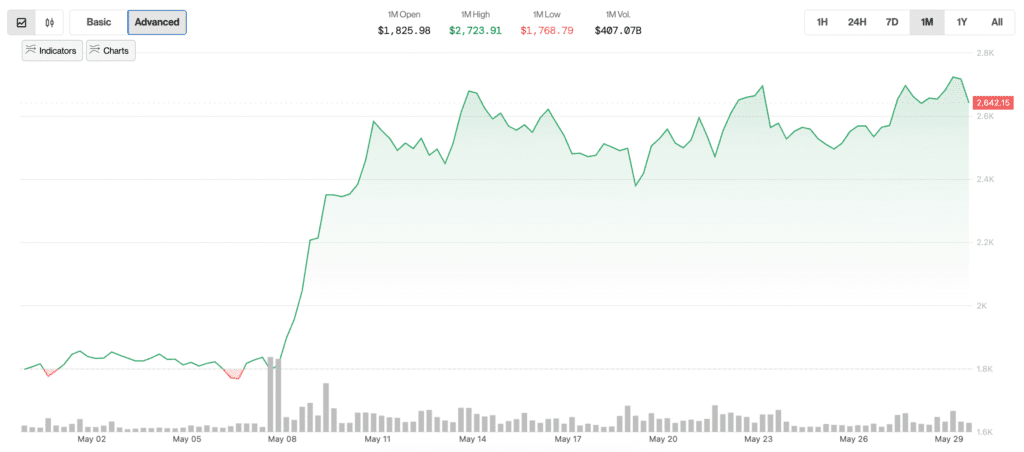

Ether

has increased 45% in the past 30 days, over-performing the decentralized finance market (DEFI) and Bitcoin, which increased by 21% and 13% respectively during the same period, according to Defillama data.

A large part of Ether’s boom has been attributed to institutional interests that have led to record ETH ETF spot entries.

ETH’s ascent came after a lull of feeling earlier this year while blockchains of layer 1 rivals like Solana took the spotlight with a wave of sameroecoin outings.

At the start of the year, ETH was traded at $ 3,340, but in early April, he fell up to $ 1,472 in the middle of world uncertainty linked to American prices.

But now, as documented in an article by Coindesk analyst, Omkar Godbole on Thursday, Ether finally broke a downward trend of 18 months against Solana when he begins to regain control of the Defi market.

It seems that a large part of this appetite is linked to yields – Defilma data shows that TVL on replenishment protocols such as Lido, Eigenlayer and Ether.Fi has all increased by 41% and 48% this month

The protocols DEFI based in Solana, however, failed to keep the pace of those on Ethereum. The TVL of Jupiter and Kamino increased by 7% and 9% while the marinade of the liquid implementation protocol saw TVL increase by 29%.

Ether’s recent performance marks a significant recovery compared to the beginning of this year, with increased institutional interest and strong growth in protocols DEFI contributing to its increase.