- Ethereum’s underperformance could delay the much-anticipated altcoin season.

- Bitcoin’s growing dominance could derail altcoins’ performance after Fed rate cuts.

Ethereum (ETH) The muted price action and poor performance of US ETH spot ETFs could delay the much-anticipated altcoin season. In fact, on August 30, US ETH spot ETFs recorded zero flows overall.

An analyst referred the zero flows like “sad” and underlines a lack of interest.

“I just realized that yesterday’s ETH inflow was literally zero. For some reason, this is even sadder than a negative inflow. Nobody on this planet cares about ETH anymore lol.”

Is ETH Underperformance a Risk to Alt Season?

Overall, the products have seen cumulative outflows since inception worth $477 million according to Farside Investors. data.

According to Quinn Thompson, founder of crypto hedge fund Lekker Capital, the weak performance was “harmful” to the altcoin universe.

“The poor performance of ETH ETFs is a bad sign for the rest of the altcoin universe… Bitcoin dominance will increase… ETHBTC is the barometer of altcoins.”

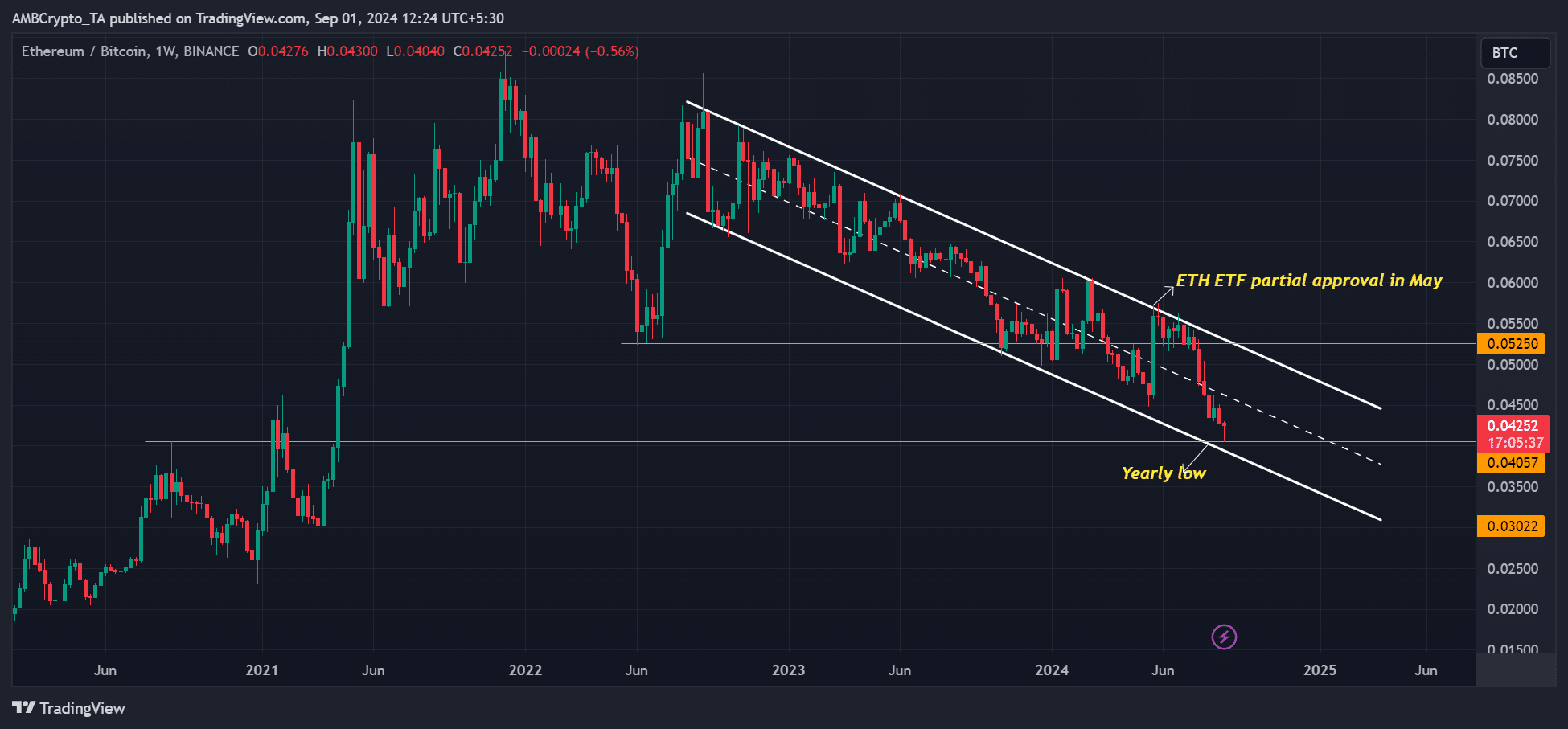

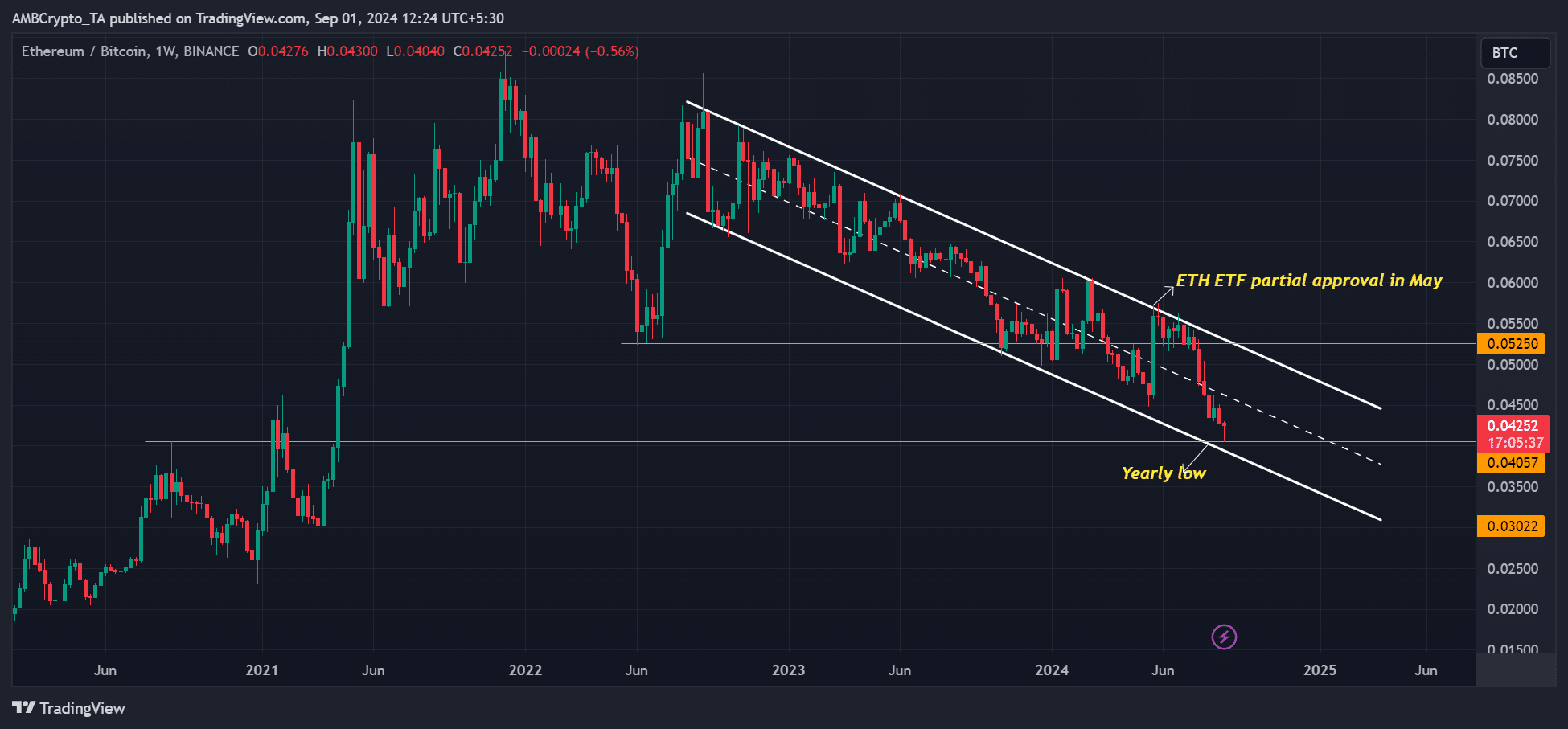

For context, the ETHBTC ratio tracks the value of ETH against BTC. The ratio has been declining for over two years and recently hit a yearly low of 0.040.

In short, ETH’s underperformance against BTC has reached an all-time high in 2024, mainly conduit by the interest of ETF buyers.

Source: ETH/BTC, TradingView

Thompson projected that ETHBTC would reach 0.033 by the end of 2024. In other words, the executive expected ETH’s underperformance to continue through December before ETF buyers showed interest in the altcoin.

Although some altcoin observers have timed a breakout for the segment using Solana (SOL) In terms of performance, the ETHBTC ratio remains an important test of the health of the sector, according to Thompson.

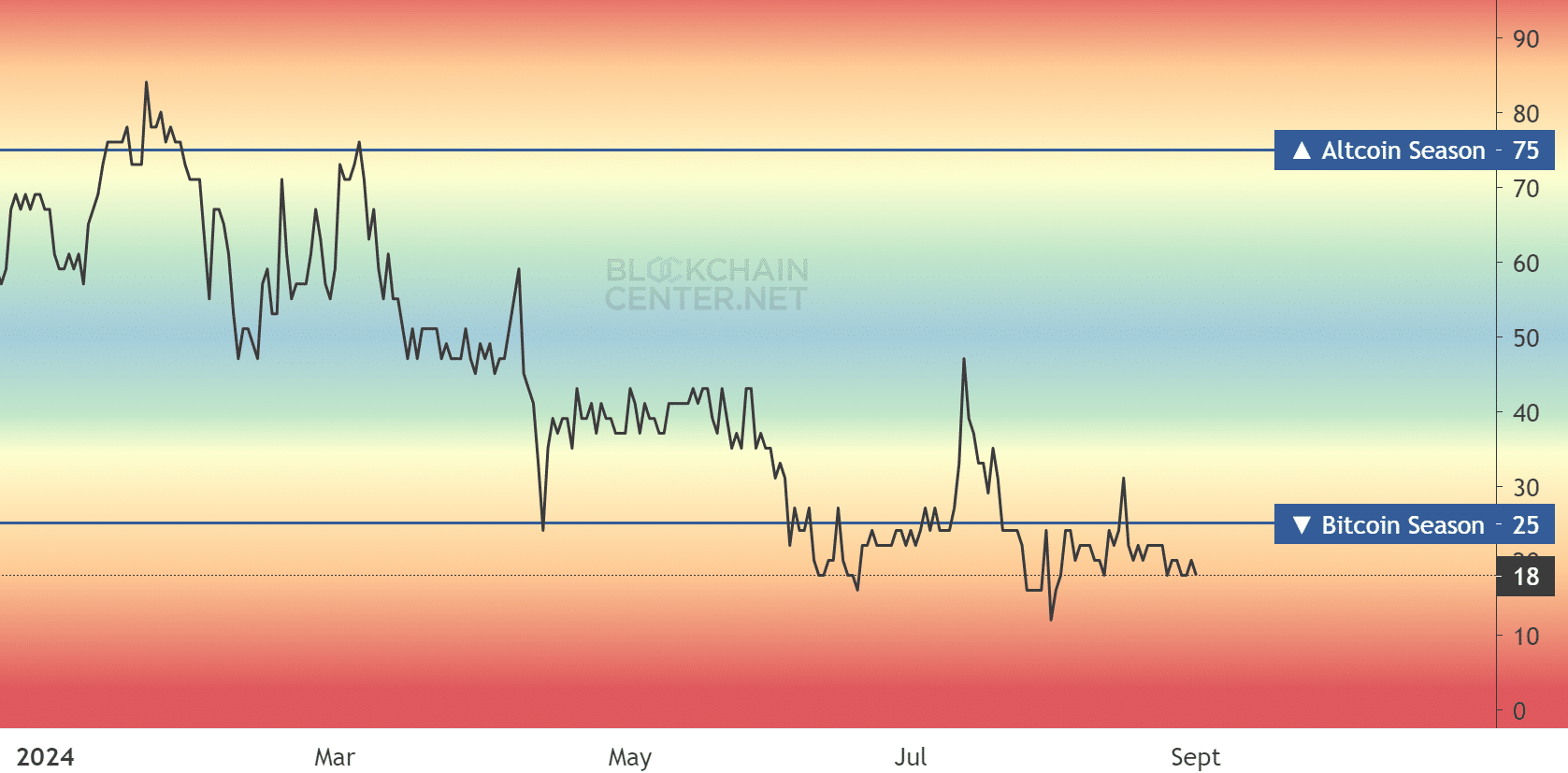

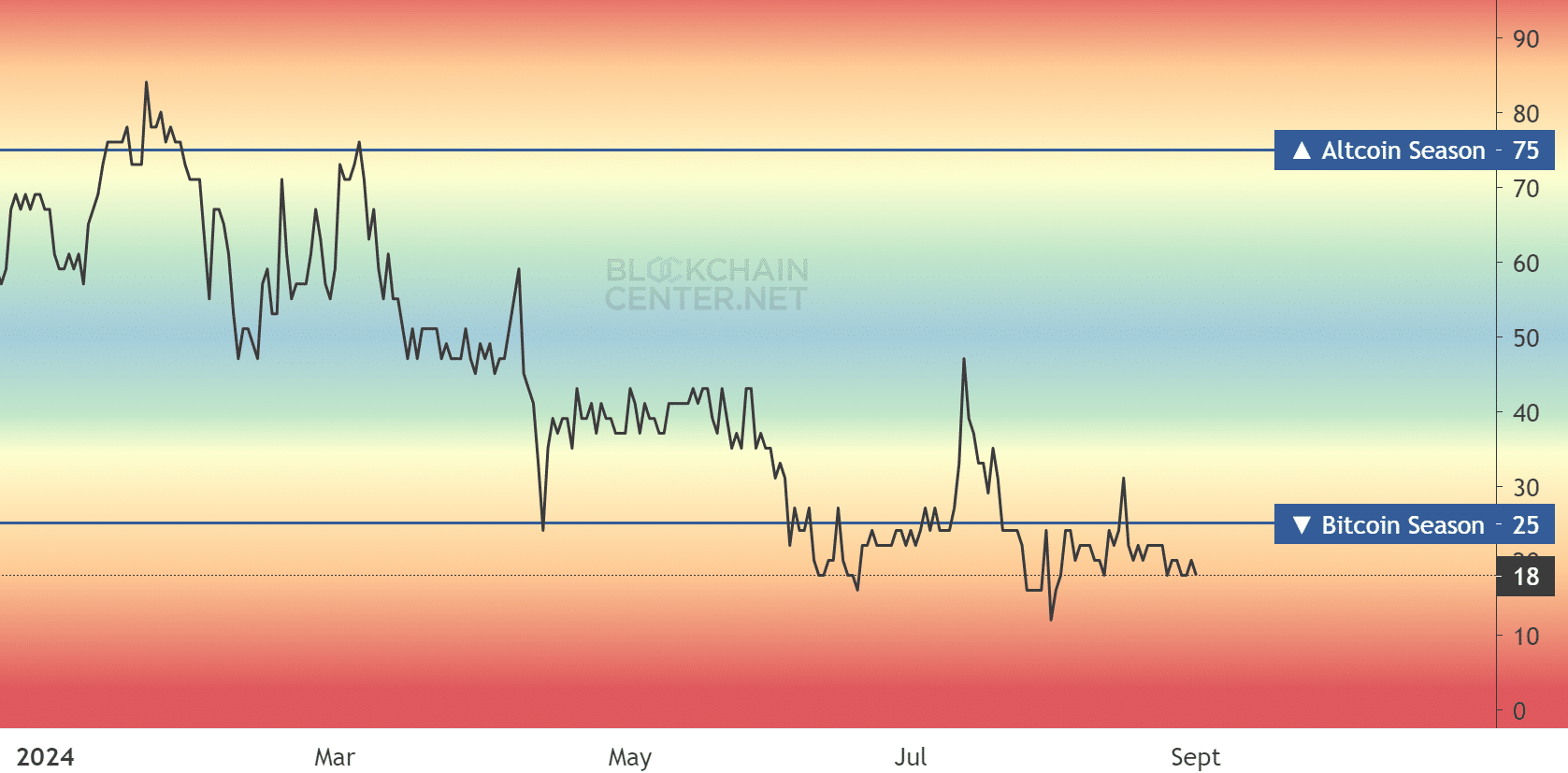

At the time of writing, the Altcoin Season Index while reading was at 18, suggesting it was still a firm BTC season.

Source: Blockchain Center

That said, some market observers have speculated that the upcoming and likely Fed rate cut could boost the altcoin segment. According to crypto analyst Benjamin Cowen, perspectives was uncertain as a similar scenario in 2019 led to the capitulation of altcoins.

“#ALT/#BTC pairs opened their monthly rates in July 2019, when the Fed first cut rates, at 0.38. They capitulated at 0.29 that month. The monthly open in September 2024 for ALT/BTC pairs is 0.38. The Fed will cut rates this month. Maybe, just maybe, this time will be no different.”

Source: X/Cowen

At the time of writing, ETH was trading at $2.4k, down nearly 10% over the past week after dropping from $2.7k.