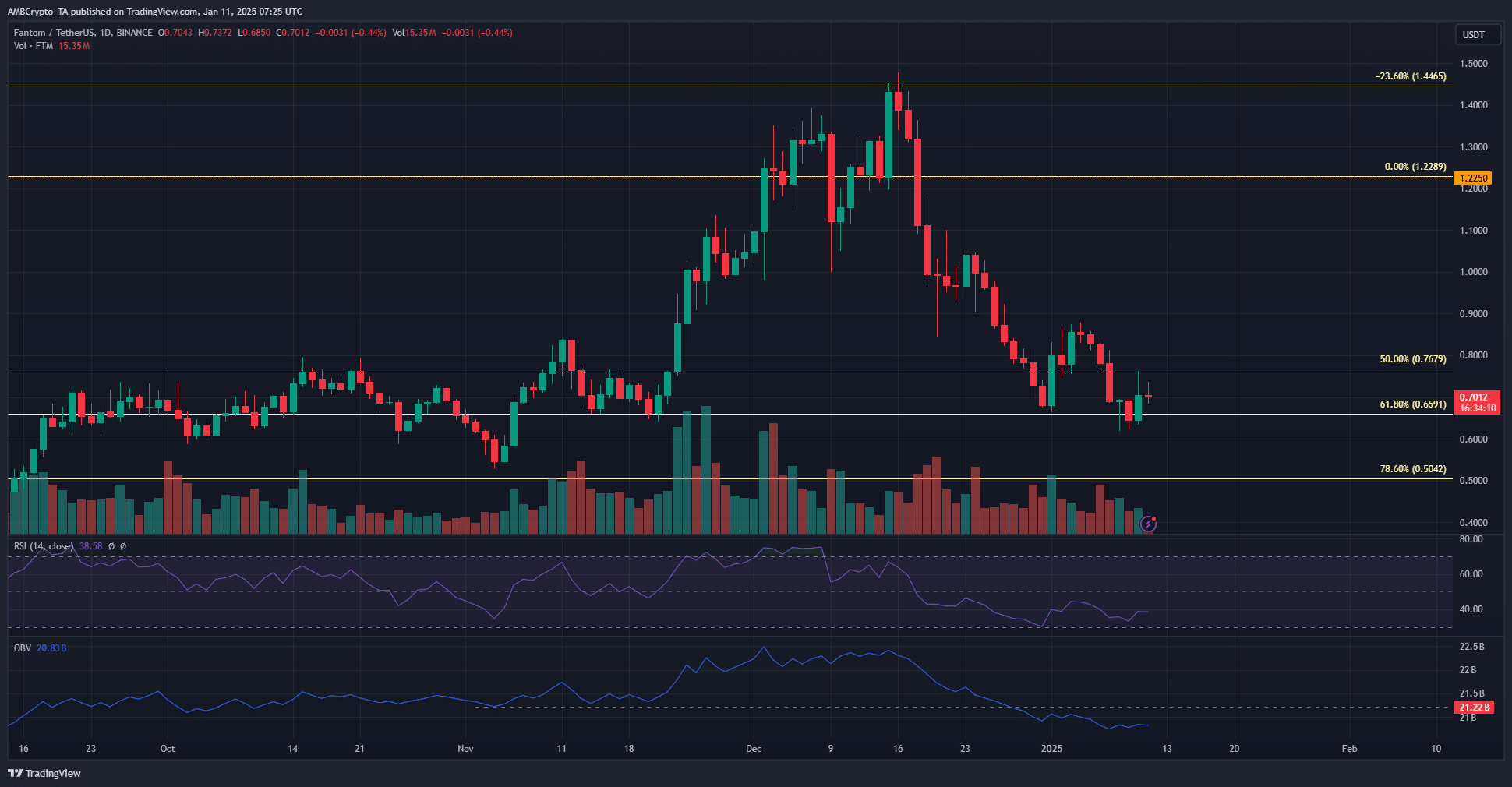

- Fantom appeared to have a strongly bearish structure on the daily chart

- OBV fell below November lows while the next downside price objective was $0.5.

At the time of writing, Fantom (FTM), soon to be renamed Sonic, had a bearish view on the technical analysis front. Its price action has been extremely bearish over the past month. In fact, it noted losses of 52.6% in just 26 days.

FTM will see a 1:1 token swap on Binance for the new Sonic S token. The strategic plan to introduce Sonic as a new layer 1 blockchain, promising 10,000 transactions per second, could strengthen demand for the token in weeks to come.

Ghost prices continue to fall

Source: FTM/USDT on TradingView

The initial rejection of FTM from the $1.44 level occurred on December 16. Two days later, Bitcoin (BTC) lost 5.6% following bearish news from the US FOMC meeting. This accelerated the woes of the FTM bulls.

The 61.8% Fibonacci retracement level at $0.659 offered some respite towards the end of December, but the sellers were too strong. Over the past two weeks, they forced a new low, continuing Fantom’s downtrend.

The RSI has been below 50 for almost a month now, demonstrating strong bearish momentum. Even more worrying, OBV fell below November lows. This reflects the enormous selling pressure in the market.

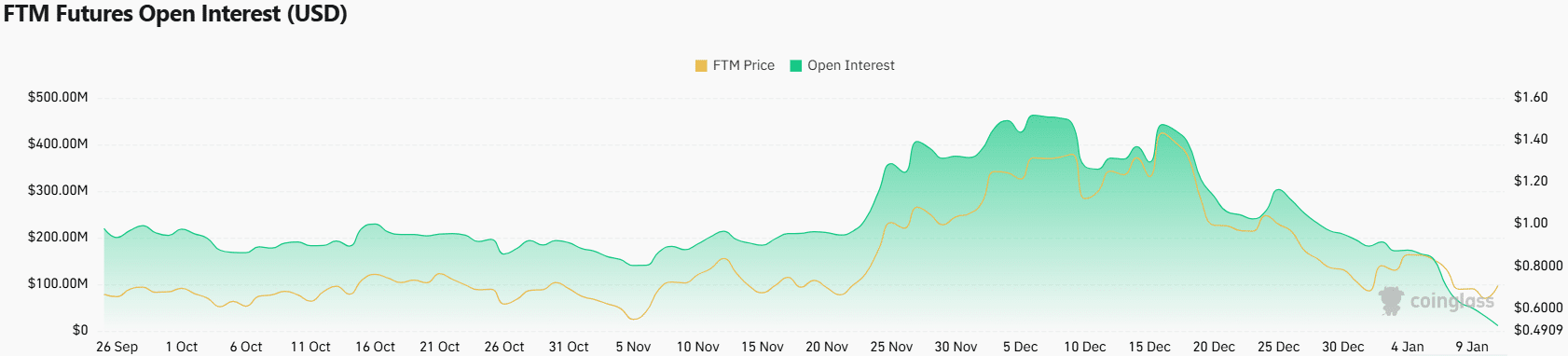

Open interest slides to new lows

Source: Coinglass

It’s not just OBV that has hit new lows. Open Interest has also reached levels not seen in two years. Together, they highlighted strong selling pressure on the token. However, the token swap from FTM to S could explain some of these losses.

Read Fantom (FTM) Price Prediction 2025-26

Due to the swap, traders could choose to exit their positions. Exchanges also announced plans to delist FTM and open Sonic trading pairs. This, combined with the overall bearish market sentiment, could explain the decline in OI and demand.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.