Users were confused by the announcement that FTX customers would receive between 10% and 25% of the value of crypto assets deposited. Why did this happen?

Sunil Kavuri, one of the creditors, recently said that several other changes were also planned in the reorganization plan. One of the points, which concerns the amount of compensation paid to victims, has raised questions in the community.

What do we know about the compensation plan

Crypto assets deposited on the platform will be valued at the rate upon filing for bankruptcy. The actual compensation will therefore be between 10% and 25% of the market value of their cryptocurrency.

FTX shareholders will also receive an additional 18% of the funds confiscated by the US Department of Justice, but no more than $230 million. It became an additional clause on increasing the share of preferred shareholders.

However, many have expressed dissatisfaction with the payment terms, calling them a scam. One user suggested that this payment schedule could be because most of FTX’s shareholders are either Sullivan & Cromwell (representing FTX’s debtors) or clients of Quinn Emanuel, hired by FTX’s new management, acting as a conflict advisor. Both law firms are working to recover assets from clients of the bankrupt exchange.

Community speculates on timing of compensation payments

Work is underway to return funds to account holders affected by the FTX collapse. Amid speculation about the timing of payments, information has emerged on the network that FTX crypto holders could start receiving payments as early as September 30.

However, this was quickly denied: according to the latest data from the Chapter 11 bankruptcy case, the court is still considering a compensation plan.

Court filings show the next hearing to approve the restructuring plan is scheduled for Oct. 7. If the court approves the plan, payments for claims under $50,000 could begin in late 2024,

while others will receive compensation during the first half of 2025.

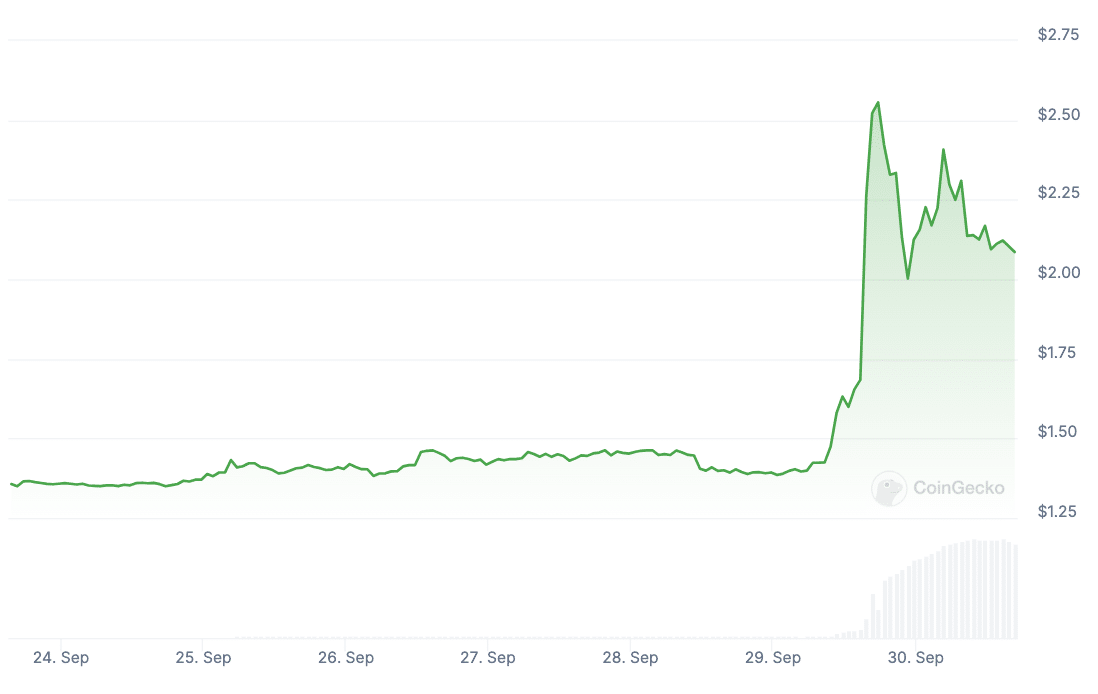

The TTF responds with growth

Amid the latest news, FTX has delighted investors. Hoping that the infamous crypto exchange would soon start returning funds, investors became more optimistic. Such an event could lead to an influx of $16 billion into the market.

At its peak on September 29, the FTX (FTT) token had gained 113% in one day. By the end of the day, the price had corrected and finally fell to $2.11 at the time of writing.

Where did the customer funds go?

FTX, once worth $32 billion, used customer funds for risky investments through its closely associated hedge fund, Alameda Research. The investigation revealed that the company used its clients’ funds to cover losses in other related activities and finance risky investment transactions.

FTX’s colossal budget deficit was discovered after customers demanded their money back. After the bankruptcy of FTX, a restructuring procedure was initiated and the processes of returning funds to clients began. However, at that time, exactly why the funds disappeared and where they were sent was still under investigation. In total, the stock market owes about $9 billion.

The victims wait and the culprits serve their sentences

The FTX bankruptcy shook the crypto market and affected the prices of many coins. It has also raised concerns among users and regulators regarding the security and liability of crypto exchanges. In addition to creating a repayment plan, the top executives of the stock market are being punished one after another.

Bankman-Fried was charged with fraud, money laundering and other financial crimes related to the handling of FTX and customer payments. The charges allege he used client funds to support his other businesses, including the trading company Alameda Research. In March, he was sentenced to 25 years in prison.

Caroline Ellison, former CEO of Alameda Research, was sentenced to two years in prison and lost $11 billion for fraud and money laundering. His active cooperation in the Bankman-Fried investigation softened the verdict. The judge emphasized that the collapse of FTX is one of the most significant financial crimes and that Ellison’s cooperation does not absolve him of responsibility. She admitted her guilt and apologized to the victims.

Following the verdict of the former Alameda CEO, other defendants are now awaiting the court’s decision: FTX co-founder and CTO Gary Wang, as well as head of engineering Nishad Singh.