Este Artículo También is respondable in Español.

Ethereum has trouble resuming the momentum, trading below the critical bar of $ 2,800 since last Thursday. The bulls are in difficulty because the price remains trapped under key supply levels, leaving investors concerned about the short -term future of Ethereum. Many of those who expected a bullish year for the second largest cryptocurrency now question their prospects after the massive sales pressure last week made the ETH $ 3,150 to $ 2,150 in $ 2,150 Less than two days.

Related reading

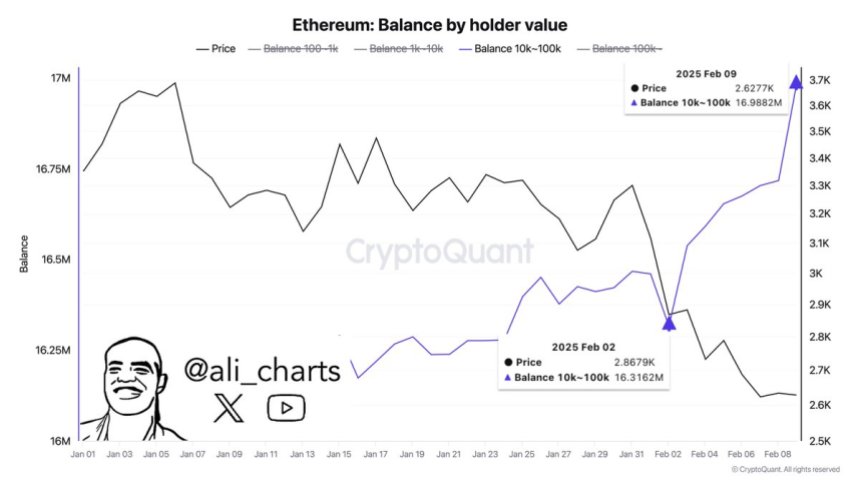

The recent price action has amplified fear and uncertainty among retail investors, many continue to sell themselves in the middle of the market turbulence. However, chain metrics tell a different story, pointing out a growing confidence of larger players. Key data shared by Top Crypto Ali Martinez analyst reveal that whales accumulated more than 600,000 Ethereum last week, even if retail investors remain cautious. This divergence highlights a critical tendency on the market – Detail investors seem to be frightened and reactive, while the big players are quietly buying ETH at reduced prices.

While the market is struggling with indecision and volatility, this accumulation by whales could prepare the ground for a significant change in the momentum. If the bulls manage to recover the $ 2,800 and the levels of $ 3,000, Ethereum could start a recovery gathering. For the moment, all eyes are on the question of whether the divergence will lead to a turning point in the action of ETH prices.

Ethereum investors are divided: fears of retail vs. whale stuff

Ethereum remains in a difficult position after the spectacular sale of last week, which experienced the price of $ 3,150 to $ 2,150 in less than 48 hours. Despite a strong resumption of return in the range of $ 2,700, ETH struggled to recover the key supply levels, leaving many prudent investors. The price remains trapped below the crucial resistance at $ 2,800, with bulls needing to exceed the $ 3,000 mark to move the downward trend and regain market confidence.

Key measures shared by Crypto analyst Ali Martinez reveal a promising trend in the midst of uncertainty. The whales accumulated more than 600,000 Ethereum in last week, reporting a strong activity of purchase of major players.

This accumulation trend strongly contrasts with the cautious behavior of retail investors, many of which continue to sell themselves in the middle of fear and uncertainty. The divergence between the accumulation of whales and retail suggests that large investors remain optimistic about the long -term prospects of Ethereum, even if short -term action remains fragile.

Related reading

This whales activity gives hope to investors who believe that Ethereum always has the potential to go up this year. An escape greater than $ 3,000, which aligns the 200 -day mobile average, could mark an important turning point for ETH, causing a rally to higher price levels. Until then, the ETH remains in a critical phase because it sails between the down pressure and the recovery potential.

Eth Price Action: Key levels to recover

Ethereum is currently negotiating at $ 2,620, trying to recover the $ 2,700 mark while it fights against key supply levels. The bulls are under pressure to break the resistance at $ 2,800 and $ 3,000, because the recovery of these levels would mean a reversal of the daily decrease trend that has persisted since the end of December. The $ 3,000 mark has a particular meaning, because it aligns the 200 -day mobile average, a largely watched indicator which signals a long -term force when prices retain.

A successful thrust above $ 3,000 could ignite a strong rally, Ethereum quickly targeting higher price levels. Such a decision would restore confidence in the market and report a potential optimistic trend for ETH, which has struggled to regain its place after the spectacular sale last week.

Related reading

However, if Ethereum does not hold above the $ 2,600 mark, the prospects are becoming a lowering. Ventilation below this level could open the door to additional drops, ETH potentially testing lower demand areas in the coming days. The market remains at a critical time, and Ethereum’s ability to recover and maintain key levels will determine its short -term management, as investors closely monitor the next movements.

Dall-e star image, tradingview graphic