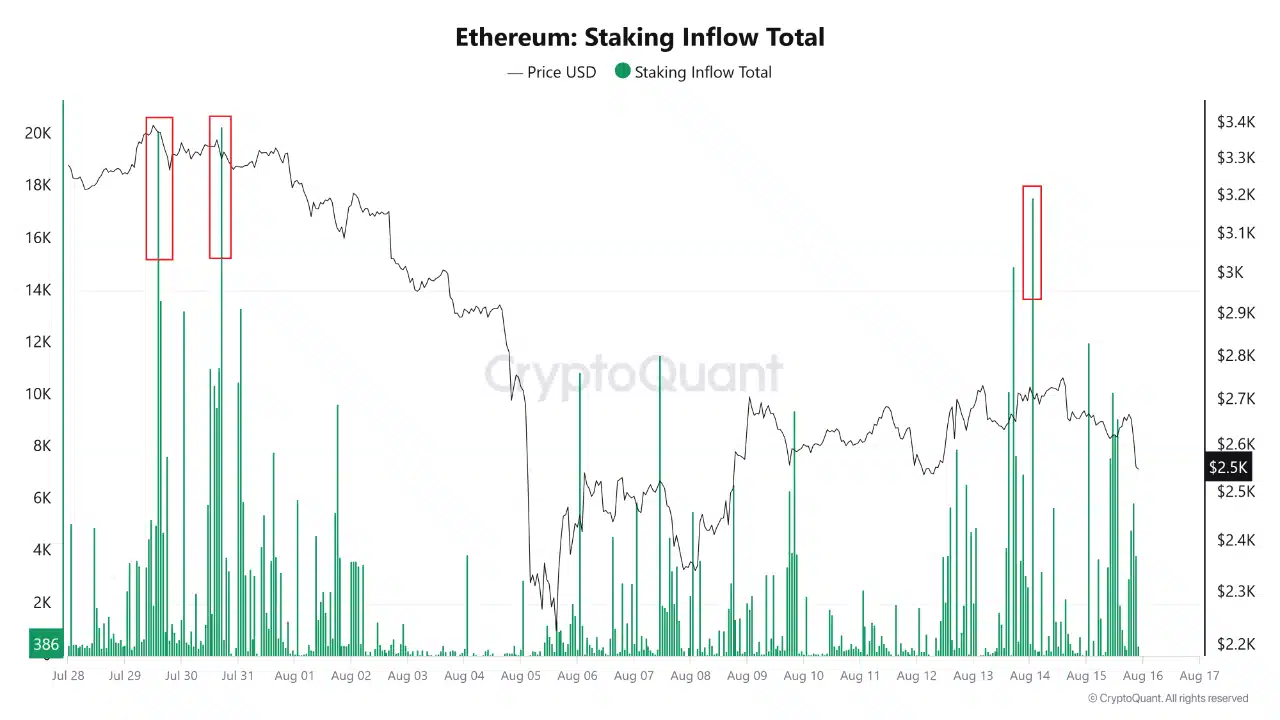

Ethereum has recently seen an increase in staking flows as reported by CryptoQuant, indicating a growing interest in securing the network through its proof-of-stake (PoS) mechanism.

This influx pushed the total staking volume past 16,000 ETH. However, there appears to be a correlation between these inflows and subsequent price drops.

According to the CryptoQuant analyst reporting this increase in staking flows, historical data from July and mid-August shows that significant increases in staked ETH often precede notable declines in Ethereum’s market price.

Source: CryptoQuant

These models suggest that while staking increases network security and stakeholder engagement, it also introduces short-term price volatility due to liquidity lock-up.

Is a short-term rise to $3,000 still possible?

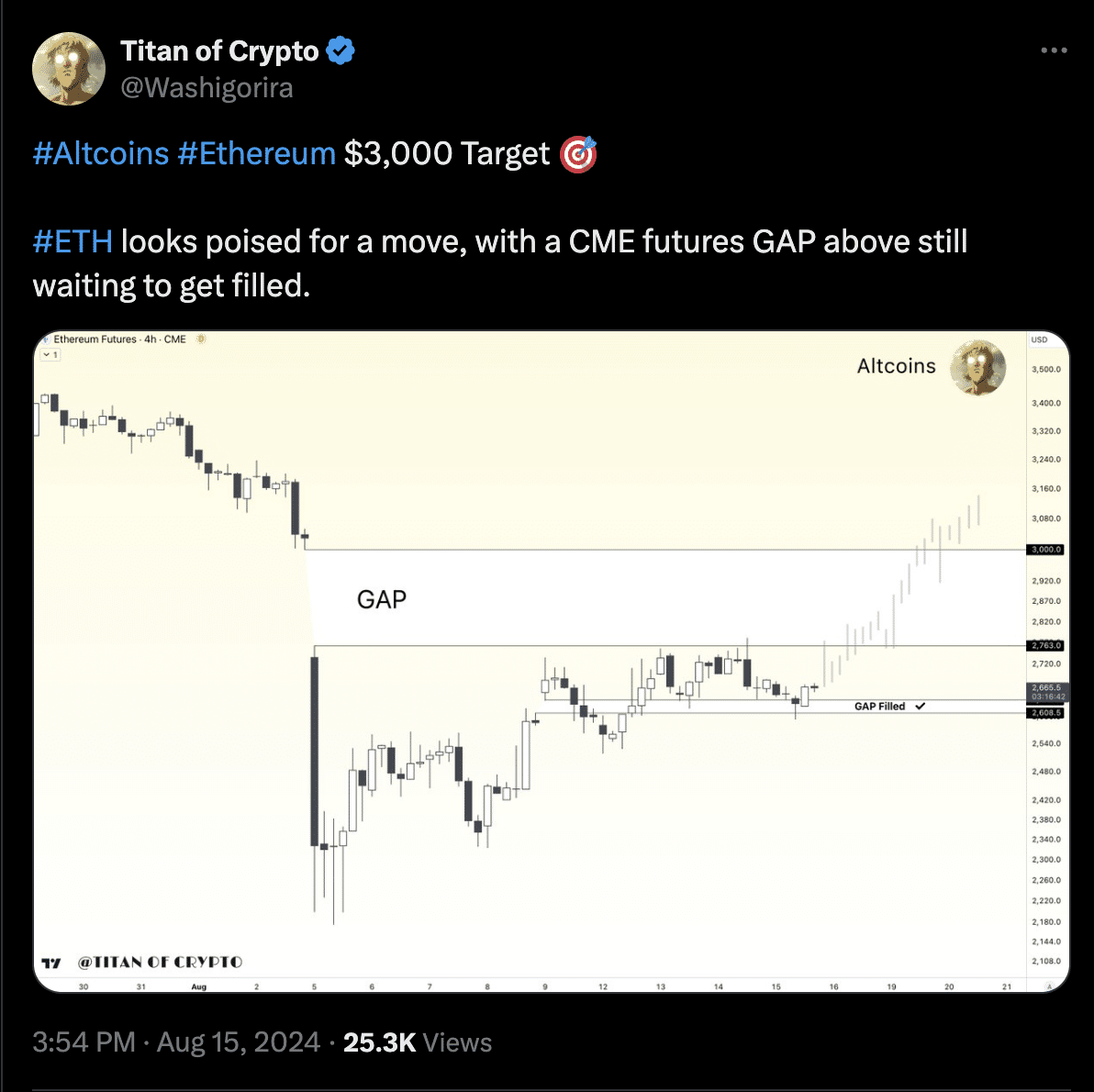

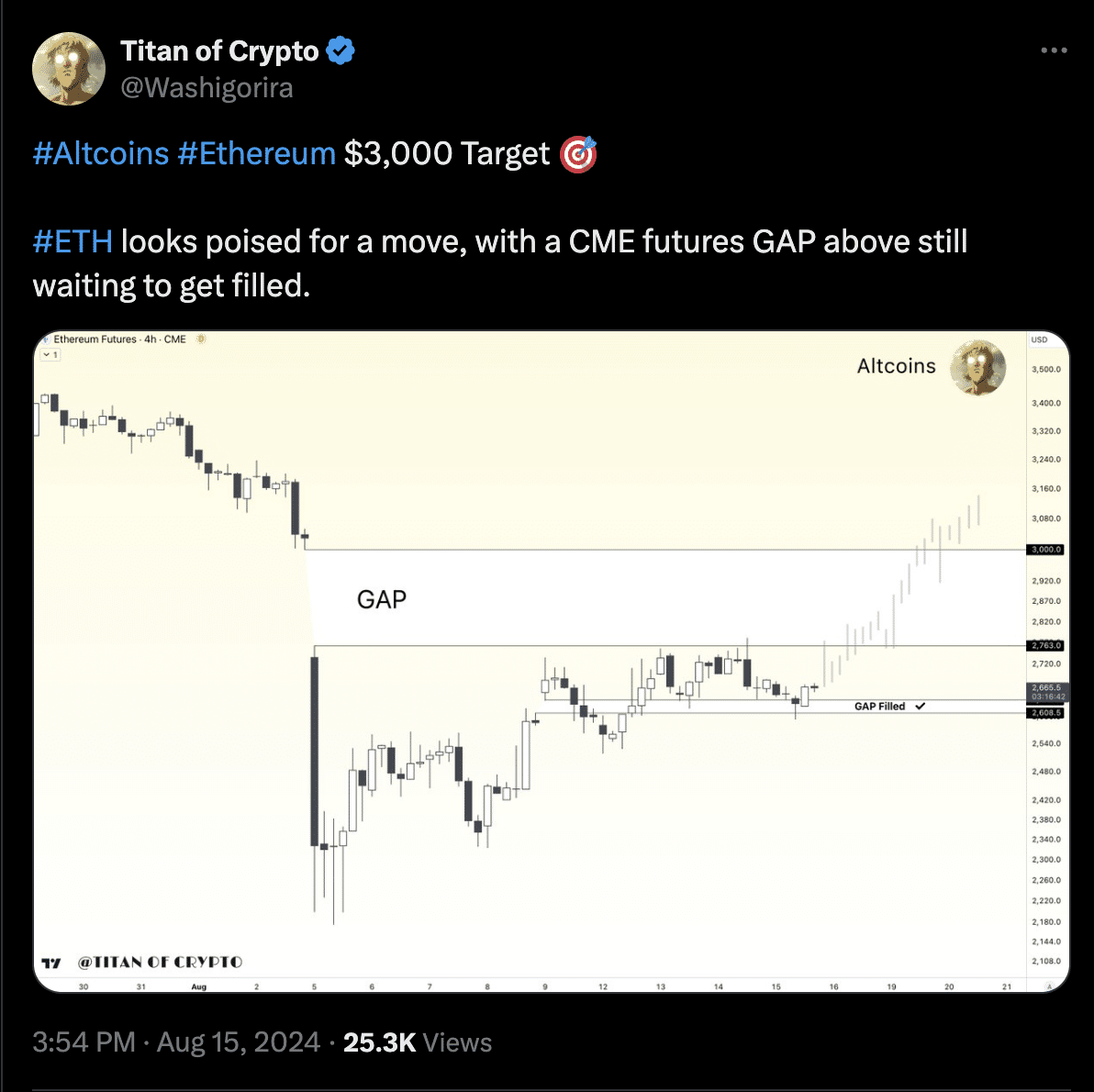

Meanwhile, other analysts remained optimistic about Ethereum’s recovery and growth potential.

A prominent crypto analyst, known on X (formerly Twitter) as the “Titan of Crypto,” has projected a $3,000 price target for Ethereum.

Source: Titan of Crypto/X

This prediction is partly based on the presence of an unfilled gap in CME futures contracts, which historically indicates a potential upward movement in prices.

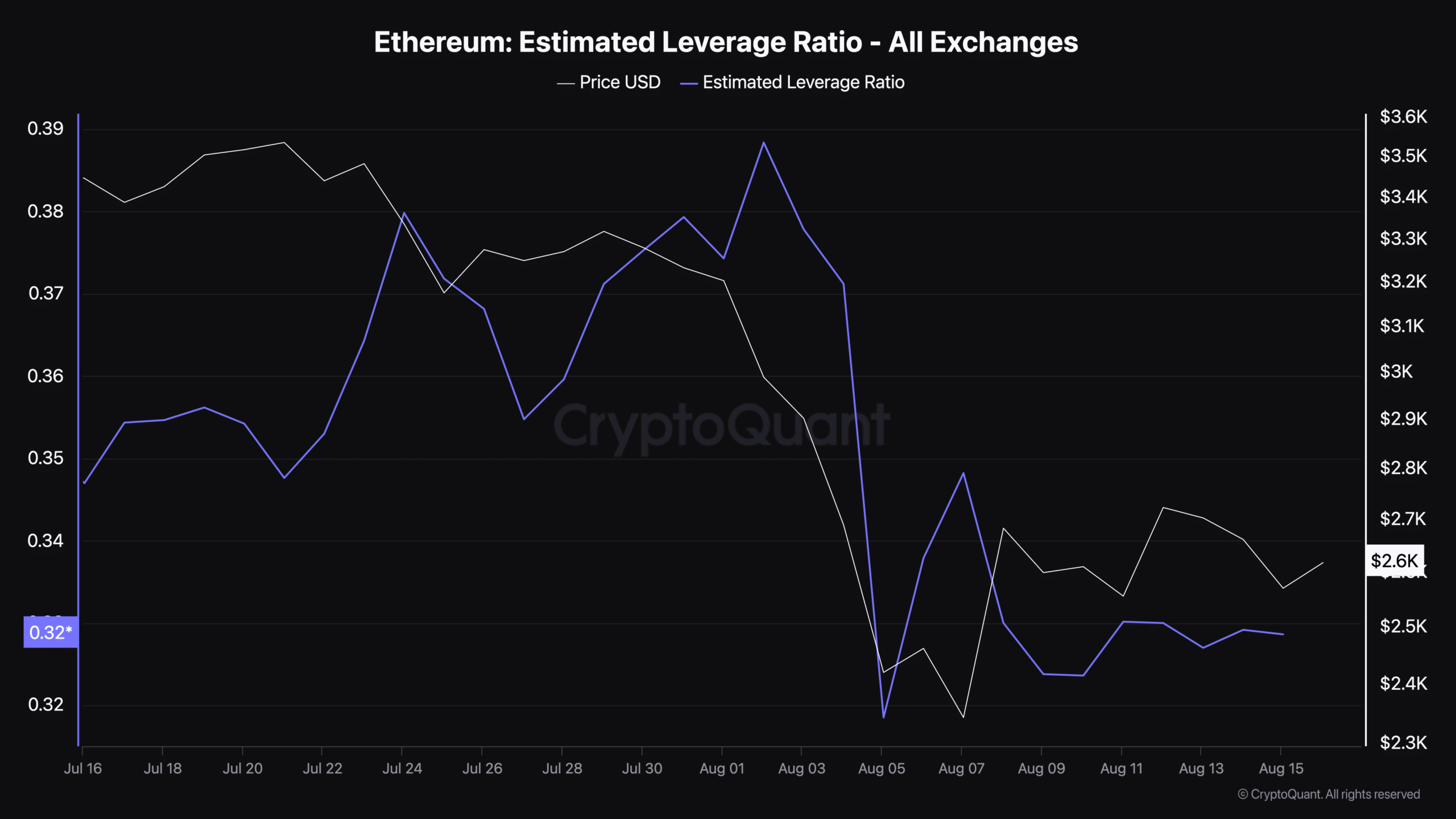

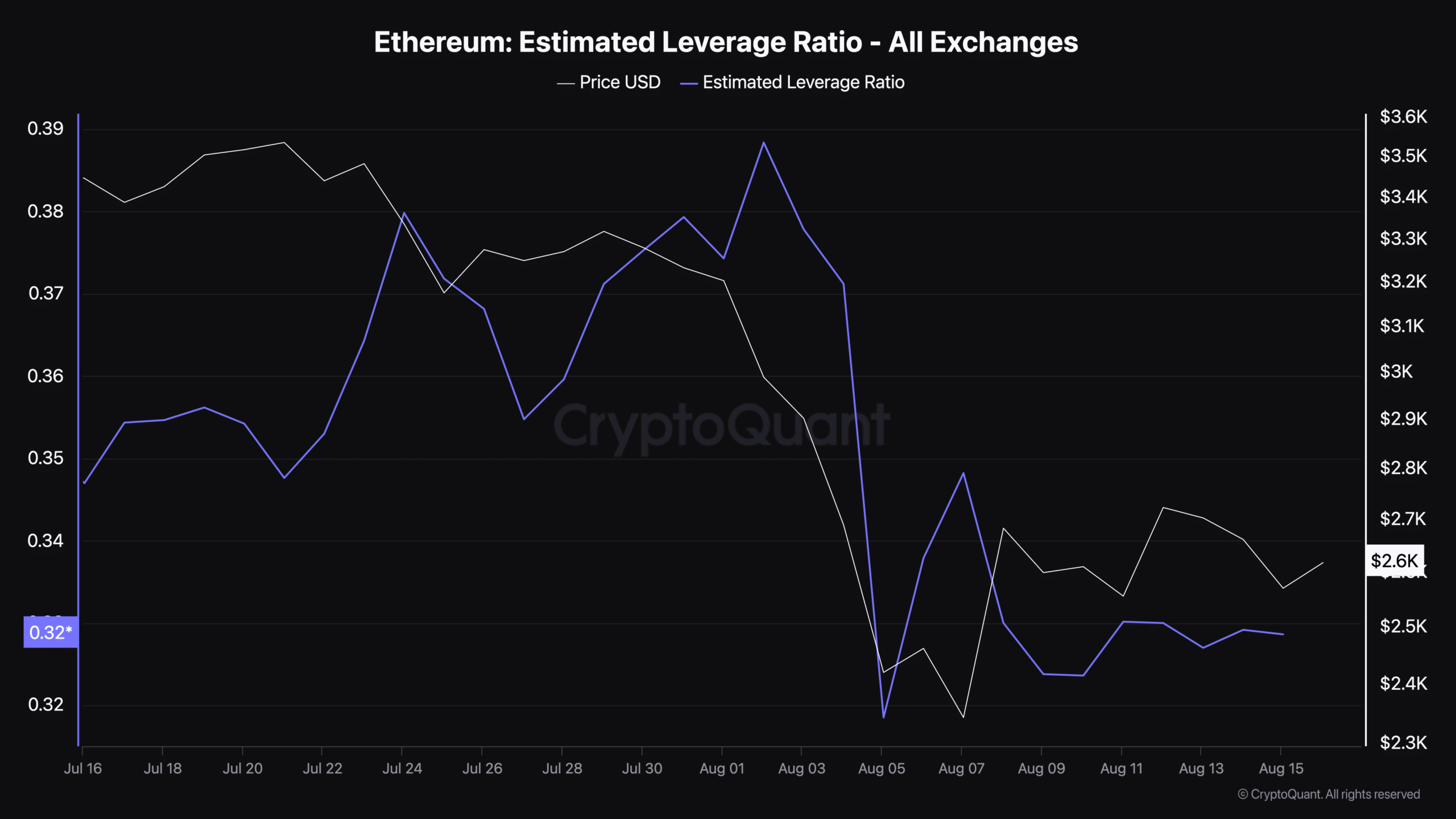

Additionally, Ethereum’s fundamental indicators, such as the estimated leverage ratio – at 0.328 at the time of publication according to data from CryptoQuant — suggested a conservative but stable market leverage situation.

Source: CryptoQuant

Read Ethereum (ETH) Price Prediction 2024-25

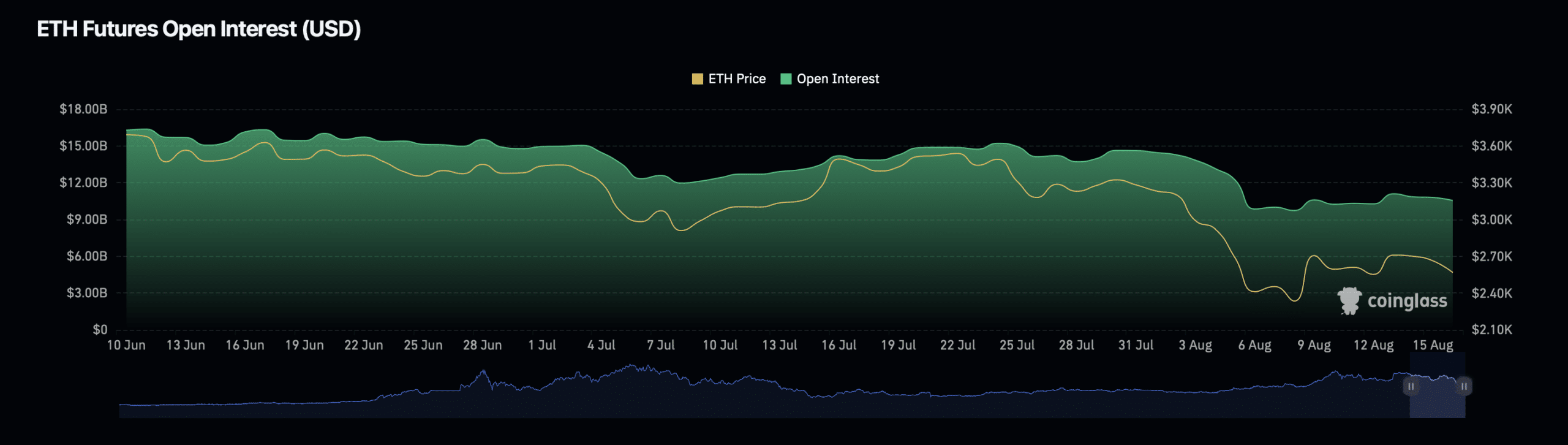

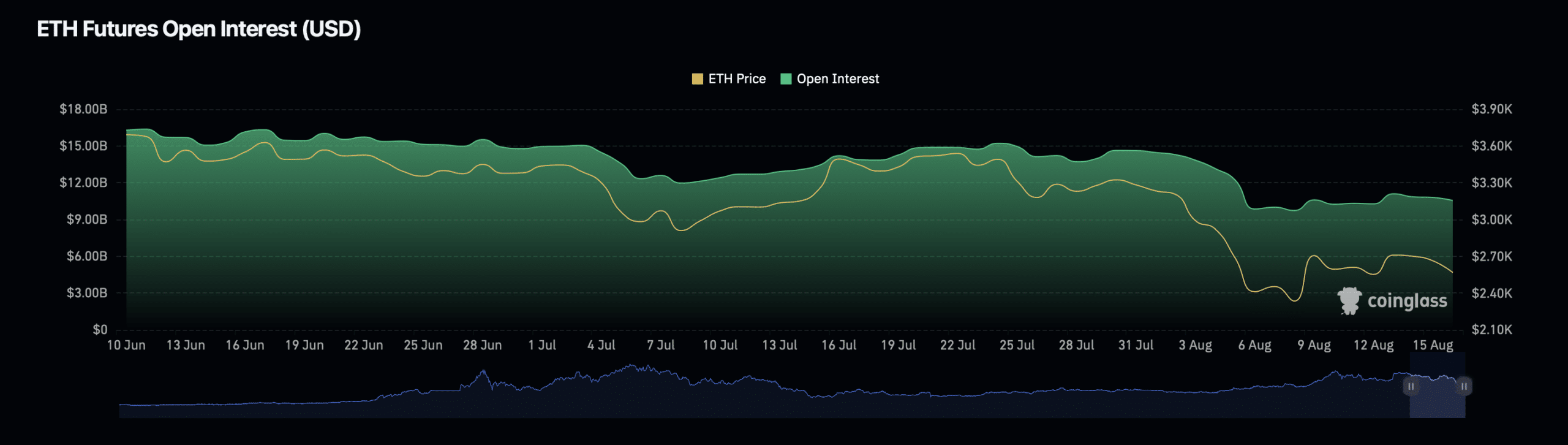

This ratio, assessed alongside the current decline in Ethereum’s open interest of Coin glasssuggested a cautious market sentiment.

However, it also highlighted the possibility of bullish momentum if market conditions improve.

Source: Coinglass