- Cryptocurrency analysis of the Sharpe ratio suggests that the TRX top is present.

- Assess if cryptocurrency is heading towards a cliff.

Tron’s native cryptocurrency TRX has maintained strong bullish momentum so far in 2024, allowing it to make considerable gains. However, new analysis suggests that the cryptocurrency could be on the verge of a significant pullback.

A recent analysis by CryptoQuant highlighted the possibility of bearish days ahead for TRX holders. This expectation was based on the cryptocurrency’s 180-day Sharpe ratio. The latter has the habit of locating vertices with a considerable degree of precision.

According to the CryptoQuant assessment, the Sharpe ratio has recently reached a high risk level. Nonetheless, he noted that prices could still rise, but prices above the current zone carry greater downside risk.

TRX has continued to rally and is up 120% so far this year. In addition to this, it recently reached a new ATH at $0.224 on November 23. Since then, some selling pressure has taken place, dampening the upward momentum. TRX traded hands at $0.20 at press time.

source: TradingView

TRX was down 10% from its recent high to its price level at press time. This does not necessarily mean that a wave of strong selling pressure has occurred.

Assessing TRX Selling Pressure

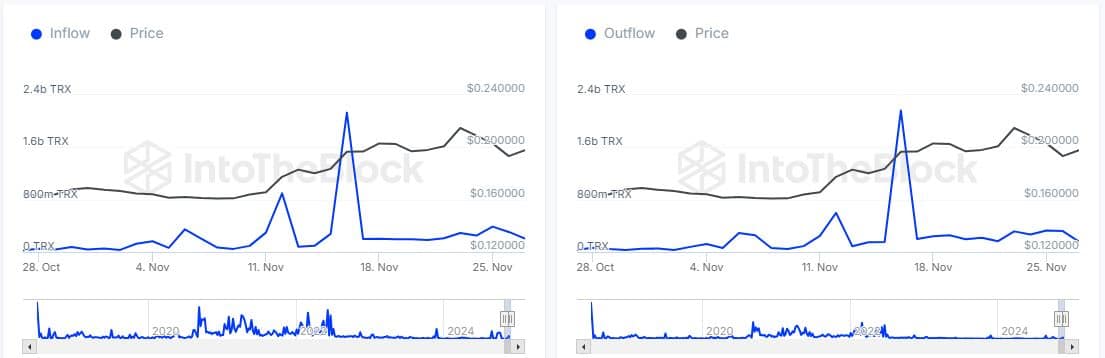

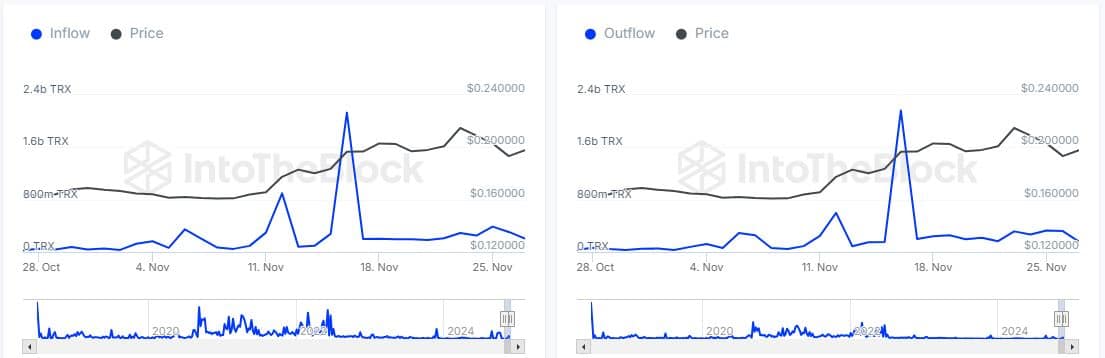

On-chain data revealed a decline in whale and institutional activity. For example, capital inflows from large holders peaked at 2.13 billion TRX on November 16. Meanwhile, outflows from large holders were slightly higher at 2.16 billion TRX on the same day.

Source: In the block

Inflows from large holders have since fallen to 205.77 million as of November 27. Outflows from large holders also fell to 159.87 million on the same day, meaning there was net positive demand from whales.

However, these figures also highlight the decline in demand from whales and the institutional class.

Spot flows revealed that TRX cryptocurrency outflows were significantly higher than inflows since mid-November.

Source: Coinglass

Note that the cryptocurrency recorded $5.27 million in positive flows on Wednesday. On the derivatives side, open interest peaked at $160.25 million on November 24. This figure is significantly lower than its peak in August.

Source: Coinglass

The low open interest this month confirms that demand for TRX in derivatives has been weak. Especially compared to open interest spikes, especially during the previous bull market.

Read TRON (TRX) Price Prediction 2024-25

Low open interest and declining demand from whales could support the idea of TRX selling pressure in the near term. However, TRX has mostly seen little selling pressure, paving the way for more upside.

This could continue to happen, facilitating more upside in the coming months.