Fantom’s native token, FTM, has surged over 12% in the past day, thanks to a strategic update from Sonic Labs.

This surge highlighted Fantom (FTM) as the best performing cryptocurrency among the top 100 digital assets by market capitalization and pushed its price from $0.43 to $0.48.

This is the highest level the token has reached since August 27, as its market cap jumped to $1.36 billion, positioning it as the 59th largest digital asset in the world, according to data from CoinGecko.

One of the main catalysts for FTM’s recent rally was a September 9 blog post by Sonic Labs CTO Andre Cronje announcing Sonic blockchain’s plans to introduce credit scores for digital wallets. The initiative aims to tap into the global unsecured lending market, which is valued at over $11 trillion.

Another potential factor in FTM’s price surge is Sonic’s new testnet, which was able to finalize a transaction in just 720 milliseconds, marking a significant milestone. In the context of blockchain, finality means that once a transaction is confirmed and recorded on the blockchain, it cannot be changed or reversed.

The renewed optimism led to a doubling of trading volume in 24 hours, further fueling FTM’s bullish momentum.

According to data from Coinglass, FTM’s daily open interest has jumped 33% to $162.46 million at the time of writing. This, combined with an increase in trading volume, suggests an increase in investor activity, which could fuel FTM’s ongoing rally.

Looking at FTM price action, the token is approaching $0.4825 on the daily chart, moving closer to the upper Bollinger Band. The Relative Strength Index at 60 indicates a bullish trend with room for further growth before possibly reaching the overbought zone.

After a steady rise above the mid-band at $0.4381, the recent spike in trading volume suggests strong market interest, suggesting upside potential.

For traders and investors monitoring FTM, the immediate resistance to watch is the upper Bollinger Band at $0.5296. A sustained break above this level could open the way for further gains, potentially targeting a higher resistance level at $0.60. If FTM continues on this trajectory, it has the potential to double its current value and move closer to the $1 mark.

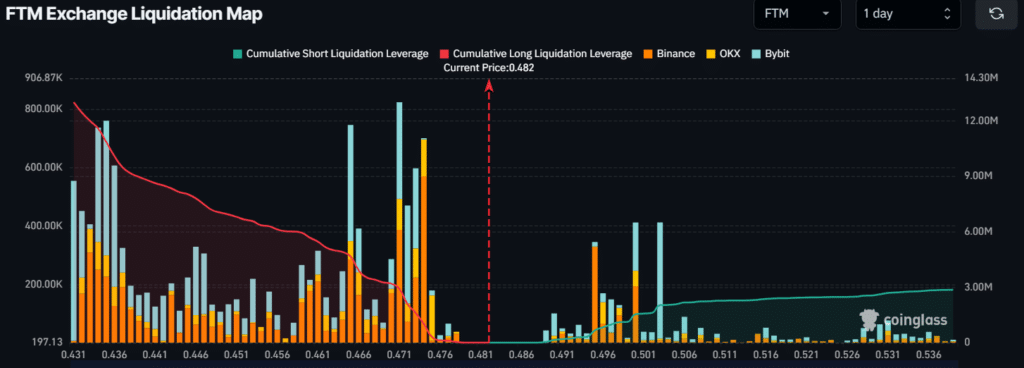

Major Liquidation Levels

Currently, the critical liquidation thresholds for FTM sit at around $0.471 on the lower side and $0.503 on the higher side, with a high level of leverage observed among intraday traders at these prices, according to Coinglass.

If market momentum changes and FTM price drops to $0.471, it could trigger the liquidation of nearly $2.9 million in long positions. Conversely, if market sentiment turns positive and the price rises to $0.503, approximately $2.02 million in short positions could be liquidated.

At press time, data indicated that bears were in control, with the potential to trigger liquidations of long positions at lower levels.