- Whale deposits reported a concern because Eigen faced a significant loss.

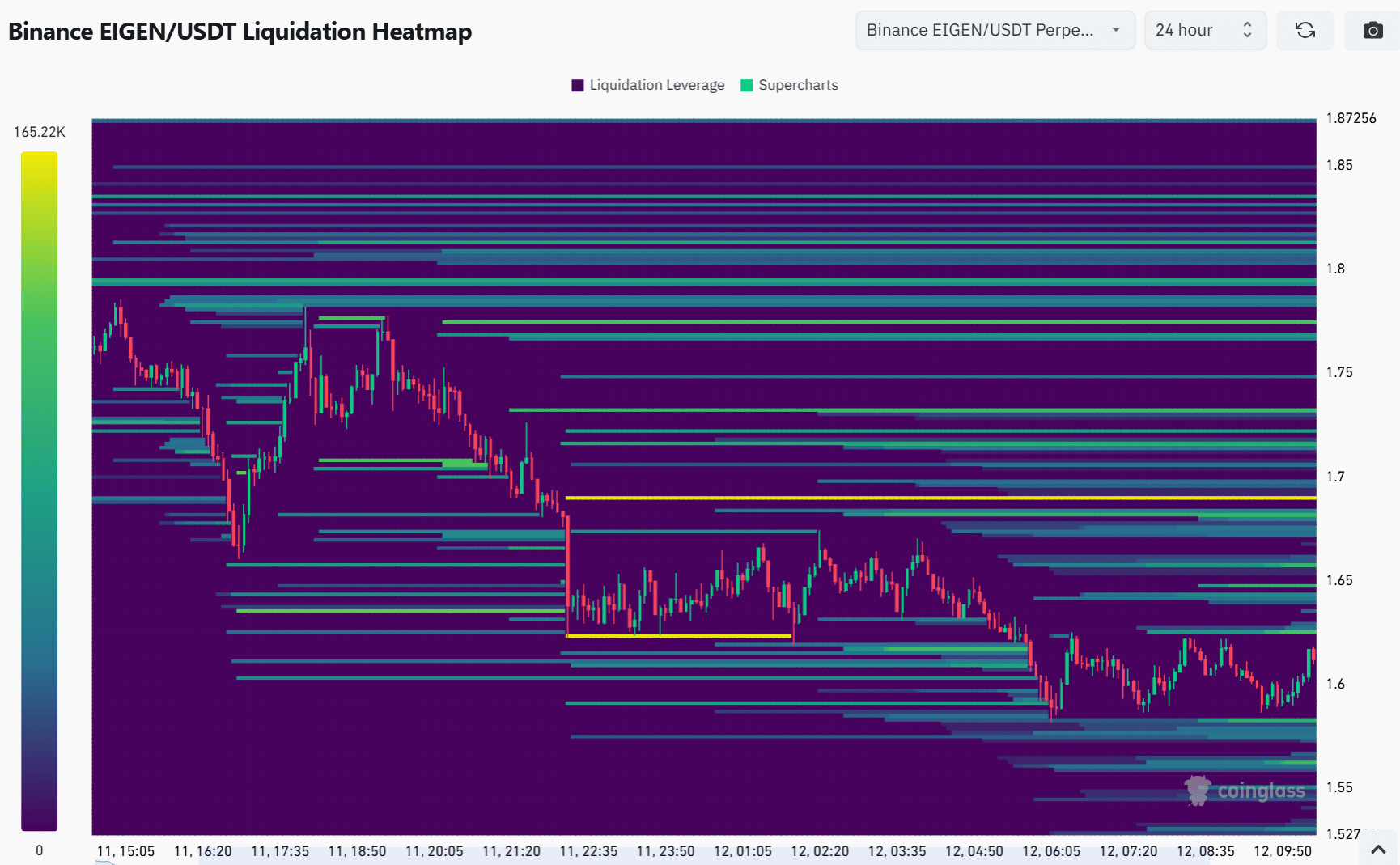

- Chain data and the thermal liquidation card suggested the lowering feeling, signaling more price reductions.

A recent whale deposit of 2 million clean people (Eigen), worth $ 3.18 million in Binance, raised eyebrows in the cryptographic community.

The whale had previously withdrawn the same amount specific to $ 9.07 million only two months ago, but with the price which now drops radically, this investor faces an amazing loss of $ 5.89 million.

The price of Altcoin went from $ 4.53 to $ 1.59, suggesting that it is a warning or a sign of a possible recovery.

What about the current action for own prices?

At the time of the press, Eigen was traded at $ 1.61, showing a sharp decrease of 9.77% in the last 24 hours. The price experienced a constant drop in the peak of $ 5.659, and is now lower than the levels of critical resistance.

The key resistance levels were $ 2.20, $ 3.03 and $ 3.47, which indicates where the price can be faced with the difficulty.

The support was also low, the level of $ 1.60 showing additional support potential if the price does not drop.

Based on the current market trend, a brief consolidation near the $ 1.60 range could be expected.

However, with the current downward trend, the probability of a potential still decreases towards the brand of $ 1.42 unless the market conditions soon change.

Source: tradingView

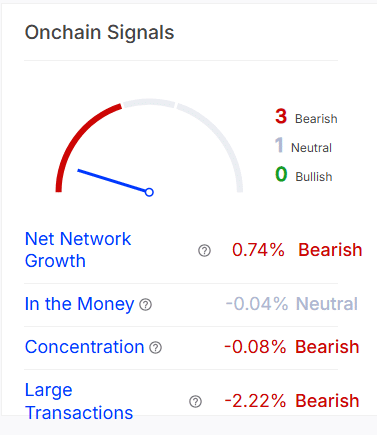

Chain activity and market feeling

The chain signals for Eigen have been fucked at the moment. The growth of the net network amounted to 0.74%, which indicated limited growth.

The concentration of significant assets and transactions also showed negative trends with -0.08% and -2.22%, respectively.

These signs reflected a decrease in interest in Eigen, potentially exacerbating the current slowdown.

In addition, the position of the “money” token has shown a slight neutral feeling at -0.04%, further stressing the current uncertainty on the market.

Source: intotheblock

Evaluation of future price movements

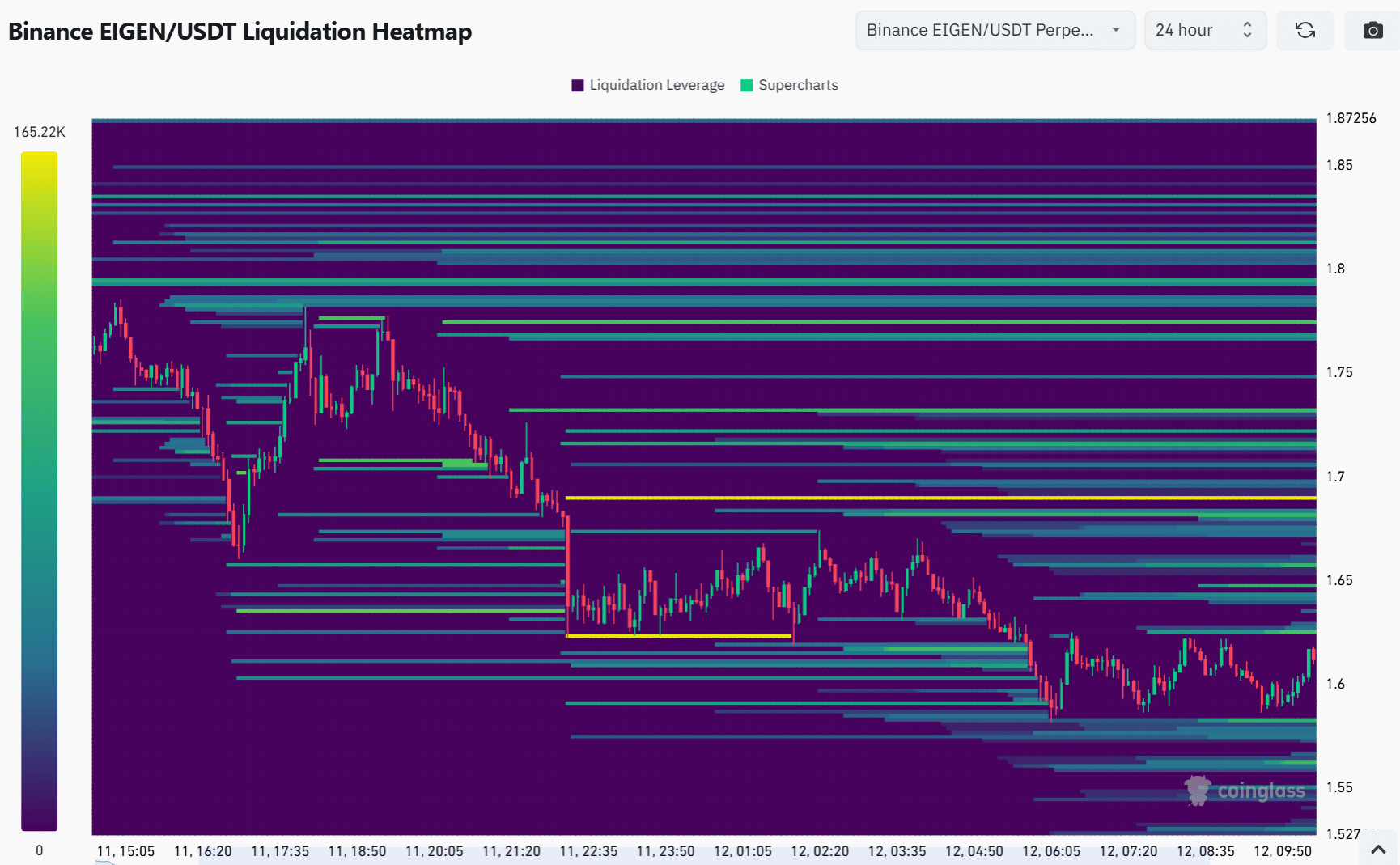

The thermal liquidation card for Eigen revealed a critical point of interest in the price range of $ 1.60, where there is a significant lever effect.

If the price remains close or falls to this level, other liquidations could trigger down pressure.

The card also shows certain support areas around $ 1.55 and $ 1.60, where purchasing activity can take place.

The large amount of liquidation lever around this level could lead to a possible rebound if the purchase of interest resumes.

Source: Coringlass

Will Eigenlayer recover or continue his decline?

The significant loss of the whale, associated with the lower price action and the data on the chain, suggests that Eigen can continue to cope with the pressure downwards.

However, support at $ 1.60 can hold in the short term, potentially offering an opportunity for rebound.

Without substantial changes in the feeling of the market, however, a sustained recovery seems unlikely in the near future.

The cryptographic community will have to carefully monitor the key levels to determine if the token can regain its place or if the downward trend will persist.