Ethereum (ETH) lost its three-year support against Bitcoin (BTC) as the top cryptocurrency hit its $100,000 target on Friday, November 22. ETH has faced sticky resistance at $3,500 for almost four months while its competitors have reached record highs this cycle.

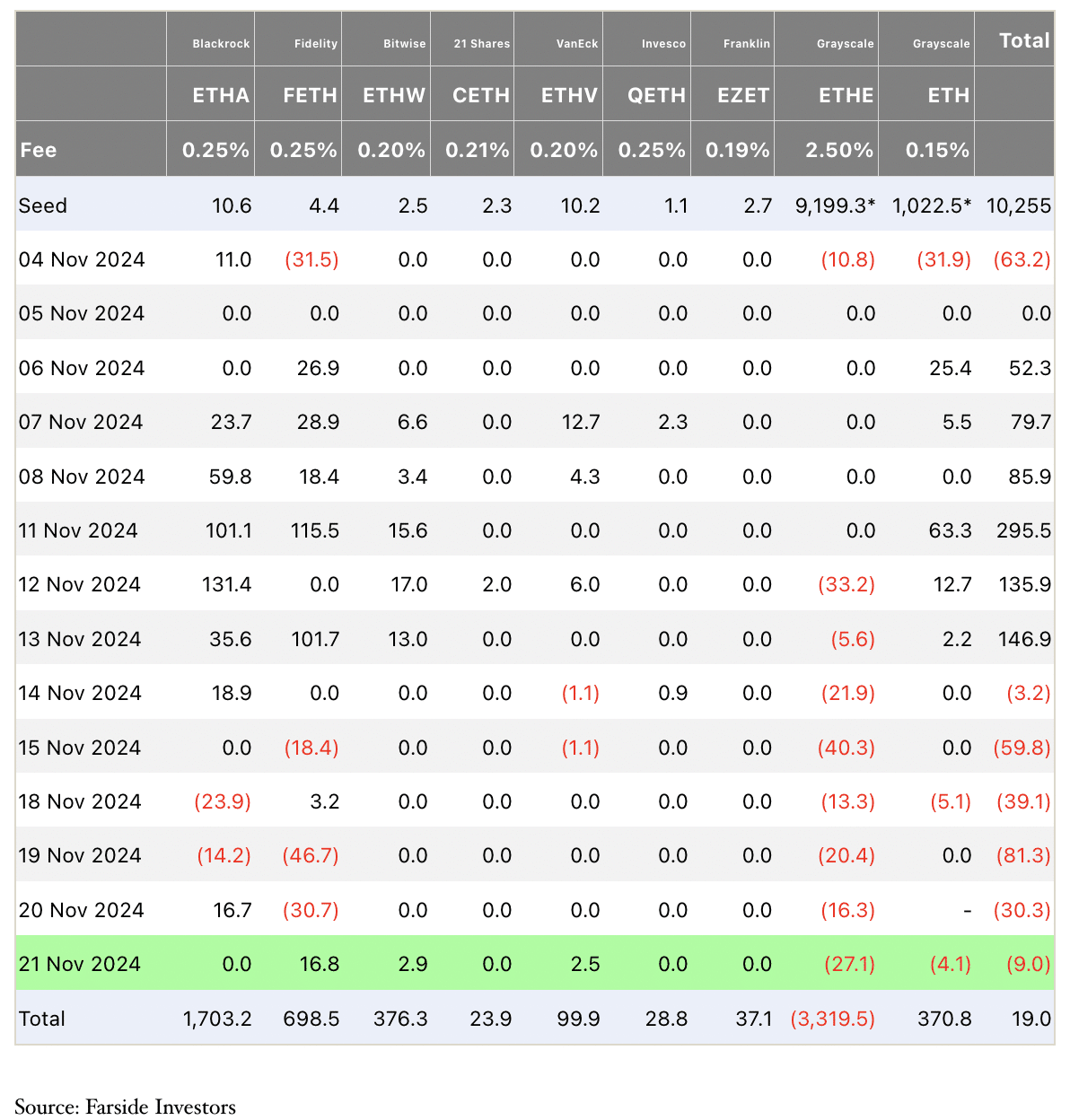

Ethereum loses favor with institutional investors, ETF performance is lackluster

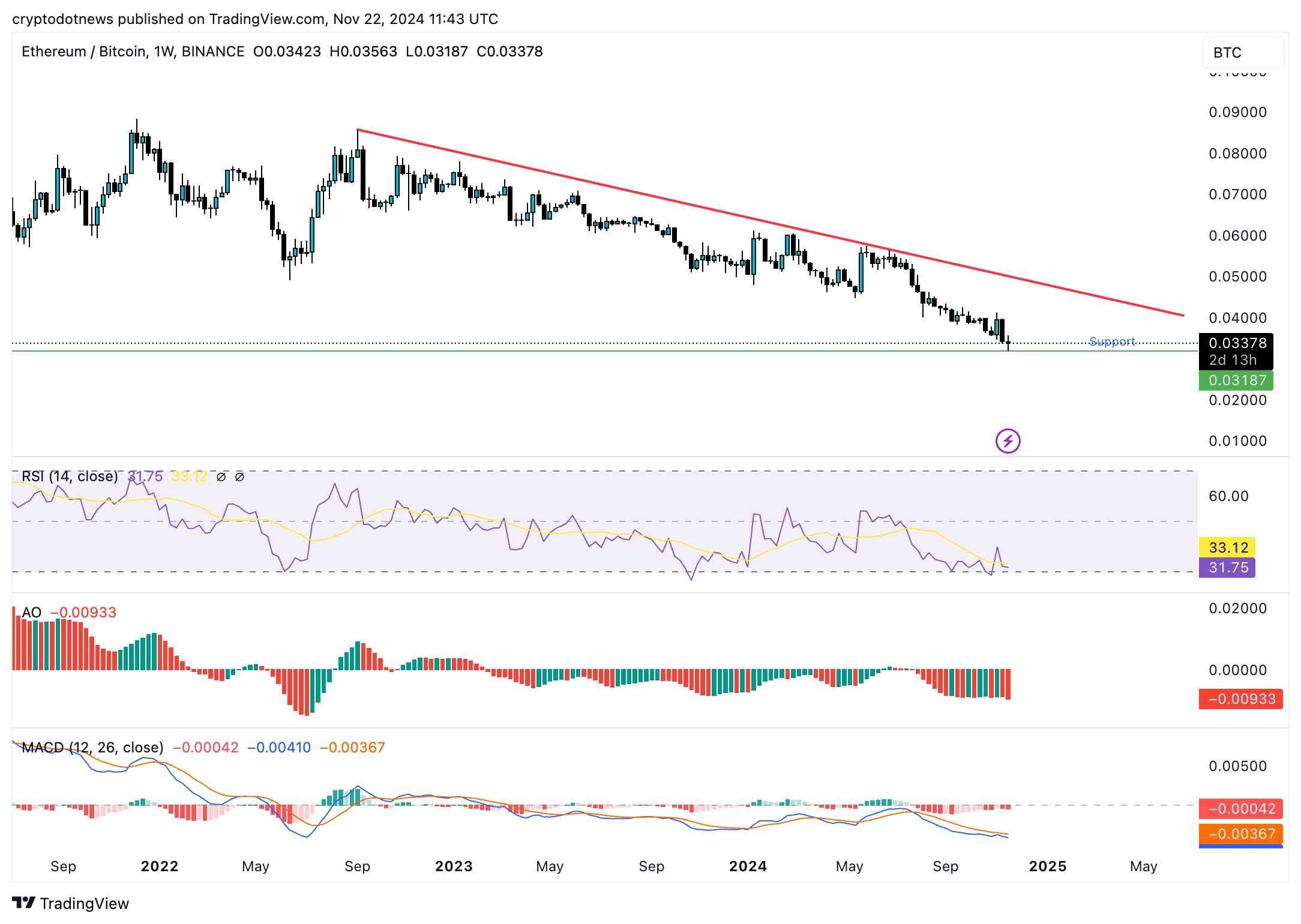

Ethereum fell to a low of 0.03187 against Bitcoin on Friday, November 22. As Bitcoin headed towards the $100,000 target, Ethereum price fell below the support level that has been held for almost three years since 2021.

Ethereum’s decline relative to Bitcoin is likely the culmination of several factors, including a lack of interest from institutional investors, a steady decline in interest from retail investors, and the shift of capital and attention to Layer 2 and 3 scaling projects, among others.

The performance of the Ethereum Spot ETF explains how the altcoin has failed to attract investment from institutions while Bitcoin Spot ETF continues to outperform.

Data from Farside Investors UK shows that ETH ETFs have seen negative net inflows or outflows over the past six days. In contrast, Bitcoin Spot ETFs continue to attract billions of dollars in institutional fund flows.

Tuur Demeester, editor-in-chief of Adamant Research, told Forbes that Ethereum could be “dying slowly,” signaling the shift in market dynamics and slowing institutional adoptions.

Solana challenges Ethereum dominance, on-chain analysis

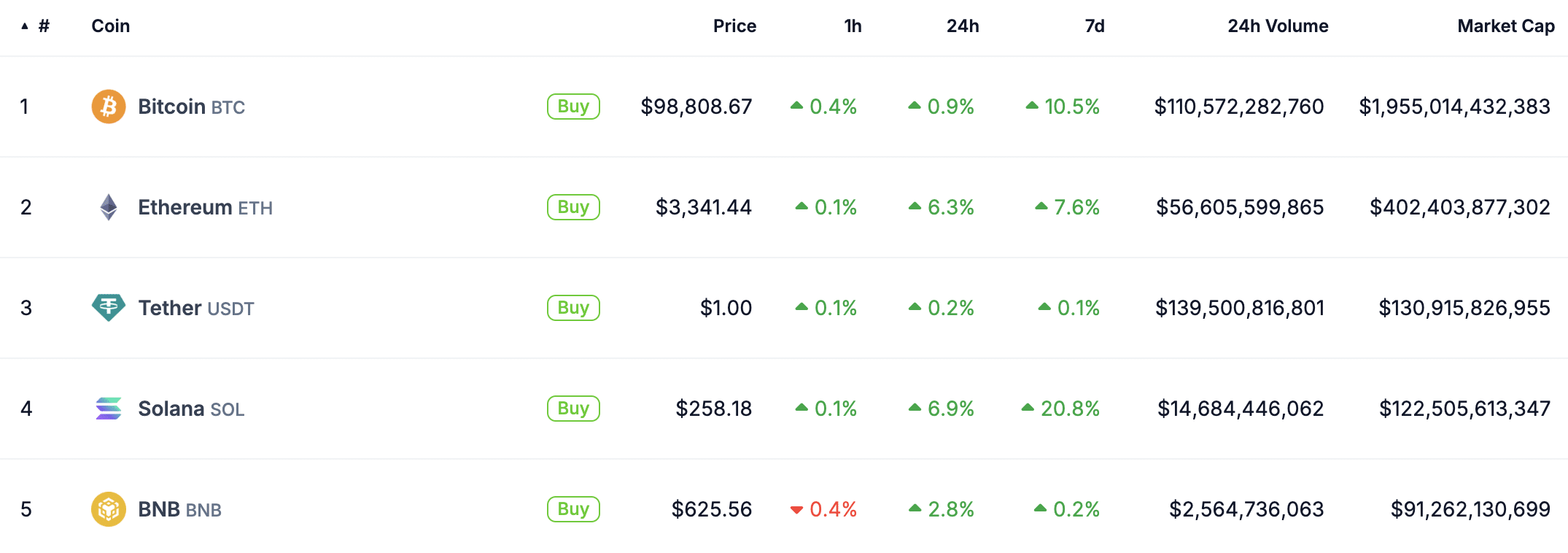

While the performance of the Ethereum ETF is struggling, the altcoin is facing a challenge from its competitor, Solana (SOL). Solana’s market cap gain and rising prices have pushed SOL among the top four cryptocurrencies, according to CoinGecko.

Solana dominates Ethereum in decentralized exchange trading volume, DEX activity, and protocol fees generated in October 2024 and November 2024.

While Ethereum’s price rallied on Thursday and Friday this week, the altcoin is struggling to resist $3,500, and failure to surpass that level could call into question the token’s likelihood of further gains.

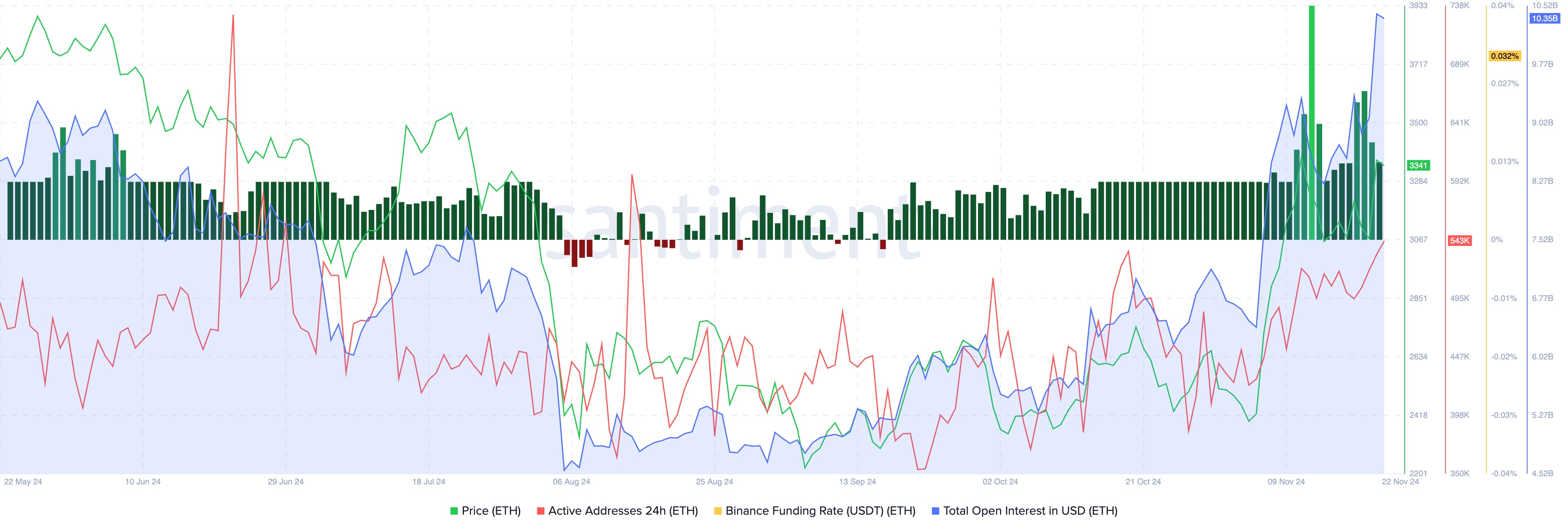

On-chain metrics are inconclusive. Although active addresses remain well below mid-August 2024 levels, the funding rate on Binance has been consistently positive since mid-September 2024.

Open interest in Ethereum futures, a metric that gauges interest and demand from derivatives traders, climbed to $10.35 billion, according to Santiment data. Derivatives market statistics support a bullish thesis for the altcoin. Combined with Ether’s recent price increase, further gains are likely if the altcoin manages to break through the resistance at $3,500.

Bitcoin Leads Cryptos With Digital Gold Narrative

Ethereum is the second largest altcoin, and for most of the last decade, analysts and traders have talked about the two cryptocurrencies together. However, Bitcoin has become “digital gold,” or a token used to hedge against geopolitical crises and unpredictable market events. At the same time, Ethereum faces scalability issues.

Ethereum’s scalability issues have given way to Layer 2 and Layer 3 protocols, and their tokens have generated gains for traders in 2024. However, the base chain is slowly losing its traction and appeal among market players.

The digital gold narrative has attracted institutional attention from countries that have seen fit to add Bitcoin to their balance sheets, while Ethereum is still working on its promise of being a “decentralized computer” for the world.

Although Ethereum has a larger market cap than Bank of America, as of November 22, the altcoin has yet to see gains in the current market cycle compared to meme coins and other cryptocurrencies like Solana.

Ethereum Future Expectations and Technical Analysis

ETH/BTC fell to a near three-year low, reaching a critical support level, as shown in the chart below. The decline is significant and the pair has been in a downward trend since September 2023.

Technical indicators such as the Relative Strength Index and momentum indicators support a bearish thesis. The RSI is 31, close to the “oversold” zone below 30. This usually generates a buy signal for traders, meaning the asset is undervalued and is a good time to buy for traders. marginalized traders.

Failure to recover from the support level could lead to further declines in the pair, with ETH/BTC falling over the coming weeks of 2024.

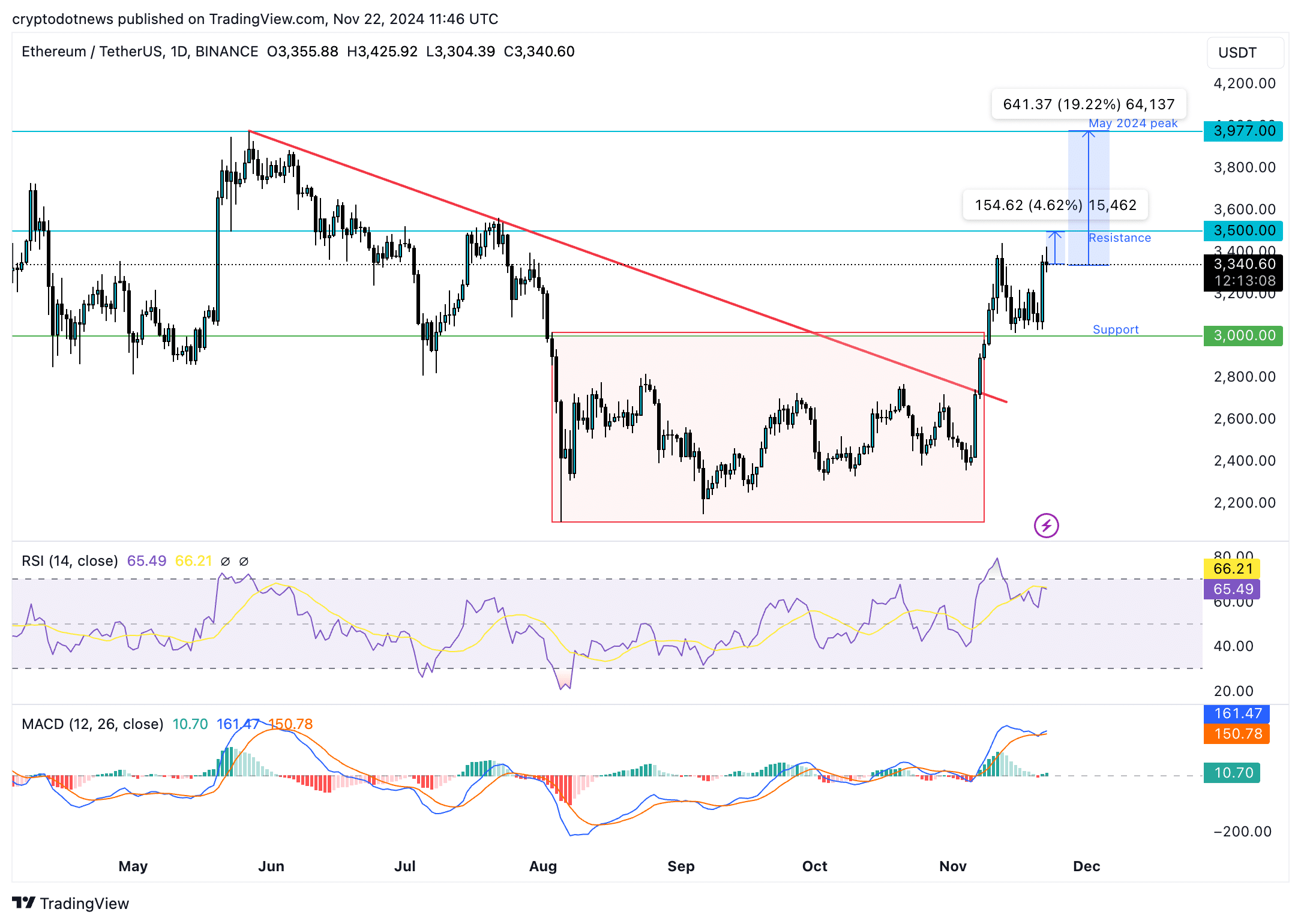

The ETH/USDT daily price chart shows positive signs for the altcoin. ETH price could post gains and rebound towards the $3,500 resistance and the May 2024 high of $3,977 if the altcoin maintains its upward momentum.

Ethereum is less than 5% away from $3,500, and nearly 20% gains could allow ETH to test the May 2024 peak of $3,977. The RSI is 65, well below the overvalued level at -above 70. The green histogram bars on the Moving Average Convergence Divergence indicator support the likelihood of further gains for Ethereum.

Ethereum’s underlying price trend is positive, and if the altcoin maintains its steady rise, the $4,000 price level, a psychologically important price level, could be breached in the near term.

A correction could send Ethereum testing support at $3,000, a key support level for the altcoin throughout 2024. Further decline would mean Ethereum finds support at the lower boundary of the range at $2,111, as shown in the daily price chart.

Strategic Considerations

Ethereum enjoys a high correlation with Bitcoin, at 0.91, according to Macroaxis.com. This implies that a significant rise in Bitcoin price could be followed by gains in Ethereum and the altcoin price is expected to observe a positive impact.

Although Ethereum is lagging its peers, a correction in Bitcoin could add to the challenges faced by the altcoin in its uphill battle against resistance at $3,500. Traders should monitor options volume and open interest in Ethereum before adding to their ETH positions.

Disclosure: This article does not represent investment advice. The content and materials presented on this page are intended for educational purposes only.