(Bloomberg) — Creditors of crypto exchange FTX are expected to receive more than $12 billion in the coming months under a court-approved payment plan, raising the possibility that part of the money can be reinvested in digital assets.

Most read on Bloomberg

The platform that went bankrupt in June had $12.6 billion to return to its customers, a figure that could reach $16.5 billion once all of its assets are found and sold. The initial distributions of around $1.1 billion are relatively small but should support Bitcoin, Alex Thorn, research director at Galaxy Digital Holdings, wrote in a note.

Crypto traders are looking for sources of volatility to bring Bitcoin and other tokens out of a prolonged period of torpor. A gauge of the top 100 coins is down 3% this month, even though October is supposed to be a seasonally strong period for digital assets, suggesting a year-long rally has run out of steam.

The planned FTX payments “effectively give liquidity to known crypto traders,” said Benjamin Celermajer, co-chief investment officer at Magnet Capital. “It is very likely that we will see some of this flow return to crypto, providing a potential price catalyst for liquidity-starved markets.”

Refunds will not take place immediately. FTX must first create a trust and hire a company to oversee the money distribution process.

Galaxy said transfers to smaller creditors could begin as early as December, while larger ones will be processed in the first half of next year. He said the remaining claims could take up to three years to resolve.

Research firm K33 in a note estimated “latent demand for FTX reallocations” at $2.4 billion, but warned of a “soft” potential impact on the crypto market as redemptions are due in waves over the next year.

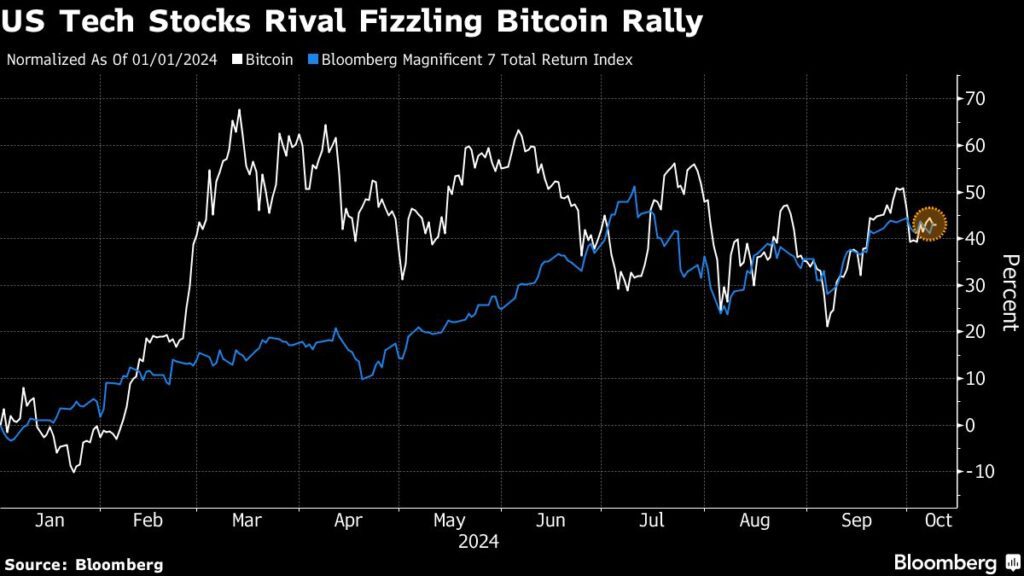

Demand for U.S. Bitcoin exchange-traded funds helped push the token to an all-time high of nearly $74,000 in March. The jump subsequently collapsed as the inflows cooled. The largest cryptocurrency is up 43% this year, about as much as an index of mega-cap technology stocks Magnificent Seven in the United States.

Bitcoin was little changed at $62,485 as of 7:22 a.m. Wednesday in London. Most other major digital assets also saw relatively limited developments.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP