- Notcoin’s falling wedge breakout pattern and strong RSI and MACD indicators suggest bullish momentum.

- Mixed on-chain signals and high short interest suggest short squeeze potential.

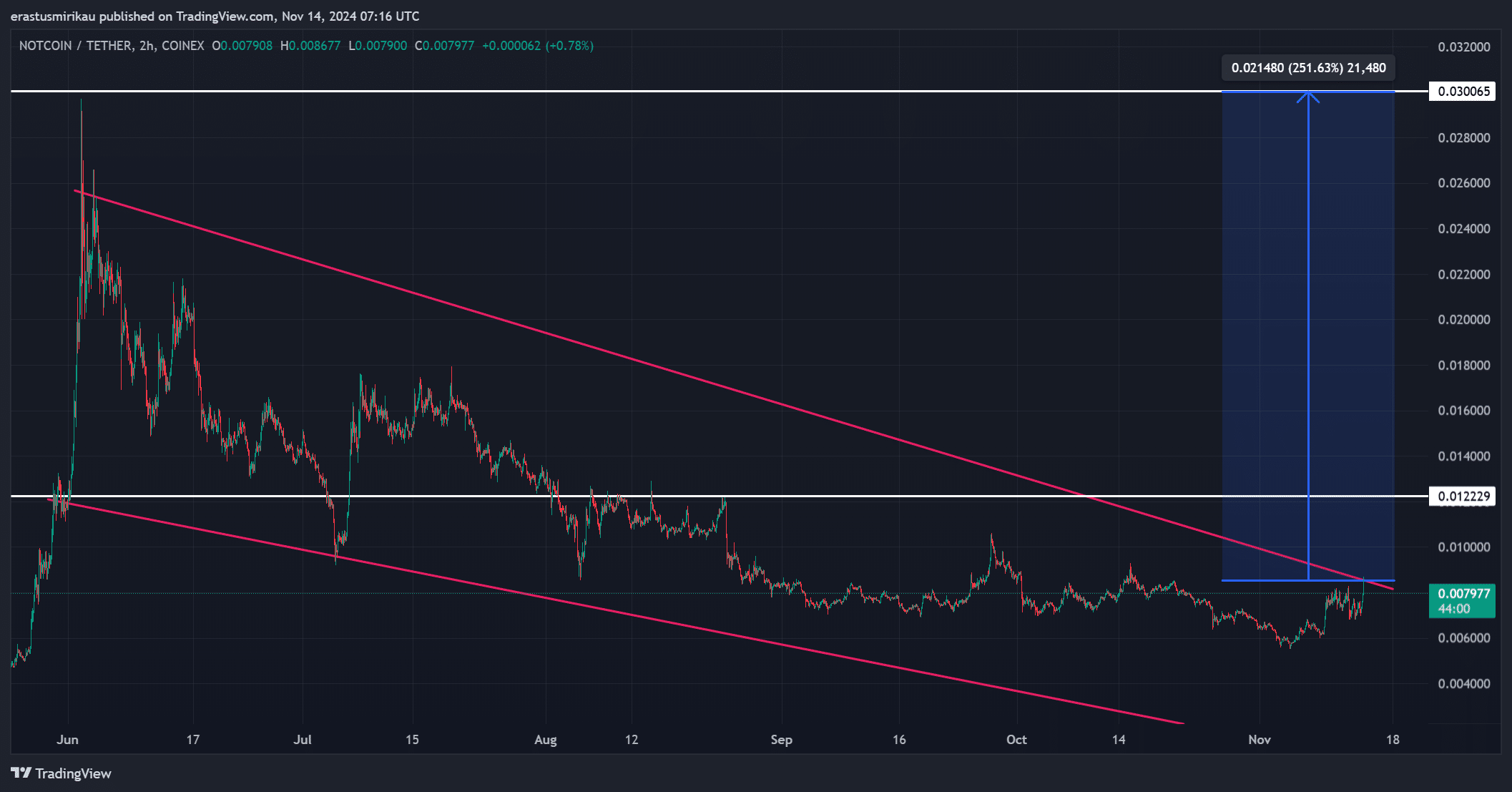

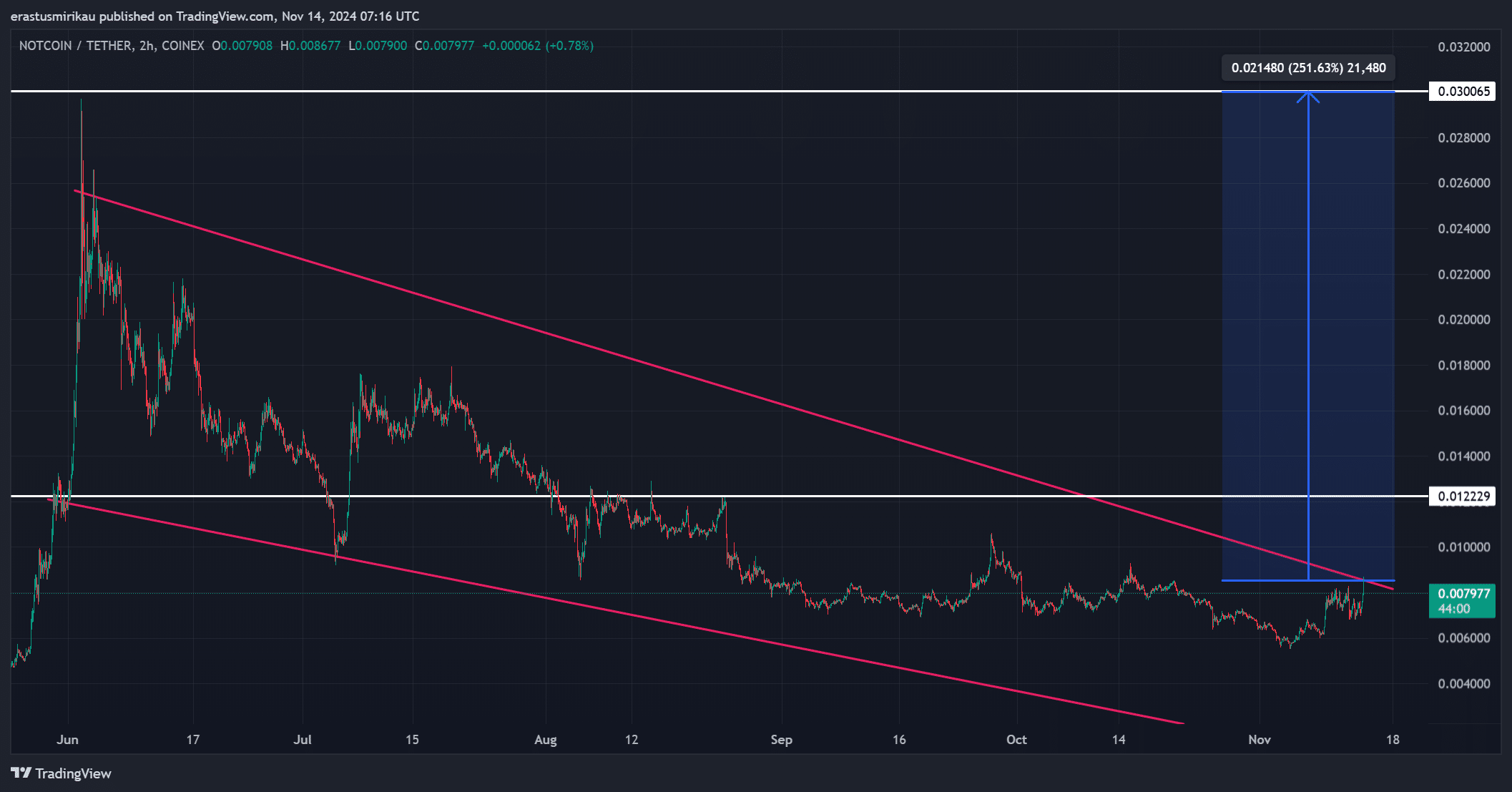

Notcoin (NOT) appears ready to break out of a falling wedge pattern, with the token surging 12.89% over the past 24 hours to $0.008007 at press time. This trend typically signals a bullish reversal, fueling speculation of further gains to come.

A successful breakout could propel the price towards the initial resistance level of $0.01222, with an extended target set at $0.030. This ambitious target represents a potential upside of 251%, sparking interest in whether NOT can capitalize on this bullish setup.

NOT approaching a crucial breakout level

The falling wedge pattern on NOT’s chart is encouraging for bulls, as this formation often leads to a trend reversal. Currently, NOT is close to a breakout, which could see it test the immediate resistance level at $0.01222.

Consequently, this price level becomes a critical threshold; removing it would not only confirm a breakout, but also may NOT push towards its long-term target of $0.030.

A move above $0.01222 could attract increased buying interest, propelling the price even further as momentum builds.

Source: TradingView

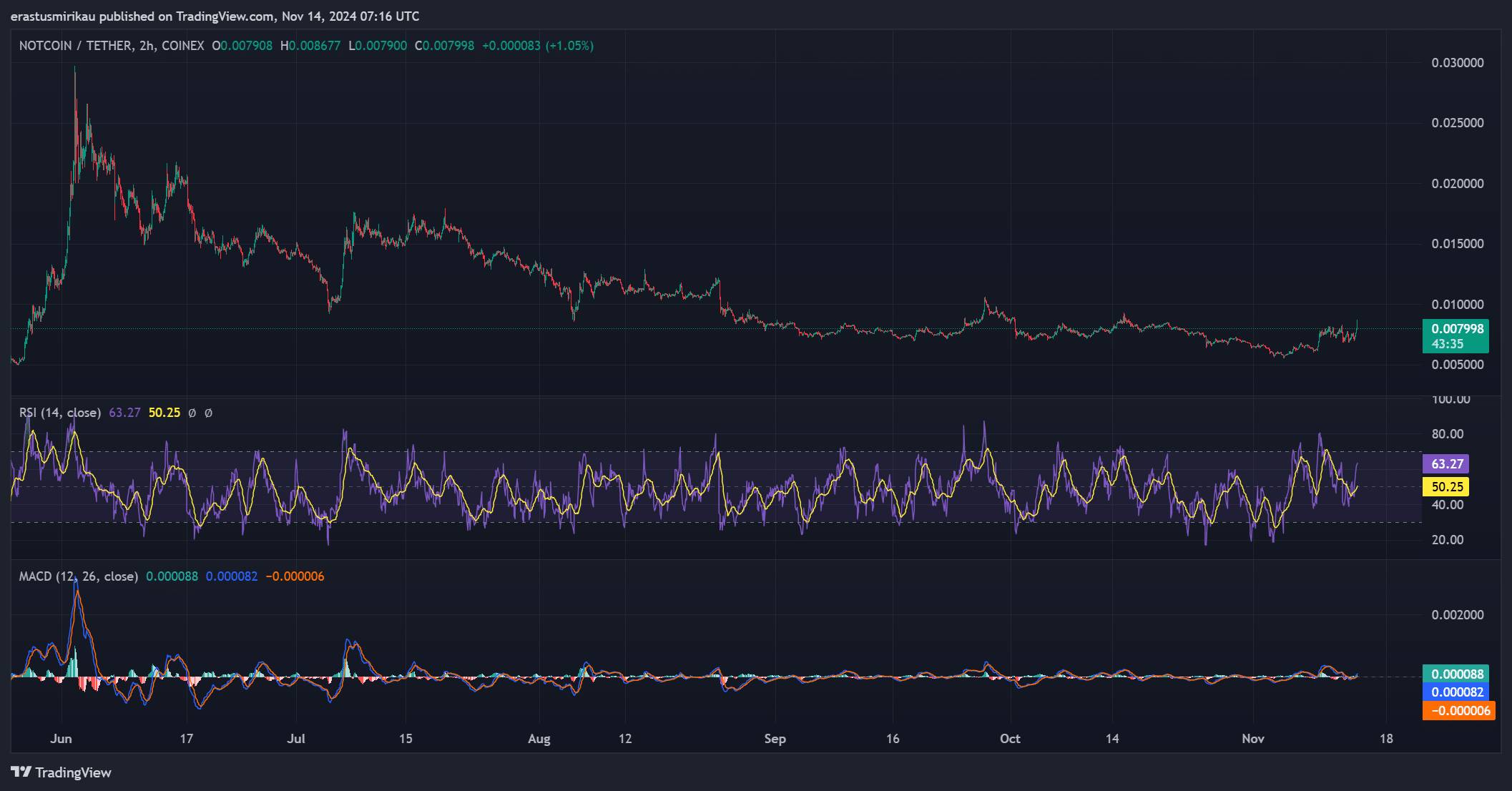

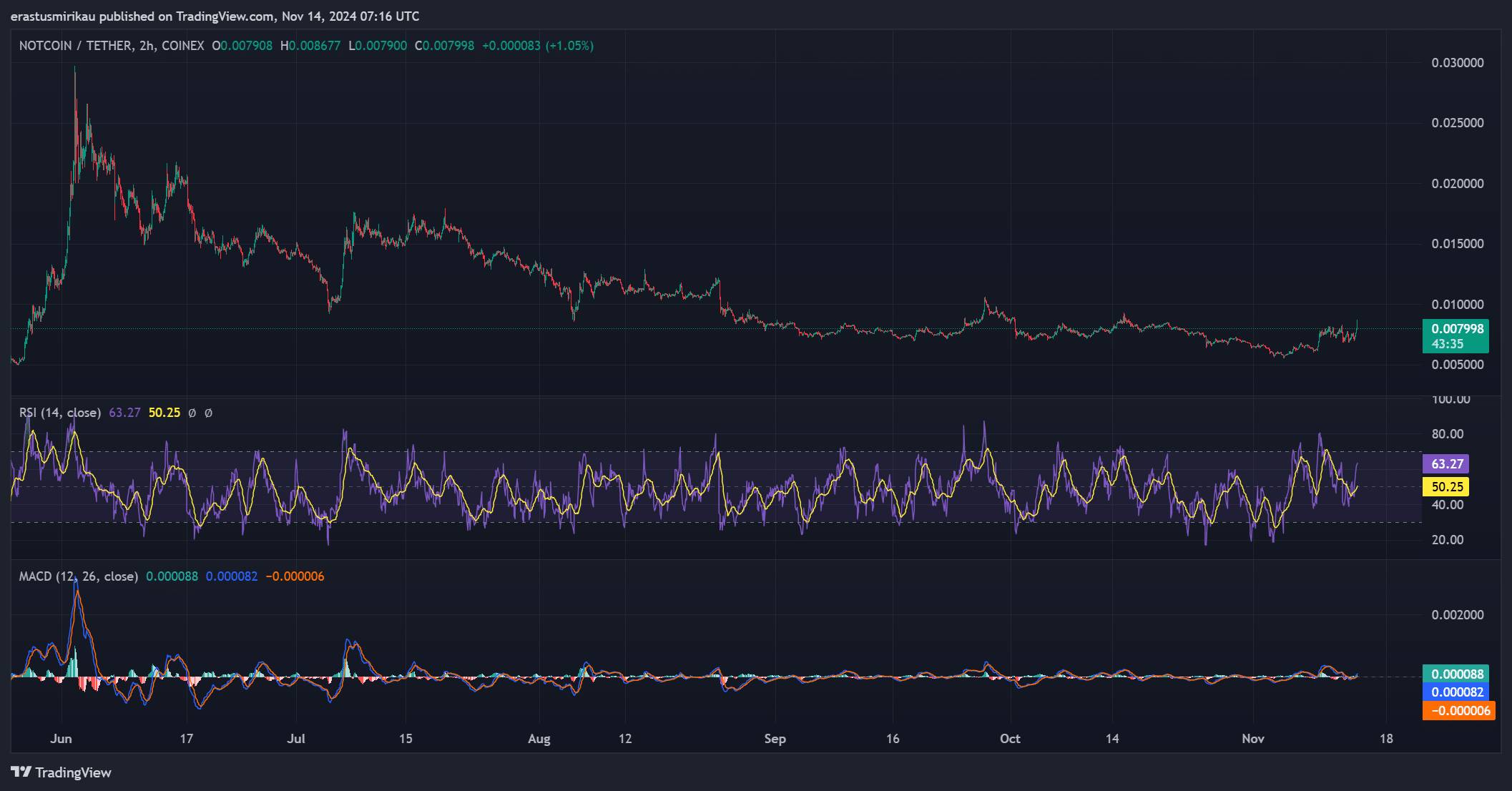

Bullish signals from the RSI and MACD

Technical indicators reinforce the NO bullish narrative. The Relative Strength Index (RSI) currently reads 63.27, indicating positive momentum without entering overbought territory.

Therefore, there is room for additional upward movement before the price faces potential pullback pressure.

Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover, where the MACD line crossed above the signal line. This crossover is a strong indication of growing buying interest, supporting the breakout scenario.

Source: TradingView

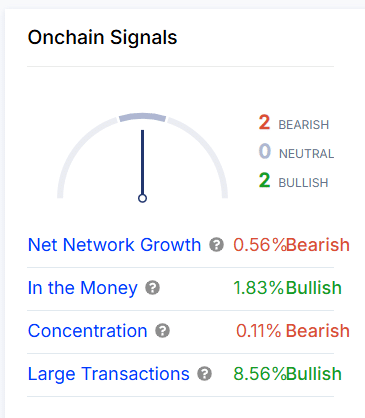

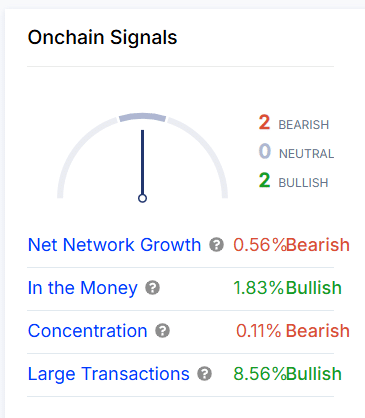

NON-on-chain activity shows mixed sentiment

Looking at the on-chain data, there are both bullish and bearish indicators for NO. The network’s net growth fell slightly by 0.56%, a bearish sign that suggests a limited influx of new users.

However, other metrics are positive, with the “In the Money” metric up 1.83%, indicating more holders are making profits, which could boost investor confidence.

Additionally, large trades jumped 8.56%, reflecting increased activity from institutional or high-value traders. Despite a slight decline in concentration (-0.11%), these mixed signals generally lean towards a positive outlook.

Source: In the block

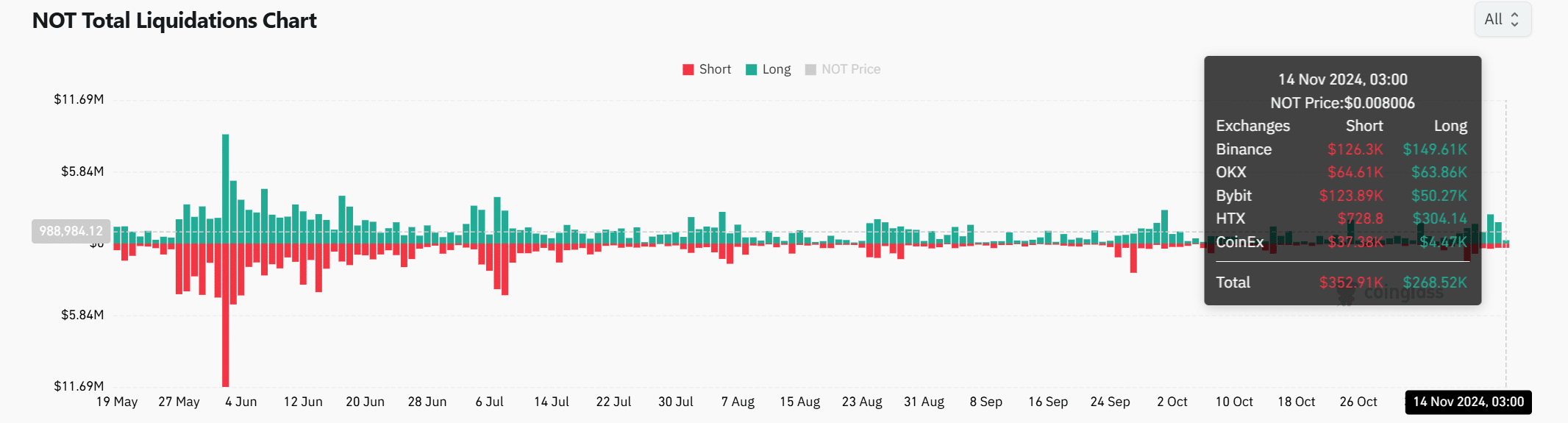

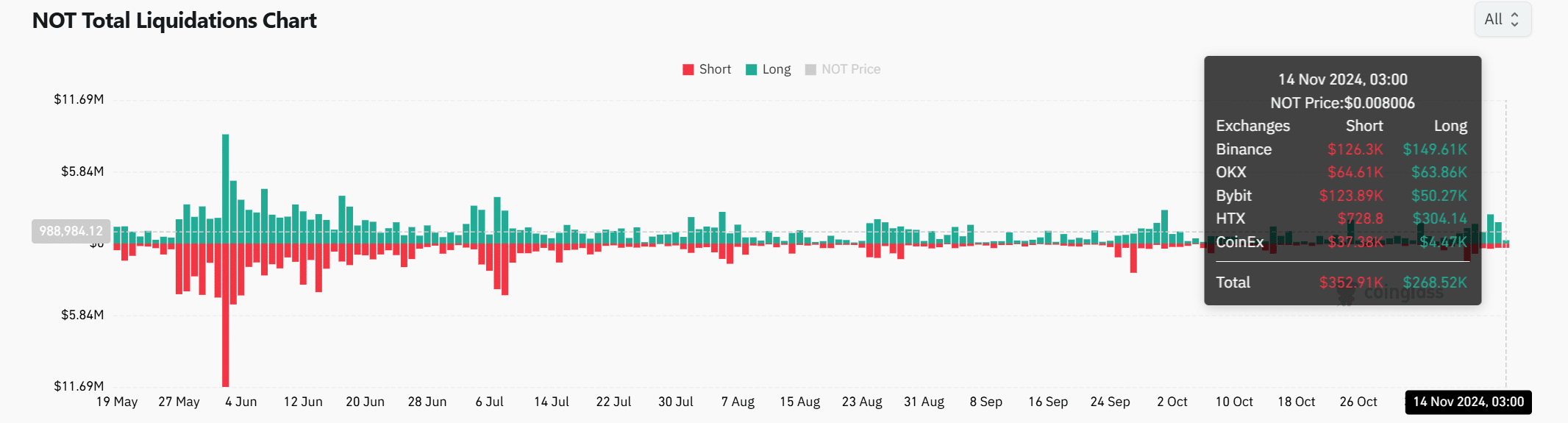

Liquidation Data Suggests a Possible Short Squeeze

Analyzing the liquidation data, we see a trend toward short positions, with $352.91K short positions versus $268.52K long positions. This indicates some market skepticism as more traders are betting against a NO rally.

However, this setup could also lead to a short squeeze if

Notcoin managed to break out, forcing short positions to close and pushing the price higher. Binance leads the long liquidations at $149.61k, indicating strong buying interest, while short positions remain significant on major exchanges, signaling potential for rapid price action.

Source: Coinglass

Read Notcoin (NOT) Price Prediction 2024-2025

With a favorable chart pattern, favorable technical indicators and mixed but mostly optimistic on-chain signals, Notcoin appears ready for a breakout. Removing the $0.01222 resistance could trigger a rally, with a realistic path towards the $0.030 target.

Given the current momentum and the potential for near-term tightening, NOT has a strong chance of realizing its ambitious upside potential.