Four digital asset companies have become the first to obtain coveted crypto asset marketplace (MiCA) licenses in the Netherlands, highlighting the country’s rapid adoption of the European Union’s new regulatory framework. The Dutch Financial Markets Authority (AFM) has granted licenses to MoonPay, BitStaete, ZBD and Hidden Road, granting each company the right to operate in all 27 EU member states.

The new development complies with EU requirements that crypto companies be licensed as Crypto Asset Service Providers (CASP) to serve customers across the block. While member states were required to adopt MiCA by December 30, not all jurisdictions have progressed at the same pace. Observers say the Netherlands’ rapid implementation underscores its leading position in European crypto regulation.

Tether under surveillance

Tether’s USDT stablecoin is underway scrutiny in the European Union, as the Markets in Crypto-Assets (MiCA) Regulation comes into full force on December 30, 2024. MiCA introduces strict requirements for stablecoin issuers, including obtaining e-money licenses , maintaining reserves in recognized banks and respecting detailed rules. disclosure obligations.

In anticipation of these regulations, Coinbase proactively removed USDT for its EU customers, citing compliance concerns. Other major exchanges like Binance and Crypto.com continue to offer USDT, taking a wait-and-see approach while awaiting explicit guidance from European regulators.

The potential delisting of USDT on European platforms raises concerns about market liquidity and stability. USDT is the largest stablecoin by market capitalization and plays a crucial role in facilitating cross-border transactions and providing liquidity on digital asset exchanges. Its removal could lead traders to seek alternatives such as Circle’s USDC, which is already MiCA compliant, although this transition may introduce challenges such as increased trading fees and reduced liquidity.

Tether has expressed concerns over MiCA’s reserve management rules, suggesting they could disrupt its business model and introduce risks to both local banking systems and stablecoins. The company has not yet obtained the official license required by MiCA, unlike competitors like Circle, which has been MiCA compliant since mid-2024.

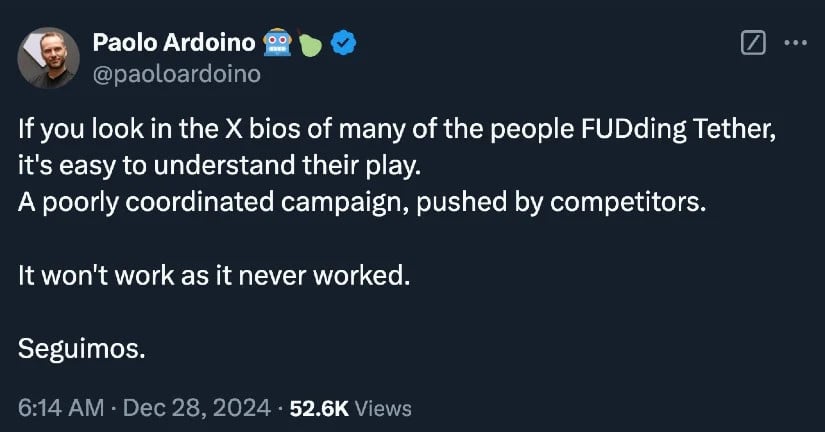

Tether CEO Paolo Ardoino defiant in response, Source:

A pivotal moment

“MiCA represents a pivotal moment for the European digital assets industryand we are proud to have worked together with the Dutch AFM to be among the first to adopt this new regulatory framework,” said the CEO and co-founder of MoonPay, one of the newly licensed companies. Backed by high-profile investors, MoonPay has been valued at over $3 billion, reflecting broader market optimism for regulated crypto services in Europe.

The licenses come as the EU crypto landscape undergoes significant changes. MiCA, introduced in 2020 and adopted in 2023, establishes a uniform regulation for digital assets. By requiring PSAPs to hold a license recognized across the bloc, the legislation aims to replace the patchwork of national regulations that previously governed the sector. Many crypto companies operating in the EU have followed various regulations and applied for multiple operating authorizations in different countries.

Beyond the Netherlands, other jurisdictions are also taking steps to align with new European standards. In Malta, fan engagement platform Socios.com announced that it has obtained a Class 3 license under the Virtual Financial Assets Act (VFAA) from the Malta Financial Services Authority. This authorization allows the company to operate as a regulated virtual financial asset service provider under Maltese law, which officials say is compatible with MiCA rules.

The UK, which closely follows EU regulatory standards despite no longer being a member of the bloc, recently added trading firm GSR Markets to its crypto registry. The move demonstrates the UK’s intention to keep pace with Europe’s increased focus on anti-money laundering and investor protection requirements in the digital assets sector.

The overarching goal of MiCA is to improve legal clarity, protect investors, and curb market manipulation in crypto. The framework outlines a phased implementation, starting with regulations on stablecoins, called asset-referenced tokens (ART) and electronic money tokens (EMT). The next step involves the licensing of PSAPs, with a transition period allowing existing providers to continue operations while seeking full authorization.

Under MiCA, companies that offer management, custody or exchange services for digital crypto-assets must comply with stricter transparency and security requirements. Companies must meet capital thresholds, publish clear white papers and implement strong anti-money laundering measures. Although non-fungible tokens (NFTs) and decentralized applications (dApps) generally fall outside the scope of MiCA, any token resembling a financial instrument could still be subject to legal scrutiny.