- Analysts believe that BTC could be on the verge of a major rally, citing historical on-chain indicators.

- However, profit-taking continues to exert downward pressure, limiting immediate gains.

Bitcoin (BTC) performed impressively, accounting for a monthly gain of 46.59% and bringing its market capitalization to $1.94 trillion.

Despite this, momentum has slowed, with no clear market direction yet emerging. Over the past 24 hours, the BTC price has increased slightly by 0.80%, keeping it in a consolidation phase.

AMBCrypto’s analysis suggests that even though BTC is range-bound, history shows that it tends to rise once market sentiment improves.

BTC still has room to recover

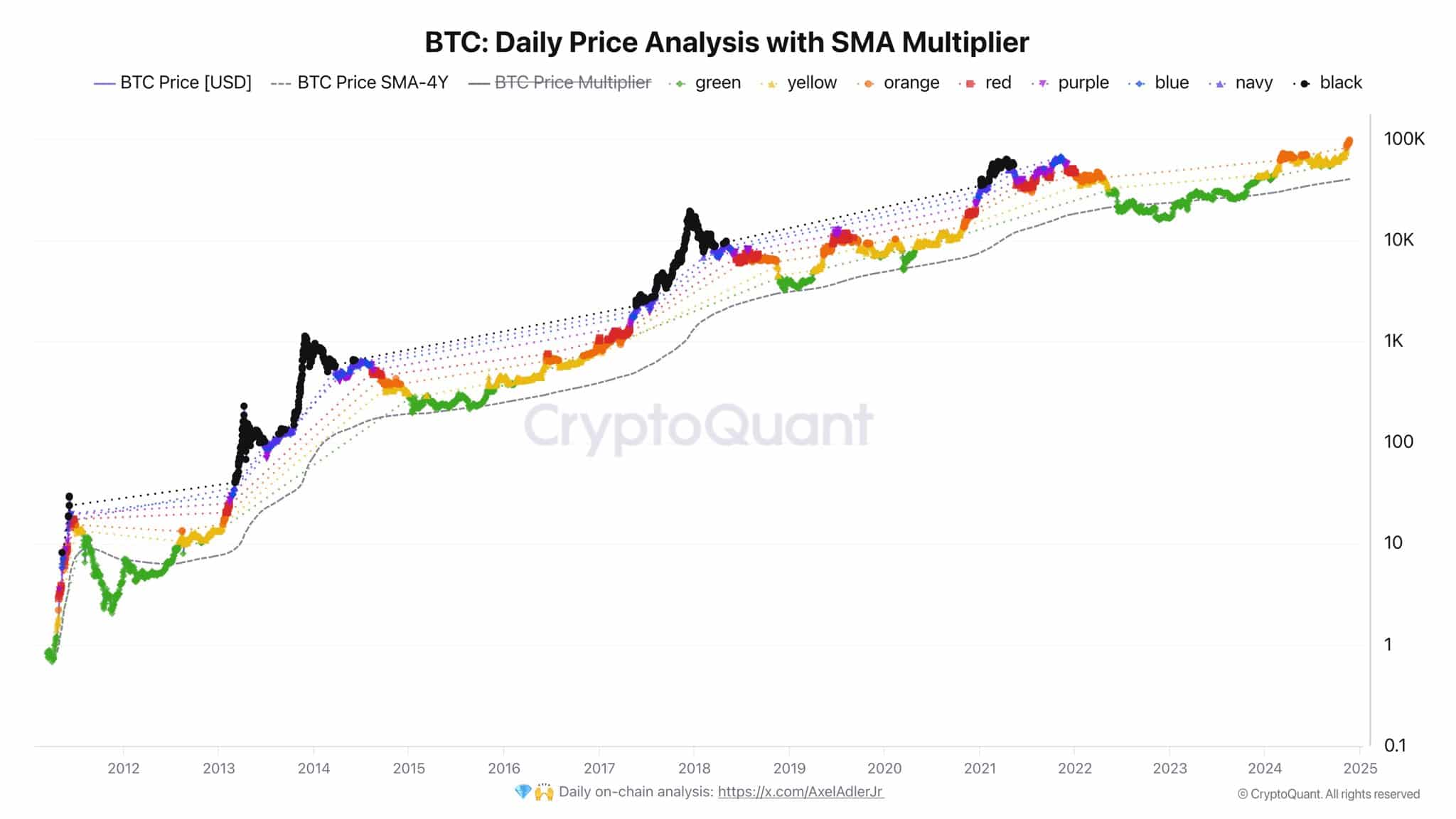

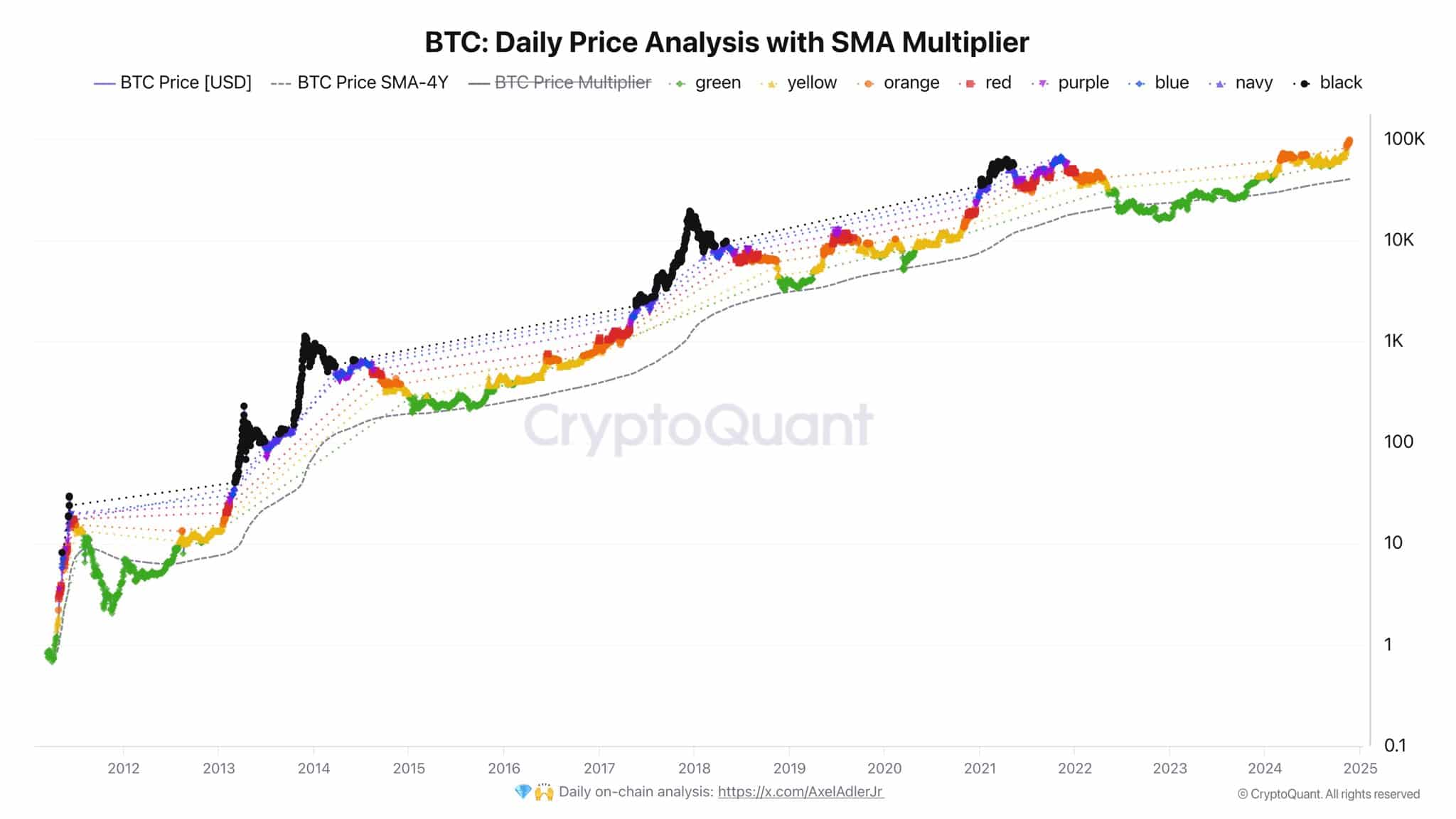

According to a chart shared by Alex Adler Jr., Bitcoin has not yet reached its cyclical peak.

The chart examines BTC’s performance using the simple moving average (SMA) multiplier, a tool designed to track price trends throughout market cycles.

The analysis uses color-coded areas – ranging from green (start of cycle) to black (top of cycle) – to represent Bitcoin market sentiment during different phases, from accumulation to peak speculation.

In his message, Adler said:

“The orange dot has arrived. Red, purple, blue, navy and black are coming.

Source:

This means that BTC is still far from the peak of its cycle, with five more phases to come. Historically, these phases follow a predictable pattern, with the final “black” phase marking the start of a decline.

If this trend continues, BTC could surpass the much-anticipated $100,000 target that has caught the market’s attention.

AMBCrypto explored additional insights into why Bitcoin, despite these promising moves, has yet to see its rally fully materialize.

Profit-taking activities slow BTC rally

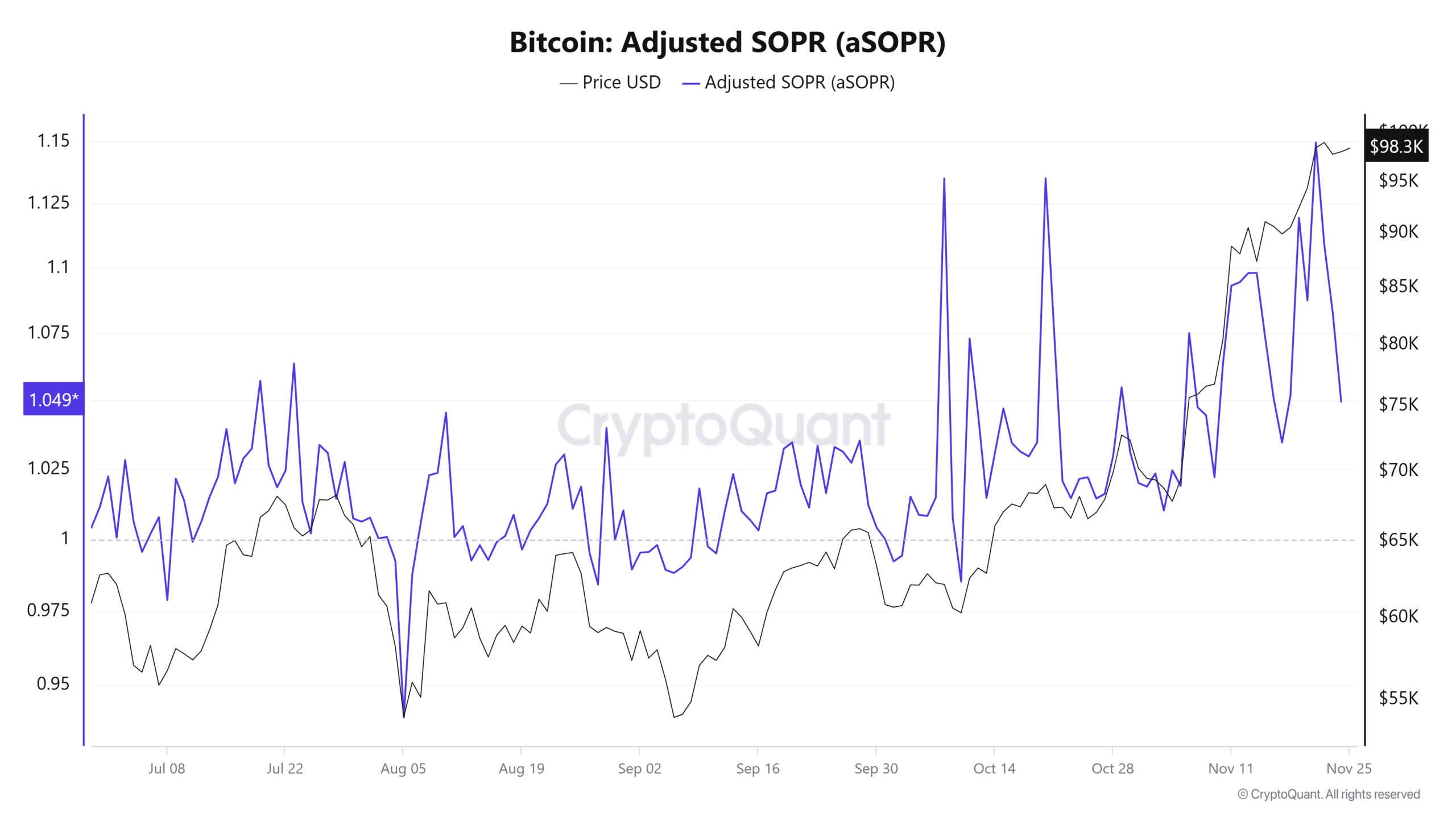

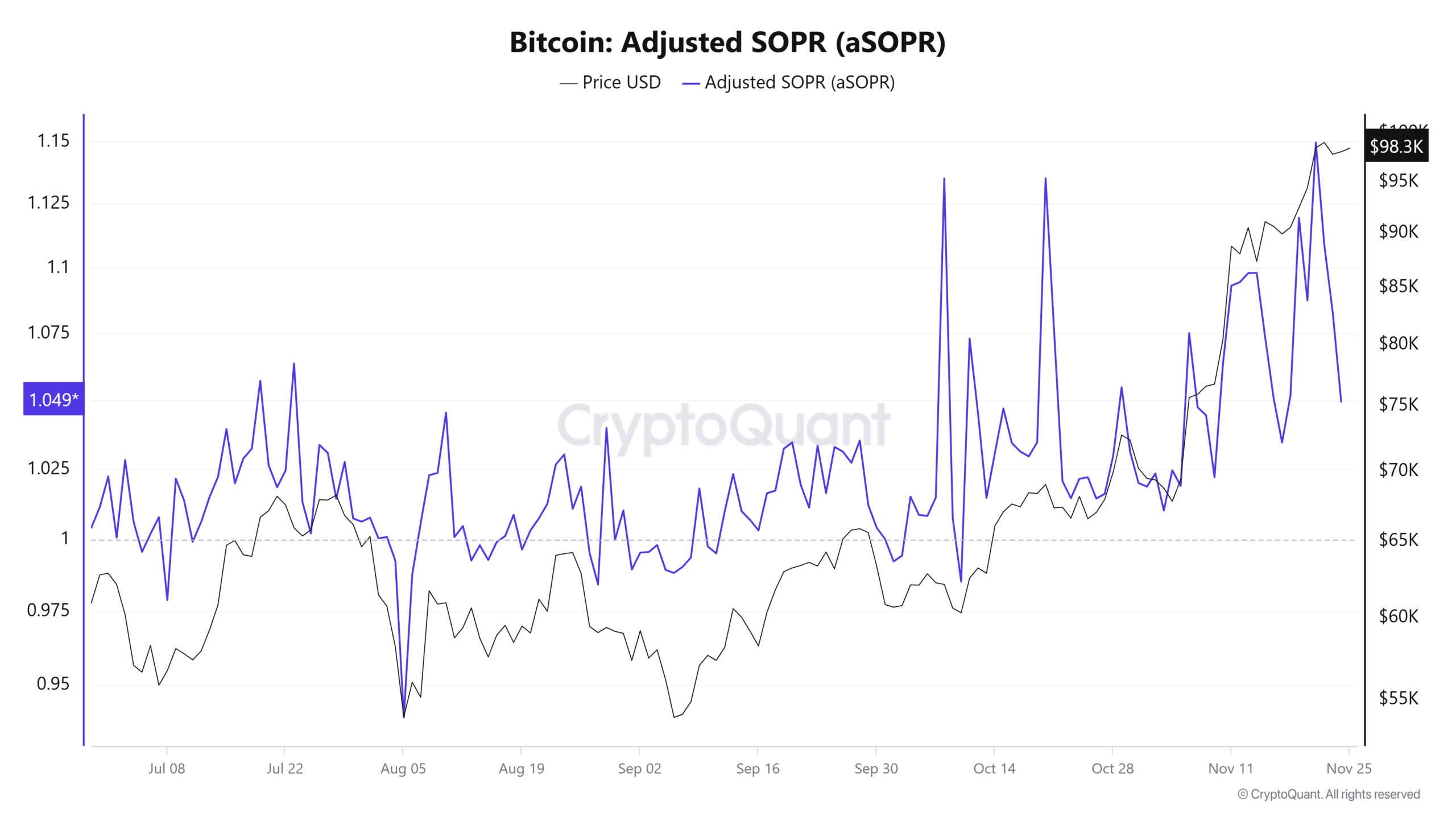

The latest insights from CryptoQuant reveal that increased profit-taking activities are weighing on Bitcoin (BTC) price momentum, preventing it from making any significant upward moves.

The adjusted output spent profit ratio (aSOPR), which measures whether investors are selling their BTC holdings at a profit or loss, stood at 1.049 at press time.

A reading above 1 indicates that investors were selling for profit, which added pressure to the BTC price, slowing its rise.

Source: Coinglass

Additionally, the Take Buy/Sell ratio, an indicator that shows whether buyers or sellers dominate the market, was 0.963 at the time of writing.

This suggests that selling volume is outpacing buying volume, giving bears the upper hand and further delaying BTC’s upward movement.

Investors prevent BTC from falling

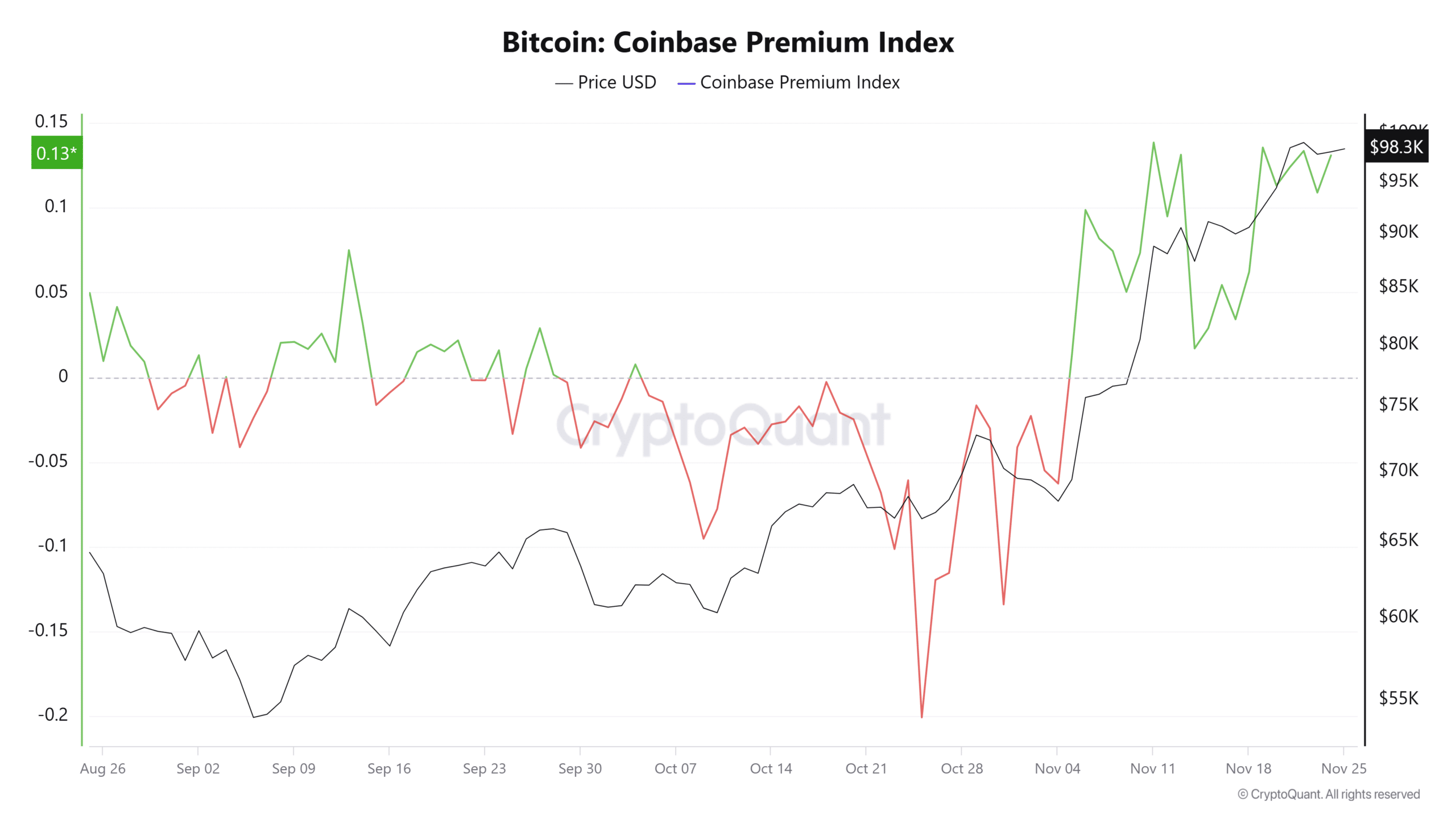

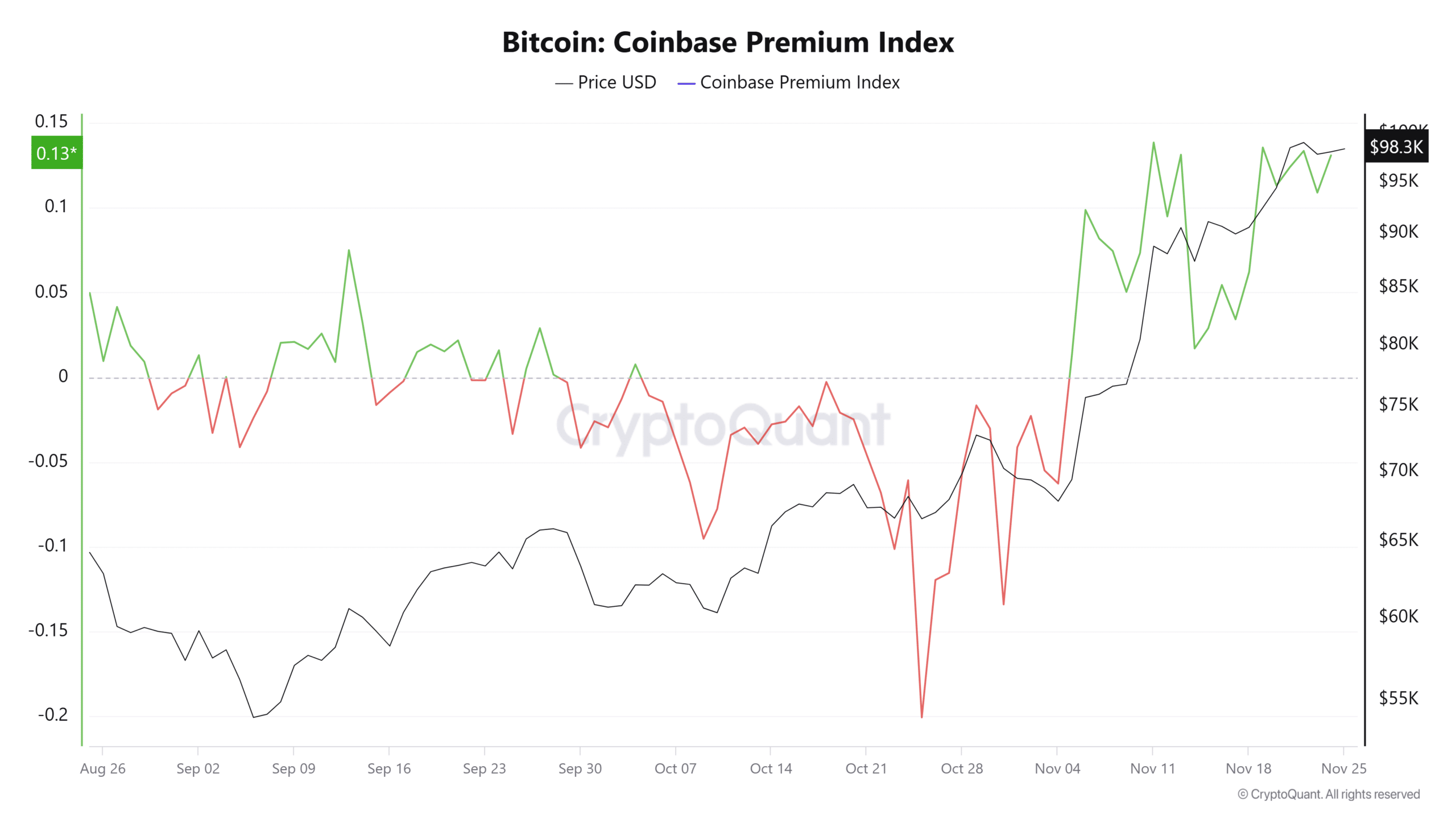

CryptoQuant reports that US investors have been actively buying Bitcoin (BTC) in recent days.

The Coinbase Premium Index, which measures the price difference between BTC on Coinbase and Binance, increased, sitting at 0.1308. This is close to its November high of 0.1384.

Source: Coinglass

Read Bitcoin (BTC) Price Forecast 2024-2025

A positive reading of this index – above zero – indicates stronger buying activity from US investors compared to other markets.

This increased demand helped stabilize the price of BTC, preventing further declines.