Main to remember

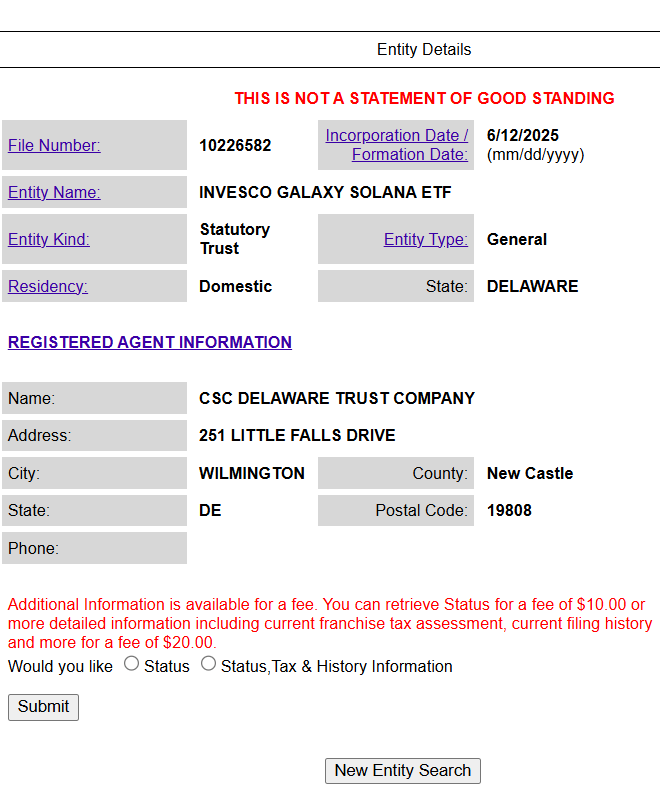

- Invesco and Galaxy Digital filed an ETF Solara in Delaware in the middle of the expectations of the dry approval.

- The dry may approve the Solana ETF in an accelerated calendar of three to five weeks.

Share this article

Investco and Galaxy Asset Management, the Galaxy Digital Fund Management Branch, have submitted a file to record a trust in Delaware for a proposed Solana ETF, a key precocious step towards the launch of the fund. The deposit suggests that an official dry application can be imminent.

Once Invesco and Galaxy Asset Management have submitted an official request to the SEC, companies will officially join the growing list of asset managers seeking to launch an ETF Solara Spot in the United States.

To date, this list includes Graycale, Vaneck, Bitwise, 21Shares, Canary Capital, Franklin Templeton and Fidelity. Indeed, almost all fund managers that offer Bitcoin Etf Ethereum, co-artisanals, are now pursuing a counterpart based in Solana, with the exception of BlackRock.

The latest Investo and Galaxy movement is involved in the midst of growing optimism around the potential approval of the dry of ETF SOP Solana. The momentum resumed this week following reports according to which the SEC was engaged directly with the ETF issuers, asking them to submit revised S-1 registration statements.

The requested revisions suggest a possible acceleration of the approval process, which, according to some sources, could conclude within three to five weeks. The SEC would also have reported its opening to the implementation in the ETF structure.

Bloomberg ETF analysts, Eric Balchunas and James Seyffart, estimate this year a 90% chance of approval for Solana and Litecoin ETF, placing them at the top of their list. The ETF XRP follows closely with approval ratings of around 85%.

I also wrote on this subject a little today. Maybe read on this link here if you are a terminal Bloomberg client: pic.twitter.com/jaq048ewdr

– James Seyffart (@jseyff) June 10, 2025

Solana ranks fifth by market capitalization, excluding stablecoins. Sol is negotiated at around $ 147 at the time of the declaration, down 7% in the last 24 hours, according to Coingecko data.

Share this article