Chain data show that Ethereum whales have recently increased their accumulation, a panel that could be optimistic for the price of the assets.

Ethereum whales bought large

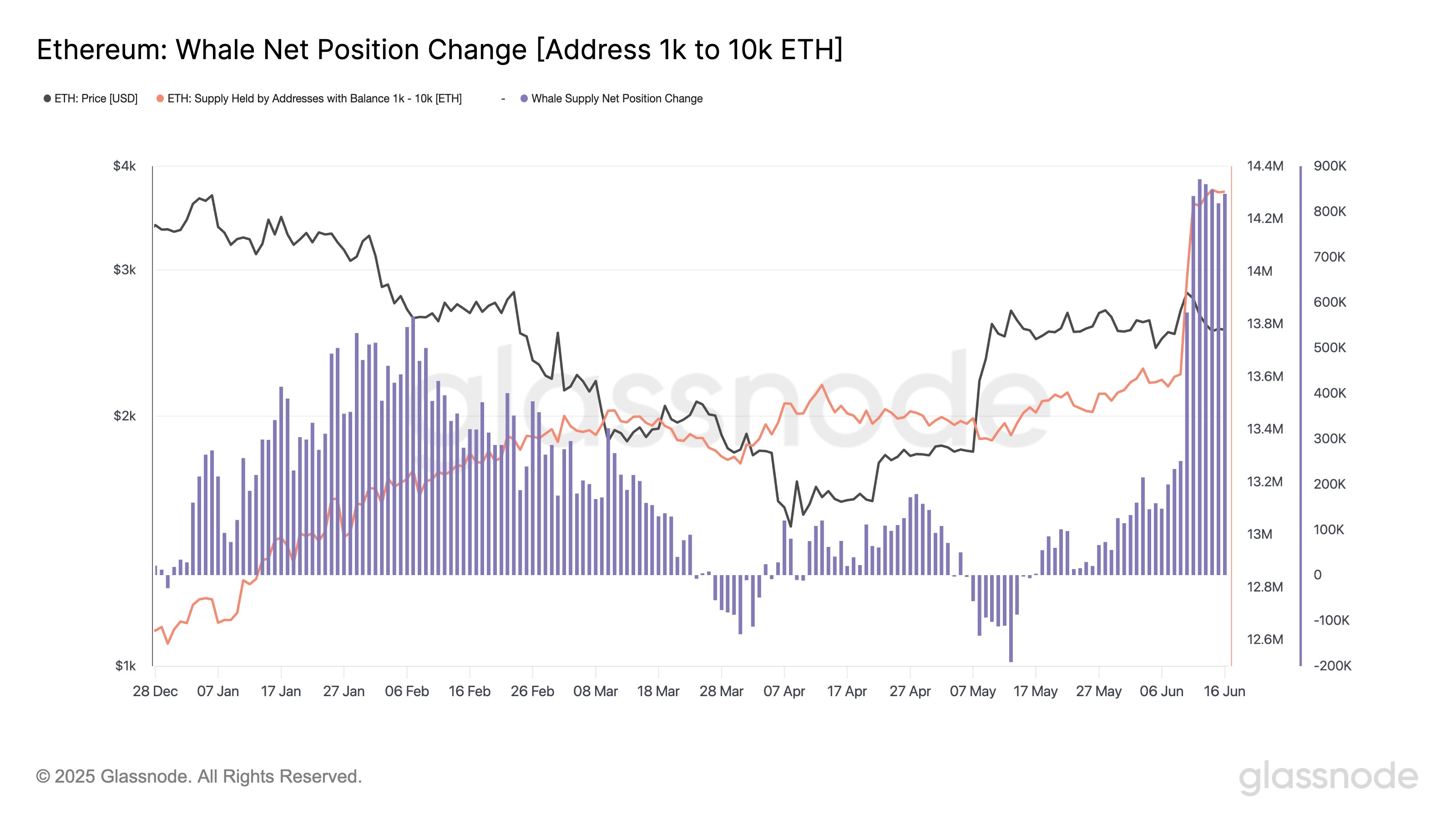

According to data from the Glassnode chain analysis company, Ethereum whales participated in a very large amount of accumulation during last week.

The “whales” refer to ETH investors holding between 1,000 and 10,000 cryptocurrency tokens. To the current exchange, this range converted to around 2.5 million dollars at the lower end and $ 25 million at the next level.

Although this range does not cover the absolute upper end of the market, it still includes enormous investors which can be considered as a key element of the ecosystem. As such, given this role, the movements linked to these holders could deserve surveillance.

One way to monitor the behavior of the whales is the total quantity of the Ethereum offer owned by them. You will find below the graphic shared by Glassnode which shows the trend of this metric in recent months.

The value of the metric appears to have seen a steep climb in recent days | Source: Glassnode on X

As it is visible in the graph, the supply of Ethereum whales recently triggered, a sign that large money investors accumulate cryptocurrency. “For almost a week, the daily accumulation of whales exceeded 800,000 ETH, pushing the assets in 1K portfolios to 10k to> 14.3 million ETH,” notes the analysis company.

From the table, it is obvious that a particularly important peak occurred on June 12. On this date, the ETH Whales added more than 871,000 ETH to their assets, the highest daily entry for the updated year cohort.

The last wave of accumulation is not only notable in terms of the year, but rather impressive in a historical context. “This purchase scale has not been seen since 2017,” explains Glassnode. Naturally, the extraordinary push of purchase of these investors could be a potential indication that they have confidence in the future of the medal.

Although this strong accumulation activity was identified in the chain, another side of the sector also experienced the request: the funds negotiated on the stock market (ETF). The FNB Spot are investment vehicles that offer investors a way to expose themselves to Ethereum without having the asset directly.

The FNB spots are negotiated on traditional exchanges, so that holders who do not know the wallets and cryptocurrency exchanges can find easier to invest in the room through them.

There has been a high demand for the ETH ETH ETH points lately, because the Netflow table shared by GlassNode in a Post present.

The trend in the netflow of the US ETH spot ETFs since their inception | Source: Glassnode on X

“Last week saw 195.32K ETH take place in FNB and ETH Spot – the third net weekly influx never recorded,” explains the analysis firm.

Ethn price

Ethereum has taken a look at $ 2,700 on Monday, but it seems that the price has taken a bearish turn since during its exchange approximately $ 2,470.

Looks like the price of the coin has plunged over the last 24 hours | Source: ETHUSDT on TradingView

Dall-E star image, Glassnode.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.