- Bitcoin price faced a decline after surpassing $66,000, increasing market uncertainty.

- Technical indicators suggest bullish sentiment, but a potential trend reversal looms with increasing volatility.

After surpassing the $66,000 mark, generating excitement among the crypto community and fueling hopes of an impending bull run, Bitcoin (BTC) found itself under a bearish cloud.

According to the latest data from CoinMarketCap, BTC was trading at $64,519, following a 1.65% decline over the past 24 hours.

This sudden slowdown has dampened the optimism of many investors, leaving the market uncertain about the future of the leading cryptocurrency.

Bitcoin turns bearish

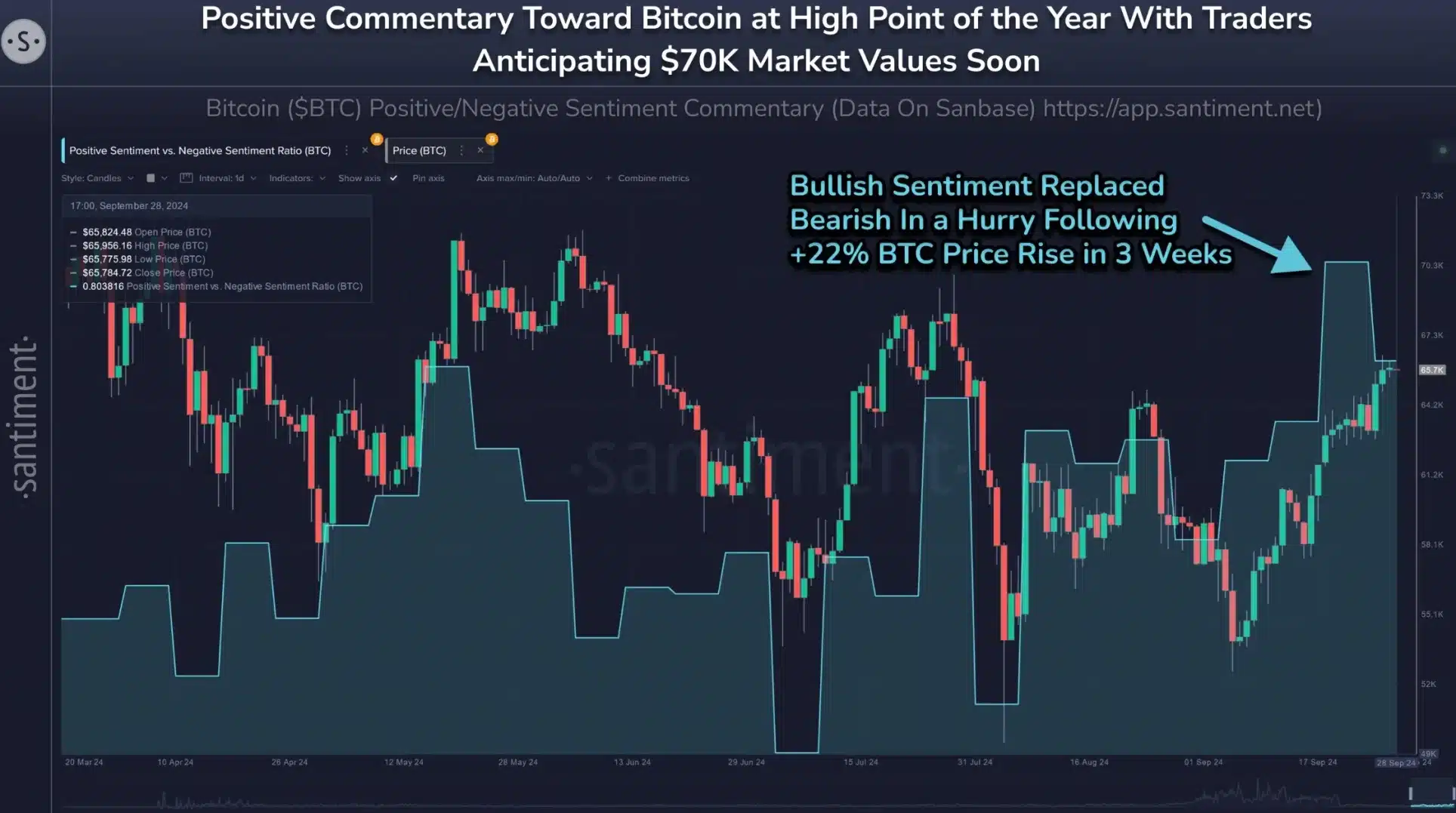

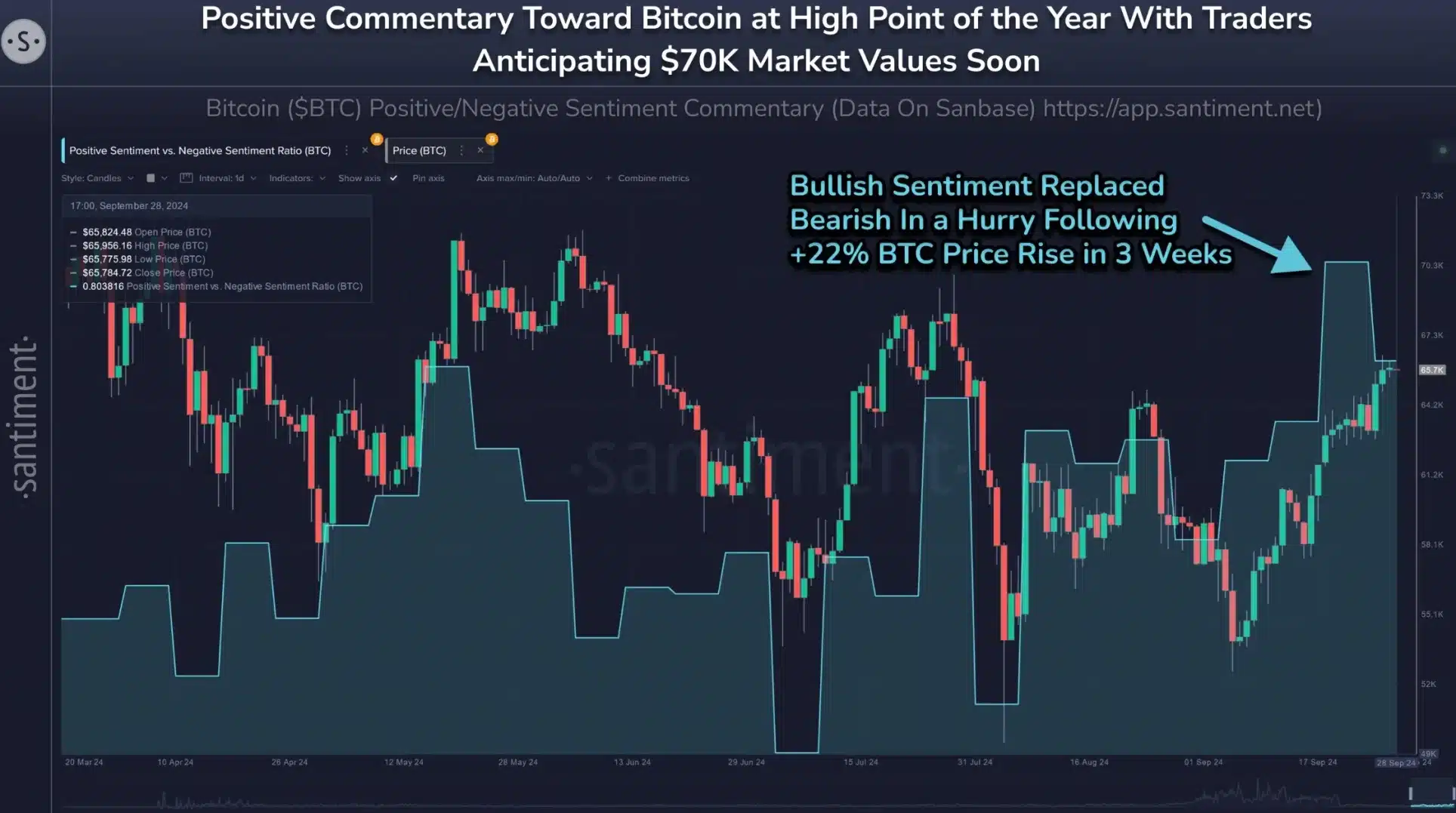

Noticing the bearish divergence, on-chain analytics platform Santiment shared its insights on X (formerly Twitter) on September 29 and noted:

“If you’re waiting for Bitcoin’s new all-time high, you might have to wait for the crowd to slow down their own expectations.”

Source: Santiment/X

In his latest article, Santiment highlighted that there are now approximately “1.8 bullish messages toward BTC for every bearish message,” reflecting continued optimism despite recent market downturns.

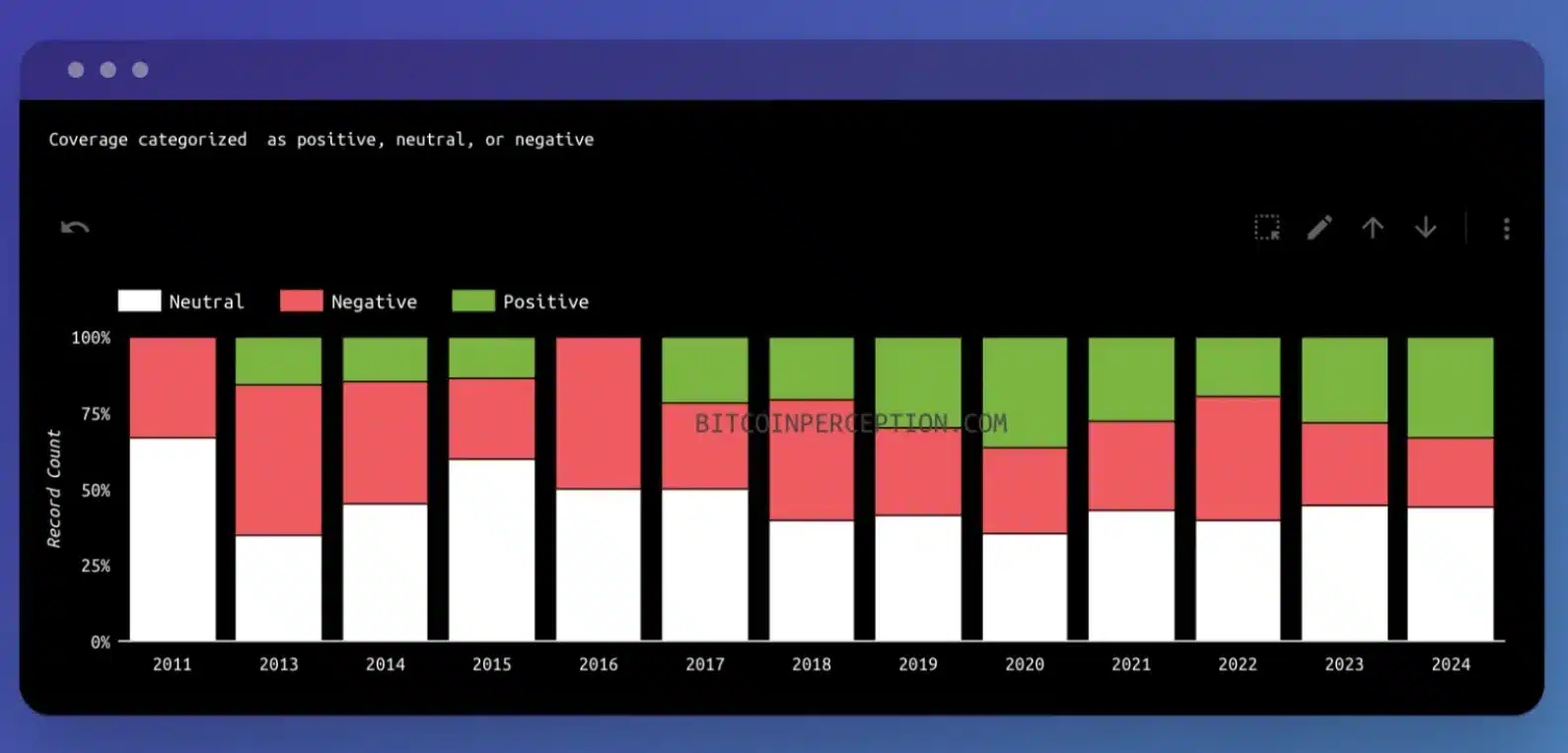

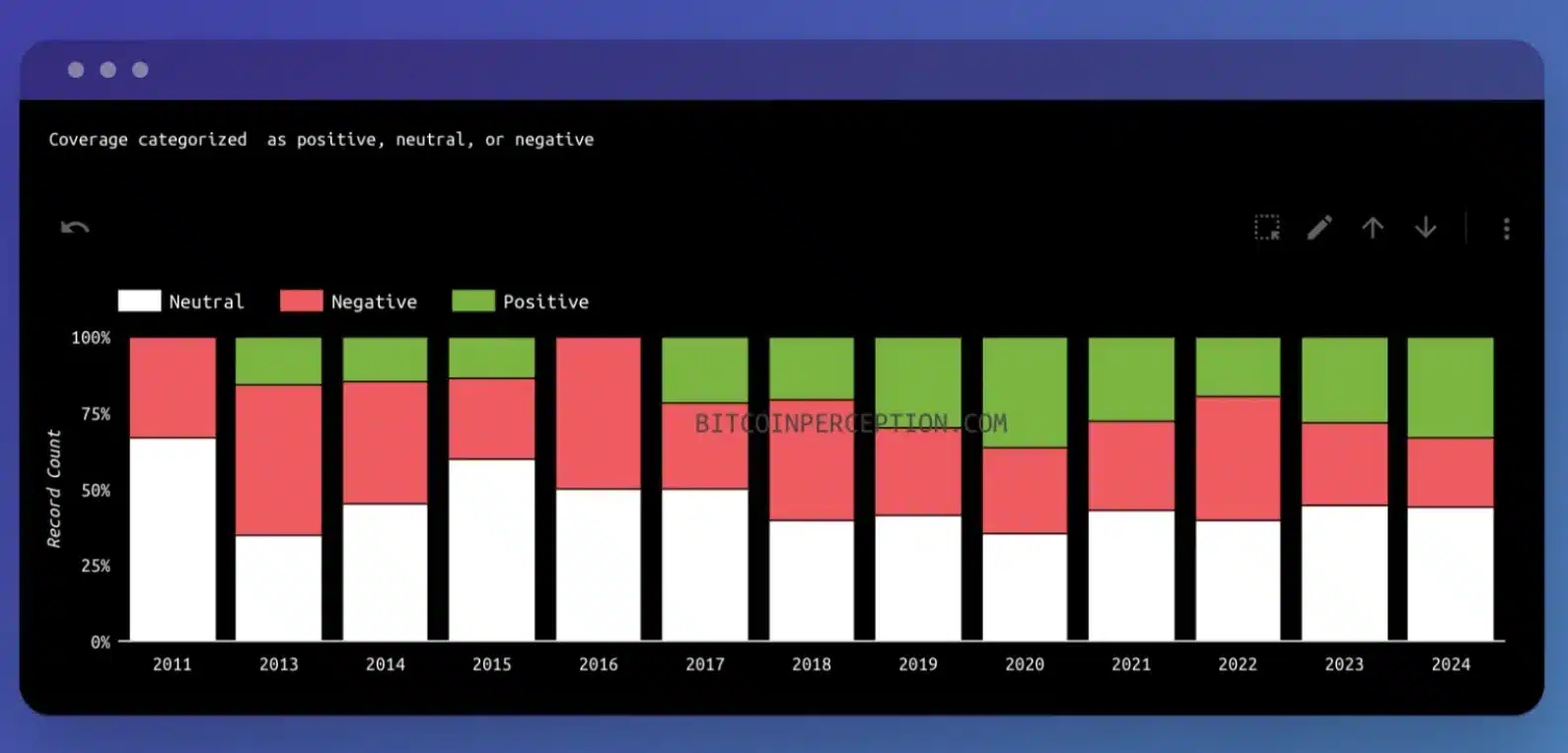

This was further confirmed by Jameson Lopp, Head of Security at Casa, who said:

“Bitcoin sentiment is trending positively in mainstream media as FUD does not stand the test of time.”

Source: Jameson Lopp/X

However, drawing parallels with past performances, Santiment added:

“Historically, markets always move in the opposite direction to crowd expectations. »

Do technical indicators paint a different picture?

While talk suggests that Bitcoin may take time to reach a new all-time high, technical indicators paint a more nuanced picture.

For example, the Relative Strength Index (RSI) is currently above the neutral zone at 59, reflecting bullish sentiment.

However, it is worth noting that the RSI has been in a downward trend since September 29, signaling a potential trend reversal.

This cautious outlook is also reinforced by the Bollinger bands, which have widened, indicating increased volatility and possible changes in market sentiment.

Source: Commercial View

However, the community still seems positive, as noted by user X – Crypto Rover who said:

“The #Bitcoin bull market starts here!

Source: Crypto Rover/X