As Bitcoin (BTC) retests the $90,000 price level after falling nearly 9% last week, institutional investors and businesses are seizing the pullback as an opportunity to increase their BTC reserves. Business intelligence firm MicroStrategy is one such entity, having purchased 2,530 BTC during the current market downturn.

MicroStrategy buys Bitcoin dip

Undeterred by the decline in the crypto market, MicroStrategy added more BTC to its holdings for the 10th consecutive week. According to an announcement from the company’s CEO Michael Saylor, MicroStrategy acquired an additional 2,530 BTC for $243 million at an average price of $95,972, including fees and other expenses.

The latest purchase brings MicroStrategy’s total Bitcoin holdings to over 450,000 BTC, acquired for a cumulative amount of $28.2 billion at an average price of $62,691 per BTC. Saylor also revealed that on a year-to-date (YTD) basis, MicroStrategy achieved a BTC yield of 0.32%.

For the uninitiated, BTC Yield is a key performance indicator (KPI) used to evaluate the strategy used to acquire Bitcoin. In the context of MicroStrategy, the company financed its BTC purchase by issuing additional shares of its common stock.

Between January 1 and January 12, MicroStrategy sold 710,245 shares, raising approximately $243 million. These proceeds funded the purchase of Bitcoin, propelling the company’s BTC holdings to a new all-time high (ATH).

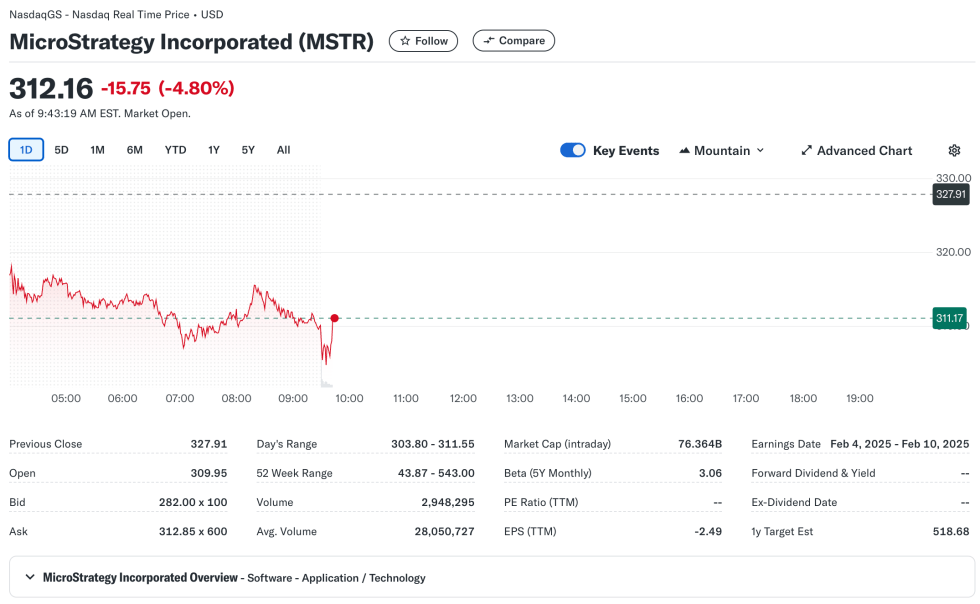

Despite this strategic acquisition, MicroStrategy’s stock price has not experienced a positive impact. At the time of writing, MSTR is trading at $312.16, down 4.8% on the day. However, MSTR is up 540% over the past year, reflecting its strong correlation with Bitcoin’s price trajectory in 2024.

Alongside MicroStrategy, medical healthcare manufacturing company Semler Scientific announced the purchase of 237 BTC for $23.3 million – purchased between December 16 and January 10 – at an average price of $98,267 .

Semler Scientific now holds 2,321 BTC, acquired for a total of $191.9 million at an average price of $82,687 per BTC. The company funded its latest BTC purchase with proceeds from its on-the-market (ATM) offering and operating cash flow.

It is worth recalling that Semler Scientific began its BTC acquisition journey in May 2024 by adding 581 BTC to its balance sheet. In December 2024, the company collected an additional 303 BTC to increase its cryptocurrency reserves.

Will BTC recover from the price drop?

After hitting a new ATH of $108,135 on December 17, BTC remained stuck in the $90,000 to $100,000 price range. The recent crypto market pullback has pushed Bitcoin to the lower end of this range, with a risk of a fall to $84,000 if the $90,000 support level fails to hold.

While the purchases of MicroStrategy and Semler Scientific demonstrate corporate confidence in Bitcoin, crypto entrepreneur Arthur Hayes has warned that further corrections could take place before the inauguration of US President-elect Donald Trump on January 20.

Some analysts nevertheless remain optimistic. A recent Elliott Wave analysis suggests that after the current correction, BTC could surge as high as $210,000. At press time, BTC is trading at $92,277, down 3% in the last 24 hours.