- PEPE tested key support levels, drawing parallels to its price behavior in April for potential future gains.

- Despite the recent declines, PEPE saw active trading with a 24-hour volume of $1.29 billion.

Grandpa (PEPE) has emerged as one of the most robust tokens during the recent market downturn. Known for its organic growth, the memecoin has maintained an uptrend, attracting the attention of market analysts.

At press time, PEPE was testing a key support level, with analysts drawing parallels to its behavior in April.

Key Support Levels and Price Action

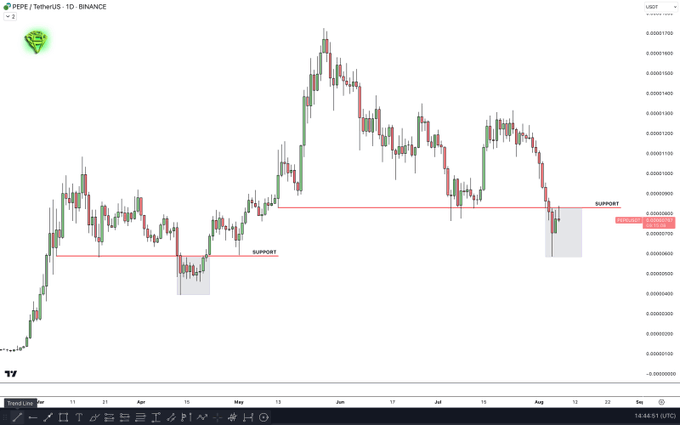

PEPE was attempting to reclaim a support level around $0.00000080 at press time, as highlighted by analyst Sjuul of AltCryptoGems.

In a recent article on X (formerly Twitter), Sjuul compared with the current market situation to the price movements of PEPE in April, noting,

“Look at the PEPE price in April, before its incredible rise to an all-time high, and you will see that it took several days to form a real bottom before it started to rise.”

According to AMBCrypto’s analysis of TradingView data, PEPE had previously tested a support level at around $0.0000060 on multiple occasions between March and May.

After establishing this support in May, the memecoin has seen a substantial uptrend, providing context to current price movements and potential future behavior.

Source: X

Sjuul’s analysis highlighted the importance of patience in difficult market times.

“Dips take time to form,” the analyst noted, referring to historical price data that shows periods of consolidation before significant price moves.

This observation suggests that PEPE may need time to establish a new support level before any potential uptrend.

At the time of going to press, the price of PEPE was $0.057725reflecting a 4.14% decline over the past 24 hours and a 26.84% decline over the past seven days.

The 24-hour trading volume stood at $1,296,441,631, indicating trading activity despite the recent price drop. With a circulating supply of 420 trillion PEPE, the token’s market cap was valued at $3,256,599,746.

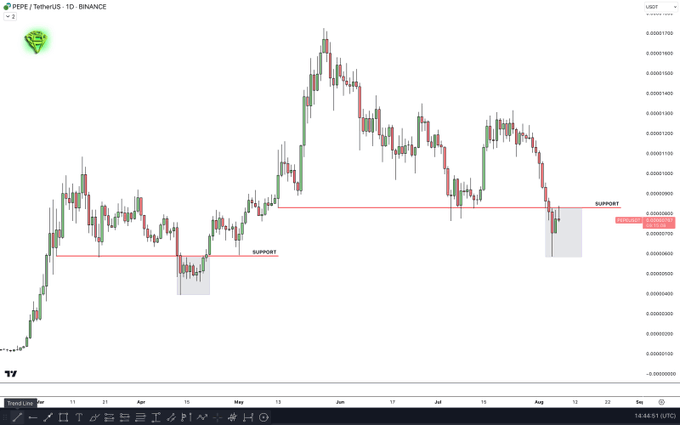

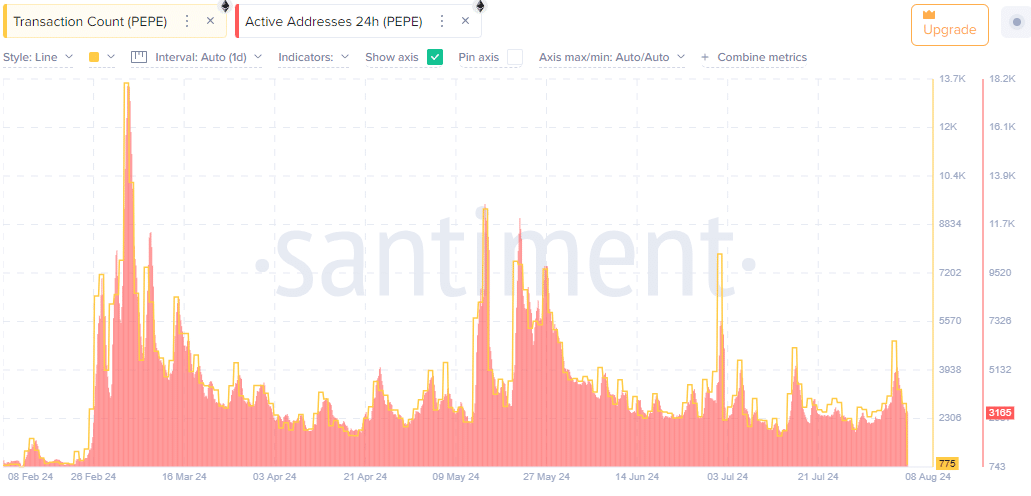

PEPE recorded 775 active addresses and 3,165 transactions, showing fluctuating trends with notable spikes throughout the year.

These figures highlight the dynamic participation in the PEPE network, despite the general slowdown in the market.

Source: Santiment

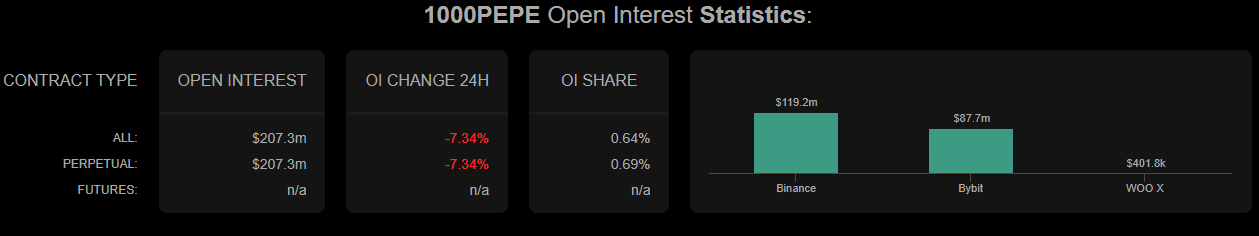

Market Liquidity and Open Interest

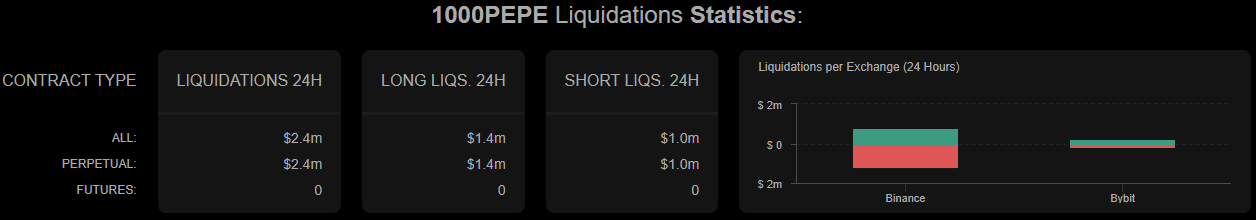

Over the past 24 hours, total liquidations on the PEPE market amounted to $2.4 million, of which $1.4 million came from long positions and $1 million from short positions. This indicates active trading and potential price volatility.

Source: Coinalyze

Realistic or not, here is PEPE’s market capitalization in terms of BTC

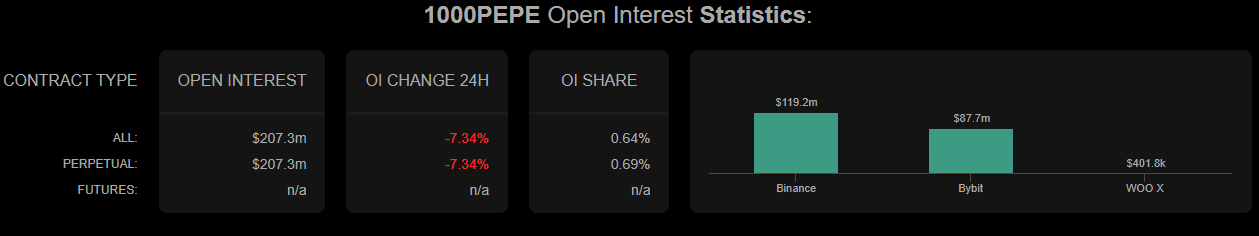

Additionally, AMBCrypto’s analysis of Coinalyze data showed a 7.34% decrease in open interest (OI) for PEPE over the past 24 hours.

The decline in OI, along with the price consolidation, suggests a potential downside risk for PEPE price in the short term.

Source: Coinalyze