- Trading volumes on Quant Whales jumped almost 1,000% in 24 hours.

- Recent gains have led to a 20% increase in profitable addresses.

Quant (QNT) was trading at $116 at press time after a 3.7% gain in 24 hours. Trading volume also jumped 42% to $48 million, by CoinMarketCap.

Quant’s recent uptrend has brought his weekly gains to 12%. However, the altcoin remained down 11% in a month, but a closer look at on-chain metrics shows a positive outlook that could push QNT higher.

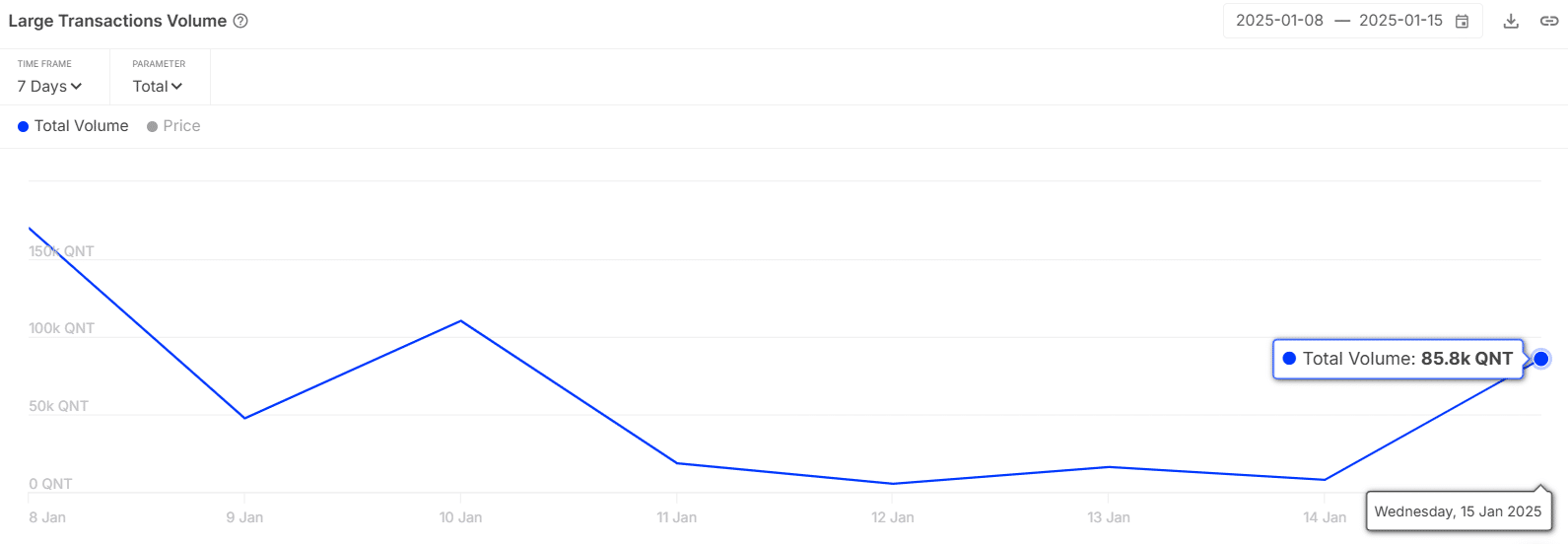

Whale activity increases by 1,000%

Data from IntoTheBlock shows an increase in QNT trading volumes exceeding $100,000. In just 24 hours, these volumes increased from 7,930 to 85,800, an increase of almost 1,000%.

Source: In the block

The increase in volumes suggests that Quant whales are becoming active again, which could precede a spike in volatility, given that these addresses represent 51% of QNT’s ownership.

If these whales buy, it could increase buying pressure and push Quant prices higher. On the other hand, selling activity could derail the uptrend.

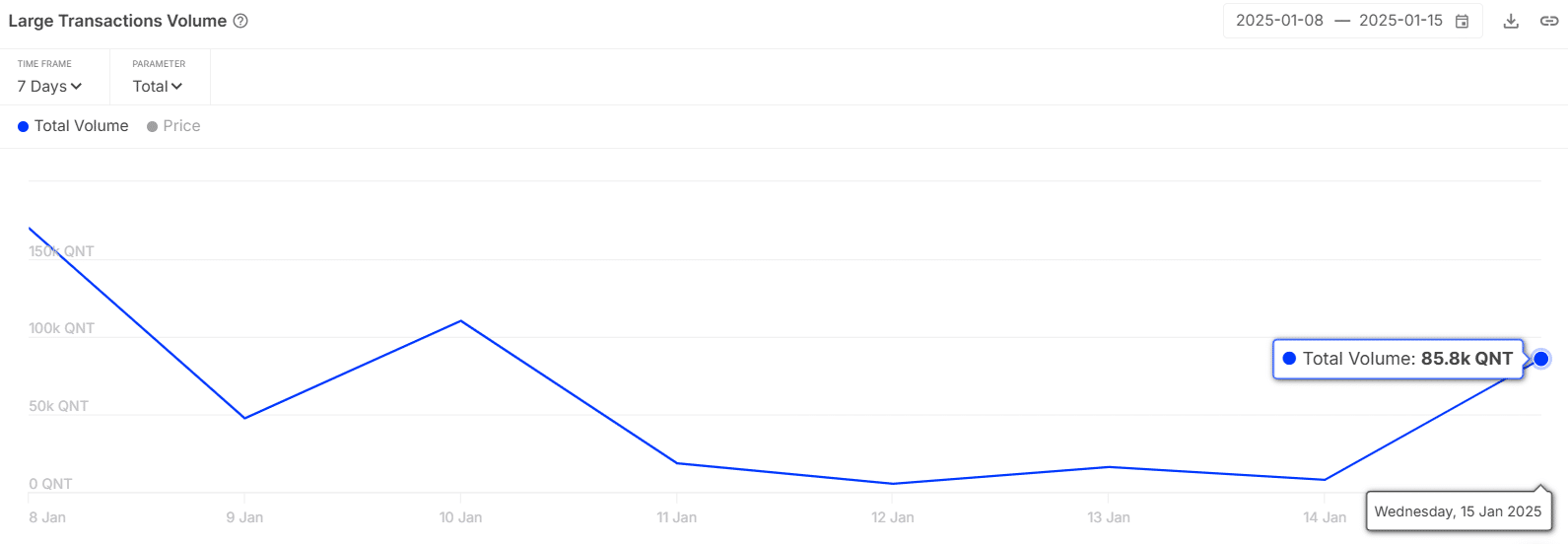

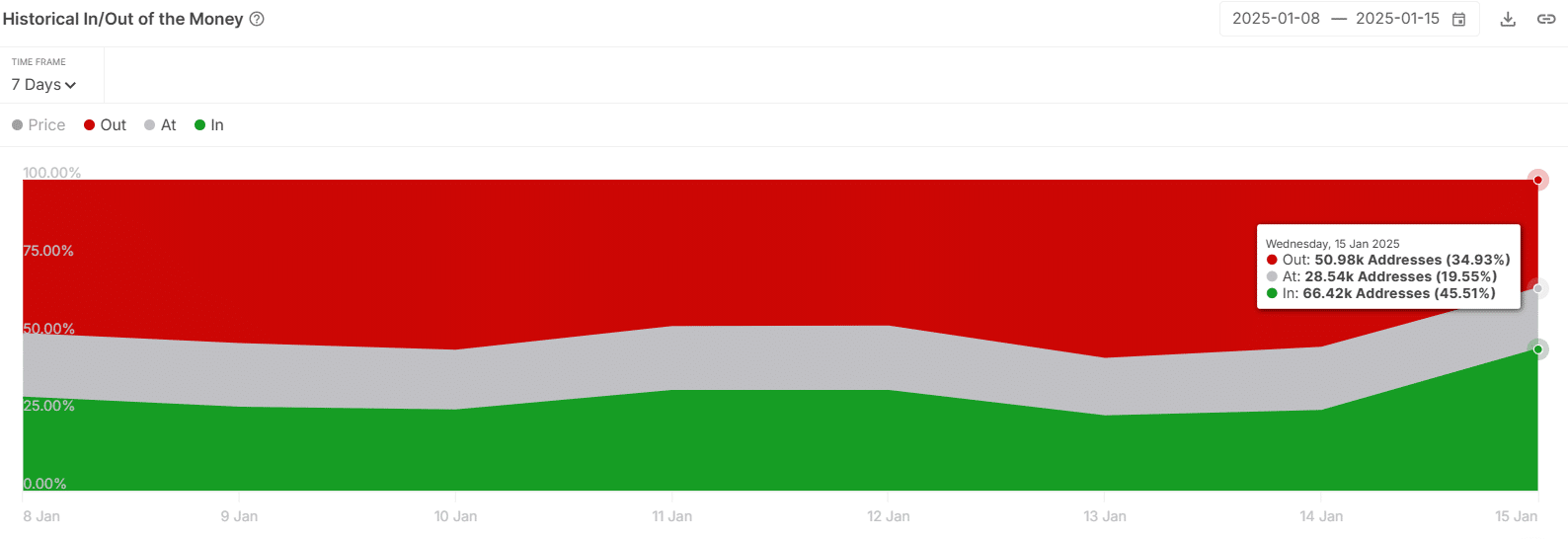

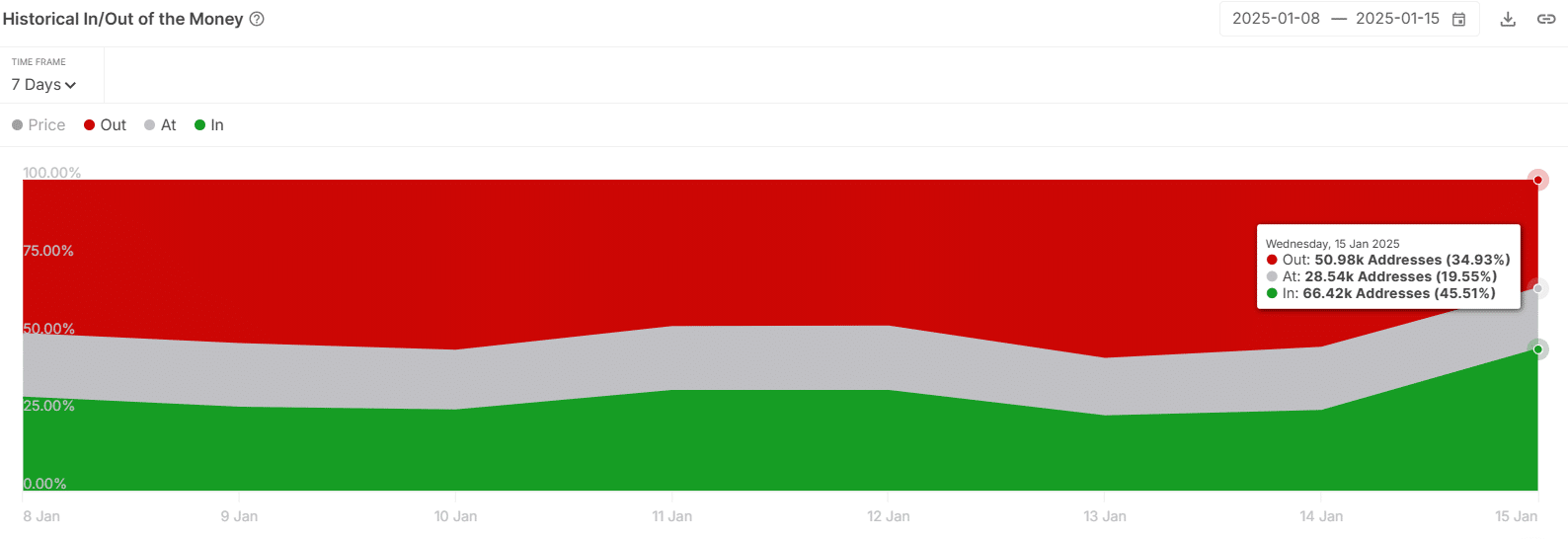

Portfolio profitability fuels positive sentiment

Following recent gains, QNT portfolios’ percentage of profits has increased significantly. In just 24 hours, these wallets jumped 20%, from 37,000 addresses to 66,000 addresses.

Source: In the block

When many portfolios become profitable, this can attract new buyers looking to make a profit. Increasing profitability also indicates positive sentiment around a token.

Recent gains, whale activity, and increasing profits have led to bullish sentiment around Quant. According to Market Prophit, crowd and smart money sentiment is optimistic as traders expect more gains for the altcoin.

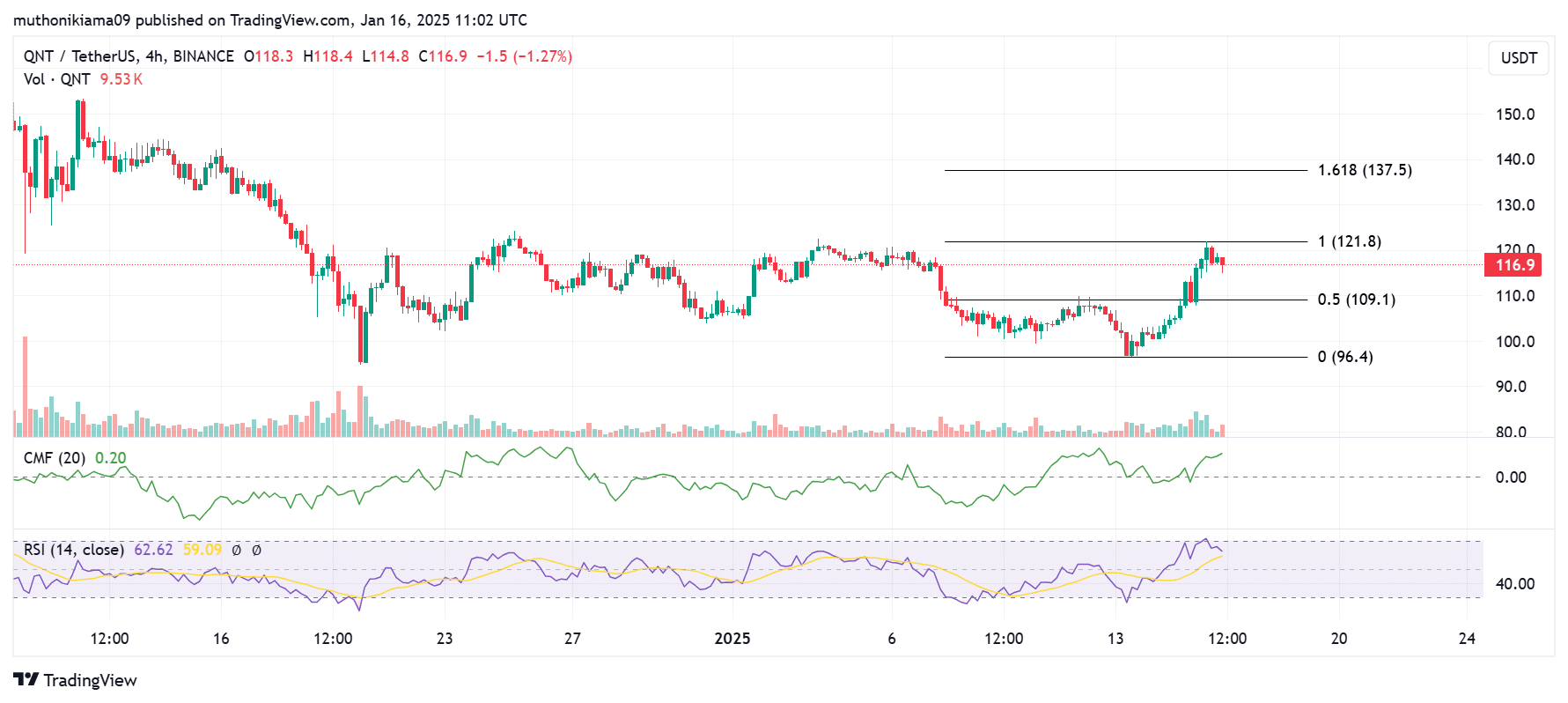

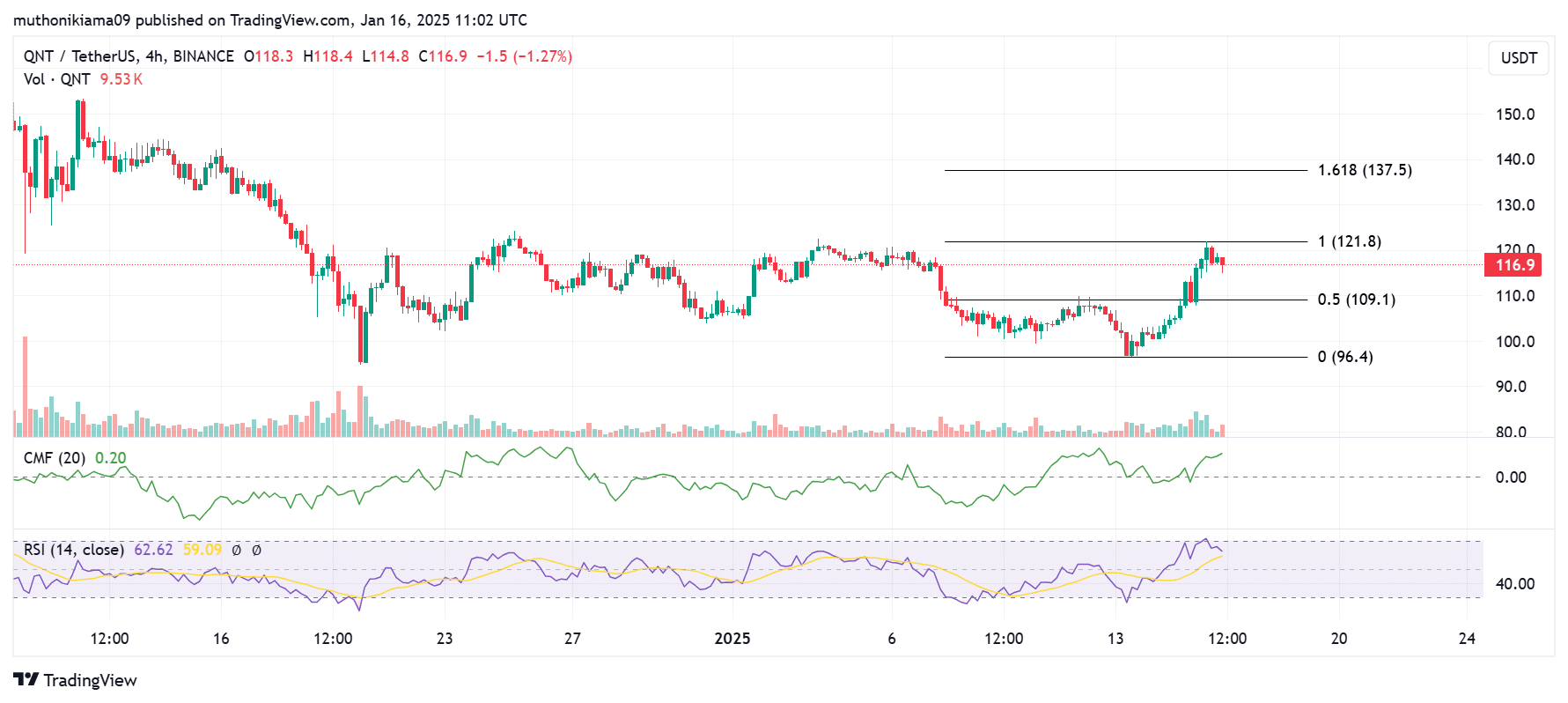

Will QNT climb back to $137?

The four-hour Quant chart showed bullish signs. The Chaikin Money Flow (CMF) indicator increased to 0.19, suggesting strong buying pressure and increased capital inflows into the asset.

The Relative Strength Index (RSI) confirms this bullish thesis, standing at 61. This RSI also indicates that despite the recent price rally, QNT is not yet overbought, leaving room for a continued uptrend.

Source: TradingView

The recent uptrend saw QNT rejected at the 100% Fibonacci level ($121). If it topples this level again, the altcoin could be poised for a 16% rally to the next Fib level of $137.

Quant’s open interest suggests…

Quant’s Open Interest(OI) had increased 12% at press time to $21 million per coin mechanism. This rise indicates that traders are opening new positions in QNT, demonstrating the market’s conviction in the altcoin’s performance in the near term.

Read Quant (QNT) Price Prediction 2025-2026

Despite the increase, Quant’s OI remains down 15% month over month. However, past trends indicate that an increase previously boded well for prices. If this continues, it could lead to solid gains for the altcoin.