Key takeaways

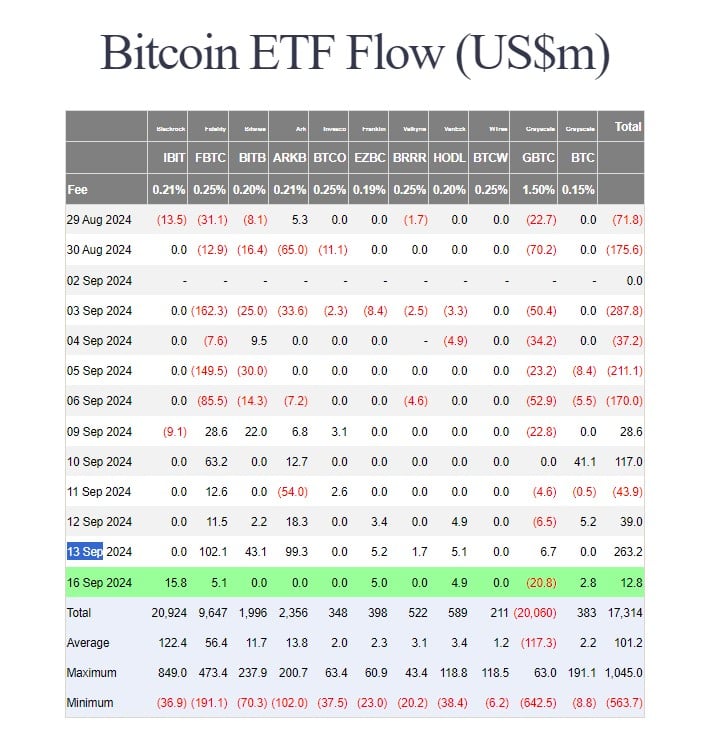

- Total net outflows from GBTC have exceeded $20 billion since its conversion to an ETF.

- BlackRock’s iShares Bitcoin Trust saw a resurgence in inflows, raising $15.8 million.

Share this article

Grayscale Investments’ Bitcoin Trust (GBTC) continues to see investor redemptions, with another $20.8 million withdrawn Monday, according to data tracked by Farside Investors. That brings the total net outflows since its conversion into an exchange-traded fund (ETF) in January to more than $20 billion.

The pace of capital outflows has slowed compared to the beginning of the year. The data shows that the first $10 billion was withdrawn within two months of being converted into ETFs, while the next $10 billion took more than six months.

However, GBTC remains under pressure as investors continue to exit their positions. The fund’s Bitcoin holdings have shrunk to about 222,170, valued at about $12.8 billion, the data showed.

Despite GBTC’s losses, the U.S. Bitcoin ETF spot market remains broadly positive. On Monday, these ETFs collectively attracted $12.8 million in net capital.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a resurgence in flows after a period of stagnation, taking in $15.8 million. Other prominent Bitcoin ETFs managed by Fidelity, Franklin Templeton and VanEck reported flows of around $5 million each.

Grayscale’s low-cost Bitcoin ETF also managed to attract some inflows, ending the day with $2.8 million. The rest reported zero flows.

Share this article