- The Altcoin Season Index also hinted at a delayed altcoin rally.

- All major altcoins have been victims of price corrections in the recent past.

The crypto market has seen some volatility over the past week, but on the negative side. While many were expecting an altcoin season, the latest data revealed that investors may have to wait longer for it to happen.

In fact, investors might not see an altcoin summer until 2025.

Bitcoin continues to dominate

Alphractal, a popular data analytics platform, recently released a tweet revealing a major update. According to the tweet, only a small number of altcoins outperformed Bitcoin (BTC) over the last 30 days.

Generally, when BTC rises and stabilizes, certain altcoins tend to stand out.

However, over a 90-day period, there is still no sign of an altcoin season in this cycle. At the same time, Bitcoin’s dominance has continued to grow. This rise was justified given the disappointing performance of most altcoins.

Although Bitcoin declined somewhat in the short term, altcoins declined even more, supporting the prediction that Bitcoin will continue to gain market share.

In just one week, BTC dominance jumped 1%, and at press time the metric had a value of over 56%.

Source: CoinStats

Apart from this, AMBCrypto’s analysis found that the altcoin season index had a value of 27. To begin with, it is considered a Bitcoin season if the metric has a reading near or below 25.

On the contrary, an altcoin season occurs when the metric reaches 75. All these aforementioned data sets clearly suggest that it would take longer for an altcoin season to arrive.

Source: Blockchaincenter

How are the best altcoins doing?

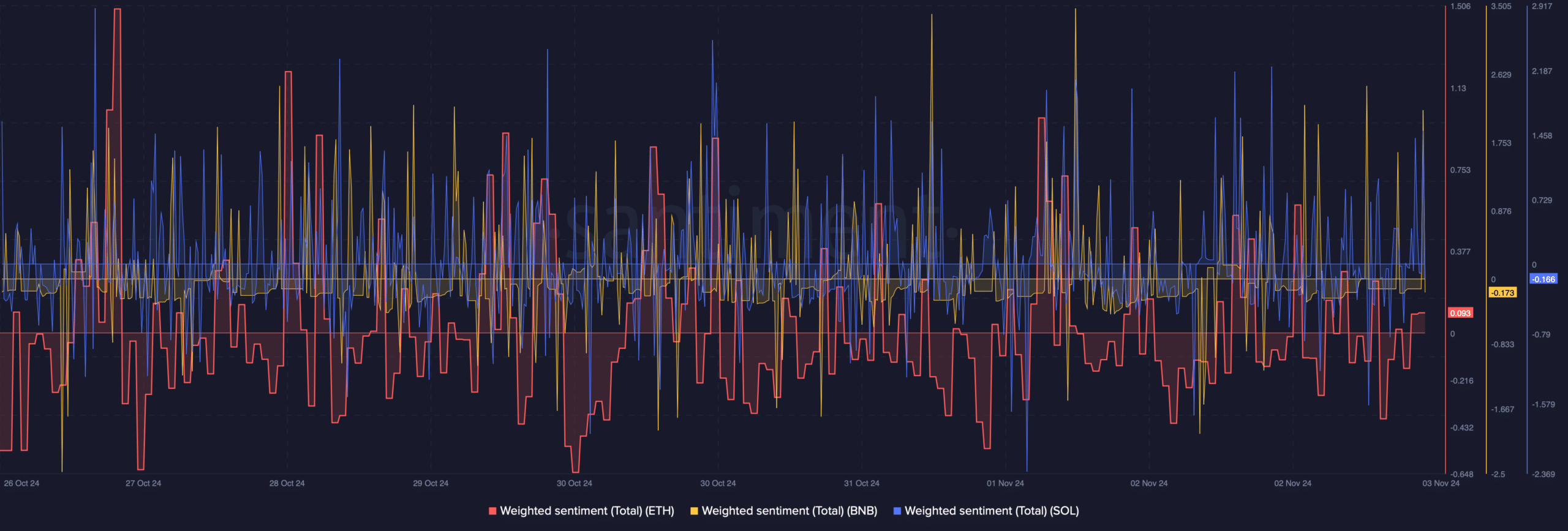

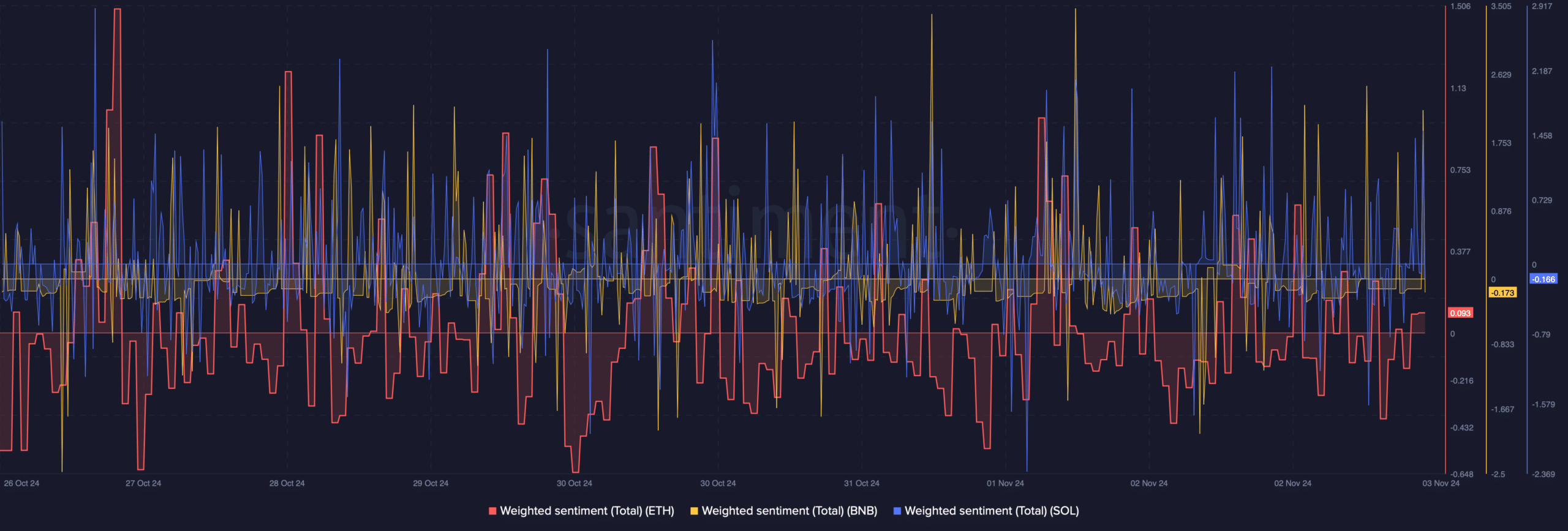

To check if alts could begin a rally, AMBCrypto evaluated the states of Ethereum (ETH), BNBAnd Solana (SOL).

According to an analysis of Santiment data, weighted ETH sentiment fell last week, indicating an increase in bearish sentiment.

Surprisingly, despite the price decline, BNB’s weighted sentiment remained high. A similar upward trend was also seen on the Solana chart. This suggests that investors had confidence in BNB and SOL and expected prices to rise soon.

Source: Santiment

We then verified each of the metrics derived from these altcoins. Interestingly, the weighted sentiment of BNB and SOL has increased. Their long/short ratios have fallen, according to Coinglass’ data.

Read Ethereum (ETH) Price Prediction 2024-25

A decline in the metric means there are more short positions in the market than short positions, which is bearish. On the contrary, the ETH long/short ratio recorded a sharp increase, hinting at a possible price rise.

Source: Coinglass