- Morpho is expected to continue its uptrend and break above the local resistance at $3.6.

- Momentum and sentiment on the lower time frame was firmly bullish, and a decline would be a buying opportunity.

Morpho (MORPHO) was trading at $3.38 at press time. It reached a new all-time high at $3.61 on December 31. In the short term, the $3-$3.2 zone should serve as a demand zone in the event of a retest.

Bitcoin (BTC) has yet to show signs of bullish strength in the shortest time frame. A sustained BTC decline below $91.5K could hurt MORPHO’s bullish chances, while a BTC rally would strengthen buyer sentiment.

MORPHO tests 23.6% rise, en route to new highs

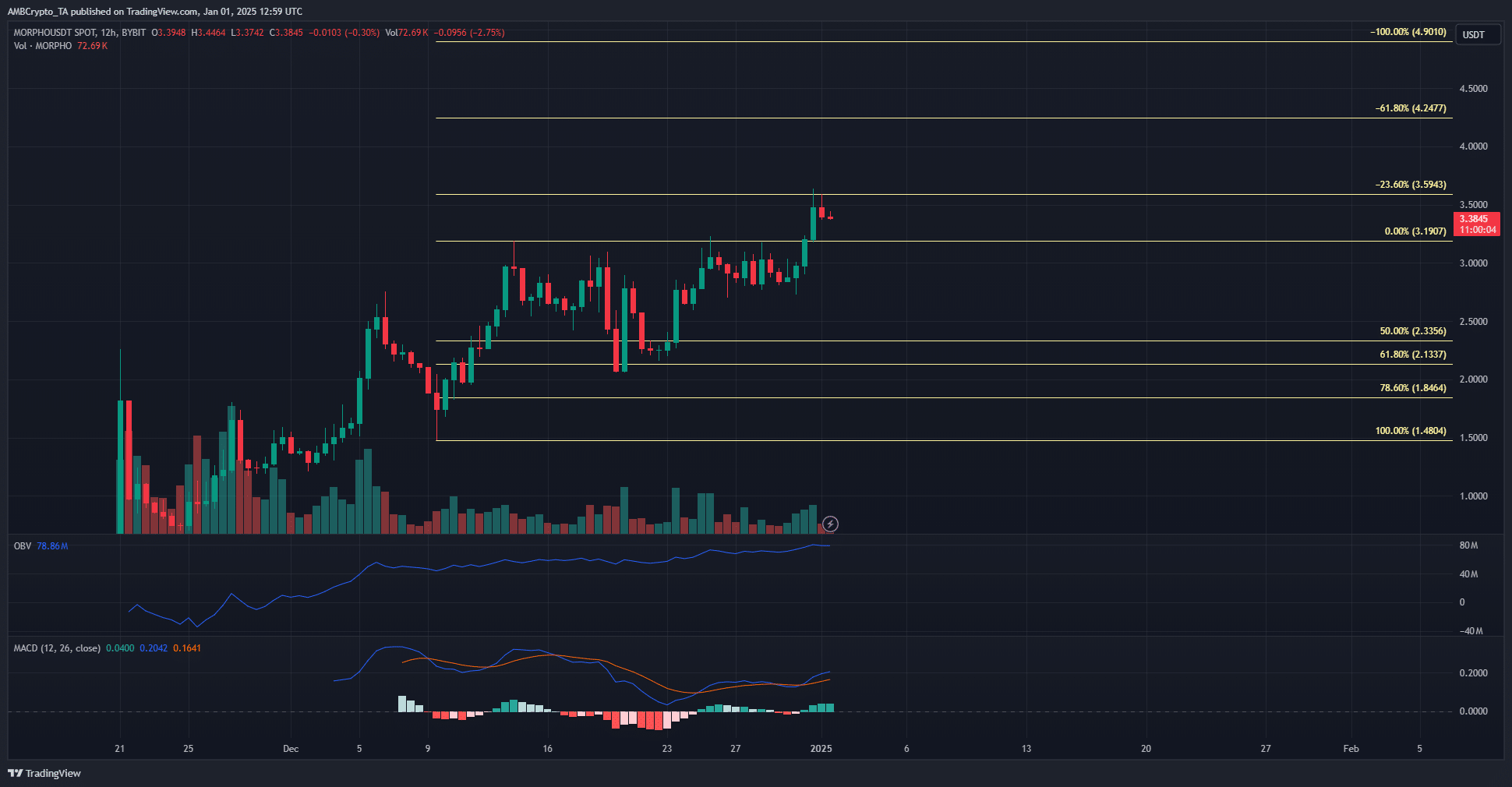

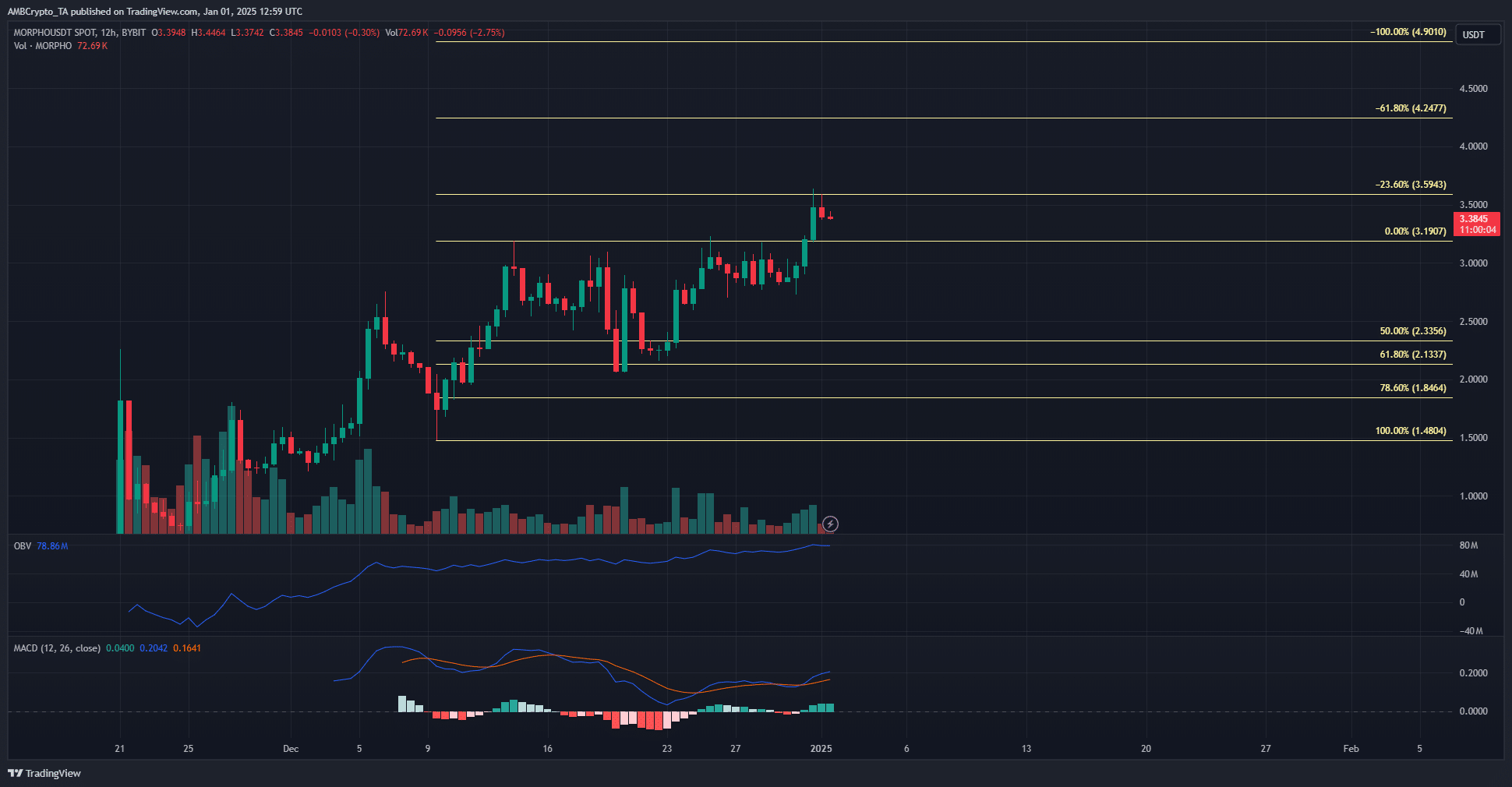

Source: MORPHO/USDT on TradingView

On the 12-hour chart, the market structure of MORPHO appears strongly bullish. In December, buyers struggled with the $3.19 resistance level and attempted several breakouts. The dominance of buyers was evident on the OBV, which displayed a steadily rising chart.

Sustained buying pressure managed to push Morpho to new highs, reaching $3.61 before falling to $3.38 at press time. The MACD indicated bullish momentum without showing bearish divergence or signs of an overextended market.

The next Fibonacci extension targets are $4.24 and $4.9.

Lower Timeframe Support Zones to Watch

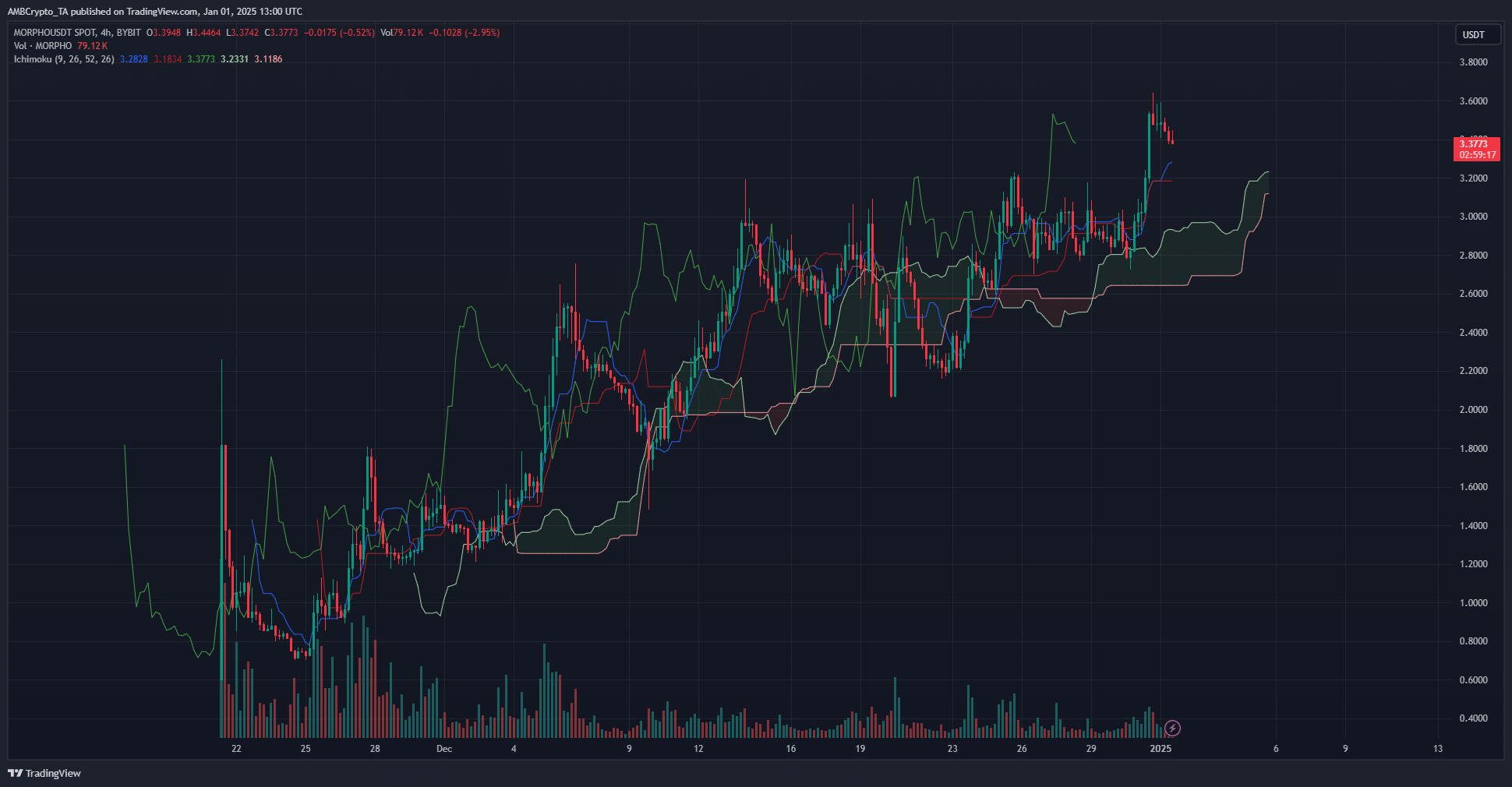

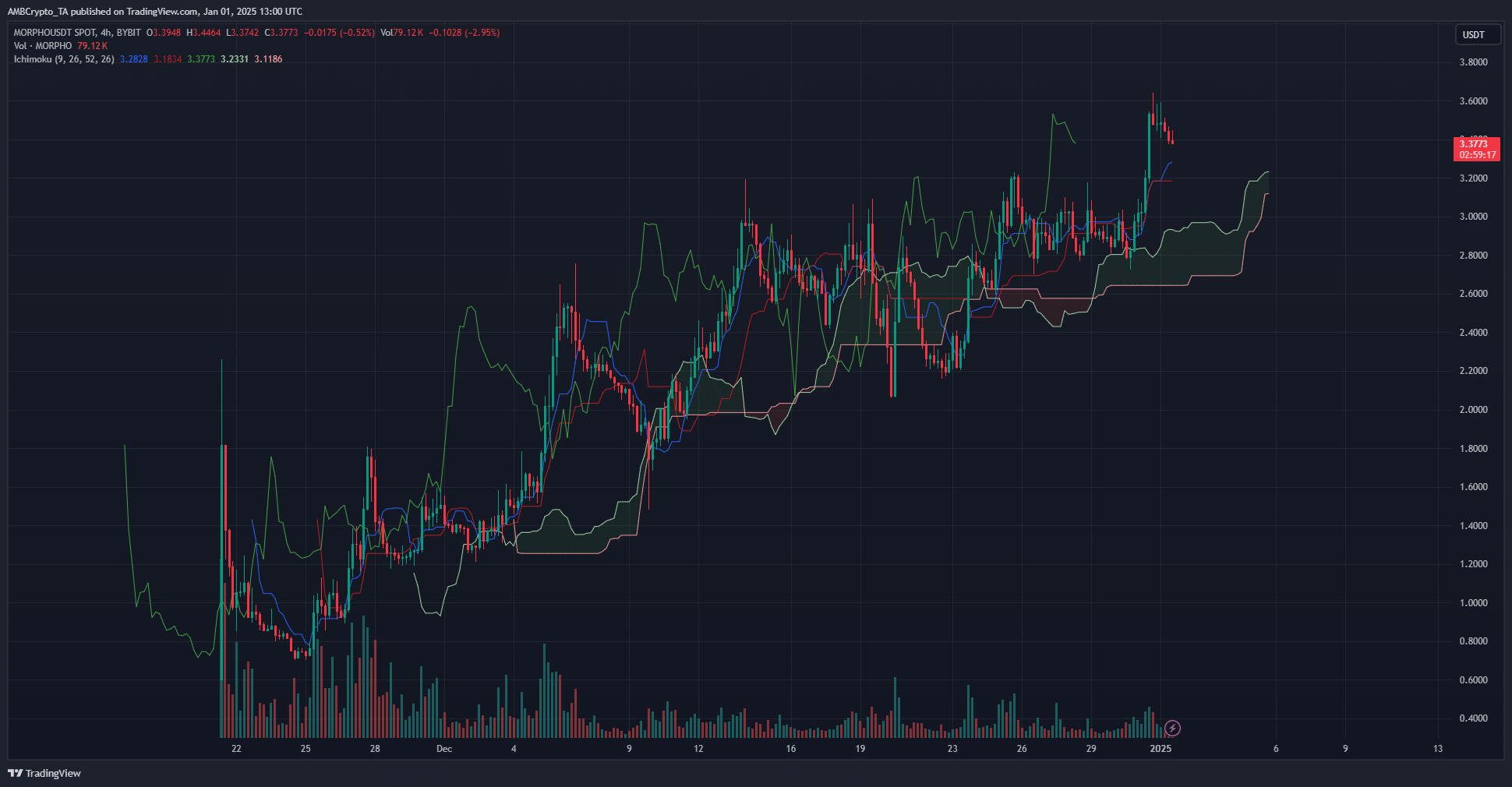

Source: MORPHO/USDT on TradingView

The Ichimoku Cloud indicator showed a bullish cloud, but its thickness has decreased over the past 24 hours. Tuesday’s momentum has not been maintained in recent hours, but the trend remains strongly bullish.

The conversion line (Tenkan-sen) has crossed above the base line (Kijun-sen), confirming the uptrend. These lines may also serve as dynamic support levels, with $3.18 and $3.28 highlighted as impending supports, at press time.

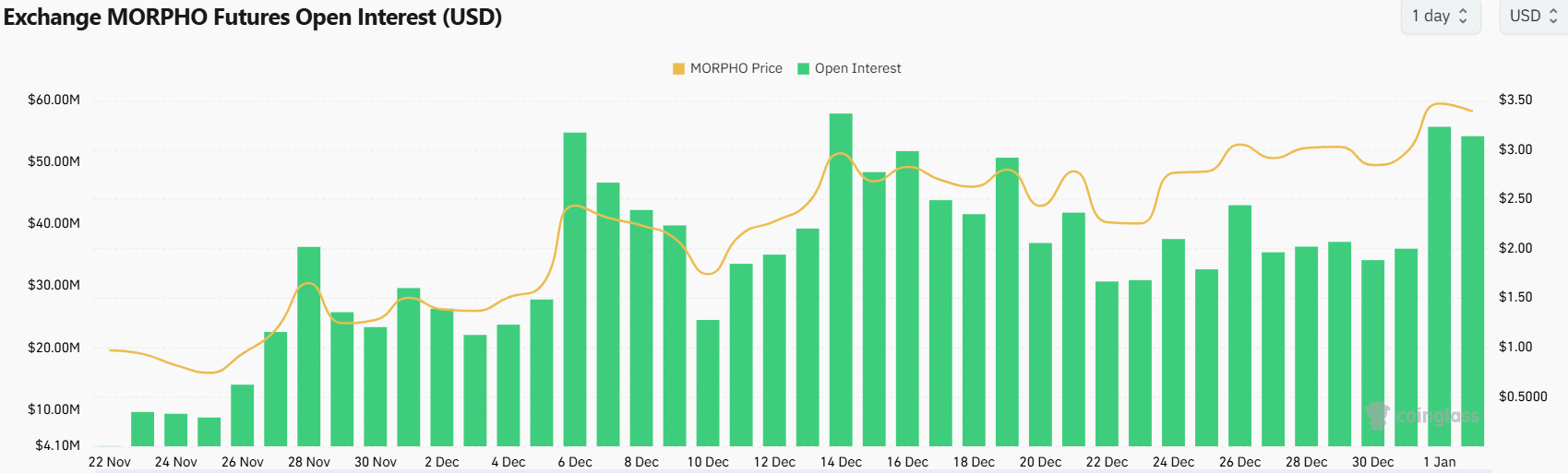

Source: Coinglass

Open Interest (OI) recovered strongly on December 31. The rally past the $3.2 resistance was accompanied by high speculative interest and signaled bullish sentiment.

Is your wallet green? Check out the Morpho Profit Calculator

Over the past 24 hours, OI fell from $56.57 million to $53.73 million, to reflect slightly subdued interest in futures. Overall, MORPHO’s trajectory has remained firmly bullish.

A move towards $3-$3.2 would represent a buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, business or other advice and represents the opinion of the author only.