- TAO is approaching the critical resistance level of $685 after increasing volume and technical strength.

- Market sentiment is supported by increased open interest, a bullish MA crossover, and weak social dominance.

Bittensor (TAO) recently saw a significant increase in 24-hour trading volume, surpassing $500 million, reflecting strong interest and market activity.

The spike in activity signals increased interest as TAO price climbs to $599.66, up 8.01% in the past 24 hours. Consequently, TAO’s market capitalization reached $4.43 billion at press time, further indicating renewed momentum as it approaches a key resistance level at $685.

With bullish sentiment strengthening, TAO could be gearing up for a significant move.

Technical analysis: signs of a bullish breakout

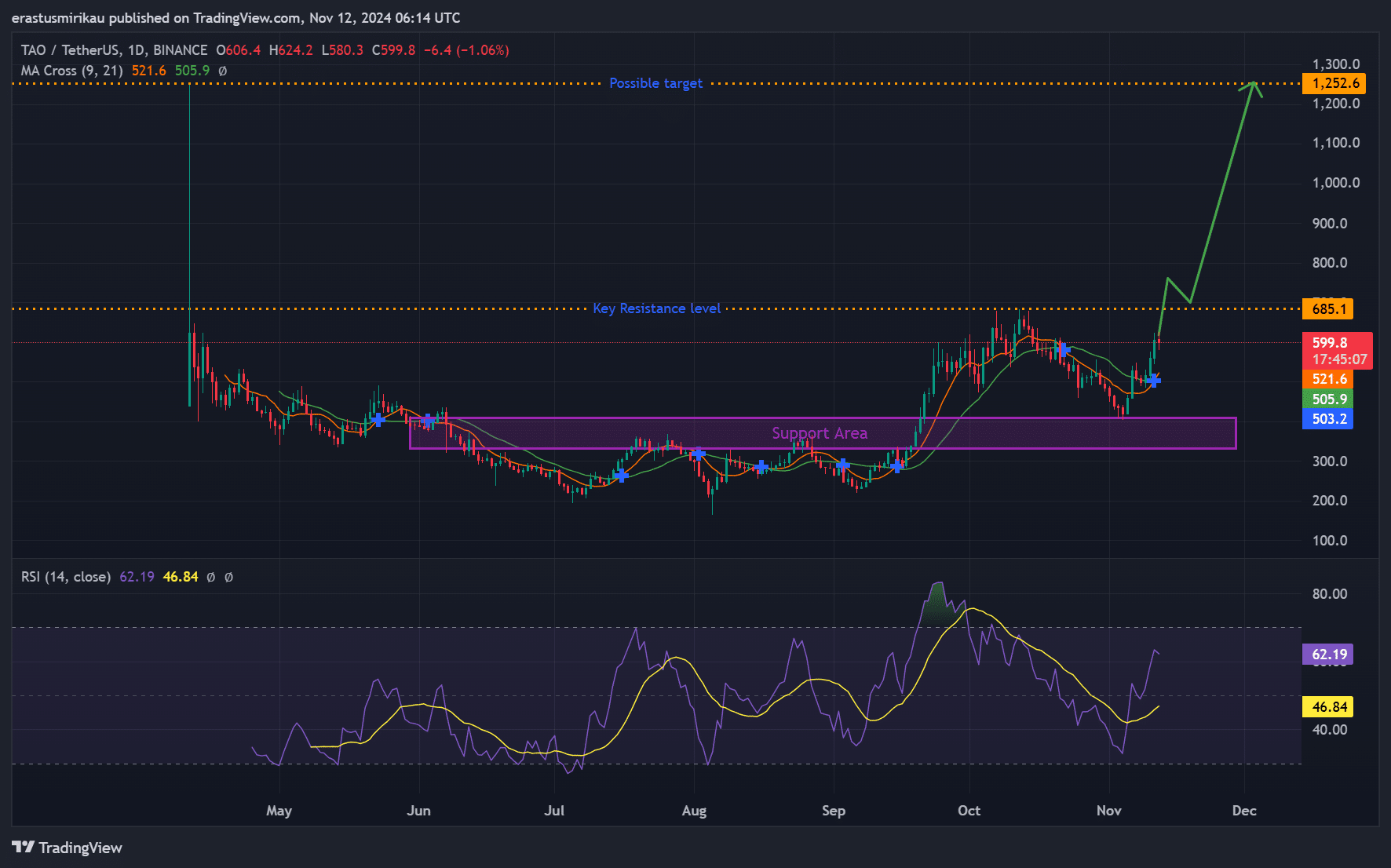

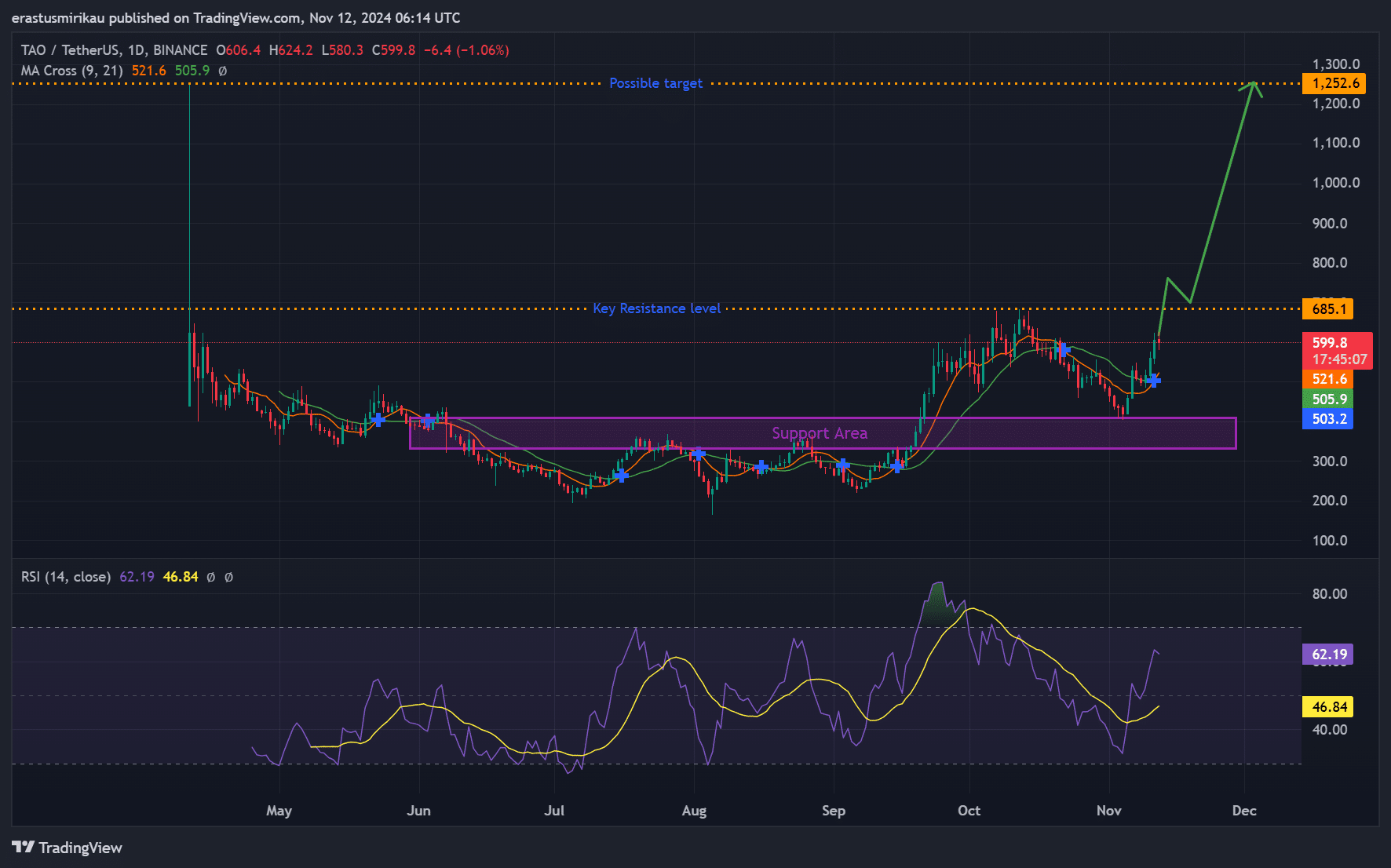

TAO technical indicators point to a potential breakout. After bouncing off the strong support zone between $400 and $500, the price is approaching the critical resistance level at $685.

Surpassing this point could open the way to the next target of $1,252.6, offering a significant potential gain. However, continued buying pressure is essential for this rally to sustain.

The relative strength index (RSI) stood at 62.19, signaling that TAO is approaching overbought territory. This level could encourage some profit taking if buying pressure eases. However, the upward movement of the RSI still aligns with a bullish outlook.

Additionally, the recent moving average (MA) crossover between the 9-day and 21-day MAs strengthens the bullish case. Both averages are trending upward, showing sustained momentum and strong buying interest.

Therefore, this MA crossover suggests that the TAO rally could extend beyond a short-term rebound, indicating a possible sustained uptrend.

Source: TradingView

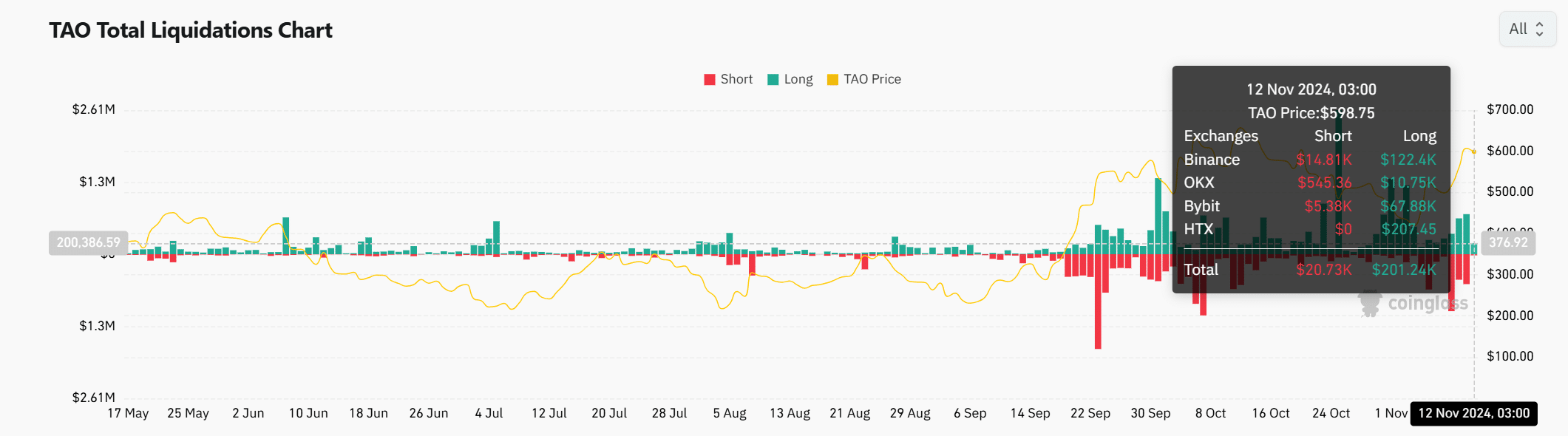

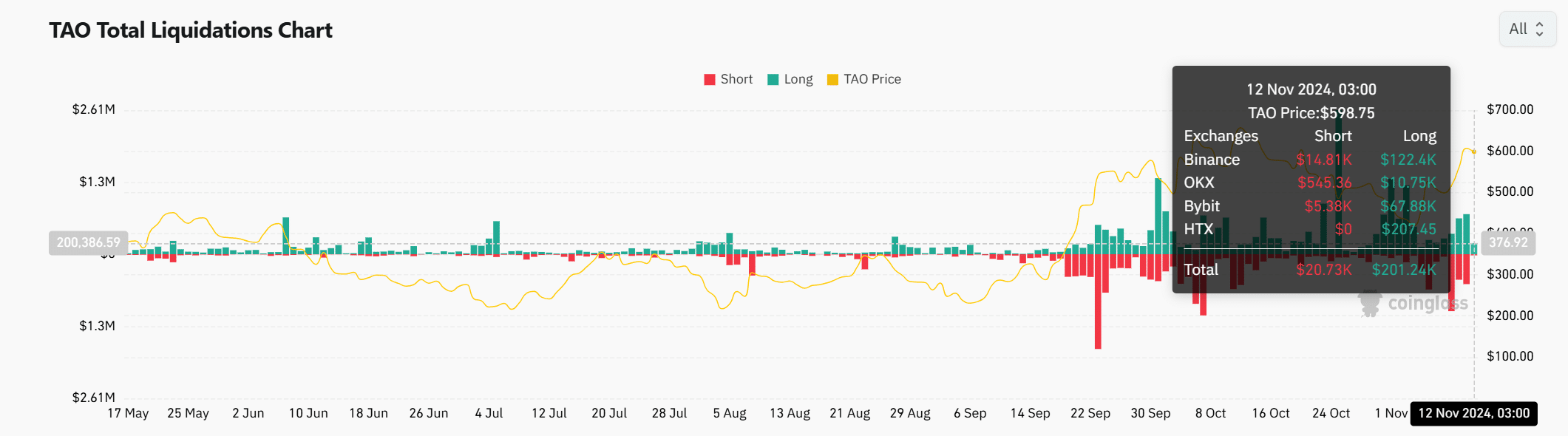

Liquidation data: a bullish imbalance

The latest liquidation data reveals an interesting trend: long positions exceed $200 million, significantly outpacing short positions. This indicates that market sentiment is bullish.

However, this imbalance increases the risk of cascading liquidations if the TAO faces sudden downward pressure, which could amplify losses and create volatility.

Source: Coinglass

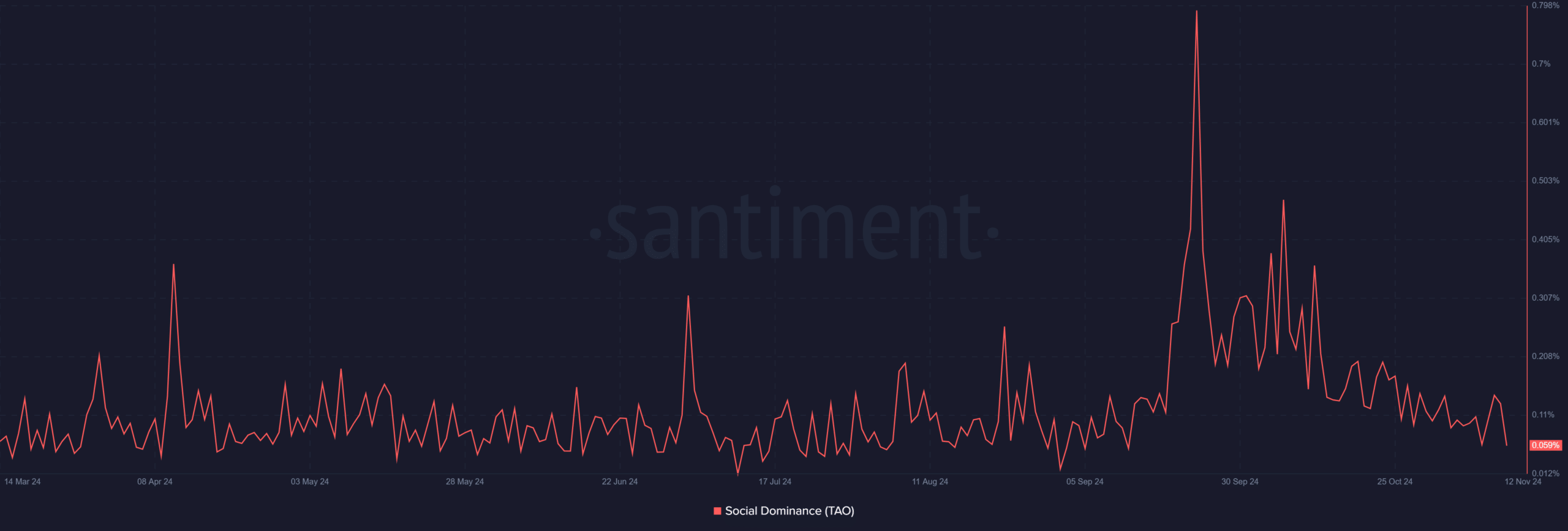

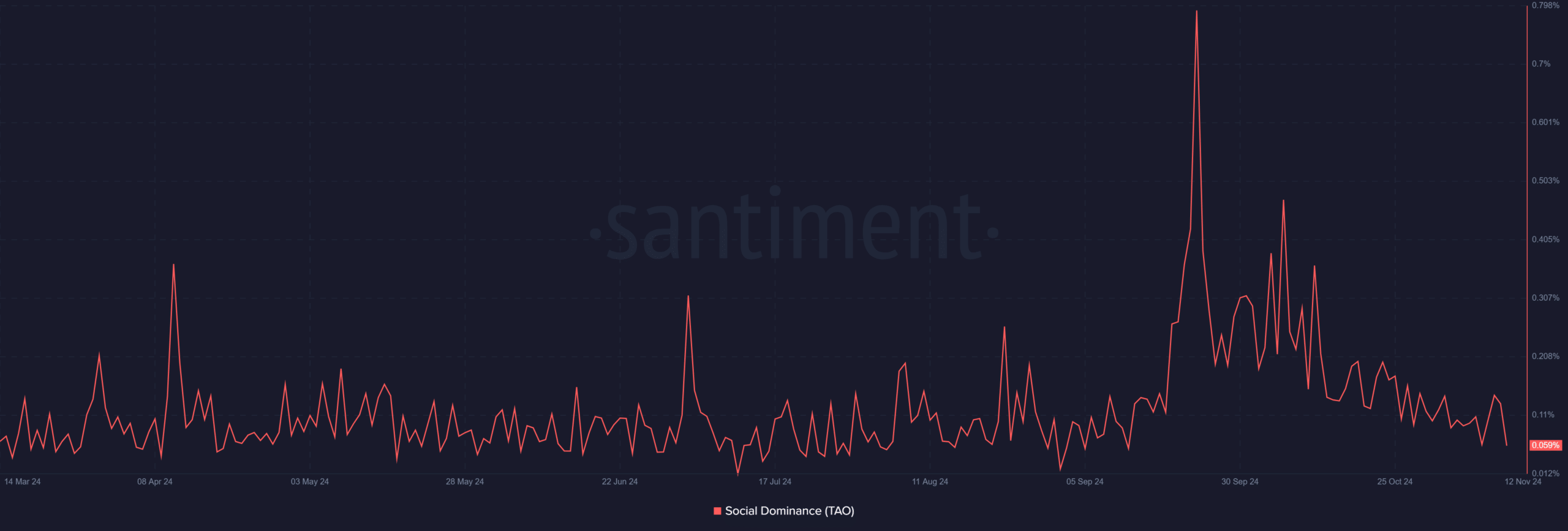

Social dominance diminishes in the middle of a rally

Interestingly, social dominance has decreased, currently standing at 0.059%. This suggests that TAO’s recent price rally is driven less by retail hype and more by large investors, which could lend stability to its uptrend.

Consequently, this less social domination could contribute to reducing speculative volatility.

Source: Santiment

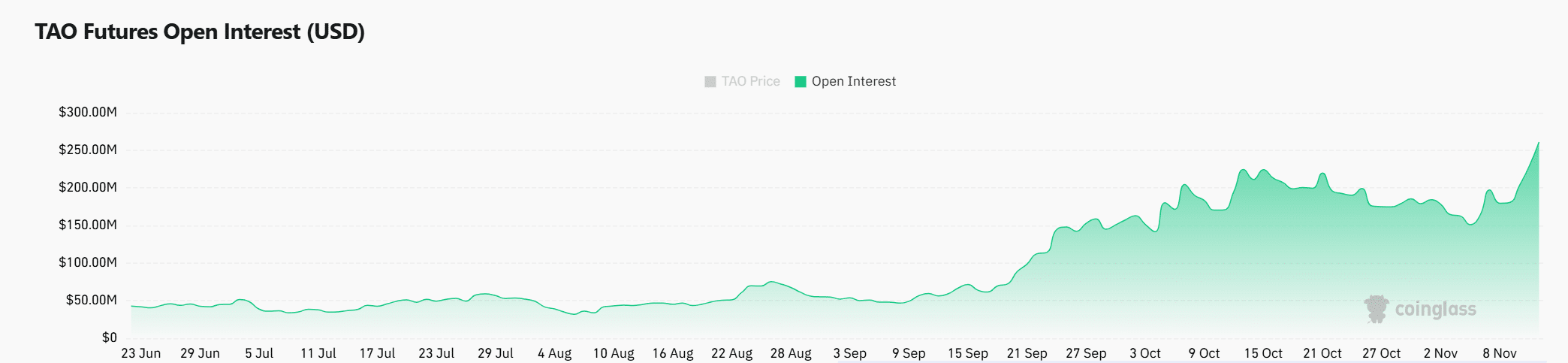

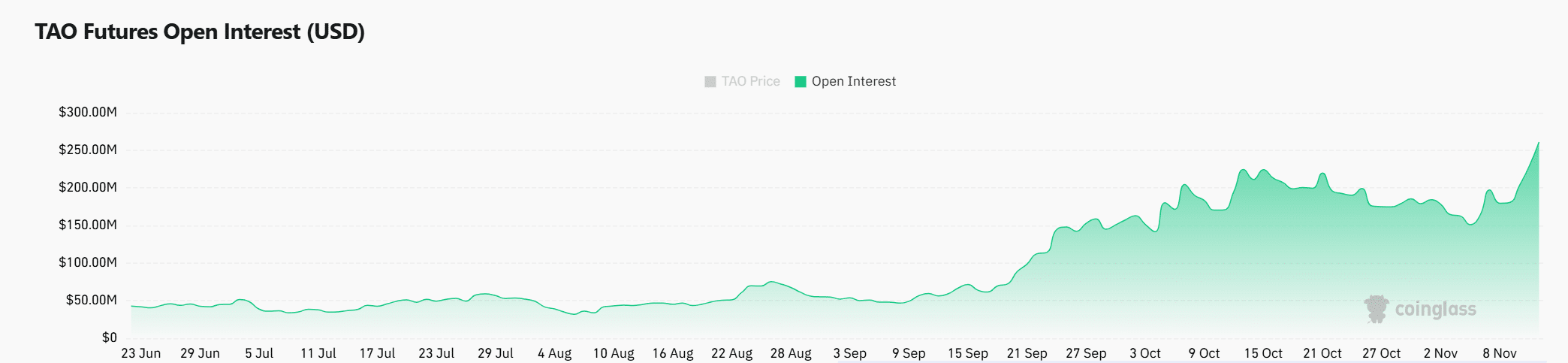

Rising open interest rates signal bullish sentiment

Open stake increased by 12.58%, reaching $251.12 million. This rise in open interest, coupled with increased trading volume, highlights strong investor confidence and engagement.

Therefore, this growth suggests that the market is expecting further upward movement, thereby adding momentum to the current TAO rally as it tests the $685 resistance level.

Source: Coinglass

Read Bittensor (TAO) Price Prediction 2024-2025

TAO’s technical indicators, rising open interest and strong trading volume suggest a likely breakout above $685. However, the RSI near overbought territory and declining social dominance warrant caution.

Even though TAO could reach its ambitious target of $1,252.6, any loss of momentum or sudden selling pressure could disrupt its upward trajectory.