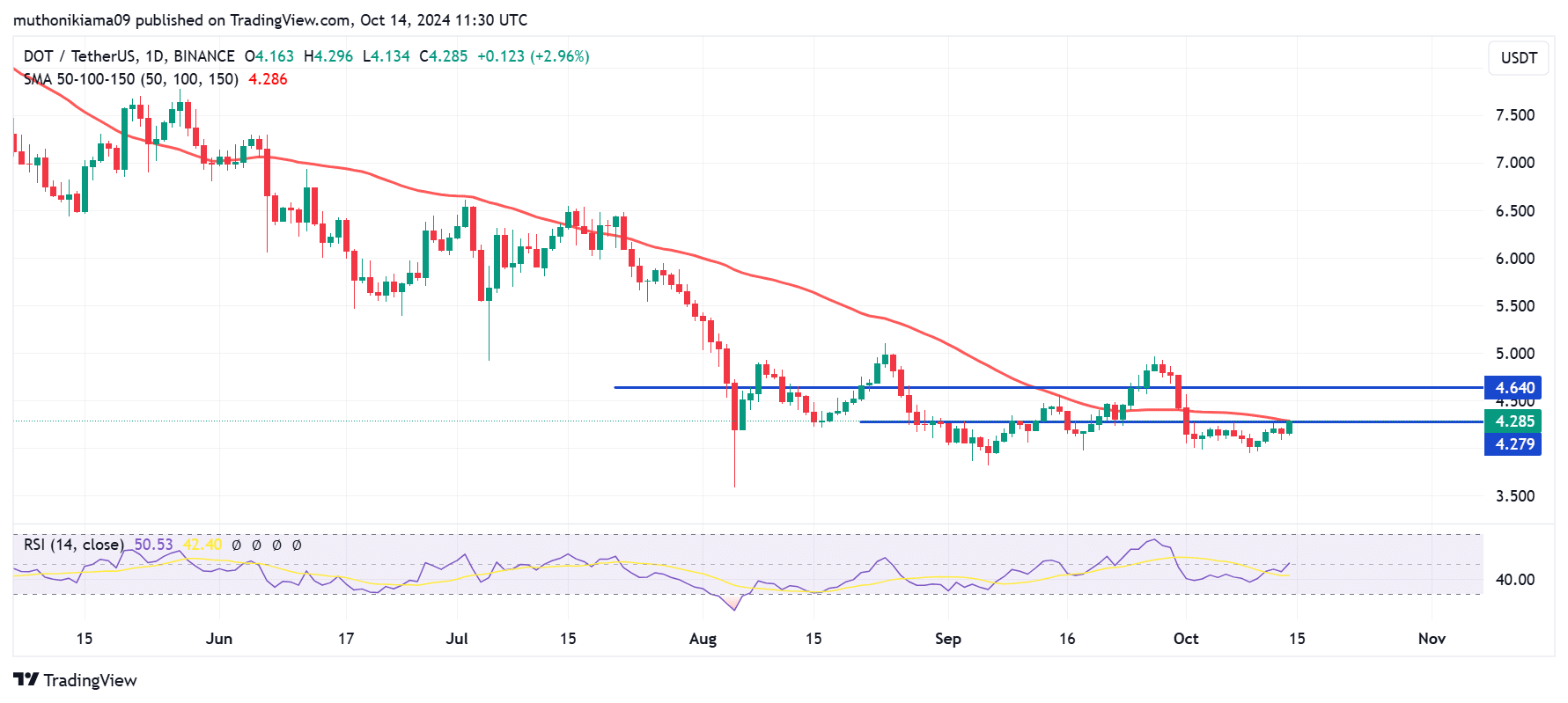

- Polkadot faced strong resistance at $4.27, but the RSI shows that a breakout is now possible.

- The price also touched the 50-day SMA, indicating that the short-term trend is turning bullish.

Polka dot (DOT) was trading at $4.25 at press time after gaining nearly 2% in 24 hours. The altcoin has faced strong resistance above its current price as each breakout attempt failed due to lack of buyer support.

However, interest in Polkadot is now growing. CoinMarketCap shows that in the last 24 hours, DOT trading volumes increased by more than 20%.

In addition to these increasing volumes, several indicators suggest that the trend could be reversed.

Top Reasons Why DOT Can Overcome Resistance

Bulls are preparing to support DOT’s breakout above the $4.27 resistance level. This price has acted as strong resistance for almost two weeks, reflecting the lack of interest from buyers.

The Relative Strength Index (RSI) shows that the momentum is changing. The RSI stood at 50, indicating that market sentiment moved from negative to neutral.

The rising RSI has also crossed above the signal line, suggesting that an uptrend is underway.

Source: TradingView

DOT also touched the 50-day simple moving average (SMA) at $4.28. If the price breaks above this level, the short-term sentiment will turn bullish, with the price poised to rebound to test the next resistance at $4.64.

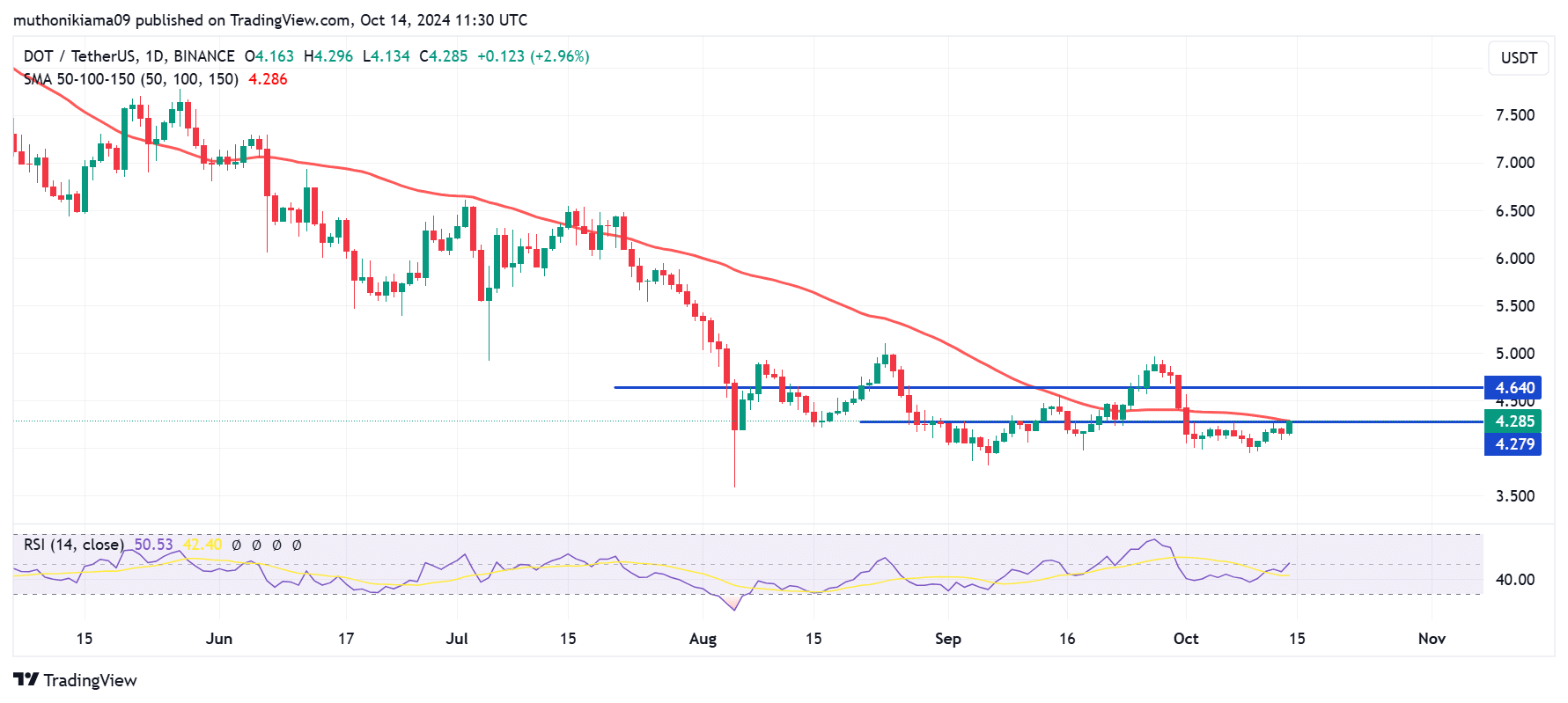

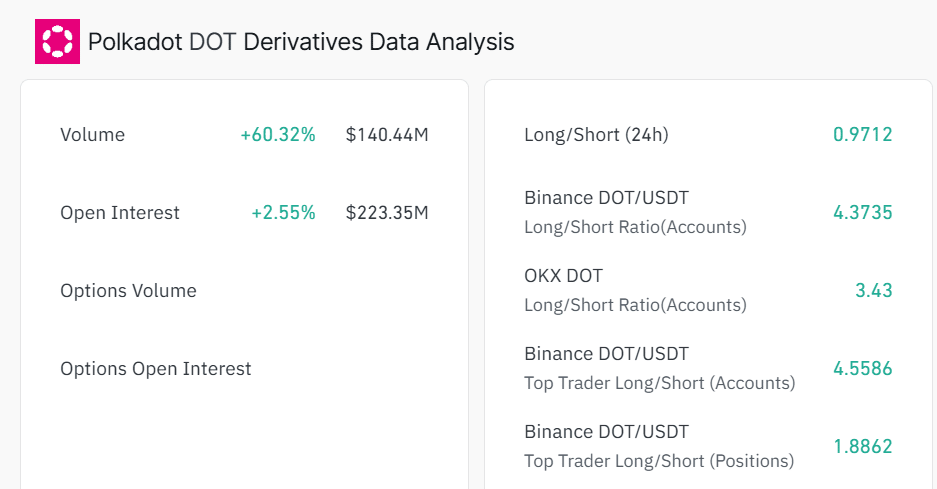

Analyze derivatives data

A review of Coinglass data shows that derivatives traders are opening and maintaining their positions in DOT. Trading volumes increased by more than 60%, while open interest jumped about 2% to $223 million.

Source: Coinglass

The Long/Short ratio was at a neutral level of 0.97, showing that the market is not heavily tilted towards long or short traders.

However, on Binance, there appears to be a significantly higher number of long traders than short traders, with a Long/Short ratio of 4.37.

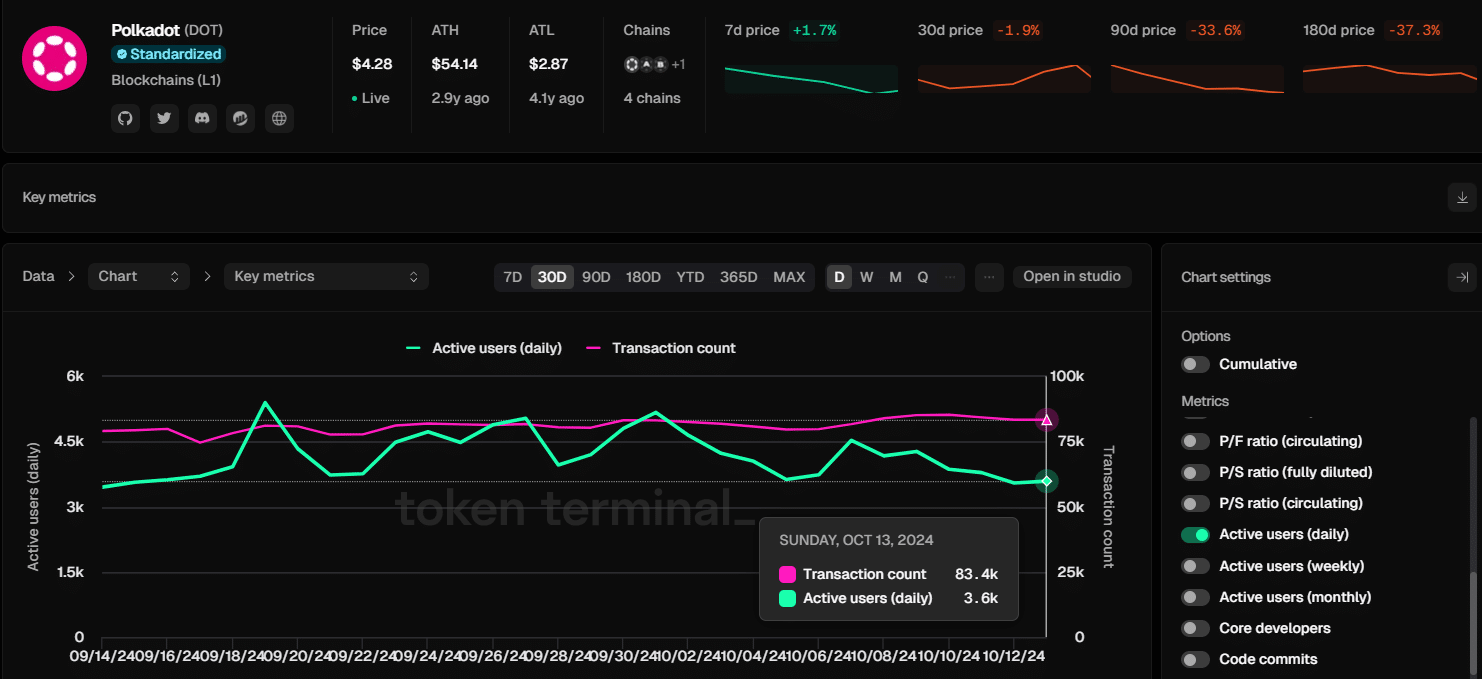

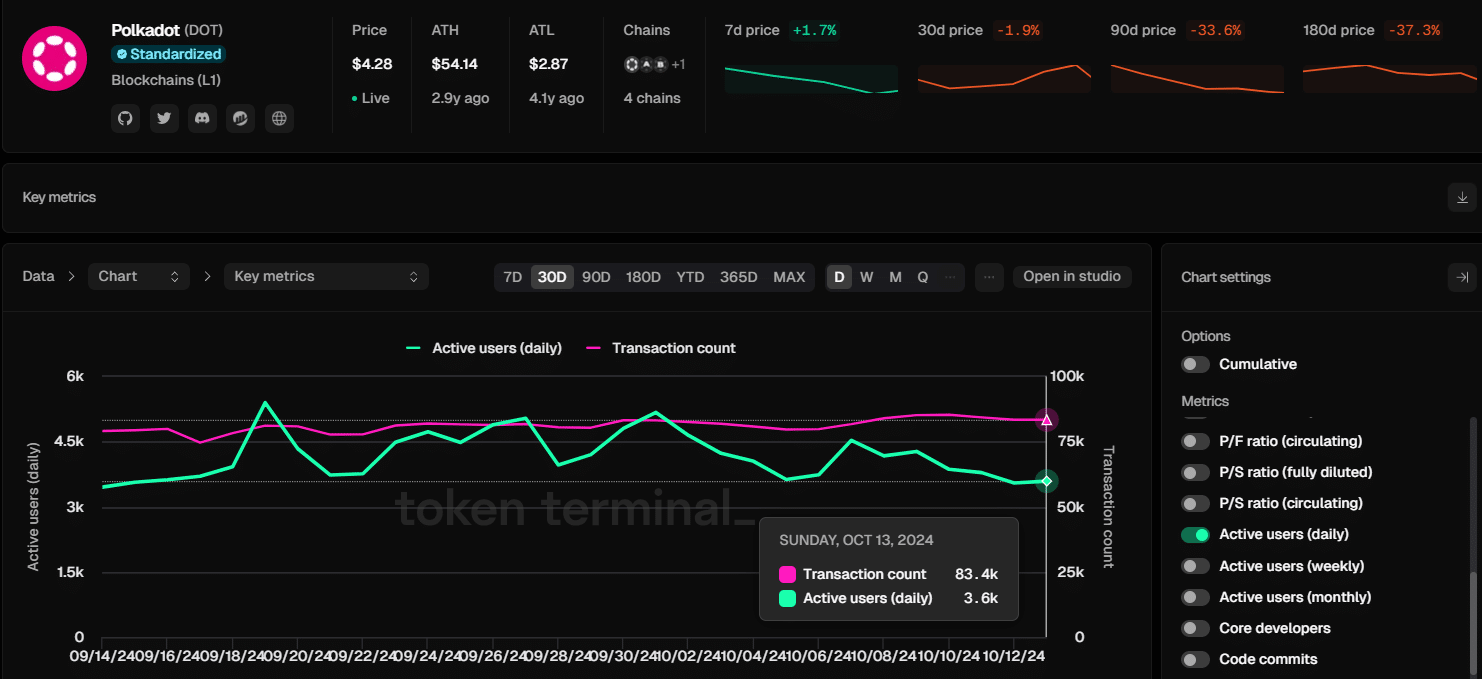

Polkadot network activity

One of the factors that could hinder Polkadot’s breakout above resistance is a drop in network activity.

According to Token Terminal, there has been a notable drop in the number of daily active addresses, which shows a decline in usage.

Since the start of the month, daily active addresses have fallen from 5,200 to around 3,600. On the other hand, the number of daily transactions has remained relatively stable, with no major changes.

Source: Token Terminal

Read Polkadot (DOT) Price Prediction 2024-2025

Decreasing network usage tends to reduce token demand. This also indicates a decline in confidence in Polkadot, further dampening market sentiment.

Data from Market Prophet shows that sentiment around Polkadot has been mostly negative over the past month. If this sentiment does not change, DOT will likely continue to face reduced performance.